Energy

Coal: one million tons an hour

From Resource Works

By Stewart Muir

There is no “energy transition” – It’s all “energy addition”

Politicians and climate campaigners like to talk of an “energy transition” in which the world is going to burn less and less fossil fuel, switch to clean (or cleaner) energy, and thus resolve climate issues.

But so far the “transition” is not so much about moving away from traditional fuels as about adding renewable energy sources on top of them.

Our latest episode of Power Struggle looks at the impact of world use of coal, which is still a prime source of energy — and growing. That’s bad, we agree, but some uses of coal are going to be hard to change.

Experts have been predicting “peak coal” for years but they’ve always been wrong. This year, global coal consumption is expected to reach an all-time high.

Some key points from our podcast with our Stewart Muir:

- The world burns over one million tons of coal every hour. That’s the weight of nearly 5,000 Statues of Liberty or 10 aircraft carriers, or about 247,000 adult African elephants. So make that 37,000 adult African elephants every hour.

- Coal energy has enabled millions of people in developing countries to better their lives, and their nations’ economies.

- India’s coal consumption went up 10% in 2024. And Vietnam, the Philippines, Indonesia and Pakistan are increasingly reliant on coal.

- China may have installed more renewable-energy sources, and may lead in electric vehicles, but China’s green-energy business is built on coal.

So, while we hail the energy transition, and applaud solar energy, carbon capture and more, we still need to talk about the 247,000 elephants in the world’s room — coal.

Clearly, without addressing coal’s persistent use, the energy transition will fail.

Catch this latest (13th) episode of Power Struggle on YouTube here: https://ow.ly/WiSw50UzX9F

And watch our previous episodes here: https://ow.ly/XK9350UzX9R

Bjorn Lomborg

Global Warming Policies Hurt the Poor

From the Fraser Institute

Had prices been kept at the same level, an average family of four would be spending £1,882 on electricity. Instead, that family now pays £5,425 per year. The average UK person now consumes just over 10 kWh per day—a low point in consumption not seen since the 1960s.

We are often told by climate campaigners that climate change is especially pernicious because its effects over coming decades will disproportionately affect the poorest people in Canada and the world. Unfortunately, they miss that climate policies are directly hurting the poor right now.

More energy leads to better, healthier, longer lives. Less energy means fewer opportunities. Climate policies demand we pay more for less reliable energy. The impact is greater if you’re poorer: the wealthy might grumble about higher costs but can generally absorb them; the poor are forced to cut back.

For evidence, look to the United Kingdom which has led the world on stiff climate policies and net zero promises for some two decades, sustained by successive governments: its inflation-adjusted electricity price, weighted across households and industry, has tripled from 2003 to 2023, mostly because of climate policies. The total, annual UK electricity bill is now $CAD160 billion, which is $CAD105 billion more than if prices in real terms had stayed unchanged since 2003. This unnecessary increase is so costly that it is twice the entire cost that the UK spends on elementary education. Had prices been kept at the same level, an average family of four would be spending £1,882 on electricity. Instead, that family now pays £5,425 per year.

Over that time, the richest one per cent absorbed the costs and even managed to increase their consumption. But the poorest fifth of UK households saw their electricity consumption decline by a massive one-third.

The effects of climate policies mean the UK can afford less power. The average UK person now consumes just over 10 kWh per day—a low point in consumption not seen since the 1960s. While global individual electricity consumption is steadily increasing, the energy available to an average Brit is sharply decreasing.

Climate policies hurt the poor even in energy-abundant countries like Canada and the United States. Universally, poor people in well-off countries use much more of their limited budgets paying for electricity and heating. US low-income consumers spend three-times more on electricity as a percentage of their total spending than high-income consumers. It’s easy to understand why the elites have no problem supporting electricity or gas price hikes—they can easily afford them.

As mentioned in the article on cold and heat deaths, high energy prices literally kill people—and this is especially true for the poor. Cold homes are one of the leading causes of deaths in winter through strokes, heart attacks, and respiratory diseases. Researchers looked at the natural experiment that happened in the United States around 2010, when fracking delivered a dramatic reduction in costs of natural gas. The massive increase in availability of natural gas drove down the price of heating. The scientists concluded that every single winter, lower energy prices from fracking save about 12,500 Americans from dying. To put this another way, all else being equal, a reversal and hike in energy prices would kill an additional 12,500 people each year.

