Fraser Institute

Canadians are ready for health-care reform—Australia shows the way

From the Fraser Institute

By Bacchus Barua and Mackenzie Moir

Australia offers real-world examples of how public/private partnerships can be successfully integrated in a universal health-care framework. Not only does Australia prove it can be done without sacrificing universal coverage for all, Australia spends less money (as a share of its economy) than Canada and enjoys more timely medical care.

Canada’s health-care system is crumbling. Long wait times, hallway health care and burned-out staff are now the norm. Unsurprisingly, a new poll finds that the majority of Canadians (73 per cent) say the system needs major reform.

As noted in a recent editorial in the Globe and Mail, we can learn key lessons from Australia.

There are significant similarities between the two countries with respect to culture, the economy and even geographic characteristics. Both countries also share the goal of ensuring universal health coverage. However, Australia outperforms Canada on several key health-care performance metrics.

After controlling for differences in age (where appropriate) between the two countries, our recent study found that Australia’s health-care system outperformed Canada’s on 33 (of 36) performance measures. For example, Australia had more physicians, hospital beds, CT scanners and MRI machines per person compared to Canada. And among the 30 universal health-care countries studied, Canada ranked in the bottom quartile for the availability of these critical health-care resources.

Australia also outperforms Canada on key measures of wait times. In 2023 (the latest year of available data), 39.5 per cent of patients in Australia were able to make a same or next day appointment when they were sick compared to only 22.3 per cent in Canada. And 9.6 per cent of Canadians reported waiting more than one year to see a specialist compared to only 4.5 per cent of Australians. Similarly, almost one-in-five (19.9 per cent) Canadians reported waiting more than one year for non-emergency surgery compared to only 11.8 per cent of Australians.

So, what does Australia do differently to outperform Canada on these key measures?

Although the Globe and Mail editorial touches on the availability of private insurance in Australia, less attention is given to the private sector’s prominent role in the delivery of health care.

In 2016 (the latest year of available data) almost half of all hospitals in Australia (48.5 per cent) were private. And in 2021/22 (again, the latest year of available data), 41 per cent of all hospital care took place in a private facility. That percentage goes up to 70.3 per cent when only considering hospital admissions for non-emergency surgery.

But it’s not only higher-income patients who can afford private insurance (or those paying out of pocket) who get these surgeries. The Australian government encourages the uptake of private insurance and partially subsidizes private care (at a rate of 75 per cent of the public fee), and governments in Australia also regularly contract out publicly-funded care to private facilities.

In 2021/22, more than 300,000 episodes of publicly-funded care occurred in private facilities in Australia. Private hospitals also delivered 73.5 per cent of care funded by Australia’s Department of Veterans’ Affairs. And in 2019/20, government sources (including the federal government) paid for almost one-third (32.8 per cent) of private hospital expenditures.

Which takes us back to the new opinion poll (by Navigator), which found that 69 per cent of Canadians agree that health-care services should include private-sector involvement. While defenders of the status quo continue to criticize this approach, Australia offers real-world examples of how public/private partnerships can be successfully integrated in a universal health-care framework. Not only does Australia prove it can be done without sacrificing universal coverage for all, Australia spends less money (as a share of its economy) than Canada and enjoys more timely medical care.

While provincial governments remain stubbornly committed to a failed model, Canadians are clearly expressing their desire for health-care reforms that include a prominent role for private partners in the delivery of universal care.

Australia is just one example. Public/private partnerships are the norm in several more successful universal health-care systems (such as Germany and Switzerland). Instead of continuing to remain an outlier, Canada should follow the examples of Australia and other countries and engage with the private sector to fulfill the promise of universal health care.

Authors:

Business

Latest shakedown attempt by Canada Post underscores need for privatization

From the Fraser Institute

By Alex Whalen and Jake Fuss

For the second time in just six months, the Canadian Union of Postal Workers (CUPW) is threatening strike action. As Canadians know all too well, postal strikes can be highly disruptive given the federal government provides Canada Post with a near-monopoly on letter mail across the country. CUPW is well aware of this and uses it to their advantage in negotiations. While CUPW has the right to ask for whatever they like, Canadians should finally be freed from this albatross.

In January, the Trudeau government loaned Canada Post a whopping $1.034 billion to help “maintain its solvency and continue operating.” Since 2018, Canada Post has lost more than $4.6 billion, and according to its latest financial update, lost more than $100 million in the first quarter of 2025 alone. Canadians are on the hook for these losses because the federal government owns Canada Post.

Salaries and other employee costs comprise more than 66 per cent of Canada Post’s expenses, and CUPW and Canada Post management both know they can simply pass any losses on to Canadians. Consequently, there’s less incentive for management to control the bottom line or make reasonable budget requests when negotiating with the government. But if the government privatizes Canada Post, it would impose a proper constraint on costs that doesn’t currently exist. This is only fair given there’s no compelling reason why Canadians should underwrite the inflation of salaries in a money-losing Crown corporation.

Of course, government ownership of Canada Post is archaic. When the organization was founded more than 250 years ago, the world was quite different. In today’s age of Amazon, a plethora of delivery services exist coast-to-coast that serve Canadian consumers. Other countries including the Netherlands, Austria and Germany long ago privatized their postal services. The result was increased competition, which in turn reduced prices and improved quality.

Alongside privatization, the federal government should also eliminate Canada Post’s near-monopoly status on letter mail. This policy is purportedly meant to ensure universal service. But in reality, it prohibits other potential service providers from entering the letter-delivery market (including in remote areas that may experience less Canada Post service post-privatization), deprives Canadians of choice, and crucially, reduces the incentive for Canada Post to improve its service.

