Fraser Institute

Canada’s median health-care wait time hits 30 weeks—longest ever recorded

From the Fraser Institute

By Mackenzie Moir and Bacchus Barua

Canadian patients in 2024 waited longer than ever for medical treatment, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“While most Canadians understand that wait times are a major problem, we’ve now reached an unprecedented and unfortunate milestone for delayed access to care,” said Bacchus Barua, director of health policy studies at the Fraser Institute and co-author of Waiting Your Turn: Wait Times for Health Care in Canada, 2024.

The annual study, based on a survey of physicians across Canada, this year reports a median wait time of 30 weeks from referral by a general practitioner (i.e. family doctor) to consultation with a specialist to treatment, for procedures across 12 medical specialties including several types of surgery.

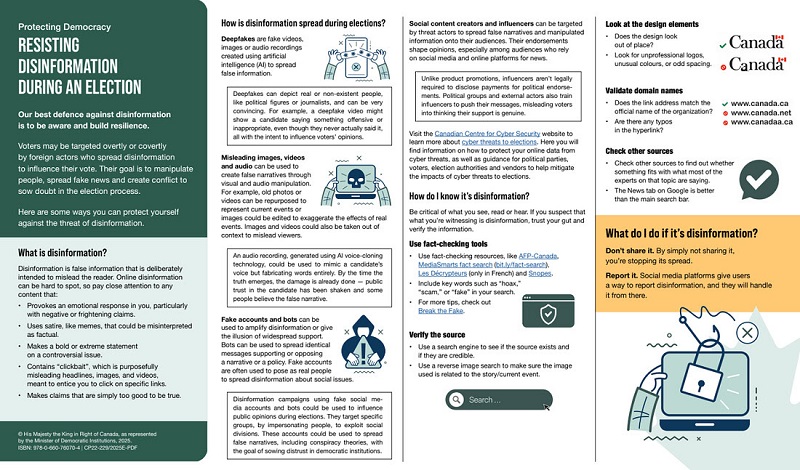

This year’s median wait (30 weeks) is the longest ever recorded—longer than the 27.7 weeks in 2023 and the 20.9 weeks in 2019 (before the pandemic), and 222 per cent longer than the 9.3 weeks in 1993 when the Fraser Institute began tracking wait times. Among the provinces, Ontario recorded the shortest median wait time (23.6 weeks, up from 21.6 weeks in 2023) while Prince Edward Island recorded the longest (77.4 weeks—although data for P.E.I. should be interpreted with caution due to fewer survey responses compared to other provinces).

Among the various specialties, national median wait times were longest for orthopedic surgery (57.5 weeks) and neurosurgery (46.2 weeks), and shortest for radiation (4.5 weeks) and medical oncology treatments (4.7 weeks). For diagnostic technologies, wait times were longest for CT scans (8.1 weeks), MRIs (16.2 weeks) and ultrasounds (5.2 weeks).

“Long wait times can result in increased suffering for patients, lost productivity at work, a decreased quality of life, and in the worst cases, disability or death,” said Mackenzie Moir, senior policy analyst at the Fraser Institute and study co-author.

Median wait times by province (in weeks)

- In 2024, physicians across Canada reported a median wait time of 30.0 weeks between a referral from a GP and receipt of treatment. Up from 27.7 in 2023.

- This is 222% longer than the 9.3 week wait Canadian patients could expect in 1993.

- Ontario reported the shortest total wait (23.6 weeks), followed by Quebec (28.9 weeks) and British Columbia (29.5 weeks).

- Patients waited longest in Prince Edward Island (77.4 weeks), New Brunswick (69.4 weeks) and Newfoundland and Labrador (43.2 weeks).

- Patients waited the longest for Orthopaedic Surgery (57.5 weeks) and Neurosurgery (46.2 weeks).

- By contrast, patients faced shorter waits for Radiation Oncology (4.5 weeks) and Medical Oncology (4.7 weeks).

- The national 30 week total wait is comprised of two segments. Referral by a GP to consultation with a specialist: 15.0 weeks. Consultation with a specialist to receipt of treatment: 15.0 weeks.

- More than 1900 responses were received across 12 specialties and 10 provinces.

- After seeing a specialist, Canadian patients waited 6.3 weeks longer than what physicians consider to be clinically reasonable (8.6 weeks).

- Across 10 provinces, the study estimated that patients in Canada were waiting for 1.5 million procedures in 2024.

- Patients also suffered considerable delays for diagnostic technology: 8.1 weeks for CT scans, 16.2 weeks for MRI scans, and 5.2 weeks for Ultrasound.

Mackenzie Moir

2025 Federal Election

Housing starts unchanged since 1970s, while Canadian population growth has more than tripled

From the Fraser Institute

By: Austin Thompson and Steven Globerman

The annual number of new homes being built in Canada in recent years is virtually the same as it was in the 1970s, despite annual population growth

now being three times higher, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think tank.

“Despite unprecedented levels of immigration-driven population growth following the COVID-19 pandemic, Canada has failed to ramp up homebuilding sufficiently to meet housing demand,” said Steven Globerman, Fraser Institute senior fellow and co-author of The Crisis in Housing Affordability: Population Growth and Housing Starts 1972–2024.

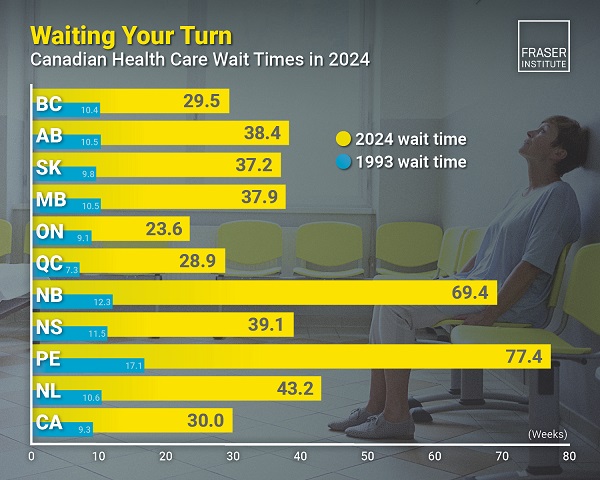

Between 2021 and 2024, Canada’s population grew by an average of 859,473 people per year, while only 254,670 new housing units were started annually. From 1972 to 1979, a similar number of new housing units were built—239,458—despite the population only growing by 279,975 people a year.

As a result, more new residents are competing for each new home than in the past, which is driving up housing costs.

“The evidence is clear—population growth has been outpacing housing construction for decades, with predictable results,” Globerman said.

“Unless there is a substantial acceleration in homebuilding, a slowdown in population growth, or both, Canada’s housing affordability crisis is unlikely to improve.”

The Crisis in Housing Affordability: Population Growth and Housing Starts 1972–2024

- Canada experienced unprecedented population growth following the COVID-19 pandemic without a commensurately large increase in new homebuilding.

- The imbalance between population growth and new housing construction is reflected in a significant gap between housing demand and supply, which is driving up housing costs.

- Canada’s population grew by a record 1.23 million new residents in 2023 almost entirely due to immigration. That growth was more than double the pre-pandemic record set in 2019.

- Population growth slowed to 951,517 in 2024, still well above any year before 2023.

- Nationally, construction began on about 245,367 new housing units in 2024, down from a recent high of 271,198 starts in 2021—Canada’s annual number of housing starts peaked at 273,203 in 1976.

- Canada’s annual number of housing starts regularly exceeded 200,000 in past decades, when absolute population growth was much lower.

- In 2023, Canada added 5.1 new residents for every housing unit started, which was the highest ratio over the study’s timeframe and well above the average rate of 1.9 residents for every unit started observed over the study period (1972–2024).

- This ratio improved modestly in 2024, with 3.9 new residents added per housing start. However, the ratio remains far higher than at any point prior to the COVID-19 pandemic.

- These national trends are broadly mirrored across all 10 provinces, where annual population growth relative to housing starts is, to varying degrees, elevated when compared to long-run averages.

- Without an acceleration in homebuilding, a slowdown in population growth, or both, Canada’s housing affordability crisis will likely persist.

Austin Thompson

Education

Schools should focus on falling math and reading skills—not environmental activism

From the Fraser Institute

In 2019 Toronto District School Board (TDSB) trustees passed a “climate emergency” resolution and promised to develop a climate action plan. Not only does the TDSB now have an entire department in their central office focused on this goal, but it also publishes an annual climate action report.

Imagine you were to ask a random group of Canadian parents to describe the primary mission of schools. Most parents would say something along the lines of ensuring that all students learn basic academic skills such as reading, writing and mathematics.

Fewer parents are likely to say that schools should focus on reducing their environmental footprints, push students to engage in environmental activism, or lobby for Canada to meet the 2016 Paris Agreement’s emission-reduction targets.

And yet, plenty of school boards across Canada are doing exactly that. For example, the Seven Oaks School Division in Winnipeg is currently conducting a comprehensive audit of its environmental footprint and intends to develop a climate action plan to reduce its footprint. Not only does Seven Oaks have a senior administrator assigned to this responsibility, but each of its 28 schools has a designated climate action leader.

Other school boards have gone even further. In 2019 Toronto District School Board (TDSB) trustees passed a “climate emergency” resolution and promised to develop a climate action plan. Not only does the TDSB now have an entire department in their central office focused on this goal, but it also publishes an annual climate action report. The most recent report is 58 pages long and covers everything from promoting electric school buses to encouraging schools to gain EcoSchools certification.

Not to be outdone, the Vancouver School District (VSD) recently published its Environmental Sustainability Plan, which highlights the many green initiatives in its schools. This plan states that the VSD should be the “greenest, most sustainable school district in North America.”

Some trustees want to go even further. Earlier this year, the British Columbia School Trustees Association released its Climate Action Working Group report that calls on all B.C. school districts to “prioritize climate change mitigation and adopt sustainable, impactful strategies.” It also says that taking climate action must be a “core part” of school board governance in every one of these districts.

Apparently, many trustees and school board administrators think that engaging in climate action is more important than providing students with a solid academic education. This is an unfortunate example of misplaced priorities.

There’s an old saying that when everything is a priority, nothing is a priority. Organizations have finite resources and can only do a limited number of things. When schools focus on carbon footprint audits, climate action plans and EcoSchools certification, they invariably spend less time on the nuts and bolts of academic instruction.

This might be less of a concern if the academic basics were already understood by students. But they aren’t. According to the most recent data from the Programme for International Student Assessment (PISA), the math skills of Ontario students declined by the equivalent of nearly two grade levels over the last 20 years while reading skills went down by about half a grade level. The downward trajectory was even sharper in B.C., with a more than two grade level decline in math skills and a full grade level decline in reading skills.

If any school board wants to declare an emergency, it should declare an academic emergency and then take concrete steps to rectify it. The core mandate of school boards must be the education of their students.

For starters, school boards should promote instructional methods that improve student academic achievement. This includes using phonics to teach reading, requiring all students to memorize basic math facts such as the times table, and encouraging teachers to immerse students in a knowledge-rich learning environment.

School boards should also crack down on student violence and enforce strict behaviour codes. Instead of kicking police officers out of schools for ideological reasons, school boards should establish productive partnerships with the police. No significant learning will take place in a school where students and teachers are unsafe.

Obviously, there’s nothing wrong with school boards ensuring that their buildings are energy efficient or teachers encouraging students to take care of the environment. The problem arises when trustees, administrators and teachers lose sight of their primary mission. In the end, schools should focus on academics, not environmental activism.

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Business2 days ago

Business2 days agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

COVID-191 day ago

COVID-191 day agoTamara Lich and Chris Barber trial update: The Longest Mischief Trial of All Time continues..

-

Energy1 day ago

Energy1 day agoStraits of Mackinac Tunnel for Line 5 Pipeline to get “accelerated review”: US Army Corps of Engineers

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoAllegations of ethical misconduct by the Prime Minister and Government of Canada during the current federal election campaign

-

Daily Caller24 hours ago

Daily Caller24 hours agoDaily Caller EXCLUSIVE: Trump’s Broad Ban On Risky Gain-Of-Function Research Nears Completion

-

Daily Caller2 days ago

Daily Caller2 days agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties