Business

CBC television ad revenue dropped 16% in first half of 2023 as mainstream media flounders

From LifeSiteNews

The news comes just weeks after the CBC announced it must lay off about 600 workers, approximately 10 percent of its staff, as it faces a $125 million budget shortfall.

The Canadian Broadcasting Corporation (CBC) television ad revenues plummeted by 16 percent in the first half of this year, a further indication that mainstream media is struggling to keep pace in the independent era.

According to information obtained December 19 by Blacklock’s Reporter, CBC, Canada’s public radio and television broadcaster, published their Second Quarter Financial Report which revealed that television ad revenues decreased from $95.7 million to $80.6 million in the first six months of 2023.

“There is much to do to prepare CBC for an uncertain future,” President and CEO Catherine Tait said. “We are experiencing the same challenges as other media in Canada and around the world.”

The news comes after Tait failed to mention the reduced ad revenues at the November 2 Commons heritage committee. It is also just weeks after the CBC announced that it must lay off about 600 workers, approximately 10 percent of its staff, as it faces a $125 million budget shortfall.

According to the report, from the beginning of the year until September 30, the CBC lost 16 percent of its television ad revenues for both English and French programming. The report further states that it does not expect a recovery from the loss for years.

“In response to the federal Budget 2023 announcement to reduce spending by three percent and in light of both the softening of the TV advertising market and the current economic environment we are developing an analysis of the revised financial context that presents an updated version of our financial pressures including the adverse revenue outlook for the next three years,” it said.

“We occupy an important place in the Canadian broadcasting system and face a unique set of risks,” the report stated. “Like all broadcasters we must adapt to accelerated technological changes, shifts in demographics, evolving consumer demands, increasing regulatory scrutiny and structural changes in the media ecosystem.”

Despite its revenue “tracking below target,” the CBC receives major funding from the Liberal government under the leadership of Prime Minister Justin Trudeau. The government subsidies make up CBC’s largest single source of income, a fact that has become a point of contention among taxpayers who see the propping up of the outlet as unnecessary.

On November 2, Tait claimed that the CBC requires further government funding, saying “To be clear over the last 30 years CBC has not had a real increase in its budget, real dollars aside.”

“When I started at CBC the number of people watching traditional television was at about 28 percent,” she added. “It has now dropped to 14 percent.”

Tait’s comment seems unfounded considering the CBC was set to receive increased funding as a result of mandated deals signed with Big Tech under Trudeau’s Online News Act.

The deal was finalized in early December. Under the new agreement, Google will pay legacy media outlets $100 million to publish links to their content on both the Google search engine and YouTube.

As a result of the recent subsidies and the Google agreement, roughly half the salary of a journalist earning $85,000 is estimated to be paid by the combined contributions of the Trudeau government and Google.

Furthermore, Trudeau recently announced increased payouts for legacy media outlets ahead of the 2025 election. The subsidies are expected to cost taxpayers $129 million over the next five years.

Beginning in 2019, Parliament changed the Income Tax Act to give yearly rebates of 25 percent for each news employee in cabinet-approved media outlets earning up to $55,000 a year, to a maximum of $13,750.

However, the Canadian Heritage Department has since admitted that the payouts are not sufficient to keep legacy media outlets running. Accordingly, the Trudeau government doubled the rebates to a maximum of $29,750 annually, up to 35 percent of a journalist’s salary.

Furthermore, despite being nominally unaffiliated with either political party in Canada, the CBC receives massive funding from the Trudeau government. According to its 2020-2021 annual report, the CBC takes in about $1.24 billion in public funding every year, which is roughly 70 percent of its operating budget.

However, the massive payouts are apparently insufficient to keep CBC afloat amid growing distrust in mainstream media.

According to a recent study by Canada’s Public Health Agency, less than a third of Canadians displayed “high trust” in the federal government, with “large media organizations” as well as celebrities getting even lower scores.

Large mainstream media outlets and “journalists” working for them scored a “high trust” rating of only 18 percent. This was followed by only 12 percent of people saying they trusted “ordinary people,” with celebrities receiving only an eight percent “trust” rating.

Business

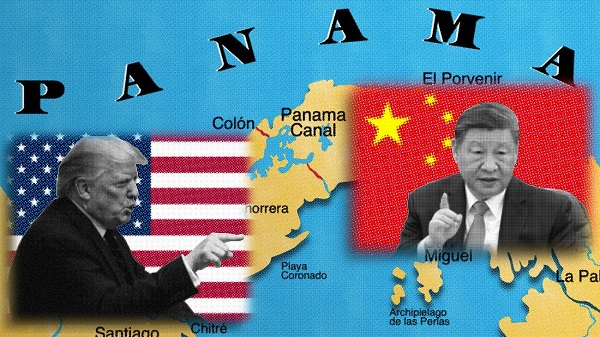

Trump demands free passage for American ships through Panama, Suez

MxM News

MxM News

Quick Hit:

President Donald Trump is pushing for U.S. ships to transit the Panama and Suez canals without paying tolls, arguing the waterways would not exist without America.

Key Details:

-

In a Saturday Truth Social post, Trump said, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

-

Trump directed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the issue, signaling a potential new diplomatic initiative with Panama and Egypt.

-

The Panama Canal generated about $3.3 billion in toll revenue in fiscal 2023, while the Suez Canal posted a record $9.4 billion. U.S. vessels account for roughly 70% of Panama Canal traffic, according to government figures.

