Business

Canada should match or eclipse Trump’s red-tape cutting plan

From the Fraser Institute

With all eyes focused on WWT (World War Tariff), another Trump initiative was quietly put in place last week in one of the now-signature Trump “flood the zone” initiative waves.

On Jan. 31, the Trump administration published an executive order (EO) titled “Unleashing Prosperity Through Deregulation,” and as regulatory reform initiatives go, well, it’s every anti-regulatory analyst’s dream as “each new regulation issued, at least 10 prior regulations be identified for elimination.”

For reference, one of Canada’s strongest regulatory-reform efforts (in British Columbia back in 2001) only called for a 2-for-1 ratio. Although B.C.’s effort did somewhat foreshadow Trump’s, in that it created something of a DOGE (Department of Government Efficiency) when the B.C. government appointed an actual minister of deregulation to oversee the effort rather than leaving it to the bureaucracy to reform itself. And it worked. By 2004, 37 per cent of regulatory requirements in B.C. had been eliminated (exceeding the initial one-third target).

Trump’s new plan is less explicit in defining regulations, but it makes sure that new regulations cost less than the 10 regulations they replace. “For fiscal year 2025,” reads the EO, “the heads of all agencies are directed to ensure that the total incremental cost of all new regulations, including repealed regulations, being finalized this year, shall be significantly less than zero, and any new incremental costs associated with new regulations shall, to the extent permitted by law, be offset by the elimination of existing costs associated with at least 10 prior regulations.”

And Trump’s plan will put regulators in government agencies on a permanent diet, as a “total amount of incremental costs… will be allowed for each agency in issuing new regulations and repealing regulations for each fiscal year after fiscal year 2025.”

Why does this matter to Canadians?

Because, unlike those few years of B.C. regulatory reform, Canada has been wrapping itself in regulatory red-tape for decades, making our economy less competitive globally and with the United States. Between 2006 to 2018, the number of restrictive regulations in Canada grew from about 66,000 to 72,000. And according to the Canadian Federation of Independent Business, the cost of regulation from all three levels of government to Canadian businesses totalled $38.8 billion in 2020, for a total of 731 million hours—the equivalent of nearly 375,000 fulltime jobs.

Clearly, Canada has a regulatory problem—our governments generate seemingly endless spools of regulatory red tape, which keep Canadian businesses tangled in inefficiency, wasted labour and non-competitiveness. President Trump’s new regulatory reform initiative will further increase the “red-tape gap” between Canada and the U.S.

Policymakers in Ottawa and the provinces would do well to learn about Canada’s experiences with deregulatory programs and strive to match—or beat—the new U.S. regulatory reform efforts before a massive lack of regulatory competitiveness becomes a serious problem, adding insult to injury on top of World War Tariff.

Business

Musk Slashes DOGE Savings Forecast By 85%

From the Daily Caller News Foundation

By Thomas English

Elon Musk announced Thursday that the Department of Government Efficiency (DOGE) is now targeting $150 billion in federal savings for fiscal year 2026 — dramatically scaling back earlier claims of slashing as much as $2 trillion.

Musk initially projected DOGE would deliver $2 trillion in savings by targeting government waste, fraud and abuse. That figure was halved to $1 trillion earlier this year, but Musk walked it back again at Thursday’s Cabinet meeting, saying the revised $150 billion projection will “result in better services for the American people” and ensure federal spending “in a way that is sensible and fair and good.”

“I’m excited to announce we anticipate saving in FY ’26 from a reduction of waste and fraud a reduction of $150 billion dollars,” Musk said. “And some of it is just absurd, like, people getting unemployment insurance who haven’t been born yet. I mean, I think anyone can appreciate — I mean, come on, that’s just crazy.”

The announcement marks the latest in a string of revised projections from Musk, who has become the face of President Donald Trump’s aggressive federal efficiency agenda.

“Your people are fantastic,” the president responded. “In fact, hopefully they’ll stay around for the long haul. We’d like to keep as many as we can. They’re great — smart, sharp, finding things that nobody would have thought of.”

Musk originally floated the $2 trillion figure during campaign appearances last fall.

“I think we could do at least $2 trillion,” Musk said at the Madison Square Garden campaign rally in November. “At the end of the day, you’re being taxed — all government spending is taxation … Your money is being wasted, and the Department of Government Efficiency is going to fix that.”

By January, he softened expectations to a “really quite achievable” $1 trillion target before downsizing that figure again this week.

“Our goal is to reduce the deficit by a trillion dollars,” Musk told Fox News’ Bret Baier “Looked at in total federal spending, to drop the federal spending from $7 trillion to $6 trillion by eliminating waste, fraud and abuse … Which seems really quite achievable.”

DOGE’s website, which tracks cost-saving initiatives and contract cancellations, currently calculates total federal savings at $150 billion.

2025 Federal Election

Taxpayers urge federal party leaders to drop home sale reporting to CRA

Party leaders must clarify position on home equity tax

The Canadian Taxpayers Federation is calling on all party leaders to prove they’re against home equity taxes by pledging to immediately remove the Canada Revenue Agency reporting requirement on the sale of primary residences.

“Canadians rely on the sale of their homes to pay for their golden years,” said Carson Binda, CTF B.C. Director. “After the government spent hundreds of thousands of dollars flirting with home taxes, taxpayers need party leaders to prove they won’t tax our homes by removing the CRA reporting requirement.”

Right now, the profit you make from selling your home is exempt from the capital gains tax. However, in 2016, the federal government mandated that Canadians report the sale of their homes to the CRA, even though it’s tax exempt.

The Canada Mortgage and Housing Corporation also spent at least $450,000 to study and influence public opinion in favour of home equity taxes. The report recommended a home equity tax targeting the “housing wealth windfalls gained by many homeowners while they sleep and watch TV.”

“A home equity tax would hurt seniors saving for their golden years and make homes more expensive for younger generations,” Binda said. “If the federal government isn’t planning on imposing a home equity tax, then Canadians shouldn’t be forced to report the sale of their home to the CRA.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

Business1 day ago

Business1 day agoCanadian Police Raid Sophisticated Vancouver Fentanyl Labs, But Insist Millions of Pills Not Destined for U.S.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre Announces Plan To Cut Taxes By $100,000 Per Home

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTwo Canadian police unions endorse Pierre Poilievre for PM

-

2025 Federal Election21 hours ago

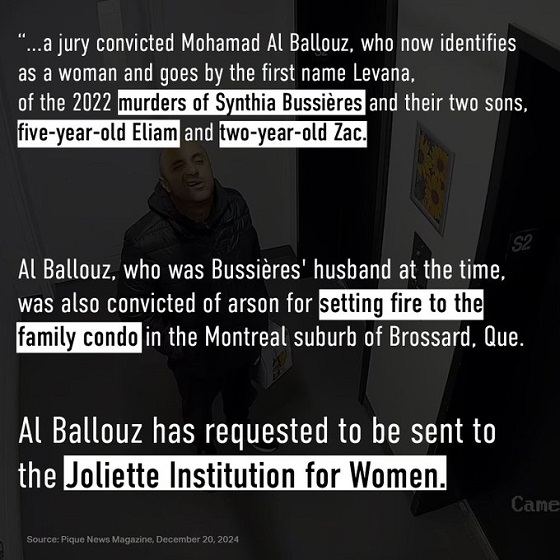

2025 Federal Election21 hours ago‘Sadistic’ Canadian murderer claiming to be woman denied transfer to female prison

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoTaxpayers urge federal party leaders to drop home sale reporting to CRA

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney needs to cancel gun ban and buyback

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney vows to provide sterilizing puberty blockers to children ‘without exception’