Alberta

Dr. Deena Hinshaw says Alberta is flattening the curve

It’s official. The province’s chief medial health officer believes Albertans are flattening the curve. In her daily COVID-19 update, Dr. Deena Hinshaw was asked if Albertans are flattening the curve and she confirmed that appears to be the case as the numbers of new cases are noticeably lower than they have been and they’ve been that way for days now. Since May 2, there have been less than 100 new cases a day. You can hear this exchange in the Q and A session right after Dr. Hinshaw’s statement.

Update from the province

Recovered cases make up more than half of Alberta’s cases of COVID-19 at 3,552.

Seventy new cases have been reported, bringing the total number to 5,963.

Six more Albertans have died.

Latest updates

- Cases have been identified in all zones across the province:

- 4,003 cases in the Calgary zone

- 1,111 cases in the South zone

- 503 cases in the Edmonton zone

- 229 cases in the North zone

- 91 cases in the Central zone

- 26 cases in zones yet to be confirmed

- Of these cases, there are currently 82 people in hospital, 19 of whom have been admitted to intensive care units (ICU).

- 730 cases are suspected of being community acquired.

- The total deaths are 112: 79 in the Calgary zone; 15 in the North zone; 12 in the Edmonton zone; five in the South zone; and one in the Central zone.

- To date, 632 cases have been confirmed at continuing care facilities, and 82 residents at these facilities have died.

- There have been 946 cases in workers from the Cargill meat processing plant in High River, with 798 recovered.

- There have been 566 cases in workers from JBS Foods Canada in Brooks, with 434 recovered.

- Thirty-eight cases have been confirmed at Harmony Beef since March and 12 have recovered.

- There have been 160,185 people tested for COVID-19 and a total of 170,509 tests performed by the lab. In the last 24 hours, 3,494 tests have been completed.

Here’s a graph from Alberta Health showing the growing gap between the active cases of COVID-19 and the recoveries. Within just a couple of days that gap between the number of recovered and the number of active cases has stretched to 1300.

That’s good news for hospitals. As you can see in this graph the number of hospitalizations is down significantly in every region of the province.

The number of cases in Red Deer is down to 4 now after another recovery. 2 more cases were diagnosed in the last 24 hours in Central Alberta. There are now 91 total cases in Central Zone. The new cases are in Vermillion County near Lloydminster and Mountain View County which includes Olds, Sundre, Didsbury, and Carstairs. There are 11 active cases in Central Alberta. Here is the breakdown

- Red Deer City – 36 cases – 4 active

- Red Deer County – 13 cases – 2 active

- Mountain View County – 7 cases – 2 active

- Vermilion River County – 4 cases – 2 active

- Clearwater County – 3 cases – 1 active

- Stettler County – 3 cases – 0 active

- Lacombe County – 3 cases – 0 active

- Ponoka County – 2 cases – 0 active

- Kneehill County – 2 cases – 0 active

- Camrose City – 2 cases – 1 death – 0 active

- Wetaskiwin City – 8 cases – 0 active

- Lacombe City – 2 cases – 0 active

- Beaver County – 2 cases – 0 active

- City of Lloydminster – 1 case – 0 active

- Camrose County – 1 case – 0 active

- Minburn County – 1 case – 0 active

- MD of Wainwright – 1 case – 0 active

And here are the total number of cases in Alberta.

Bruce Cockburn gives thumbs up to cover of perfect song for Mental Health Week

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoMEI-Ipsos poll: 56 per cent of Canadians support increasing access to non-governmental healthcare providers

-

2025 Federal Election13 hours ago

2025 Federal Election13 hours agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

2025 Federal Election1 day ago

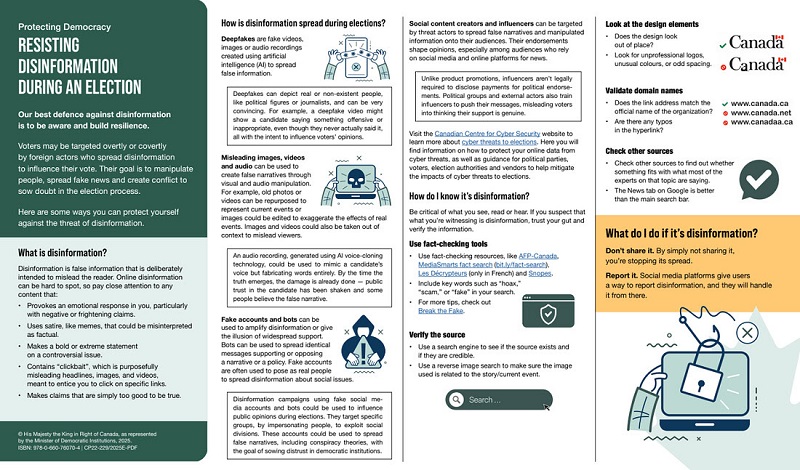

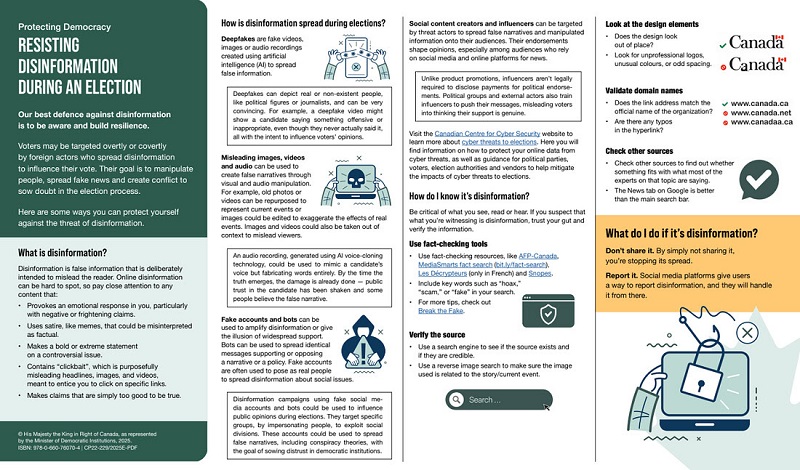

2025 Federal Election1 day agoAI-Driven Election Interference from China, Russia, and Iran Expected, Canadian Security Officials Warn

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoEuthanasia is out of control in Canada, but nobody is talking about it on the campaign trail

-

Health21 hours ago

Health21 hours agoTrump admin directs NIH to study ‘regret and detransition’ after chemical, surgical gender transitioning

-

illegal immigration2 days ago

illegal immigration2 days agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservative MP Leslyn Lewis warns Canadian voters of Liberal plan to penalize religious charities

-

Bjorn Lomborg1 day ago

Bjorn Lomborg1 day agoGlobal Warming Policies Hurt the Poor