Housing

Conservative leader Pierre Poilievre’s video on Canada’s housing crisis under Trudeau gov’t goes viral

From LifeSiteNews

‘Housing hell: How we got here and how we get out’ has been viewed more than four million times.

A video by Conservative Party of Canada (CPC) leader Pierre Poilievre exposing the country’s housing prices and supply crisis, which a taxpayer watchdog said is being fueled by high-interest rates from bad fiscal policy by Prime Minister Justin Trudeau’s government, has reached over 4 million views.

“Something new and strange has happened in Canada. Canada is sitting on probably one of the largest housing bubbles of all times, something we haven’t seen before,” Poilievre said in his 15-minute video titled Housing hell: How we got here and how we get out.

“An entire generation of youth now say they will never be able to afford a home. This is not normal for Canada.”

Housing hell: How we got here and how we get out. pic.twitter.com/vVLsXMVM35

— Pierre Poilievre (@PierrePoilievre) December 2, 2023

The video goes deep into Canada’s housing market and includes statistics on why it is in such a dire state. It currently has 4.2 million views on X (formerly Twitter) after it was released on December 2.

Poilievre documents in his video, using facts to back him up, that in the coming months and years “tens of thousands of Canadians could default on their mortgages” due to skyrocketing interest rates.

He noted how the “nightmare scenario” after “generations of affordable and stable Canadian home prices” means that 66% of a person’s average monthly income is to simply “make payments on the average single detached Canadian house.”

“Given that most of the remaining 34 percent of the family paycheck is taken out by taxes, there’s literally nothing left for food and recreation,” Poilievre noted.

Taxpayer watchdog says high house prices due to Trudeau’s out of ‘control’ government

Franco Terrazzano, federal director for the Canadian Taxpayers Federation (CTF), told LifeSiteNews that the reason house prices, along with everything else, are more expensive is due to Trudeau’s “out of control” governmental spending.

“Trudeau’s never-ending deficits and the hundreds of billions of dollars the Bank of Canada printed during the pandemic are driving up the cost of everything,” Terrazzano told LifeSiteNews.

“Life is more expensive because the cost of government is out of control.”

Terrazzano noted that governmental fiscal policy is making home prices more expensive and thus out of reach for most. He said what needs to happen is a reduction in red tape.

“Taxes and onerous government regulations are making homes more expensive,” Terrazzano told LifeSiteNews.

“If governments want to make homes more affordable, they would cut taxes and the red tape that makes it harder and more expensive to build homes.”

Terrazzano highlighted a report from the C.D. Howe Institute that shows the cost of excessive government regulations on home building.

As for Poilievre, he observed how it now would take a staggering 25 years just to save enough money to make a downpayment for a simple home in Toronto.

He continued, noting how newlyweds now on average pay $1,000 per month to rent a “single room in a townhouse that they share with two other couples.”

He also raised the issue of how 35-year-olds “live in their parent’s basements” and “rents are so high in Toronto that students live in homeless shelters.”

When it comes to middle-class workers, Poilievre emphasized how “people like nurses and carpenters now live in their vehicles.”

While housing falls primarily under provincial and municipal jurisdiction, some areas, such as interest rates, are directly influenced by the federal government.

House prices have shot up in Canada due to short supply in the market, and speculative buying and interest rates have risen to highs not seen for decades. As it stands, Canada’s interest rate sits at 5%. At this same time in 2021, interest rates were 0.25%.

This past Wednesday, the Bank of Canada decided to keep rates at 5% but did not rule out future rate increases, as it “is still concerned about risks to the outlook for inflation and remains prepared to raise the policy rate further if needed.”

Interestingly, Trudeau put out a video the same day as Poilievre that he said was to address housing challenges. This video only has 264,000 views, however.

Curiously, Poilievre made no mention of Canada’s high immigration levels, which critics say has put a strain on an already tight supply.