As bleak as things are for the poor in rich countries, virtue-signaling climate policy has even farther-reaching impacts on the developing world, where people desperately need more access to the cheap and plentiful energy that previously allowed rich nations to develop. In the poor half of the world, more than two billion people have to cook and keep warm with polluting fuels such as dung and wood. This means their indoor air is so polluted it is equivalent to smoking two packs of cigarettes a day—causing millions of deaths each year.

In Africa, electricity is so scarce that the total electricity available per person is much less than what a single refrigerator in the rich world uses. This hampers industrialization, growth, and opportunity. Case in point: The rich world on average has 650 tractors per 50km2, while the impoverished parts of Africa have just one.

But rich countries like Canada—through restrictions on bilateral aid and contributions to global bodies like the World Bank—refuse to fund anything remotely fossil fuel-related. More and more development and aid money is being diverted to climate change, away from the world’s more pressing challenges.

Canada still gets more than three-quarters of its energy (not just electricity) from fossil fuels. Yet, it blocks poor countries from achieving more energy access, with the naïve suggestion that the poor “skip” to intermittent solar and wind with an unreliability that the rich world does not accept to fulfil its own, much bigger needs.

A large 2021 survey of leaders in low- and middle-income countries shows education, employment, peace and health are at the top of their development priorities, with climate coming 12th out of 16 issues. But wealthy countries refuse to pay attention to what poor countries need, in the name of climate change.

The blinkered pursuit of climate goals blinds politicians in rich countries like Canada to the impacts on the poor, both here and across the world in developing nations. Climate policies that cause higher energy costs and push people toward unreliable energy sources disproportionately burden those least able to bear them.

Canadian Energy Centre

Why nation-building Canadian resource projects need Indigenous ownership to succeed

Chief Greg Desjarlais of Frog Lake First Nation signs an agreement in September 2022 whereby 23 First Nations and Métis communities in Alberta will acquire an 11.57 per cent ownership interest in seven Enbridge-operated oil sands pipelines for approximately $1 billion. Photo courtesy Enbridge

From the Canadian Energy Centre

U.S. trade dispute converging with rising tide of Indigenous equity

A consensus is forming in Canada that Indigenous ownership will be key to large-scale, nation-building projects like oil and gas pipelines to diversify exports beyond the United States.

“Indigenous ownership benefits projects by making them more likely to happen and succeed,” said John Desjarlais, executive director of the Indigenous Resource Network.

“This is looked at as not just a means of reconciliation, a means of inclusion or a means of managing risk. I think we’re starting to realize this is really good business,” he said.

“It’s a completely different time than it was 10 years ago, even five years ago. Communities are much more informed, they’re much more engaged, they’re more able and ready to consider things like ownership and investment. That’s a very new thing at this scale.”

John Desjarlais, executive director of the Indigenous Resource Network in Bragg Creek, Alta. Photo by Dave Chidley for the Canadian Energy Centre

John Desjarlais, executive director of the Indigenous Resource Network in Bragg Creek, Alta. Photo by Dave Chidley for the Canadian Energy Centre

Canada’s ongoing trade dispute with the United States is converging with a rising tide of Indigenous ownership in resource projects.

“Canada is in a great position to lead, but we need policymakers to remove barriers in developing energy infrastructure. This means creating clear and predictable regulations and processes,” said Colin Gruending, Enbridge’s president of liquids pipelines.

“Indigenous involvement and investment in energy projects should be a major part of this strategy. We see great potential for deeper collaboration and support for government programs – like a more robust federal loan guarantee program – that help Indigenous communities participate in energy development.”

In a statement to the Canadian Energy Centre, the Alberta Indigenous Opportunities Corporation (AIOC) – which has backstopped more than 40 communities in energy project ownership agreements with a total value of over $725 million – highlighted the importance of seizing the moment:

“The time is now. Canada has a chance to rethink how we build and invest in infrastructure,” said AIOC CEO Chana Martineau.