Simply put, the federal government should focus on its core responsibilities, and delivering mail is clearly not one of them. Given Canada Post’s latest attempted shakedown of Canadians, it’s never been clearer that it’s time for Canada Post to go the way of Air Canada, de Havilland and CN Rail. Once upon a time, the federal government owned all three of these entities until it became clear there was no reason for the government to own an airline, build planes or deliver goods by train. Why is letter mail any different? Canadians deserve better.

Business

Massive government child-care plan wreaking havoc across Ontario

From the Fraser Institute

By Matthew Lau

It’s now more than four years since the federal Liberal government pledged $30 billion in spending over five years for $10-per-day national child care, and more than three years since Ontario’s Progressive Conservative government signed a $13.2 billion deal with the federal government to deliver this child-care plan.

Not surprisingly, with massive government funding came massive government control. While demand for child care has increased due to the government subsidies and lower out-of-pocket costs for parents, the plan significantly restricts how child-care centres operate (including what items participating centres may purchase), and crucially, caps the proportion of government funds available to private for-profit providers.

What have families and taxpayers got for this enormous government effort? Widespread child-care shortages across Ontario.

For example, according to the City of Ottawa, the number of children (aged 0 to 5 years) on child-care waitlists has ballooned by more than 300 per cent since 2019, there are significant disparities in affordable child-care access “with nearly half of neighbourhoods underserved, and limited access in suburban and rural areas,” and families face “significantly higher” costs for before-and-after-school care for school-age children.

In addition, Ottawa families find the system “complex and difficult to navigate” and “fewer child care options exist for children with special needs.” And while 42 per cent of surveyed parents need flexible child care (weekends, evenings, part-time care), only one per cent of child-care centres offer these flexible options. These are clearly not encouraging statistics, and show that a government-knows-best approach does not properly anticipate the diverse needs of diverse families.

Moreover, according to the Peel Region’s 2025 pre-budget submission to the federal government (essentially, a list of asks and recommendations), it “has maximized its for-profit allocation, leaving 1,460 for-profit spaces on a waitlist.” In other words, families can’t access $10-per-day child care—the central promise of the plan—because the government has capped the number of for-profit centres.

Similarly, according to Halton Region’s pre-budget submission to the provincial government, “no additional families can be supported with affordable child care” because, under current provincial rules, government funding can only be used to reduce child-care fees for families already in the program.

And according to a March 2025 Oxford County report, the municipality is experiencing a shortage of child-care staff and access challenges for low-income families and children with special needs. The report includes a grim bureaucratic predication that “provincial expansion targets do not reflect anticipated child care demand.”

Child-care access is also a problem provincewide. In Stratford, which has a population of roughly 33,000, the municipal government reports that more than 1,000 children are on a child-care waitlist. Similarly in Port Colborne (population 20,000), the city’s chief administrative officer told city council in April 2025 there were almost 500 children on daycare waitlists at the beginning of the school term. As of the end of last year, Guelph and Wellington County reportedly had a total of 2,569 full-day child-care spaces for children up to age four, versus a waitlist of 4,559 children—in other words, nearly two times as many children on a waitlist compared to the number of child-care spaces.

More examples. In Prince Edward County, population around 26,000, there are more than 400 children waitlisted for licensed daycare. In Kawartha Lakes and Haliburton County, the child-care waitlist is about 1,500 children long and the average wait time is four years. And in St. Mary’s, there are more than 600 children waitlisted for child care, but in recent years town staff have only been able to move 25 to 30 children off the wait list annually.

The numbers speak for themselves. Massive government spending and control over child care has created havoc for Ontario families and made child-care access worse. This cannot be a surprise. Quebec’s child-care system has been largely government controlled for decades, with poor results. Why would Ontario be any different? And how long will Premier Ford allow this debacle to continue before he asks the new prime minister to rethink the child-care policy of his predecessor?

-

Business1 day ago

Business1 day agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Crime2 days ago

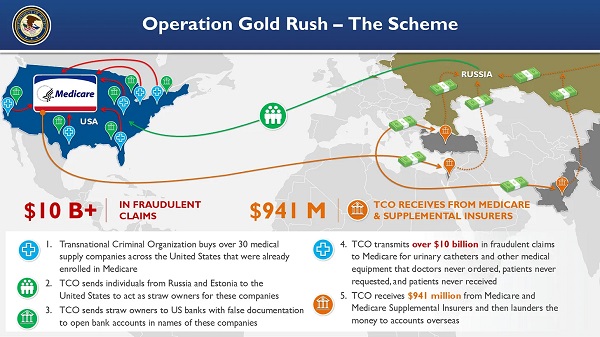

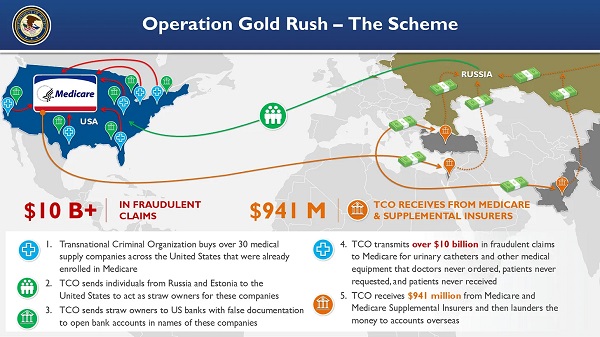

Crime2 days agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Business13 hours ago

Business13 hours agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

Alberta8 hours ago

Alberta8 hours agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Health2 days ago

Health2 days agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Alberta13 hours ago

Alberta13 hours agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Business1 day ago

Business1 day agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party