From the Fraser Institute By Ben Eisen and Jake Fuss Recently, Prime Minister Justin Trudeau announced several short-term initiatives related to tax policy. Most notably, the package includes...

From the Canadian Taxpayers Federation By Ryan Thorpe The cost of administering the federal carbon tax and rebate scheme has risen to $283 million since it...

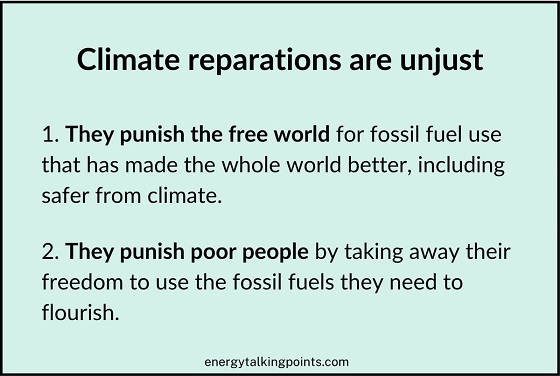

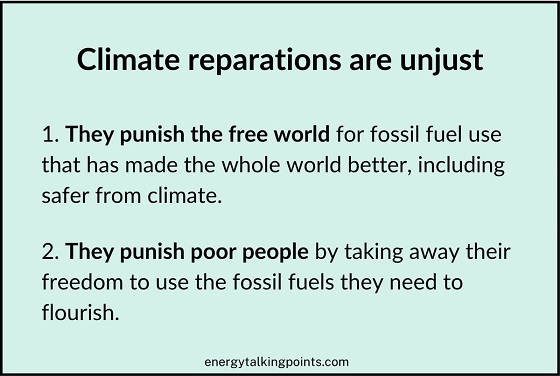

From Energy Talking Points By Alex Epstein The injustice of climate reparations COP 29 is calling for over $1 trillion in annual climate reparations A major theme...

From Resource Works Ottawa’s emissions cap for oil and gas aims to cut emissions but risks raising costs for consumers and disrupting industry stability. Ottawa has...

From EnergyNow.ca By Jim Warren Back in March 2019, the average price for a pound of lean ground beef at five major chain grocery outlets in...

Written By Dan McTeague It doesn’t bode well for our country that our economic security rests on tariff exceptions to be negotiated by Liberal politicians who...

From the Fraser Institute By Jake Fuss and Grady Munro The Trudeau government will soon release its fall economic statement. Though technically intended to be an update on...

From the Daily Caller News Foundation By Stephen Moore A few days before last week’s election, Independent Vermont Sen. Bernie Sanders issued a dire warning to voters....

From EnergyNow.ca By Deidra Garyk Analysis of the U.S. Election and the Canadian Oil and Gas Emissions Cap Monday, November 4, the Canadian federal government announced...

From the C2C Journal By Robert Lyman Most Canadians have come to agree that the federal carbon tax needs to go. But while the rallying cry...