Fraser Institute

Canadians want major health-care reform now

From the Fraser Institute

Tragic stories of multiyear waits for patients are now a Canadian news staple. Is it any wonder, therefore, that a new Navigator poll found almost two-thirds of Canadians experienced (either themselves or a family member) unreasonably long for access to health care. The poll also found that 73 per cent of respondents agree the system needs major reform.

This situation shouldn’t surprise anyone. Last year Canadians could expect a 27.7-week delay for non-emergency treatment. Nearly half this time (13.1 weeks) was spent waiting for treatment after seeing a specialist—that’s more than one month longer than what physicians considered reasonable.

And it’s not as though these unreasonable waits are simple inconveniences for patients; they can have serious consequences including continued pain, psychological distress and disability. For many, there are also economic consequences for waiting due to lost productivity or wages (due to difficulty or inability to work) or for Canadians who pay for care in another country.

Canadians are also experiencing longer delays than their European and Australian universal health-care peers. In 2020, Canadians were the least likely (62 per cent) to report receiving non-emergency surgical treatment in under four weeks compared to Germans (99 per cent) and Australians (72 per cent).

What do they do differently? Put simply, they approach universal care in a different way than we do.

In particular, these countries all have a sizeable and well-integrated private sector that helps deliver universal care including surgical care. For example, in 2021, 45 per cent of hospitals in Germany (a plurality) were private for-profit. And 99 per cent of German hospital beds are accessible to those covered under the country’s mandatory insurance scheme. In Australia, governments regularly contract with private hospitals to provide surgical care, with private facilities handling 41 per cent of all hospital services in 2021/22.

These universal health-care countries also tend to fund their hospitals differently.

Governments in Canada primarily fund hospitals through “global budgets.” With a fixed budget set at the beginning of the year, this funding method is unconnected to the level of services provided. Consequently, patients are treated as costs to be minimized.

In contrast, hospitals in most European countries and Australia are funded on the basis of their activity. As a result, because they are paid for services they actually deliver, hospitals are incentivized to provide higher volumes of care.

The data are clear. Canadian patients are frustrated with their health-care system and have an appetite for change. We stand to learn from other countries who maintain their universal coverage while delivering health care faster than in Canada.

Author:

Economy

Solar and Wind Power Are Expensive

From the Fraser Institute

Politicians—supported by powerful green energy interests and credulous journalists—keep gaslighting voters claiming green energy is cheaper than fossil fuels.

Global evidence is clear: Adding more solar and wind to the energy supply pushes up the price of electricity for consumers and businesses. Families in Ontario know this already from their bitter experience: from 2005, the Ontario government began phasing out coal energy and dived headlong into subsidizing wind and solar generation.

Those green policies led to a sharp hike in electricity prices. From 2005 to 2020 the average, inflation-adjusted cost of electricity doubled from 7.7 cents to 15.3 cents. Since 2019 the Ontario government has subsidized these high costs through a slew of programs like the “Renewable Cost Shift”, lowering the direct pain to ratepayers but simply moving the increasing costs onto the government coffers. Today, this policy costs Ontario more than $6 billion annually, four-times what was being spent in 2018.

A relatively small amount of wind energy costs Ontarians over a billion dollars each year. One peer-reviewed study finds that the economic costs of wind are at least three times their benefits. Only the owners of wind power make any money, whereas the “losers are primarily the electricity consumers followed by the governments.”

Yet, politicians—supported by powerful green energy interests and credulous journalists—keep gaslighting voters claiming green energy is cheaper than fossil fuels.

They argue fundamentally that the green transition is not just cheap but even that it makes money, because wind and solar are cheaper than fossil fuels.

At best, this is only true when the sun is shining and the wind is blowing. At all other times, their cost is significantly higher. Modern societies need around-the-clock power. The intermittency of solar and wind energy means backup is required, often delivered by fossil fuels. That means citizens end up paying for two power systems: renewables and their backup. Moreover, much more transmission is needed to ensure wind and solar reach users, and backup fossil fuels, as they are used less, have even fewer hours to earn back their capital costs. Both increase costs further.

This intermittency can be huge, as when solar power in the Yukon delivered a massive 150 times more electricity to the grid in May 2022 than it did in December 2022. It is also the reason that the real energy costs of solar and wind are far higher than green campaigners claim. Just look around the world to see how that plays out.

One study shows that in China, when including the cost of backup power, the real cost of solar power becomes twice as high as that of coal. Similarly, a peer-reviewed study of Germany and Texas shows that the real costs of solar and wind are many times more expensive than fossil fuels. Germany, the U.K., Spain, and Denmark, all of which increasingly rely on solar and wind power, have some of the world’s most expensive electricity.

Source: IEA.org energy prices data set

This is borne out by the actual costs paid across the world. The International Energy Agency’s latest data from nearly 70 countries from 2022 shows a clear correlation between more solar and wind and higher average household and business energy prices. In a country with little or no solar and wind, the average electricity cost is about 16 cents per kilowatt-hour. For every 10 per cent increase in solar and wind share, the electricity cost increases by nearly 8 cents per kWh. The results are substantially similar for 2019, before the impacts of Covid and the Ukraine war.

In Germany, electricity costs 43 cents per kWh—much more than twice the Canadian cost, and more than three-times the Chinese price. Germany has installed so much solar and wind that on sunny and windy days, renewable energy satisfies close to 70 per cent of Germany’s needs—a fact the press eagerly reports. But the press hardly mentions dark and still days, when these renewables deliver almost nothing. Twice in the past couple of months, when it was cloudy and nearly windless, solar and wind delivered less than 4 per cent of the daily power Germany needed.

Current battery technology is insufficient. Germany’s entire battery storage runs out in about 20 minutes. That leaves more than 23 hours of energy powered mostly by fossil fuels. Last month, with cloudy skies and nearly no wind, Germany faced the costliest power prices since the energy crisis caused by Russia’s invasion of Ukraine in 2022, with wholesale prices reaching a staggering $1.40 per kWh.

Canada is blessed with plentiful hydro, powering 58 per cent of its electricity. This means that there has been less drive to develop wind and solar, which deliver just 7 per cent. But the urge to virtue signal remains. Indeed, the federal government’s 2023 vision for the electricity system declares that shifting away from fossil fuels is a “scientific and moral imperative” and “the greatest economic opportunity of our lifetime”.

Yet the biggest take-away from the global evidence is that among all the nations in the world—many with very big, green ambitions—there is not one that gets much of its power from solar and wind and has low electricity costs. The lower-right of the chart is simply empty.

Instead, there are plenty of nations with lots of green energy and exorbitantly high costs.

Economy

Latest dire predictions about Carney’s emissions cap

From the Fraser Institute

According to a new report from the Parliamentary Budget Officer (PBO), the federal government’s proposed oil and gas emissions cap will curtail production, cost a not-so-small fortune and kill a lot of jobs. This news will surprise absolutely no one who’s been paying attention to Ottawa’s regulatory crusade against greenhouse gases over the past few years.

To be precise, according to the PBO’s report of March 2025, under the proposed cap, production for upstream industry oil and gas subsectors must be reduced by 4.9 per cent relative to their projected baseline levels out to 2030/32. Further, required reduction in upstream oil and gas sector production levels will lower GDP (inflation-adjusted) in Canada by an estimated 0.39 per cent in 2032 and reduce nominal GDP by $20.5 billion. And achieving the legal upper bound will reduce economy-wide employment in Canada by an estimated 40,300 jobs and fulltime equivalents by 54,400 in 2032.

The federal government is contesting the PBO’s estimates, with Jonathan Wilkinson, federal minister of Energy and Natural Resources of Canada, claiming that the “PBO wasted their time and taxpayer dollars by analyzing a made up scenario.” Of course, one might observe that using “made up scenarios” is what making forecasts of regulatory costs is all about. No one, including the government, has a crystal ball that can show the future.

But the PBO’s projected costs are only the latest analysis. A 2024 report by Deloitte (and commissioned by the federal Treasury Board) found that the proposed “cap results in a significant decline in GDP in Alberta and the Rest of Canada.” The main impacts of the cap are lower oil and gas activity and output, reduced employment, reduce income, lower returns on investment and a higher price of oil.

Consequently, according to the report, by 2040 Alberta’s GDP will be lower by 4.5 per cent and Canada’s GDP will be lower by 1 per cent compared to a no-cap baseline. Cumulatively over the 2030 to 2040 timeline, Deloitte estimated that real GDP in Alberta will be $191 billion lower, and real GDP in the Rest of Canada will be $91 billion lower compared to the no-cap (business as usual) baseline (in 2017 dollars). Employment also took a hit in the Deloitte report, which found the level of employment in 2040 will be lower by 2 per cent in Alberta and 0.5 per cent in the Rest of Canada compared to a no-cap baseline. Alberta will lose an estimated 55,000 jobs on average (35,000 in the Rest of Canada) between 2030 and 2040 under the cap.

Another 2024 report by the Conference Board of Canada estimated that the “oil and gas productions cuts forecasted lead to a one-time, permanent decline in total Canadian real GDP of between 0.9 per cent (most likely outcome) to 1.6 per cent (least likely outcome) relative to the baseline in 2030. This is equivalent to a loss of $22.8 to $40.4 billion (in 2012 dollars)… In Alberta, real GDP would fall by between $16.3 and $28.5 billion—or by 3.8 per cent and 6.7 per cent, respectively.”

Finally, a report by S&P Global Commodity Insights (and commissioned by the Canadian Association of Petroleum Producers) estimated that a “production cut driven by a stringent 40% emission cap could cause $75 billion lower upstream spend and $247 billion lower GDP contribution (vs. a no cap reference case).”

All of these estimates, by respected economic analysis firms, raise serious questions about the government’s own 2024 Regulatory Impact Analysis, which suggested that the proposed regulations will only have incremental impacts on the economy—namely, $3.3 billion (plus administrative costs to industry and the government, estimated to be $219 million). According to the analysis, the “proposed Regulations are expected to result in a net decrease in labour expenditure in the oil and gas sector of about 1.6% relative to the baseline estimate of employment income over the 2030 to 2032 time frame.”

But according to the new PBO report, the costs of the government’s proposed cap on greenhouse gas emission from Canada’s oil and gas sector will be costly and destructive to the sector, it’s primary province (Alberta), and its employees in Alberta and across Canada. All this in the face of likely-resurgent U.S. oil and gas production.

Now that policymakers in Ottawa have seemingly recognized the unpopularity of the consumer carbon tax, a good next step would be to scrap the cap.

-

Alberta1 day ago

Alberta1 day agoFederal emissions plan will cost Albertans dearly

-

International22 hours ago

International22 hours agoEurope Can’t Survive Without America

-

Business2 days ago

Business2 days agoPossible Criminal Charges for US Institute for Peace Officials who barricade office in effort to thwart DOGE

-

Business15 hours ago

Business15 hours agoWhy a domestic economy upgrade trumps diversification

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCanadian construction worker goes viral for saying he refused to shake Mark Carney’s hand

-

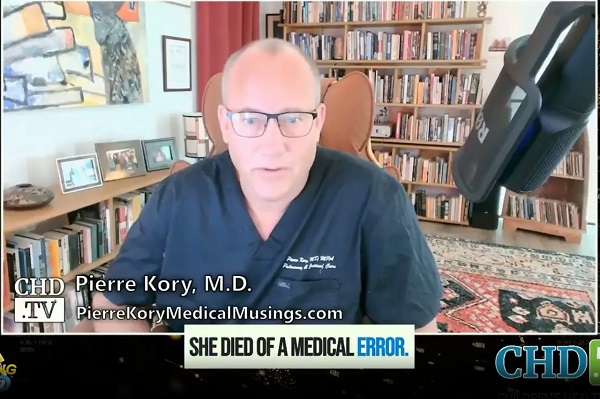

Health1 day ago

Health1 day agoDr. Pierre Kory Exposes the Truth About the Texas ‘Measles Death’ Hoax

-

Business8 hours ago

Business8 hours agoDOGE discovered $330M in Small Business loans awarded to children under 11

-

Business1 day ago

Business1 day ago28 energy leaders call for eliminating ALL energy subsidies—even ones they benefit from