Diving Deeper:

President Donald Trump is pressing for American ships to receive free passage through two of the world’s most critical shipping lanes—the Panama and Suez canals—a move he argues would recognize the United States’ historic role in making both waterways possible. In a post shared Saturday on Truth Social, Trump wrote, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

— Rapid Response 47 (@RapidResponse47) April 26, 2025

Trump added that he has instructed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the situation. His comments, first reported by FactSet, come as U.S. companies face rising shipping costs, with tolls for major vessels ranging from $200,000 to over $500,000 per Panama Canal crossing, based on canal authority schedules.

The Suez Canal, operated by Egypt, reportedly saw record revenues of $9.4 billion in 2023, largely driven by American and European shipping amid ongoing Red Sea instability. After a surge in attacks by Houthi militants on commercial ships earlier this year, Trump authorized a sustained military campaign targeting missile and drone sites in northern Yemen. The Pentagon said the strikes were part of an effort to “permanently restore freedom of navigation” for global shipping near the Suez Canal.

Trump has framed the military operations as part of a broader strategy to counter Iranian-backed destabilization efforts across the Middle East.

Meanwhile, in Central America, Trump’s administration is working to counter Chinese influence near the Panama Canal. On April 9th, Defense Secretary Pete Hegseth announced an expanded partnership with Panama to bolster canal security, including a memorandum of understanding allowing U.S. warships and support vessels to move “first and free” through the canal. “The Panama Canal is key terrain that must be secured by Panama, with America, and not China,” Hegseth emphasized during a press conference in Panama City.

American commercial shipping has long depended on the canal, which reduces the shipping route between the U.S. East Coast and Asia by nearly 8,000 miles. About 40% of all U.S. container traffic uses the Panama Canal annually, according to the U.S. Maritime Administration.

The United States originally constructed and controlled the Panama Canal following a monumental effort championed by President Theodore Roosevelt in the early 20th century. After backing Panama’s independence from Colombia in 1903, the U.S. secured the rights to build and operate the canal, which opened in 1914. Although U.S. control ended in 1999 under the Torrijos-Carter Treaties, the canal remains vital to U.S. trade.

2025 Federal Election

Columnist warns Carney Liberals will consider a home equity tax on primary residences

From LifeSiteNews

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Winnipeg Sun Columnist Kevin Klein is sounding the alarm there is substantial evidence the Carney Liberal Party is considering implementing a home equity tax on Canadians’ primary residences as a potential huge source of funds to bring down the massive national debt their spending created.

Klein wrote in his April 23 column and stated in his accompanying video presentation:

The Canada Mortgage and Housing Corporation (CMHC) — a federal Crown corporation — has investigated the possibility of a home equity tax on more than one occasion, using taxpayer dollars to fund that research. This was not backroom speculation. It was real, documented work.

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Kershaw, by the way, believes homeowners are “lottery winners” who didn’t earn their wealth but lucked into it. That’s the ideology being advanced to the highest levels of government.

It didn’t stop there. These proposals were presented directly to federal cabinet ministers. That’s on record, and most of those same ministers are now part of Mark Carney’s team as he positions himself as the Liberals’ next leader.

Watch below Klein’s 7-minute, impassionate warning to Canadians about this looming major new tax should the Liberals win Monday’s election.

Klein further adds:

The total home equity held by Canadians is over $4.7 trillion. It’s the largest pool of private wealth in the country. For millions of Canadians — especially baby boomers — it’s the only retirement fund they have. They don’t have big pensions. They have a paid-off house and a hope that it will carry them through their later years. Yet, that’s what Ottawa has quietly been circling.

The Canadian Taxpayer’s Federation has researched this issue and published a report on the alarming amount of new taxation a homeowner equity tax could cost Canadians who sell their homes that have increased in value over the years they have lived in it. It is a shocker!

A Google search on the question, “what is a home equity tax?” returns the response:

A home equity tax, simply put, it’s a proposed levy on the increased value of your home, specifically, on your principal residence. The idea is for Government to raise money by taxing wealth accumulation from rising property values.

The Canadian Taxpayers Federation has provided a Home Equity Tax Calculator Backgrounder to help Canadians understand what the impact of three different types of Home Equity Tax Calculators would have on home owners. The required tax payment resulting from all three is a shocker.

Keep in mind that World Economic Forum policies intend to eventually eliminate all private home ownership and have the state own and control not only all residences, but also eliminate car ownership, and control when and where you may live and travel.

Carney, Trudeau and several other members of the Liberal government in key positions are heavily connected to the WEF.

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoNine Dead After SUV Plows Into Vancouver Festival Crowd, Raising Election-Eve Concerns Over Public Safety

-

Opinion1 day ago

Opinion1 day agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

2025 Federal Election15 hours ago

2025 Federal Election15 hours agoMark Carney: Our Number-One Alberta Separatist

-

C2C Journal1 day ago

C2C Journal1 day ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

International2 days ago

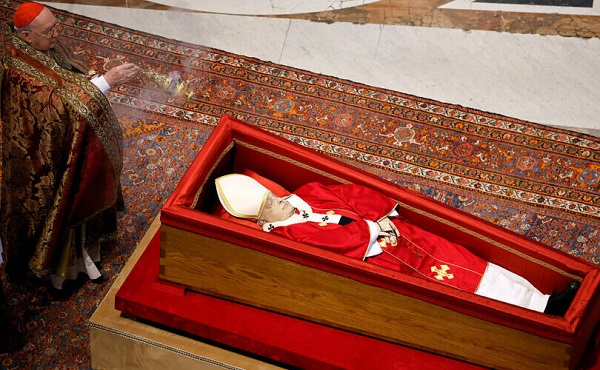

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

International19 hours ago

International19 hours agoJeffrey Epstein accuser Virginia Giuffre reportedly dies by suicide

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s