Maxime Bernier, leader of the People’s Party of Canada, has been one of the only party leaders to call out high immigration levels and their effects on housing.

Trudeau’s ‘money printing’ pouring fuel on ‘inflationary fire’

According to Poilievre in his video, in the past one could save enough to buy a house by their mid-20s but said this “changed” about “eight years ago” when Trudeau came to power.

“When the government borrows and spends, it builds up the goods we buy and the interest we pay. The Trudeau government has doubled Canada’s debt, adding more debt than all prime ministers combined. Our finance minister has conceded that this deficit spending pours fuel on the inflationary fire,” Poilievre said.

He observed how excessive money printing through a banking scheme called “quantitative easing” has only benefited well-connected banking insiders and financial institutions that are awash with money.

“In recent years, the Trudeau government spending has exploded, and they’ve been borrowing more than lenders will lend. So, the Bank of Canada has started creating the cash. The money supply has therefore grown eight times faster than the economy over the last three years,” Poilievre said.

“More money bidding on fewer goods, including fewer houses, equals higher prices.”

Poilievre ended his video by stating that the “good news is housing costs were not like this before Justin Trudeau.”

“And they won’t be like this after he’s gone,” he added.

He said that the solution, besides a change in leadership, is for all levels of government to work together to cut red tape and taxes to encourage the construction of new homes.

Under Trudeau, mainly due to excessive COVID money printing, inflation has skyrocketed.

A recent report from September 5 by Statistics Canada shows food prices are rising faster than headline inflation at a rate of between 10% and 18% per year.

Earlier this year, the Bank of Canada acknowledged that Trudeau’s federal “climate change” programs, which have been deemed “extreme” by some provincial leaders, are indeed helping to fuel inflation.

2025 Federal Election

Homebuilding in Canada stalls despite population explosion

From the Fraser Institute

By Austin Thompson and Steven Globerman

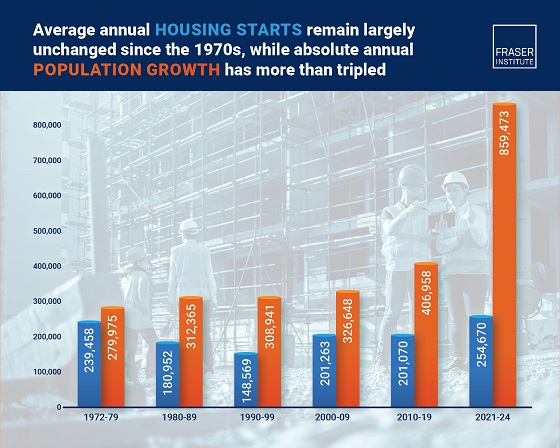

Between 1972 and 2019, Canada’s population increased by 1.8 residents for every new housing unit started compared to 3.9 new residents in 2024. In other words, Canada must now house more than twice as many new residents per new housing unit as it did during the five decades prior to the pandemic

In many parts of Canada, the housing affordability crisis continues with no end in sight. And many Canadians, priced out of the housing market or struggling to afford rent increases, are left wondering how much longer this will continue.

Simply put, too few housing units are being built for the country’s rapidly growing population, which has exploded due to record-high levels of immigration and the federal government’s residency policies.

As noted in a new study published by the Fraser Institute, the country added an all-time high 1.2 million new residents in 2023—more than double the previous record in 2019—and another 951,000 new residents in 2024. Altogether, Canada’s population has grown by about 3 million people since 2022—roughly matching the total population increase during the 1990s.

Meanwhile, homebuilding isn’t keeping up. In 2024, construction started on roughly 245,000 new housing units nationwide—down from a recent peak of 272,000 in 2021. By contrast, in the 1970s construction started on more than 240,000 housing units (on average) per year—when Canada’s population grew by approximately 280,000 people annually.

In fact, between 1972 and 2019, Canada’s population increased by 1.8 residents for every new housing unit started compared to 3.9 new residents in 2024. In other words, Canada must now house more than twice as many new residents per new housing unit as it did during the five decades prior to the pandemic. And of course, housing follows the laws of supply and demand—when a lot more prospective buyers and renters chase a limited supply of new homes, prices increase.

This key insight should guide the policy responses from all levels of government.

For example, the next federal government—whoever that may be—should avoid policies that merely fuel housing demand such as home savings accounts. And provincial governments (including in Ontario and British Columbia) should scrap any policies that discourage new housing supply such as rent controls, which reduce incentives to build rental housing. At the municipal level, governments across the country should ensure that permit approval timelines and building fees do not discourage builders from breaking ground. Increasing housing supply is, however, only part of the solution. The next federal government should craft immigration and residency policies so population growth doesn’t overwhelm available housing supply, driving up costs for Canadians.

It’s hard to predict how long Canada’s housing affordability crisis will last. But without more homebuilding, slower population growth, or both, there’s little reason to expect affordability woes to subside anytime soon.

2025 Federal Election

Housing starts unchanged since 1970s, while Canadian population growth has more than tripled

From the Fraser Institute

By: Austin Thompson and Steven Globerman

The annual number of new homes being built in Canada in recent years is virtually the same as it was in the 1970s, despite annual population growth

now being three times higher, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think tank.

“Despite unprecedented levels of immigration-driven population growth following the COVID-19 pandemic, Canada has failed to ramp up homebuilding sufficiently to meet housing demand,” said Steven Globerman, Fraser Institute senior fellow and co-author of The Crisis in Housing Affordability: Population Growth and Housing Starts 1972–2024.

Between 2021 and 2024, Canada’s population grew by an average of 859,473 people per year, while only 254,670 new housing units were started annually. From 1972 to 1979, a similar number of new housing units were built—239,458—despite the population only growing by 279,975 people a year.

As a result, more new residents are competing for each new home than in the past, which is driving up housing costs.

“The evidence is clear—population growth has been outpacing housing construction for decades, with predictable results,” Globerman said.

“Unless there is a substantial acceleration in homebuilding, a slowdown in population growth, or both, Canada’s housing affordability crisis is unlikely to improve.”

The Crisis in Housing Affordability: Population Growth and Housing Starts 1972–2024

- Canada experienced unprecedented population growth following the COVID-19 pandemic without a commensurately large increase in new homebuilding.

- The imbalance between population growth and new housing construction is reflected in a significant gap between housing demand and supply, which is driving up housing costs.

- Canada’s population grew by a record 1.23 million new residents in 2023 almost entirely due to immigration. That growth was more than double the pre-pandemic record set in 2019.

- Population growth slowed to 951,517 in 2024, still well above any year before 2023.

- Nationally, construction began on about 245,367 new housing units in 2024, down from a recent high of 271,198 starts in 2021—Canada’s annual number of housing starts peaked at 273,203 in 1976.

- Canada’s annual number of housing starts regularly exceeded 200,000 in past decades, when absolute population growth was much lower.

- In 2023, Canada added 5.1 new residents for every housing unit started, which was the highest ratio over the study’s timeframe and well above the average rate of 1.9 residents for every unit started observed over the study period (1972–2024).

- This ratio improved modestly in 2024, with 3.9 new residents added per housing start. However, the ratio remains far higher than at any point prior to the COVID-19 pandemic.

- These national trends are broadly mirrored across all 10 provinces, where annual population growth relative to housing starts is, to varying degrees, elevated when compared to long-run averages.

- Without an acceleration in homebuilding, a slowdown in population growth, or both, Canada’s housing affordability crisis will likely persist.

Austin Thompson

-

2025 Federal Election24 hours ago

2025 Federal Election24 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

Business13 hours ago

Business13 hours agoHudson’s Bay Bid Raises Red Flags Over Foreign Influence

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoCanada’s pipeline builders ready to get to work

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust