Automotive

Current EV strategy charging ahead to failure

Written By Dan McTeague

Written By Dan McTeague

For years now I’ve been saying that electric vehicles, and EV mandates, are bad for Canada.

Back in 2020, when the then-CEO of Toyota, Akio Toyoda, voiced his concerns that governments were moving too fast in their push for an all-electric car market when there were other good options available which didn’t require the same multi-billion dollar infrastructure overhaul or increase in electricity generation, I asked why we weren’t listening to a man who knows his own business.

When Europe found itself in an energy crisis in the winter of 2022, and the Swiss government asked its citizens to avoid driving their EVs, even considering an outright ban, to protect their fragile electricity grid, I said that with our already-strained grid we were seeing our future playing out before us in Switzerland and mandates or no, consumers just wouldn’t stand for it.

And more recently, as stories have piled up of EVs’ vulnerability to the cold — “We got a bunch of dead robots out here,” as one frustrated EV owner put it, surrounded by frozen EVs that had run out of juice while waiting for a charge in a cold snap — I’ve asked over and over again, why on earth our government is trying to force the large scale adoption of an automobile technology which functions so poorly in a normal Canadian winter.

I take no pleasure in being proved right, but nearly every day brings about a new story of EVs failing to meet the lofty expectations our leaders have set for them.

- Recent headlines have trumpeted the difficulties EV drivers are having getting their cars fixed, because so few mechanics know how to work on them.

- People are finding that the resale value of their EV is falling at a much faster rate than their neighbour’s reliable internal combustion engine vehicle.

- Rental car companies like Hertz have been taking major losses after over-investing in EVs, that no one wants to rent. Apparently people don’t like the idea of pinning their vacation on a car they might not be able to charge.

- And major auto manufacturers have been significantly scaling back their annual EV production, despite impending mandates which will force consumers to buy their product in just over a decade.

Even with the generous government subsidies handed to Ford in order to produce made-in-Canada electric SUVs, that company has decided to push their release date for the vehicles back two years — a decision that means layoffs for the majority of the 2,700 workers at the plant, according to the Globe and Mail. GM has followed suit, with recent reports claiming that they are “having a second look” at plans to build EV motors at their plant in St. Catherines, Ontario.

Those companies are beginning to accept reality, something various nations around the world have started to do, as well. The U.K., Germany, Italy, and other European countries, as well as the U.S., have had resistance to EV mandates play a big role in their politics lately. The Biden campaign was even forced to issue a statement saying, “There is no ‘EV mandate,’” after Donald Trump predicted to Detroit autoworkers that the White House’s pro-EV policies would put them out of work.

In the face of all of this, the Trudeau government continues to double down, reaffirming mandates and shovelling more and more tax dollars into the EV fire.

They should know better.

And maybe they do.

But maybe the dollars and the promises to their activist friends have just gotten so big that they feel like they can’t change course now.

Or maybe they are just too stubborn to admit that people like me were right all along, that they bet big and they bet wrong. And they can’t say they weren’t warned.

Buckle up.

Dan McTeague is President of Canadians for Affordable Energy

Automotive

Canadians’ Interest in Buying an EV Falls for Third Year in a Row

From Energy Now

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index

Fewer Canadians are considering buying an electric vehicle, marking the third year in a row interest has dropped despite lower EV prices, a survey from AutoTrader shows.

Forty-two per cent of survey respondents say they’re considering an EV as their next vehicle, down from 46 per cent last year. In 2022, 68 per cent said they would consider buying an EV.

Meanwhile, 29 per cent of respondents say they would exclusively consider buying an EV — a significant drop from 40 per cent last year.

The report, which surveyed 1,801 people on the AutoTrader website, shows drivers are concerned about reduced government incentives, a lack of infrastructure and long-term costs despite falling prices.

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index.

The survey, conducted between Feb. 13 and March 12, shows 68 per cent of non-EV owners say government incentives could influence their decision, while a little over half say incentives increase their confidence in buying an EV.

Automotive

Hyundai moves SUV production to U.S.

MxM News

MxM News

Quick Hit:

Hyundai is responding swiftly to 47th President Donald Trump’s newly implemented auto tariffs by shifting key vehicle production from Mexico to the U.S. The automaker, heavily reliant on the American market, has formed a specialized task force and committed billions to American manufacturing, highlighting how Trump’s America First economic policies are already impacting global business decisions.

Key Details:

-

Hyundai has created a tariffs task force and is relocating Tucson SUV production from Mexico to Alabama.

-

Despite a 25% tariff on car imports that began April 3, Hyundai reported a 2% gain in Q1 operating profit and maintained earnings guidance.

-

Hyundai and Kia derive one-third of their global sales from the U.S., where two-thirds of their vehicles are imported.

Diving Deeper:

In a direct response to President Trump’s decisive new tariffs on imported automobiles, Hyundai announced Thursday it has mobilized a specialized task force to mitigate the financial impact of the new trade policy and confirmed production shifts of one of its top-selling models to the United States. The move underscores the gravity of the new 25% import tax and the economic leverage wielded by a White House that is now unambiguously prioritizing American industry.

Starting with its popular Tucson SUV, Hyundai is transitioning some manufacturing from Mexico to its Alabama facility. Additional consideration is being given to relocating production away from Seoul for other U.S.-bound vehicles, signaling that the company is bracing for the long-term implications of Trump’s tariffs.

This move comes as the 25% import tax on vehicles went into effect April 3, with a matching tariff on auto parts scheduled to hit May 3. Hyundai, which generates a full third of its global revenue from American consumers, knows it can’t afford to delay action. Notably, U.S. retail sales for Hyundai jumped 11% last quarter, as car buyers rushed to purchase vehicles before prices inevitably climb due to the tariff.

Despite the trade policy, Hyundai reported a 2% uptick in first-quarter operating profit and reaffirmed its earnings projections, indicating confidence in its ability to adapt. Yet the company isn’t taking chances. Ahead of the tariffs, Hyundai stockpiled over three months of inventory in U.S. markets, hoping to blunt the initial shock of the increased import costs.

In a significant show of good faith and commitment to U.S. manufacturing, Hyundai last month pledged a massive $21 billion investment into its new Georgia plant. That announcement was made during a visit to the White House, just days before President Trump unveiled the auto tariff policy — a strategic alignment with a pro-growth, pro-America agenda.

Still, the challenges are substantial. The global auto industry depends on complex, multi-country supply chains, and analysts warn that tariffs will force production costs higher. Hyundai is holding the line on pricing for now, promising to keep current model prices stable through June 2. After that, however, price adjustments are on the table, potentially passing the burden to consumers.

South Korea, which remains one of the largest exporters of automobiles to the U.S., is not standing idle. A South Korean delegation is scheduled to meet with U.S. trade officials in Washington Thursday, marking the start of negotiations that could redefine the two nations’ trade dynamics.

President Trump’s actions represent a sharp pivot from the era of global corporatism that defined trade under the Obama-Biden administration. Hyundai’s swift response proves that when the U.S. government puts its market power to work, foreign companies will move mountains — or at least entire assembly lines — to stay in the game.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTrump Has Driven Canadians Crazy. This Is How Crazy.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoThe Anhui Convergence: Chinese United Front Network Surfaces in Australian and Canadian Elections

-

Automotive19 hours ago

Automotive19 hours agoHyundai moves SUV production to U.S.

-

2025 Federal Election2 days ago

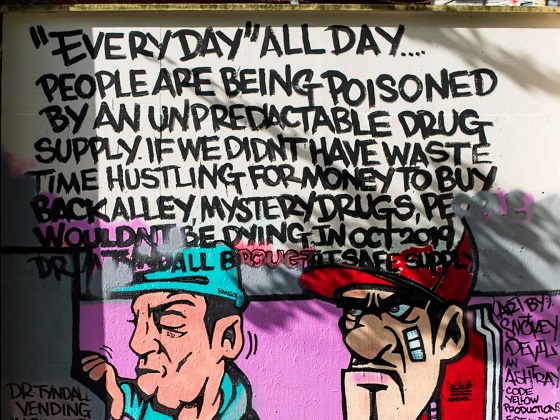

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

Entertainment1 day ago

Entertainment1 day agoPedro Pascal launches attack on J.K. Rowling over biological sex views

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

2025 Federal Election15 hours ago

2025 Federal Election15 hours agoAs PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work