“Indigenous partnerships are key to making true nation-building projects happen by ensuring critical infrastructure is built in a way that is competitive, inclusive and beneficial for all Canadians. Indigenous Nations are essential partners in the country’s economic future.”

Key to this will be provincial and federal programs such as loan guarantees to reduce the risk for Indigenous groups and industry participants.

“There are a number of instruments that would facilitate ownership that we’ve seen grow and develop…such as the loan guarantee programs, which provide affordable access to capital for communities to invest,” Desjarlais said.

Workers lay pipe during construction of the Trans Mountain pipeline expansion on farmland in Abbotsford, B.C. on Wednesday, May 3, 2023. CP Images photo

Workers lay pipe during construction of the Trans Mountain pipeline expansion on farmland in Abbotsford, B.C. on Wednesday, May 3, 2023. CP Images photo

Outside Alberta, there are now Indigenous loan guarantee programs federally and in Saskatchewan. A program in British Columbia is in development.

The Indigenous Resource Network highlights a partnership between Enbridge and the Willow Lake Métis Nation that led to a land purchase of a nearby campground the band plans to turn into a tourist destination.

“Tourism provides an opportunity for Willow Lake to tell its story and the story of the Métis. That is as important to our elders as the economic considerations,” Willow Lake chief financial officer Michael Robert told the Canadian Energy Centre.

The AIOC reiterates the importance of Indigenous project ownership in a call to action for all parties:

“It is essential that Indigenous communities have access to large-scale capital to support this critical development. With the right financial tools, we can build a more resilient, self-sufficient and prosperous economy together. This cannot wait any longer.”

In an open letter to the leaders of all four federal political parties, the CEOs of 14 of Canada’s largest oil and gas producers and pipeline operators highlighted the need for the federal government to step up its participation in a changing public mood surrounding the construction of resource projects:

“The federal government needs to provide Indigenous loan guarantees at scale so industry may create infrastructure ownership opportunities to increase prosperity for communities and to ensure that Indigenous communities benefit from development,” they wrote.

For Desjarlais, it is critical that communities ultimately make their own decisions about resource project ownership.

“We absolutely have to respect that communities want to self-determine and choose how they want to invest, choose how they manage a lot of the risk and how they mitigate it. And, of course, how they pursue the rewards that come from major project investment,” he said.

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoEuthanasia is out of control in Canada, but nobody is talking about it on the campaign trail

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoMEI-Ipsos poll: 56 per cent of Canadians support increasing access to non-governmental healthcare providers

-

2025 Federal Election18 hours ago

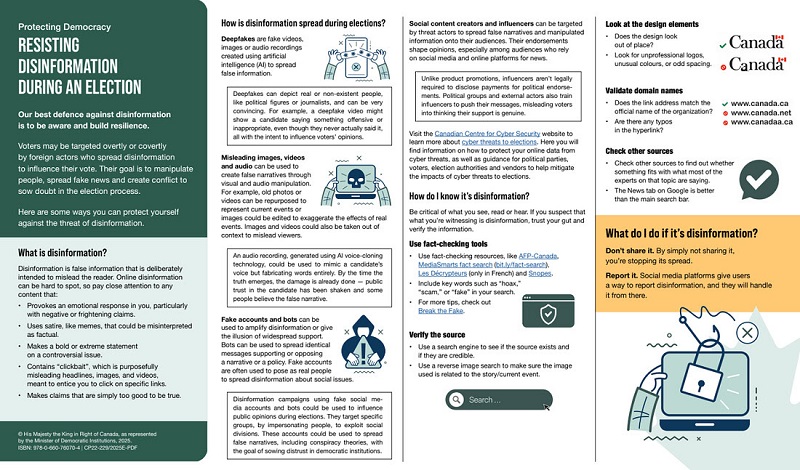

2025 Federal Election18 hours agoAI-Driven Election Interference from China, Russia, and Iran Expected, Canadian Security Officials Warn

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoInside Buttongate: How the Liberal Swamp Tried to Smear the Conservative Movement — and Got Exposed

-

illegal immigration1 day ago

illegal immigration1 day agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.

-

Bjorn Lomborg23 hours ago

Bjorn Lomborg23 hours agoGlobal Warming Policies Hurt the Poor