Digital Currency

Conservatives urge Canadians to reject mandatory digital IDs proposed by Liberal gov’t

From LifeSiteNews

Canadian federal regulators have disclosed they are working on digital credentials for Canadians despite the fact MPs have repeatedly rejected the proposal over safety concerns.

The Conservative Party of Canada (CPC) called on Canadians to resist and oppose “mandatory digital ID.”

“He’s (Prime Minister Justin Trudeau) trying to encroach on your freedom and privacy, again. The Liberal government has been CAUGHT trying to create a mandatory digital ID,” the CPC said in a recent email to members.

As reported by LifeSiteNews, Canadian federal regulators have disclosed they are working on digital credentials for Canadians despite the fact MPs have repeatedly rejected the proposal over safety concerns.

Shared Services Canada, which is a federal IT department, is developing “digital credentials” like Social Insurance Numbers, which one needs in order to work.

The CPC has launched a petition that anyone can sign calling for Canadians to “oppose” any such digital ID system.

“This Liberal government can’t be trusted to protect confidential information. They have already been HACKED and scammed, costing Canadians hundreds of millions of dollars,” the CPC said.

The CPC noted that Trudeau is “trying to win re-election through TOTAL CONTROL.”

“Canadians do not want more intrusive government surveillance,” the CPC stated.

CPC leader Pierre Poilievre is opposed to digital IDs as well as a federal digital dollar, which seems to be on hold for now, and has promised to introduce a new online harms bill that would “expressly prohibit” digital IDs in Canada.

The Trudeau government is trying to push through laws affecting Canadians’ online freedoms such as Bill C-63 that seeks to punish “hate speech” online.

Banks

Top Canadian bank studies possible use of digital dollar for ‘basic’ online payments

From LifeSiteNews

A new report released by the Bank of Canada proposed a ‘promising architecture well-suited for basic payments’ through the use of a digital dollar, though most Canadians are wary of such an idea.

Canada’s central bank has been studying ways to introduce a central bank digital currency (CBDC) for use for online retailers, according to a new report, despite the fact that recent research suggests Canadians are wary of any type of digital dollar.

In a new 47-page report titled, “A Retail CBDC Design For Basic Payments Feasibility Study,” which was released on June 13, 2025, the Bank of Canada (BOC) identified a “promising architecture well-suited for basic payments” through the use of a digital dollar.

The report reads that CBDCs “can be fast and cheap for basic payments, with high privacy, although some areas such as integration with retail payments systems, performance of auditing and resilience of the core system state require further investigation.”

While the report authors stopped short of fully recommending a CBDC, they noted it is a decision that could happen “outside the scope of this analysis.”

“Our framing highlights other promising architectures for an online retail CBDC, whose analysis we leave as an area for further exploration,” reads the report.

When it comes to a digital Canadian dollar, the Bank of Canada last year found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Indeed, a 2023 study found that most Canadians, about 85 percent, do not want a digital dollar, as previously reported by LifeSiteNews.

The study found that a “significant number” of Canadians are suspicious of government overreach and would resist any measures by the government or central bank to create digital forms of official money.

The BOC has said that it would continue to look at other countries’ use and development of CBDCs and will work with other “central banks” to improve so-called cross border payments.

Last year, as reported by LifeSiteNews, the BOC has already said that plans to create a digital “dollar,” also known as a central bank digital currency (CBDC), have been shelved.

Digital currencies have been touted as the future by some government officials, but, as LifeSiteNews has reported before, many experts warn that such technology would restrict freedom and could be used as a “control tool” against citizens, similar to China’s pervasive social credit system.

The BOC last August admitted that the creation of a CBDC is not even necessary, as many people rely on cash to pay for things. The bank concluded that the introduction of a digital currency would only be feasible if consumers demanded its release.

Conservative Party leader Pierre Poilievre has promised, should he ever form the government, he would oppose the creation of a digital dollar.

Contrast this to Canada’s current Liberal Prime Minister Mark Carney. He has a history of supporting central bank digital currencies and in 2022 supported “choking off the money” donated to the Freedom Convoy protests against COVID mandates.

Business

Justice Centre launches new petition: Keep cash legal and accessible. Stop Bill C-2

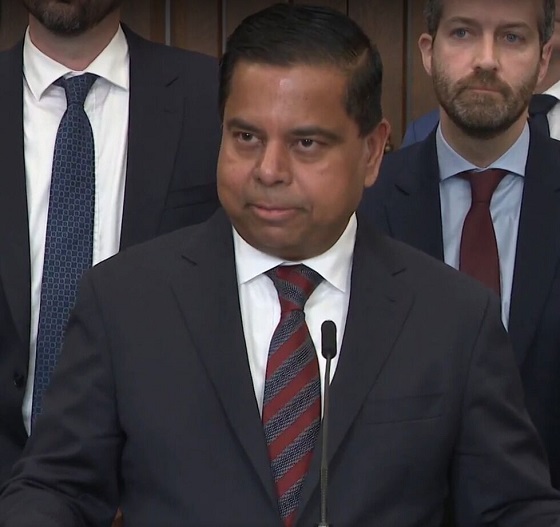

Public Safety Minister Gary Anandasangaree speaks to Bill C-2 (Screenshot from CBC video)

The Justice Centre for Constitutional Freedoms has launched a petition calling upon the Prime Minister of Canada to strike the criminalization of cash payments of $10,000 or more from Bill C-2 and to introduce legislation protecting the right of Canadians to use cash of any amount for legal transactions.

Public Safety Minister Gary Anandasangaree introduced Bill C-2, or the Strong Borders Act, in the House of Commons on June 3, 2025. According to a Government of Canada statement, Bill C-2 will equip law enforcement with tools to secure borders and to combat crime, the drug trade, and money laundering.

Buried deep within the Bill, however, are provisions that would make it a criminal offence for businesses, professionals, and charities to accept cash payments of $10,000 or more in a single transaction or in a series of related transactions.

Bill C-2 at page 59

Justice Centre President John Carpay warns that the criminalization of cash transactions threatens the privacy, freedom of expression, and autonomy of all Canadians. When cash transactions are criminalized, governments, banks, and law enforcement can track and interfere with legitimate purchases and donations.

“We must not criminalize everyday Canadians for using physical currency. Once $10,000 is criminalized, it will be all too easy for future governments to lower the threshold to $5,000, then $1,000, and eventually nothing.”

Bill C-2 is just one point in a concerning anti-cash trend in Canada.

Quebec’s controversial Bill 54, passed into law in March 2024, allows police to assume that any person carrying $2,000 or more in cash is connected to criminal activity. Officers can seize the cash, and citizens must prove their innocence to get the cash back.

“Restricting the use of cash is a dangerous step towards tyranny,” continued Mr. Carpay. “Cash protects citizens from surveillance by government and banks, credit card companies, and other corporations. In a free society, violating the right of law-abiding citizens to use cash is not the answer to money laundering or the drug trade.”

Signers of the petition call upon the Prime Minister of Canada to strike the criminalization of cash payments from Bill C-2.

Signers of the petition also call upon the Prime Minister of Canada to introduce legislation that protects Canadians’ right to use cash of any amount for legal transactions.

-

Energy1 day ago

Energy1 day agoB.C. Residents File Competition Bureau Complaint Against David Suzuki Foundation for Use of False Imagery in Anti-Energy Campaigns

-

Alberta2 days ago

Alberta2 days agoAlberta uncorks new rules for liquor and cannabis

-

COVID-191 day ago

COVID-191 day agoCourt compels RCMP and TD Bank to hand over records related to freezing of peaceful protestor’s bank accounts

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

C2C Journal23 hours ago

C2C Journal23 hours agoCanada Desperately Needs a Baby Bump

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

Agriculture10 hours ago

Agriculture10 hours agoLacombe meat processor scores $1.2 million dollar provincial tax credit to help expansion