Alberta

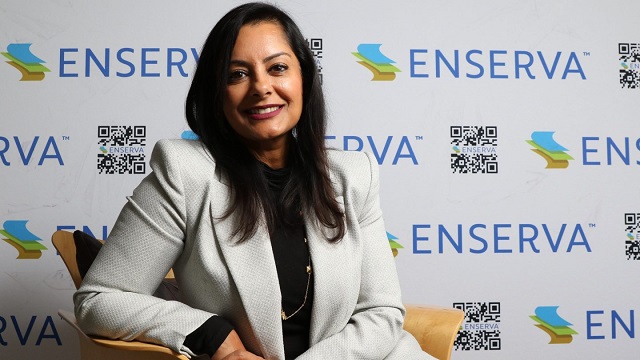

Enserva key to unlocking Canadian energy: CEO Gurpreet Lail

Photo for the Canadian Energy Centre by Dave Chidley

From the Canadian Energy Centre

By Cody Ciona“We are in the quality of life business, and that’s exactly what our business provides.”

A lawyer by education, with terms in high profile roles as executive director of STARS Air Ambulance and CEO of Big Brothers Big Sisters Calgary, Gurpreet Lail is no stranger to working in organizations dedicated to helping everyday Canadians.

Now two years into her term as the president and CEO of Enserva , formerly known as the Petroleum Services Association of Canada, Lail’s work continues to focus on improving quality of life.

She has no qualms about stating her support for the work the energy industry is doing.

“I will be the first one to say stop apologizing for the work we do, because the work that we do actually, no pun intended, fuels Canadians. We are in the quality of life business, and that’s exactly what our business provides.”

Enserva represents the service, supply and manufacturing sectors of the Canadian energy industry. This includes companies that supply hydraulic fracturing services to equipment suppliers and oilfield construction.

As the energy industry innovates towards more sustainable, low emissions products, she is confident that Enserva’s membership is more than up for the challenge.

“We are all moving to a new energy mix, and we all realize that as an industry we’re going to need new forms of energy to help us meet the demands of the future, especially when we look at global demand,” Lail says.

“Every company we represent has been diversifying their business to make sure we have a cleaner future. A lot of our companies are bringing in technology and artificial intelligence processes that are going to help streamline energy well into the future.

Photo for the Canadian Energy Centre by Dave Chidley

Enserva members are unlocking Canadian energy to make the world a better place, she says.

“They bring their services, they bring their supplies, they bring their manufacturing, globally.”

This includes technology used by drilling companies to replace their diesel fleets with natural gas power and other alternative energy sources, which reduces emissions while drilling wells.

“They just want to do good work, they want to make sure we can provide for Canadians, and they want to provide back into the community with community investments,” Lail says.

“You cannot go into rural Alberta or rural Canada and not see energy companies putting up community rinks or helping local hospitals or making sure your local Tim Hortons is still in business.”

Indigenous reconciliation is an ongoing process, and in Canada, where the oil and gas industry employs thousands of Indigenous workers across the country, she says working with those communities is crucial.

“It’s a good thing to do and it’s the right thing to do, and a lot of other industries aren’t quite thinking that way.”

In her eight years at STARS, Lail helped grow the organization to span three provinces and was a leading driver working with Enserva on the annual STARS & Spurs Gala. The event has raised over $20 million, 29 years and counting.

“STARS has become a fabric of our businesses; it helps save lives including those of our members, and we’re proud of that.”

In the ever-changing dynamic of Canada’s oil and gas industry, more women are finding themselves, like Lail, driving the conversation about Canadian energy.

“If there’s young women out there, or women in general I would always tell them to get involved and don’t shy away from coming into the sector,” she says.

Alberta

Alberta takes big step towards shorter wait times and higher quality health care

From the Fraser Institute

On Monday, the Smith government announced that beginning next year it will change the way it funds surgeries in Alberta. This is a big step towards unlocking the ability of Alberta’s health-care system to provide more, better and faster services for the same or possibly fewer dollars.

To understand the significance of this change, you must understand the consequences of the current (and outdated) approach.

Currently, the Alberta government pays a lump sum of money to hospitals each year. Consequently, hospitals perceive patients as a drain on their budgets. From the hospital’s perspective, there’s little financial incentive to serve more patients, operate more efficiently and provide superior quality services.

Consider what would happen if your local grocery store received a giant bag of money each year to feed people. The number of items would quickly decline to whatever was most convenient for the store to provide. (Have a favourite cereal? Too bad.) Store hours would become less convenient for customers, alongside a general decline in overall service. This type of grocery store, like an Alberta hospital, is actually financially better off (that is, it saves money) if you go elsewhere.

The Smith government plans to flip this entire system on its head, to the benefit of patients and taxpayers. Instead of handing out bags of money each year to providers, the new system—known as “activity-based funding”—will pay health-care providers for each patient they treat, based on the patient’s particular condition and important factors that may add complexity or cost to their care.

This turns patients from a drain on budgets into a source of additional revenue. The result, as has been demonstrated in other universal health-care systems worldwide, is more services delivered using existing health-care infrastructure, lower wait times, improved quality of care, improved access to medical technologies, and less waste.

In other words, Albertans will receive far better value from their health-care system, which is currently among the most expensive in the world. And relief can’t come soon enough—for example, last year in Alberta the median wait time for orthopedic surgeries including hip and knee replacements was 66.8 weeks.

The naysayers argue this approach will undermine the province’s universal system and hurt patients. But by allowing a spectrum of providers to compete for the delivery of quality care, Alberta will follow the lead of other more successful universal health-care systems in countries such as Australia, Germany, the Netherlands and Switzerland and create greater accountability for hospitals and other health-care providers. Taxpayers will get a much better picture of what they’re paying for and how much they pay.

Again, Alberta is not exploring an untested policy. Almost every other developed country with universal health care uses some form of “activity-based funding” for hospital and surgical care. And remember, we already spend more on health care than our counterparts in nearly all of these countries yet endure longer wait times and poorer access to services generally, in part because of how we pay for surgical care.

While the devil is always in the details, and while it’s still possible for the Alberta government to get this wrong, Monday’s announcement is a big step in the right direction. A funding model that puts patients first will get Albertans more of the high-quality health care they already pay for in a timelier fashion. And provide to other provinces an example of bold health-care reform.

Alberta

Alberta’s embrace of activity-based funding is great news for patients

From the Montreal Economic Institute

From the Montreal Economic Institute

Alberta’s move to fund acute care services through activity-based funding follows best practices internationally, points out an MEI researcher following an announcement made by Premier Danielle Smith earlier today.

“For too long, the way hospitals were funded in Alberta incentivized treating fewer patients, contributing to our long wait times,” explains Krystle Wittevrongel, director of research at the MEI. “International experience has shown that, with the proper funding models in place, health systems become more efficient to the benefit of patients.”

Currently, Alberta’s hospitals are financed under a system called “global budgeting.” This involves allocating a pre-set amount of funding to pay for a specific number of services based on previous years’ budgets.

Under the government’s newly proposed funding system, hospitals receive a fixed payment for each treatment delivered.

An Economic Note published by the MEI last year showed that Quebec’s gradual adoption of activity-based funding led to higher productivity and lower costs in the province’s health system.

Notably, the province observed that the per-procedure cost of MRIs fell by four per cent as the number of procedures performed increased by 22 per cent.

In the radiology and oncology sector, it observed productivity increases of 26 per cent while procedure costs decreased by seven per cent.

“Being able to perform more surgeries, at lower costs, and within shorter timelines is exactly what Alberta’s patients need, and Premier Smith understands that,” continued Mrs. Wittevrongel. “Today’s announcement is a good first step, and we look forward to seeing a successful roll-out once appropriate funding levels per procedure are set.”

The governments expects to roll-out this new funding model for select procedures starting in 2026.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

Alberta2 days ago

Alberta2 days agoAlberta takes big step towards shorter wait times and higher quality health care

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFifty Shades of Mark Carney

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCorporate Media Isn’t Reporting on Foreign Interference—It’s Covering for It

-

Business2 days ago

Business2 days agoTrump raises China tariffs to 125%, announces 90-day pause for countries who’ve reached out to negotiate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoThe status quo in Canadian politics isn’t sustainable for national unity