National

Canadian gov’t budget report targets charitable status of pro-life groups, churches

From LifeSiteNews

A Pre-Budget Consultations in Advance of the 2025 Budget report recommends no longer providing charitable status to anti-abortion organizations and amending the Income Tax Act to remove the privileged status of ‘advancement of religion’ as a charitable purpose.

In 2022, I wrote an essay titled “What is coming next for Canadian churches?” In that essay, as well as in my recent book How We Got Here, I noted that as Canada shifted from being a post-Christian society to an increasingly anti-Christian one, Christian churches and organizations will inevitably lose tax-exempt or charitable status:

Churches and other religious institutions that refuse to bend the knee will likely lose their tax-exempt status at some point. Canadian LGBT activists have been making this case for years, and it is only a matter of time before the idea catches on or — more likely — a progressive politician decides that the time is right. I suspect that a key reason this has not yet been discussed is the awkward fact that many non-Christian institutions hold similar positions on marriage, sexuality, and abortion. That said, I have no doubt that a way to target churches specifically will be worked out. LGBT activists are already asking why the government is “rewarding bigotry” by awarding tax-exempt status to churches with a traditional view of sexuality, and LGBT activists have publicized sermons they disagree with as evidence of hatred. The churches and the state are on a collision course, and it isn’t hard to guess how this will end.

We may be seeing the first move in that direction. With the Christmas season upon us and Ottawa in chaos, few Canadians noticed the government’s publication of “Pre-Budget Consultations In Advance of the 2025 Budget,” the report of the Standing Committee on Finance. The report of annual pre-budget consultations included 462 recommendations that have been tabled and, according to the Standing Committee, will be taken into account by “the Minister of Finance in the development of the 2025 federal budget” (which, if Trudeau is still in power, will be Dominic LeBlanc).

Two recommendations included in that report are deeply concerning, and the Christian Legal Fellowship has written to both the Minister of Finance and the Finance Committee Chair Peter Fonseca to express that concern:

Recommendation 429: No longer provide charitable status to anti-abortion organizations.

Recommendation 430: Amend the Income Tax Act to provide a definition of a charity which would remove the privileged status of ‘advancement of religion’ as a charitable purpose.

Those two recommendations, of course, were buried at the very end of the report. The first is unsurprising — Trudeau’s government is currently targeting crisis pregnancy centers that assist moms and babies in need, so it was inevitable that the government was eventually going to target local Right to Life organizations and other pro-life groups that still have charitable status. More brazen is the recommendation that the Income Tax Act be amended to eliminate “advancement of religion” as a charitable purpose — this could, according to the Christian Legal Fellowship, “have a devastating impact, not only on the 32,000+ religious charities in this country, but the millions of Canadians they serve.” CLF urged the government “to reject any such approach and clarify exactly what is being contemplated.” As CLF noted in their letter:

Religious charities account for nearly 40% of all charities in Canada, including churches, mosques, temples, synagogues, and other faith communities, operating programs such as soup kitchens, shelters, refugee homes, and food banks. They provide indispensable social, economic, and spiritual support, filling a significant gap in our communities and meeting the needs of millions of Canadians.

Suggesting that such organizations must do something other than “advance religion” to be considered charitable ignores the reality that these services are themselves the very manifestation of religious beliefs, inherent to and inextricable from the charity’s religion itself. It also betrays a long-standing recognition of the intrinsic goods provided by religious communities, who offer people hope, encouragement, and belonging in ways that simply cannot be quantified or replaced. Ultimately, any efforts to substitute their much-needed services would place an extraordinary strain on all levels of government.

I have no doubt that the Trudeau government is willing to purse these recommendations regardless; these plans, however, may be thwarted by the next election. Trudeau no doubt remembers the Canada Summer Jobs Program fight, when his government insisted that recipients sign an attestation of support for abortion and LGBT ideology and suddenly found themselves facing angry imams, rabbis, and other religious leaders instead of just the priests and pastors they’d assumed would be impacted. It seems unlikely that going after religious charities is a fight Trudeau wants now.

Trudeau will, however, be campaigning on abortion — it’s the wedge issue he returns to again and again as the PMO increasingly resembles Custer’s Last Stand. Thus, Recommendation 429 may be taken up sooner rather than later. Either way, these two recommendations are essentially a statement of purpose. The Liberals may not get to them just now, but be assured that this is what progressives intend to do just as soon as they get the chance.

2025 Federal Election

Campaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

Dan Knight

Dan Knight

Carney is trying to redefine the deficit by splitting it into two categories: “operating” and “capital”—a little trick borrowed from UK public finance to confuse voters and dodge political accountability. It’s not something Canada has ever used in federal budget reporting, and there’s a reason for that: it’s misleading by design.

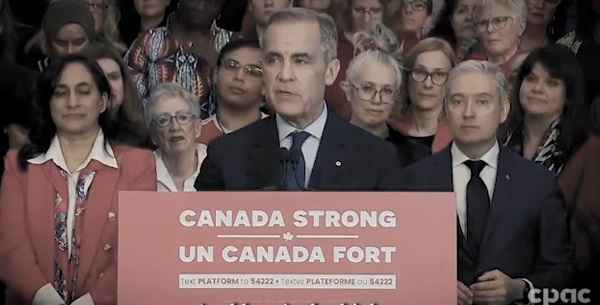

Mark Carney, the unelected banker-turned-savior of the Liberal Party, stood on a stage at Durham College on April 19 and did what professional economic grifters do best—he smiled politely, gestured at some numbers, and attempted to sell Canadians on a $130 billion illusion.

He called it a “costed platform.” What it really was, was a pitch deck for national decline—a warmed-over slab of recycled Trudeauism, backed by deficit delusion and framed as “bold leadership.”

And yes, the numbers are real. Terrifyingly real.

The Liberal platform promises $130 billion in new spending over four years, while running deficits of $62.3 billion this year, $59.9 billion next year, and still sitting at $48 billion in the red by 2028. To balance all of this out? A magical $28 billion in “unspecified cuts.” Not outlined. Not itemized. Just floated in the air like a promise from a door-to-door vacuum salesman.

Carney, in his perfectly rehearsed banker tone, assures us it’s not spending. No, it’s “investment.” Which is hilarious, because that’s exactly what Justin Trudeau said when he kicked off a decade of reckless spending, capital flight, and housing inflation. Carney has simply pulled off the Liberal magic trick of rebranding debt as growth.

But this isn’t just fiscal mismanagement. This is coordinated, high-level dishonesty.

Let’s be clear: Mark Carney is not new to any of this. He isn’t some white knight riding in to clean up Trudeau’s mess. He is the mess. He was Trudeau’s economic consigliere. He sat in the backrooms when they passed Bill C-69, which throttled Canada’s energy sector. He championed ESG, oversaw the implosion of GFANZ (his climate finance alliance), and helped drive $500 billion in investment out of this country.

Now he’s back—wearing a new title, making the same promises, using the same playbook. Only this time, he’s brought a spreadsheet.

In one breath, Carney says we need to “diversify trade.” In the next, he’s counting on $20 billion in one-time countertariff revenues to prop up his platform. In one paragraph, he says Canada will be “fiscally responsible.” In the next, he admits the deficit will nearly double this year. He claims he’ll spend 2% of GDP on defense—but not until 2029, because, of course, there’s no urgency when you’re protected by the American military umbrella you secretly resent.

And his housing plan? If you thought things couldn’t get worse than Justin Trudeau’s housing disaster, buckle up. Carney’s solution is modular housing—yes, government-subsidized, prefabricated micro-boxes dropped onto federally controlled land.

Mark Carney will never live in modular housing. His children will never live in modular housing. But for you, the taxpayer? That’s the future he envisions—managed housing, managed economy, managed speech, managed life.

He’s not here to lift Canadians up. He’s here to lock them down—into a permanent, bureaucratically engineered middle class, dependent on state subsidies and grateful for whatever dignity Ottawa hasn’t yet taxed away.

And when asked how he’ll find the $28 billion in cuts needed to make this plan remotely plausible, his answer was priceless:

“Technology, attrition, and a review of consultant contracts.”

Translation: “We don’t know.”

And here’s where the grift goes full throttle—the accounting scam.

Carney is trying to redefine the deficit by splitting it into two categories: “operating” and “capital”—a little trick borrowed from UK public finance to confuse voters and dodge political accountability. It’s not something Canada has ever used in federal budget reporting, and there’s a reason for that: it’s misleading by design.

Here’s how it works: Carney claims that by 2028, the government will run an “operating surplus.” Sounds responsible, right? Like the books are balanced?

Wrong.

Because even while he’s claiming an “operating surplus,” the federal government will still be running a $48 billion deficit overall. That’s real debt—borrowed money the country doesn’t have.

So how does he square the circle?

Simple: he relabels infrastructure and program spending as “capital investment”, pushes it off to the side, and tells you the main budget is in good shape.

But guess what?

You still owe the money.

The debt still grows.

And interest payments still stack up.

It’s like maxing out your credit card, then saying “no problem—I only overspent on long-term purchases, not day-to-day expenses.”

Try that line with your bank. Let me know how it goes.

This isn’t honest budgeting. It’s spreadsheet manipulation by a guy who knows how to massage the optics while the house burns down.

And let’s not forget who we’re talking about here.

This is the man who moved his financial headquarters to New York while lecturing Canadians about economic sovereignty.

This is the guy with a Cayman Islands tax haven, who built his fortune offshore and now wants to manage your budget while shielding his own.

This is the architect of GFANZ—the so-called climate finance alliance—that imploded under his leadership. The same alliance that saw JPMorgan, Citigroup, and the Big Six Canadian banks bail because Carney couldn’t keep the cartel together without running afoul of antitrust laws.

This is the same man mentioned in Marco Mendicino’s Emergencies Act texts—the man who said, Move the tanks on the protesters.

That’s right.

He wasn’t calling for dialogue. He wasn’t calling for democracy. He was calling for force—on peaceful Canadians exercising their rights. That’s who this is.

So let’s drop the fantasy.

Mark Carney isn’t here to save you.

2025 Federal Election

A Perfect Storm of Corruption, Foreign Interference, and National Security Failures

From Yakk Stack

Canada’s Democracy Under Siege: And You’re Paying for It

Grab a drink…this is a long one…

We are witnessing an unprecedented erosion of our democratic institutions, fueled by a trifecta of domestic corruption, foreign interference, and alarming national security lapses...while the Legacy Media continues to Promote the greatest attack on Canada – The Liberal Party of Canada.

A Complicit Media Machinery

Our taxpayer-funded media outlets, have completely abandoned journalistic integrity, morphing into propaganda arms for the Liberal Party, promises of more funding by the Liberals – defunding by the Conservatives. They disseminate narratives that label concerned citizens as unpatriotic, diverting attention from the real issues plaguing our nation.

This weekend…CTV had the stones to post this:

If this doesn’t get your blood boiling and throwing out a few Blue Words…nothing will.

These people are engaged in hit-pieces against the federal and provincial conservatives on Abortion – which is absolutely not a topic anybody is talking about, Poilievre not signing an NDA for Security Clearance – that he already has – barring the New and Improved Trudeau version on Foreign Interference…and Alberta NDP Leader Naheed Nenshi continuing to coin his “Punching Down” comments in regards to Premier Smith’s and the UCP legislation to protect parental rights and not allow children to be mutilated nor take chemicals which will alter them forever – to protect people who are gender confused or who’ve been peer-pressured into believing that God put them in the wrong body.

Even Carney came out in statements to say that while he believes there are only 2 sexes, he’ll be forcing Alberta to do away with protective legislation – approved by Albertans!

And the Taxpayer funded Nanos polling seemingly only wants to have Liberals included in their polling – CTV promoting messages that Conservatives are either Not Canadians, or as some sort of Fringe Minority – (where have we seen this before) while the statistics on crime show clearly that the Liberals, through their ‘Catch and Release’ & ‘Hug A Thug’ legislation have created:

Statistics show that there has been an increase in:

Homicide: 33%

Auto Theft: 39%

Theft over $5000: 49%

Identity Theft: 121%

Firearm Crimes: 136%

Child Sexual Abuse: 141%

Human Trafficking: 210%

Extortion: 429%

Child Pornography: 565%

And this doesn’t even address the 50K Canadians Lives, lost to overdose following the Liberals promoting “Safe Injection Sites”, “No Charges for Possession of Illicit Narcotics” and “Taxpayer Funded Supply (Safe Supply)”.

Nor does it touch where the police in the GTA made recommendations to “Leave your car keys by your door”, so that criminals wouldn’t go through a full home invasion to steal your car…

Nor how Toronto Police Association continue to Scorch the Liberals on the abysmal failure of their nonsensical policies:

[Refill your drink here – make it stiffer]

Foreign Interference: A Silent Invasion

Reports have surfaced detailing how foreign entities, notably from China, have infiltrated our political landscape. One egregious example involves a Liberal candidate who advocated for the kidnapping of a political opponent, a transgression that was astonishingly overlooked by party leadership.

This, brought to light during the Election cycle…where it took the candidate to step down because Mark Carney – de facto caretaker Prime Minister – absolved him of a clear threat to our democracy and ignoring the Criminal Code of Canada…because he apologized?

We still have no idea:

- How Many Canadians are on an Abduction for Cash List – by China;

- How Much Bounty is being offered for Canadians on Canadian Soil, by China;

- How many Chinese Police Stations – of which have ALSO been funded by Taxpayer Money, still exist in Canada.

Moreover, Chinese-backed influence campaigns have been detected on social media platforms, aiming to sway public opinion and undermine our electoral process.

Adding in…Taxpayers funded 2 “we investigated ourselves and found that we did nothing wrong” investigations by Special Rapporteur and – Trudeau’s Uncle Dave Johnston, and Liberal Friendly Justice Marie-Josée Hogue…who both reassured Canadians – after 2 years of investigation – that there was not only “Nothing to see here” – but that “Misinformation” is the bigger of the concerns.

National Security: A System in Disarray

[Refill your drink here – make it even stiffer]

Our national security apparatus is failing us. The Canadian Security Intelligence Service (CSIS) has reported significant breaches, including the unauthorized transfer of sensitive information to foreign entities. A notable case involves scientists at the National Microbiology Laboratory who were found to have undisclosed ties to Chinese institutions, compromising our biosecurity.

9 Members of the Liberal Caucus/Cabinet – have been named – as they are guilty of gross negligence if not being complicit in the collapse of our National Security:

Furthermore, our cyber defenses are woefully inadequate. The Auditor General’s report highlights that Canada lacks the necessary tools and coordination to combat cybercrime effectively, leaving us vulnerable to attacks from hostile nations.

This convergence of media complicity, foreign meddling, and security failures represents a dire threat to our nation’s sovereignty and democratic integrity.

Advanced polling has begun.

Carney is still trying to lay out his mandate through excessive and being even more reckless with spending than Trudeau…

The Political Debates are clad in buffoonery…closing down conversations on the Number One issue Plaguing Canada – Immigration…

Shutting down the Media Scrum – Following the English Debate, citing Security Concerns…where the security concerns were having Independent Media being able to hold our future PM wannabe’s feet to the fire in their own question period…

From my being looped into conversations with political support and affiliation…I can tell you that all of the above is only the tip of the iceberg.

Doesn’t get to the depth of reporting that you can find through Sam Cooper and Andy Lee – especially on the Chinese hijacking of our democracy…

And while we’ve watched corruption stealing elections in other countries where political opponents have been Charged with Criminal Offenses and barred from running for Presidency – under the guise of Protecting Democracy through trumped up charges (don’t get me started on Trump) – watching the world burn:

We want to believe that this couldn’t happen in Canada…

Only, it is…

And we’re all on the hook for paying the tab on this!

-

Energy2 days ago

Energy2 days ago‘War On Coal Is Finally Over’: Energy Experts Say Trump Admin’s Deregulation Agenda Could Fuel Coal’s ‘Revival’

-

COVID-192 days ago

COVID-192 days agoThe Pandemic Justice Phase Begins as Criminal Investigations Commence

-

Economy1 day ago

Economy1 day agoThe Net-Zero Dream Is Unravelling And The Consequences Are Global

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBefore the Vote: Ask Who’s Defending Our Health

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHomebuilding in Canada stalls despite population explosion

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe “Hardhat Vote” Has Embraced Pierre Poilievre

-

2025 Federal Election14 hours ago

2025 Federal Election14 hours agoCarney’s Fiscal Fantasy: When the Economist Becomes More Dangerous Than the Drama Teacher

-

Addictions1 day ago

Addictions1 day agoAddiction experts demand witnessed dosing guidelines after pharmacy scam exposed