Business

Capital gains tax hike will cause widespread damage in Canadian economy

From the Fraser Institute

By Jake Fuss and Grady Munro

According to an analysis by economist Jack Mintz, 50 per cent of taxpayers who claim more than $250,000 of capital gains in a year earned less than $117,592 in normal annual income from 2011 to 2021. These include individuals with modest annual incomes who own businesses, second homes or stocks, and who may choose to sell those assets once or infrequently in their lifetimes (such as at retirement)

On Monday, two months after tabling the federal budget, Finance Minister Chrystia Freeland introduced a motion in Parliament to increase taxes on capital gains. On Tuesday, the motion passed as the NDP, Bloc Québécois and Green Party voted with the Liberals. Unfortunately for Canadians, the tax hike will likely hurt Canada’s economy. And the finance minister continues to make misleading claims to defend it.

Currently, investors who sell capital assets pay taxes on 50 per cent of the gain (based on their highest marginal tax rate). On June 25, thanks to Freeland’s motion, that share will increase to 66.7 per cent for capital gains above $250,000. (Critically, the gain includes inflationary and real increases in the value of the asset.)

According to Minister Freeland, the hike is necessary because it will bring in more than $19 billion of revenue over five years to pay for new spending on housing, national defence and other programs. This claim is disingenuous for two reasons.

First, investors do not pay capital gains taxes until they sell assets and realize gains. A higher capital gains tax rate gives them an incentive to hold onto their investments, perhaps anticipating that a future government may reduce the rate. Individuals and businesses may not sell their assets as quickly as the government anticipates so the tax hike ends up generating less revenue than expected.

Second, the government does not have a revenue problem. Annual federal revenue is increasing and has grown (nominally) more than $185 billion (or 66.2 per cent) from 2014-15 to 2023-24. Before tabling the budget in April, the government was already anticipating annual revenue to increase by more than $27 billion this year. But the government has chosen to spend every dime it takes in (and then some) instead of being disciplined.

Years of unrestrained spending and borrowing have led to a precarious fiscal situation in Ottawa. If the government wanted to pay for new programs, it could’ve reduced spending in other areas. But Minister Freeland largely chose not to do this and sought new revenue tools after realizing this year’s deficit was on track to surpass her fiscal targets. Clearly, raising taxes to generate revenue was unnecessary and could’ve been avoided with more disciplined spending.

Further misleading Canadians, the Trudeau government claims this tax hike will only increase taxes for “0.13 per cent of Canadians.” But in reality, many Canadians earning modest incomes will pay capital gains taxes.

According to an analysis by economist Jack Mintz, 50 per cent of taxpayers who claim more than $250,000 of capital gains in a year earned less than $117,592 in normal annual income from 2011 to 2021. These include individuals with modest annual incomes who own businesses, second homes or stocks, and who may choose to sell those assets once or infrequently in their lifetimes (such as at retirement). Contrary to the government’s claims, the capital gains tax hike will affect 4.74 million investors in Canadian companies (or 15.8 per cent of all tax filers).

In sum, many Canadians who you wouldn’t consider among “the wealthiest” will earn capital gains exceeding $250,000 following the sale of their assets, and be impacted by Freeland’s hike.

Finally, the capital gains tax hike will also inhibit economic growth during a time when Canadians are seeing a historic decline in living standards. Capital gains taxes discourage entrepreneurship and business investment. By raising capital gains taxes the Trudeau government is reducing the return that entrepreneurs and investors can expect from starting a business or investing in the Canadian economy. This means that potential entrepreneurs or investors are more likely to take their ideas and money elsewhere, and Canadians will continue to suffer the consequences of a stagnating economy.

If Minister Freeland and the Trudeau government want to pave a path to widespread prosperity for Canadians, they should reverse their tax hike on capital gains.

Authors:

2025 Federal Election

Alcohol tax and MP pay hike tomorrow (April 1)

The Canadian Taxpayers Federation is calling on all party leaders to stop a pair of bad policies that are scheduled to happen automatically on April 1: pay raises for members Parliament and another alcohol tax increase.

“Party leaders owe taxpayers answers to these two questions: Why do you think you deserve a pay raise and why should Canadians pay higher taxes on beer and wine?” said Franco Terrazzano, CTF Federal Director. “Politicians don’t deserve a raise while millions of Canadians are struggling.

“And the last thing Canadians need is another tax hike when they pour a cold one or uncork a bottle with that special someone.”

MPs give themselves pay raises each year on April 1, based on the average annual increase in union contracts with corporations with 500 or more employees.

The CTF estimates tomorrow’s pay raise will amount to an extra $6,200 for backbench MPs, $9,200 for ministers and $12,400 for the prime minister, based on contract data published by the federal government.

After tomorrow’s pay raise, backbench MPs will receive a $209,300 annual salary, according to CTF estimates. A minister will collect $309,100 and the prime minister will take home $418,600.

Meanwhile, the alcohol escalator automatically increases excise taxes on beer, wine and spirits every year on April 1, without a vote in Parliament. Alcohol taxes will increase by two per cent tomorrow, costing taxpayers about $40 million this year, according to Beer Canada estimates.

The alcohol escalator tax has cost taxpayers more than $900 million since it was imposed in 2017, according to Beer Canada estimates.

“Politicians are padding their pockets on the same day they’re raising beer taxes and that’s wrong,” Terrazzano said. “If party leaders want to prove they care about taxpayers, they should stop the MP pay raises.

“And if party leaders care about giving Canadian brewers, distillers and wineries a fighting chance against tariffs, it’s time to stop hitting them with alcohol tax hikes year after year.”

The CTF released Leger polling showing 79 per cent of Canadians oppose tomorrow’s MP pay raise.

2025 Federal Election

Poilievre To Create ‘Canada First’ National Energy Corridor

From Conservative Party Communications

Poilievre will create the ‘Canada First’ National Energy Corridor to rapidly approve & build the infrastructure we need to end our energy dependence on America so we can stand up to Trump from a position of strength.

Conservative Leader Pierre Poilievre announced today he will create a ‘Canada First’ National Energy Corridor to fast-track approvals for transmission lines, railways, pipelines, and other critical infrastructure across Canada in a pre-approved transport corridor entirely within Canada, transporting our resources within Canada and to the world while bypassing the United States. It will bring billions of dollars of new investment into Canada’s economy, create powerful paycheques for Canadian workers, and restore our economic independence.

“After the Lost Liberal decade, Canada is poorer, weaker, and more dependent on the United States than ever before,” said Poilievre. “My ‘Canada First National Energy Corridor’ will enable us to quickly build the infrastructure we need to strengthen our country so we can stand on our own two feet and stand up to the Americans.”

In the corridor, all levels of government will provide legally binding commitments to approve projects. This means investors will no longer face the endless regulatory limbo that has made Canadians poorer. First Nations will be involved from the outset, ensuring that economic benefits flow directly to them and that their approval is secured before any money is spent.

Between 2015 and 2020, Canada cancelled 16 major energy projects, resulting in a $176 billion hit to our economy. The Liberals killed the Energy East pipeline and passed Bill C-69, the “No-New-Pipelines” law, which makes it all but impossible to build the pipelines and energy infrastructure we need to strengthen the Canadian economy. And now, the PBO projects that the ‘Carney cap’ on Canadian energy will reduce oil and gas production by nearly 5%, slash GDP by $20.5 billion annually, and eliminate 54,400 full-time jobs by 2032. An average mine opening lead time is now nearly 18 years—23% longer than Australia and 38% longer than the US. As a result of the Lost Liberal Decade, Canada now ranks 23rd in the World Bank’s Ease of Doing Business Index for 2024, a seven-place drop since 2015.

“In 2024, Canada exported 98% of its crude oil to the United States. This leaves us too dependent on the Americans,” said Poilievre. “Our Canada First National Energy Corridor will get us out from under America’s thumb and enable us to build the infrastructure we need to sell our natural resources to new markets, bring home jobs and dollars, and make us sovereign and self-reliant to stand up to Trump from a position of strength.”

Mark Carney’s economic advice to Justin Trudeau made Canada weaker while he and his rich friends made out like bandits. While he advised Trudeau to cancel Canadian energy projects, his own company spent billions on pipelines in South America and the Middle East. And unlike our competitors Australia and America, which work with builders to get projects approved, Mark Carney and Steven Guilbeault’s radical “keep-it-in-the-ground” ideology has blocked development, killed jobs, and left Canada dependent on foreign imports.

“The choice is clear: a fourth Liberal term that will keep our resources in the ground and keep us weak and vulnerable to Trump’s threats, or a strong new Conservative government that will approve projects, build an economic fortress, bring jobs and dollars home, and put Canada First—For a Change.”

-

Uncategorized1 day ago

Uncategorized1 day agoPoilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

-

Business2 days ago

Business2 days agoCuba has lost 24% of it’s population to emigration in the last 4 years

-

2025 Federal Election1 day ago

2025 Federal Election1 day ago2025 Election Interference – CCP Bounty on Conservative Candidate – Carney Says Nothing

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day ago2025 Federal Election Interference from China! Carney Pressed to Remove Liberal MP Over CCP Bounty Remark

-

2025 Federal Election8 hours ago

2025 Federal Election8 hours agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

Aristotle Foundation2 days ago

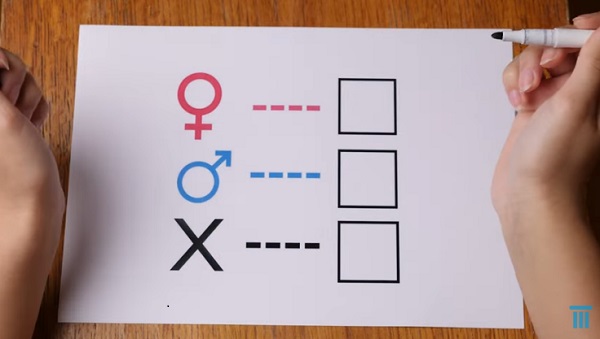

Aristotle Foundation2 days agoCanada has the world’s MOST relaxed gender policy for minors

-

International2 days ago

International2 days agoTrump signs executive order to make Washington D.C. “safe and beautiful”