National

Canadians pay dearly in gas taxes – it’s only going to get worse

From the Canadian Taxpayers Federation

Author: Jay Goldberg

Two thousand dollars. That’s how much the typical two-car family spends on gas taxes every year.

Big numbers can sometimes be hard to process. But the feeling of dread Canadians get as the gas metre ticks up sure isn’t.

Go to the gas station and you’ll see moms filling up the minivan before soccer practice, praying the metre doesn’t tick past $100 so she can afford to take the kids to McDonald’s after an hour of drills.

Or dads fueling up after a week of long commutes to the office, who might choose to only fill the tank halfway in order to have enough money left over to pick up groceries on the way home for Friday night dinner.

All too often, folks will throw up their hands when they see the gas bill, not knowing who to blame. But the truth is a lot of the fault for high gas prices lies at the feet of our politicians.

The average price of gas in Ontario late last month was $1.66 per litre. Out of that total per litre cost, a whopping 56 cents was taxes.

That means that more than a third of the price of gas is taxes, money going out of the pockets of hardworking families and into the coffers of big government.

A family filling up a Dodge Caravan and Honda Accord once every two weeks ends up paying just shy of two grand in gas taxes over the course of a year.

That’s the equivalent of two months’ worth of groceries for a family of four.

Yes, gas taxes have been around for decades. But politicians today, particularly those in Ottawa, keep driving the tax burden higher and higher.

The Trudeau government’s carbon tax now costs 17.6 cents per litre. For that family filling up the Caravan and Accord once every two weeks, over the course of a year, the carbon tax bill alone will reach $604.

And it’s a cost that wasn’t charged at the pump just six short years ago.

If a 56 cent per litre tax bill sounds bad to you now, just wait until you see what Prime Minister Justin Trudeau has in store for Canadians.

Trudeau plans to keep raising his carbon tax each and every year until 2030.

Today, the carbon tax costs 17.6 cents per litre of gas at the pumps. In six years, with Trudeau’s two carbon taxes fully implemented (the second one coming through fuel regulations), that number will be 54.4 cents per litre.

And that will bring the total per litre tax bill to $1.04.

By 2030, that same family filling up the Caravan and Accord every other week will be paying over $1,800 in carbon taxes. And the cost of overall gas taxes per year will hit $3,570.

This is a future Canadians can’t afford. And the federal carbon tax is making that future unaffordable.

The Trudeau government has tried to argue that somehow, by charging a carbon tax, paying bureaucrats to collect the carbon tax, charging sales tax on top of that carbon tax, and then using a magic formula to send some of that money back to taxpayers, Canadians will be better off.

Anyone who buys that should be looking for a beachfront property in Saskatoon.

And there are no refunds for Trudeau’s second carbon tax.

For those wondering, there are politicians out there willing to cut fuel taxes to make life more affordable at the pumps.

Provincial governments of all stripes, from the Liberals in Newfoundland and Labrador to the Progressive Conservatives here in Ontario to the NDP in Manitoba, have cut fuel taxes, saving families hundreds of dollars.

Trudeau’s scheduled carbon tax hikes over the next six years will crush family budgets like an asteroid wiping out the dinosaurs. It’s time for the feds to learn from the provinces and lower costs at the pumps.

That means putting scrapping the carbon tax at the top of the agenda.

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

2025 Federal Election

Mark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

From LifeSiteNews

Mark Carney described the Freedom Convoy as an act of ‘sedition’ and advocated for the government to use its power to crush the non-violent protest movement.

Canadian Prime Minister Mark Carney refused to elaborate on comments he made in 2022 referring to the anti-mandate Freedom Convoy protest as an act of “sedition” and advocating for the government to put an end to the movement.

“Well, look, I haven’t been a politician,” Carney said when a reporter in Windsor, Ontario, where a Freedom Convoy-linked border blockade took place in 2022, asked, “What do you say to Canadians who lost trust in the Liberal government back then and do not have trust in you now?”

“I became a politician a little more than two months ago, two and a half months ago,” he said. “I came in because I thought this country needed big change. We needed big change in the economy.”

Carney’s lack of an answer seems to be in stark contrast to the strong opinion he voiced in a February 7, 2022, column published in the Globe & Mail at the time of the convoy titled, “It’s Time To End The Sedition In Ottawa.”

In that piece, Carney wrote that the Freedom Convoy was a movement of “sedition,” adding, “That’s a word I never thought I’d use in Canada. It means incitement of resistance to or insurrection against lawful authority.”

Carney went on to claim in the piece that if “left unchecked” by government authorities, the Freedom Convoy would “achieve” its “goal of undermining our democracy.”

Carney even targeted “[a]nyone sending money to the Convoy,” accusing them of “funding sedition.”

Internal emails from the Royal Canadian Mounted Police (RCMP) eventually showed that his definition of sedition were not in conformity with the definition under Canada’s Criminal Code, which explicitly lists the “use of force” as a necessary aspect of sedition.

“The key bit is ‘use of force,’” one RCMP officer noted in the emails. “I’m all about a resolution to this and a forceful one with us victorious but, from the facts on the ground, I don’t know we’re there except in a small number of cases.”

Another officer replied with, “Agreed,” adding that “It would be a stretch to say the trucks barricading the streets and the air horns blaring at whatever decibels for however many days constitute the ‘use of force.’”

The reality is that the Freedom Convoy was a peaceful event of public protest against COVID mandates, and not one protestor was charged with sedition. However, the Liberal government, then under Justin Trudeau, did take an approach similar to the one advocated for by Carney, invoking the Emergencies Act to clear-out protesters. Since then, a federal judge has ruled that such action was “not justified.”

Despite this, the two most prominent leaders of the Freedom Convoy, Tamara Lich and Chris Barber, still face a possible 10-year prison sentence for their role in the non-violent assembly. LifeSiteNews has reported extensively on their trial.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election2 days ago

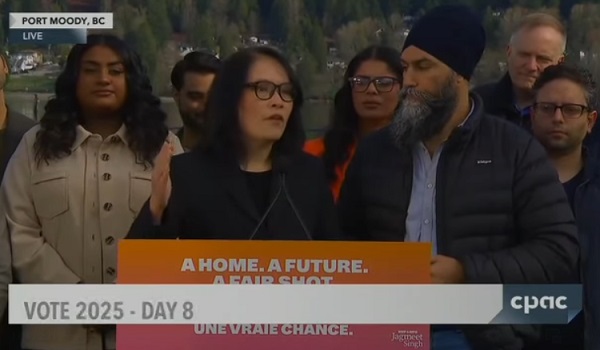

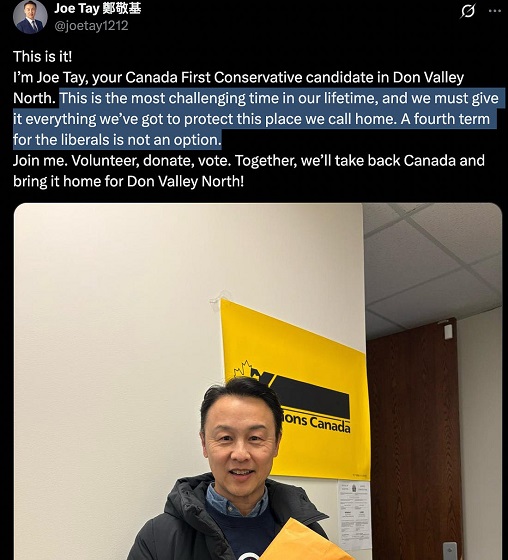

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBeijing’s Echo Chamber in Parliament: Part 2 – Still No Action from Carney

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments