Energy

Canadian Liquified Natural Gas (LNG) is the Cleaner Fuel Alternative that Asian Markets Want and Need – CPW

Trans Mountain LNG Terminal Expansion

From EnergyNow Media

A woman in rural China gets ready to make dinner. She starts with food prep, then reaches for her fuel source to begin cooking.

Her options: likely wood or coal.

As she cooks, she is probably not aware that nearly half a million people in China who cook with wood or coal have an increased risk of major eye diseases that lead to blindness.

This was detailed in a University of Oxford study that also showed nearly half of the world’s population (that’s 3.8 billion people) is exposed to household air pollution from cooking with “dirty” solid fuels like wood or coal.

Even if she knew all this, what other choice would she have? Everyone has to prepare food for their family.

Poor air quality and its effect on human health is a significant cost to consider when using coal, but there are others as well, such as greenhouse gas emissions.

When burned for energy, coal releases carbon dioxide into the atmosphere. If you shift from thinking about the individual cooking at home to large-scale coal burning for electricity generation, the problem becomes a major environmental concern — and a significant contributing factor to climate change.

How big is the problem?

Coal power plants produce 20% of global greenhouse gas emissions, more than any other single source, says the International Energy Agency (IEA).

This issue is important to us because that woman cooking at home could be any one of us. The difference is, we have options. With energy demand continuing to grow, the IEA reports that many countries feel they have little choice but to continue generating power with coal.

Furthermore, Canada Powered by Women research (which captures the opinions of 24% of all women in Canada) shows that the vast majority (84%) personally care about tackling climate change through global greenhouse gas (GHG) emission reduction.

So, what exactly is the solution to this problem? It’s choice.

The solution for regions of the world that don’t have access to different types of energy is to provide alternatives to what they have today. One choice can, and should, be Canadian liquified natural gas (LNG).

(Assuming, that is, Canadian suppliers are supported enough by regulatory environments to produce and export this resource. More on this later…)

Many parts of the world — particularly Asia — want to replace coal with cleaner energy like LNG. Foreign markets such as Japan, Korea, Malaysia, and China are interested in turning to Canada as their source, over countries with less-than-stellar environmental and human rights records (not to mention uncertain political structures).

“We have incredible volumes of lower-carbon gas in B.C., and it represents an important new source of energy,” says Teresa Waddington, vice president, corporate relations at LNG Canada. “Canada is politically stable in an increasingly energy security-conscious world. We have good infrastructure and good systems in place to make sure that we are able to produce very, very reliably.”

It’s not just industry players who are on board with exporting our energy resources to foreign markets, either.

The majority of Canadian women we asked consider it important to supply ethical and responsibly produced oil, as well as LNG, internationally.

Canada is primed to take its cleaner energy options to the world — we just need the ability to get it to market.

Canadian LNG: The Same Energy for Half the Emissions

Markets around the world are interested in LNG over coal for good reason. It has half the emissions of coal for the same output of energy.

But in some Asian countries, coal-burning plants are being built at a lightning-fast pace because populations and manufacturers need rapid access to energy, Reuters reports.

“If we can displace current and future energy electricity generation and power generation with LNG, we’re taking a massive step forward,” Waddington says.

Beyond being a cleaner molecule, Canadian LNG is particularly attractive because it’s produced ethically and safely, thanks in part to strict industry regulations.

“We have the lowest methane emissions leakage anywhere in the globe,” Waddington notes.

And this is in part because Canada has highly stringent requirements for managing methane leakage — which can lead to greenhouse gas emissions and is a common concern about this kind of fuel.

“If you look across the spectrum of environment, social, governance (ESG), Canadian LNG is made with human rights at the forefront,” says Waddington.

With Support, Canada Can Lead the Global LNG Opportunity

Canada has the potential to pull ahead as a global leader in the production and export of clean energy to foreign markets — a move that would play an important role in reducing global emissions, facilitating a prosperous Canada economy and providing for those in need at home and abroad.

But that will only happen if governments offer LNG projects the support they need in the form of utility infrastructure investments and clear and fast permitting, Waddington says.

As an example, partnerships with local hydro providers to power LNG facilities is one way provincial governments can lower the carbon intensity of processing and exporting the fuel, she says.

Then of course, there’s also the potential of government incentives that inspire more investment in LNG facilities, as well as in technologies that support the production of an ever-cleaner natural gas molecule.

With technology and innovation in Canada advancing all the time, Waddington is optimistic about the opportunity ahead.

“We’re going to see Canada continue to emerge as world-leading in some of the ways that we can [reduce emissions] — as long as we keep up this momentum, supported by government.”

About Canada Powered by Women

Uniting Women Through Bold Conversations

Canada Powered by Women represents Canadian women who believe sound energy policies are vital for the continuing economic prosperity of our country. We’re driven by the unshakable belief that a better world is possible and we can make it happen… together. Visit our website HERE for more information and JOIN OUR COMMUNITY.

Alberta

The beauty of economic corridors: Inside Alberta’s work to link products with new markets

From the Canadian Energy Centre

Q&A with Devin Dreeshen, Minister of Transport and Economic Corridors

CEC: How have recent developments impacted Alberta’s ability to expand trade routes and access new markets for energy and natural resources?

Dreeshen: With the U.S. trade dispute going on right now, it’s great to see that other provinces and the federal government are taking an interest in our east, west and northern trade routes, something that we in Alberta have been advocating for a long time.

We signed agreements with Saskatchewan and Manitoba to have an economic corridor to stretch across the prairies, as well as a recent agreement with the Northwest Territories to go north. With the leadership of Premier Danielle Smith, she’s been working on a BC, prairie and three northern territories economic corridor agreement with pretty much the entire western and northern block of Canada.

There has been a tremendous amount of work trying to get Alberta products to market and to make sure we can build big projects in Canada again.

CEC: Which infrastructure projects, whether pipeline, rail or port expansions, do you see as the most viable for improving Alberta’s global market access?

Dreeshen: We look at everything. Obviously, pipelines are the safest way to transport oil and gas, but also rail is part of the mix of getting over four million barrels per day to markets around the world.

The beauty of economic corridors is that it’s a swath of land that can have any type of utility in it, whether it be a roadway, railway, pipeline or a utility line. When you have all the environmental permits that are approved in a timely manner, and you have that designated swath of land, it politically de-risks any type of project.

CEC: A key focus of your ministry has been expanding trade corridors, including an agreement with Saskatchewan and Manitoba to explore access to Hudson’s Bay. Is there any interest from industry in developing this corridor further?

Dreeshen: There’s been lots of talk [about] Hudson Bay, a trade corridor with rail and port access. We’ve seen some improvements to go to Churchill, but also an interest in the Nelson River.

We’re starting to see more confidence in the private sector and industry wanting to build these projects. It’s great that governments can get together and work on a common goal to build things here in Canada.

CEC: What is your vision for Alberta’s future as a leader in global trade, and how do economic corridors fit into that strategy?

Dreeshen: Premier Smith has talked about C-69 being repealed by the federal government [and] the reversal of the West Coast tanker ban, which targets Alberta energy going west out of the Pacific.

There’s a lot of work that needs to be done on the federal side. Alberta has been doing a lot of the heavy lifting when it comes to economic corridors.

We’ve asked the federal government if they could develop an economic corridor agency. We want to make sure that the federal government can come to the table, work with provinces [and] work with First Nations across this country to make sure that we can see these projects being built again here in Canada.

Energy

Why are Western Canadian oil prices so strong?

By Rory Johnston for Inside Policy

By Rory Johnston for Inside Policy

While Canadian crude markets are as optimistic as they’ve been in months regarding US tariffs, the industry is still far from safe.

Western Canadian heavy crude oil prices are remarkably strong at the moment, providing a welcome uplift to the Canadian economy at a time of acute macroeconomic uncertainty. The price of Western Canadian Select (WCS) crude recently traded at less than $10/bbl (barrel) under US Benchmark West Texas Intermediate (WTI): a remarkably narrow differential (i.e., “discount”) for the Canadian barrel, which more commonly sits around $13/bbl but has at moments of crisis blown out to as much as $50/bbl.

Stronger prices mean greater profits for Canadian oil producers and, in turn, both higher royalty and income tax revenues for Canadian governments as well as more secure employment for the tens of thousands of Canadians employed across the industry. For example, a $1/bbl move in the WCS-WTI differential drives an estimated $740 million swing in Alberta government budget revenues.

Why are Canadian oil prices so strong today? It’s due to the perfect storm of three distinct yet beneficial conditions:

- Newly sufficient pipeline capacity following last summer’s start-up of the Trans Mountain Expansion pipeline, which eliminated – albeit temporarily – the effect of egress constraint-driven discounting of Western Canadian crude;

- Globally, the bolstered value of heavy crudes relative to lighter grades – driven by production cuts, shipping activity, sanctions, and other market forces – has benefited the fundamental backdrop against which Canadian heavy crude is priced; and

- The near elimination of tariff-related discounting as threat of US tariffs has diminished, after weighing on the WCS differential to the tune of $4–$5/bbl between late-January through early March.

We break down each of these factors below.

A quick primer: differentials, decomposed

Before we dive in, let’s quickly review how Canadian crude pricing works. WCS crude is Canada’s primary export grade and is virtually always priced at a discount to WTI, the US benchmark for oil prices, for two structural reasons outlined below. More accurately referred to as the differential (in theory, the price difference could go both ways), this price difference is a fact of life for Canadian crude producers and sits between $11–$15/bbl in “normal” times. Over the past decade, WCS has only sported a sub-$10/bbl differential less than 10 per cent of the time and most such instances reflected unique market conditions, like the Alberta government’s late-2018 production curtailment and the depths of COVID in early 2020.

The structurally lower value of WCS relative to WTI is driven by two main structural factors: quality and geography.

First and very simply, WCS is extremely heavy oil – diluted bitumen, to be specific – in contrast to WTI, which is a light crude oil blend. Furthermore, WCS has a high sulphur content (“sour,” in industry parlance) compared to the virtually sulphur-free WTI (“sweet”). WCS crude requires specialized equipment to be effectively processed into larger shares of higher-value transportation fuels like diesel as well as the remove the sulphur, which is environmentally damaging (see: acid rain)l; so, WCS is “discounted” to reflect the cost of that additional refining effort. Quality-related discounting typically amounts to $5-$8/bbl and can be seen in its pure form in the price of a barrel of WCS is Houston, Texas, where it enjoys easy market access.

Second, Western Canadian oil reserves are landlocked and an immense distance from most major refining centers. Unlike most global oil producers that get their crude to market via tanker, virtually all Canadian crude gets to end markets via pipeline. So, this higher cost of transportation away from where the crude is produced (aka “egress”) represents the second “discount” borne by the relative price of Canadian crude, required to keep it competitive with alternative feedstocks. Transportation-related discounting typically amounts to $7-$10/bbl and can be seen in the difference between the price of a barrel of WCS in the main hub of Hardisty, Alberta and the same barrel in Houston, Texas.

Moreover, transportation-related discounting is worse when pipeline capacity is insufficient, which has so frequently been the case over the past decade and a half. When there isn’t enough pipeline space to go around, barrels are forced to use more expensive alternatives like rail and that adds at least another $5/bbl to the required industry-wide pricing discounting – because prices are always set at the margin, or in other words by the weakest barrel. In especially acute egress scarcity, the geographic-driven portion of the differential can blow out, as we saw in late-2018 when the differential rose to more than $50/bbl before the Alberta government forcibly curtailed provincial production to reduce that overhang.

Additionally, the election of US President Donald Trump – and, specifically, the threat of US tariffs on Canadian exports – has introduced a third factor in the differential calculation. Over the past few months, shifts in the WCS differential have also been reflecting the market’s combined handicapping of (i) the probability of tariffs hitting Canadian crude and (ii) the rough share of the tariff burden borne by Canadian exporters.

All three of these factors – global quality, egress availability, and market anticipation of tariff US risk – have shifted decisively and strongly in favour of WCS over the recent weeks and months.

More pipelines, fewer problems

The first reason that Canadian oil prices are remarkably strong at the moment is sufficient pipeline capacity. The perennial bugbear of Western Canadian oil producers, pipeline capacity is, quite unusually, sufficient thanks to last summer’s start-up of the Trans Mountain Expansion Project (TMX). TMX is the largest single addition to Western Canadian egress capacity in more than a decade and, since TMX entered service last summer, the transportation-related differential has remained low and stable, eliminating the largest and most common drag on Canadian crude pricing.

Without TMX, the Western Canadian oil industry would be suffering an all too familiar and increasingly acute egress crisis. Acute egress shortages would have dwarfed the threat of US tariffs and pushing differentials, in stark contrast to today, far wider – the spectre of provincial production curtailment would not have been out of the question. And it is also important to note that this pipeline sufficiency is inherently temporary. Current pipeline sufficiency will likely only last another year or two at most and then Western Canadian egress will require additional expansions to avoid the resurrecting of egress-scarcity-driven differential blowouts.

Heavy is the crude that wears the crown

The second reason that Canadian oil prices are remarkably strong now is the unusually strong global market for heavy crude. Heavy crude grades (e.g., Iraqi Basra Heavy and Mexican Maya), medium crude grades (e.g., Dubai and Mars), and high sulphur fuel oil (used in global shipping) have all seen their value rise relative to Brent and WTI benchmarks, which both reflect lighter, sweet grades of crude.

For WCS, the differential has narrowed from more than $10/bbl at the end of 2023 to around $2.8/bbl under WTI. The bolstered value of heavy crudes relative to lighter grades is being driven by a host of factors including ongoing OPEC+ production cuts (much of which came in the form of heavier crude grades), strong shipping activity, and tighter sanctions against traditional suppliers of heavy shipping fuel like Russia and more recently Venezuela.

What tariff threat?

Finally, the most acute and volatile reason that Canadian oil prices are remarkably strong at the moment is the near elimination of US tariff-related discounting. The US imports more than half of its total foreign oil purchases from Canada and Canadian crude has long enjoyed tariff-free access to the US market. Tariff-related pricing pressure began in earnest in late-2024 as Canadian crude markets tried to build in an ever-evolving handicapping of that tariff risk following Trump’s initial tariff threats. Tariff-related discounting grew stronger from mid-January through February with the excess geographic WCS differential rising to nearly $5/bbl (see chart above and read “Canadian Crude Drops Tariff Discount” for more on the logic of this measure).

After a months-long rollercoaster of “will he/won’t he” uncertainty around the imposition of US tariffs on Canadian crude imports, USMCA-compliant exemptions and broader US official chatter regarding potential outright Canadian crude exemptions have allowed markets to reduce the (roughly) implied probability to effectively zero. This factor alone narrowed the headline WCS differential in Hardisty, Aberta, by $3–$4/bbl over the past month.

Conclusion

Canadian oil prices are so strong today because just about everything that can be going right is going right. WCS differentials are benefitting from a perfect storm of (i) unusually sufficient pipeline capacity, (ii) exceptionally strong global heavy crude markets, and (iii) a near elimination of US tariff-related discounting. Together, these factors are lifting the relative value of Canadian crude oil exports, and this is a boon for Canadian oil industry profits, provincial royalty income, income tax receipts, and employment in the sector.

Looking ahead, WCS differentials may narrow by another dollar or two as this beneficial momentum persists. However, the balance of risk is now tilted towards a reversal (i.e., widening) of differentials over the coming year as OPEC+ begins to ease production cuts and Western Canadian production continues to grow without the hope of any new near-term pipeline additions. While Canadian crude markets are as optimistic as they’ve been in months regarding US tariffs, the industry is still far from safe – given the volatility of policy coming out of the White House, there is still a chance that this near-erasure of tariff risk from Canadian crude pricing may have come too far, too fast.

If and as tariff concerns fall away, egress sufficiency (i.e., pipeline capacity) will resume its place as king of the differential determinants. At the current rates of Western Canadian production growth, Canada is set to again overrun egress capacity – after the relief provided by the start-up of TMX – over the next year or two at most. While Canada may have dodged a near-term bullet to crude exports destined for the US, this situation serves to only emphasize the continued challenges associated with current pipeline infrastructure. It would be prudent for Canadian politicians to begin shifting their current concerns towards the structural, and entirely predictable, threat of renewed egress insufficiently coming down the pipe.

About the author

Rory Johnston is a leading voice on oil market analysis, advising institutional investors, global policy makers, and corporate decision makers. His views are regularly quoted in major international media. Prior to founding Commodity Context, Johnston led commodity economics research at Scotiabank where he set the bank’s energy and metals price forecasts, advised the bank’s executives and clients, and sat on the bank’s senior credit committee for commodity-exposed sectors.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election2 days ago

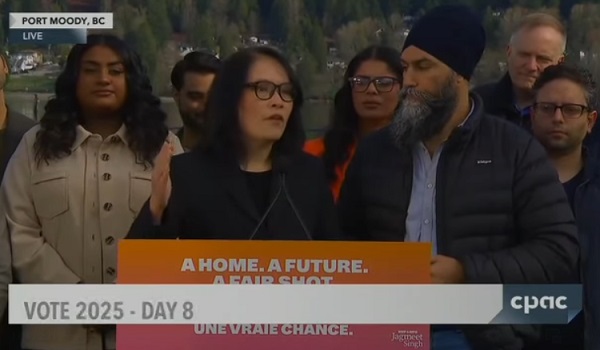

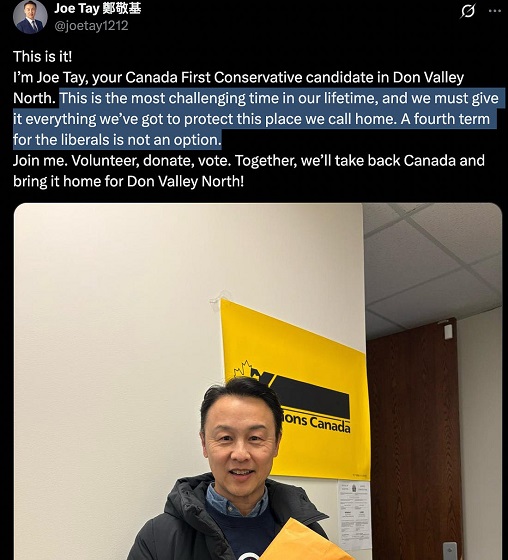

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBeijing’s Echo Chamber in Parliament: Part 2 – Still No Action from Carney

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments