Canadian Energy Centre

Business leaders blast Ottawa’s ‘unnecessary and unacceptable’ oil and gas emissions cap

From the Canadian Energy Centre

The federal government is proceeding with its plans to cap emissions from the oil and gas industry in a move business leaders say will ultimately hurt Indigenous communities and everyday Canadians.

The Business Council of Canada called the cap part of a “full-on charge against the oil and gas sector.”

The government announced on December 7 that it will implement measures to cap oil and gas emissions in 2030 at 35 to 38 percent below 2019 levels. A similar cap has not been announced for any other industry.

“It all seems punitive and short-sighted,” wrote Business Council of Canada vice-president Michael Gullo and Theo Argitis, managing director of Compass Rose Group.

A cap on production

They don’t put much stock into the government’s claims that the cap is not intended to limit Canada’s oil and gas production.

“That’s semantics. To work, a cap would ultimately need to be severe enough to curtail production if needed, and that would have significant economic consequences,” Gullo and Argitis said, warning of a “direct and immediate” loss of income for Canada’s economy.

“There would be significant indirect costs as well, incurred by every household and business across the nation because Canada relies on income generated by oil and gas companies—totaling $270 billion in 2022 alone—to support social programs like health care, education, and infrastructure,” they wrote.

Already on the path to net zero

On the world’s current trajectory, oil and gas will still account for 46 per cent of world energy needs in 2050, down only moderately from 51 per cent in 2022, according to the International Energy Agency.

Industry leaders argue that Canada’s oil and gas producers are already on the path to net zero emissions without the need for the cap.

According to Environment and Climate Change Canada’s latest report to the United Nations, emissions from so-called “conventional” (non-oil sands) production declined to 26 megatonnes in 2021, from 34 megatonnes in 2019.

Producers in Alberta have already reduced total methane emissions by 45 per cent compared to 2014, hitting the target three years ahead of schedule.

Oil sands emissions did not increase last year despite production growth, and total emissions are expected to start going down before 2025, according to S&P Global.

“Imposing an emissions cap on Canada’s oil and gas producers, who are already achieving significant emissions reductions as shown in the federal government’s own data, is unnecessary and unacceptable,” the Explorers and Producers Association of Canada said in a statement.

A cap on Indigenous opportunity

The Indigenous Resource Network (IRN) – which advocates for Indigenous participation in resource projects – said the cap would be “devastating” for Indigenous communities.

“A pathway to self-determination is being achieved through the ownership of oil and gas projects and involvement in the sector,” said IRN executive director John Desjarlais.

“This would result in a cap on Indigenous opportunity in the oil and gas sector.”

Desjarlais said the IRN is seeking an exemption from the cap for Indigenous communities who are engaged in oil and gas development.

He said the proposed cap directly contradicts the government’s promises on reconciliation and its support for the United Nations Declaration on the Rights of Indigenous People.

Counter–approach to the United States

The approach of capping emissions runs counter to the incentive-based approach being pursued in the United States, the Canadian Association of Energy Contractors (CAOEC) said in a statement.

“There, the Inflation Reduction Act has attracted capital and accelerated low-carbon technology and innovation in the energy sector at the expense of Canadian businesses and workers,” the CAOEC said.

Ottawa has yet to finalize announced investment tax credits to support clean technologies like hydrogen production and carbon capture, utilization and storage (CCUS), the Business Council of Canada noted.

“We have engaged the federal government in good faith over the past two years and have asked them to partner with us to accelerate the deployment of carbon abatement technology. As of today, we have received no support from this government,” said CAOEC president Mark Scholz.

“Stop working against us and start working with us.”

Final regulations on the proposed emissions cap are expected in 2025.

Alberta

The beauty of economic corridors: Inside Alberta’s work to link products with new markets

From the Canadian Energy Centre

Q&A with Devin Dreeshen, Minister of Transport and Economic Corridors

CEC: How have recent developments impacted Alberta’s ability to expand trade routes and access new markets for energy and natural resources?

Dreeshen: With the U.S. trade dispute going on right now, it’s great to see that other provinces and the federal government are taking an interest in our east, west and northern trade routes, something that we in Alberta have been advocating for a long time.

We signed agreements with Saskatchewan and Manitoba to have an economic corridor to stretch across the prairies, as well as a recent agreement with the Northwest Territories to go north. With the leadership of Premier Danielle Smith, she’s been working on a BC, prairie and three northern territories economic corridor agreement with pretty much the entire western and northern block of Canada.

There has been a tremendous amount of work trying to get Alberta products to market and to make sure we can build big projects in Canada again.

CEC: Which infrastructure projects, whether pipeline, rail or port expansions, do you see as the most viable for improving Alberta’s global market access?

Dreeshen: We look at everything. Obviously, pipelines are the safest way to transport oil and gas, but also rail is part of the mix of getting over four million barrels per day to markets around the world.

The beauty of economic corridors is that it’s a swath of land that can have any type of utility in it, whether it be a roadway, railway, pipeline or a utility line. When you have all the environmental permits that are approved in a timely manner, and you have that designated swath of land, it politically de-risks any type of project.

CEC: A key focus of your ministry has been expanding trade corridors, including an agreement with Saskatchewan and Manitoba to explore access to Hudson’s Bay. Is there any interest from industry in developing this corridor further?

Dreeshen: There’s been lots of talk [about] Hudson Bay, a trade corridor with rail and port access. We’ve seen some improvements to go to Churchill, but also an interest in the Nelson River.

We’re starting to see more confidence in the private sector and industry wanting to build these projects. It’s great that governments can get together and work on a common goal to build things here in Canada.

CEC: What is your vision for Alberta’s future as a leader in global trade, and how do economic corridors fit into that strategy?

Dreeshen: Premier Smith has talked about C-69 being repealed by the federal government [and] the reversal of the West Coast tanker ban, which targets Alberta energy going west out of the Pacific.

There’s a lot of work that needs to be done on the federal side. Alberta has been doing a lot of the heavy lifting when it comes to economic corridors.

We’ve asked the federal government if they could develop an economic corridor agency. We want to make sure that the federal government can come to the table, work with provinces [and] work with First Nations across this country to make sure that we can see these projects being built again here in Canada.

Alberta

Alberta’s massive oil and gas reserves keep growing – here’s why

From the Canadian Energy Centre

Q&A with Mike Verney, executive vice-president, McDaniel & Associates

New analysis commissioned by the Alberta Energy Regulator has increased the province’s natural gas reserves by 440 per cent, bumping Canada into the global top 10.

Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

The report was conducted by Calgary-based consultancy McDaniel & Associates. Executive vice-president Mike Verney explains what it means.

CEC: What are “reserves” and why do they matter?

Verney: Reserves are commercial quantities of oil and gas to be recovered in the future. They are key indicators of future production potential.

For companies, that’s a way of representing the future value of their operations. And for countries, it’s important to showcase the runway they have in terms of the future of their oil and gas.

Some countries that have exploited a lot of their resource in the past have low reserves remaining. Canada is in a position where we still have a lot of meat on the bone in terms of those remaining quantities.

CEC: How long has it been since Alberta’s oil and gas reserves were comprehensively assessed?

Verney: Our understanding is the last fully comprehensive review was over a decade ago.

CEC: Does improvement in technology and innovation increase reserves?

Verney: Technological advancements and innovation play a crucial role in increasing reserves. New technologies such as advanced drilling techniques (e.g., hydraulic fracturing, horizontal drilling), enhanced seismic imaging and improved extraction methods enable companies to discover and access previously inaccessible reserves.

As these reserves get developed, the evolution of technology helps companies develop them better and better every year.

CEC: Why have Alberta’s natural gas reserves increased?

Verney: Most importantly, hydraulic fracturing has unlocked material volume, and that’s one of the principal reasons why the new gas estimate is so much higher than what it was in the past.

The performance of the wells that are being drilled has also gotten better since the last comprehensive study.

The Montney competes with every American tight oil and gas play, so we’re recognizing the future potential of that with the gas reserves that are being assigned.

In addition, operators continue to expand the footprint of the Alberta Deep Basin.

CEC: Why have Alberta’s oil reserves increased?

Verney: We discovered over two billion barrels of oil reserves associated with multilateral wells, which is a new technology. In a multilateral well, you drill one vertical well to get to the zone and then once you hit the zone you drill multiple legs off of that one vertical spot. It has been a very positive game-changer.

Performance in the oil sands since the last comprehensive update has also gone better than expected. We’ve got 22 thermal oil sands projects that are operating, and in general, expectations in terms of recovery are higher than they were a decade ago.

Oil sands production has grown substantially in the past decade, up 70 per cent, from two million to 3.4 million barrels per day. The growth of several projects has increased confidence in the commercial viability of developing additional lands.

CEC: What are the implications of Alberta’s reserves in terms of the province’s position as a world energy supplier?

Verney: We’re seeing LNG take off in the United States, and we’re seeing lots of demand from data centers. Our estimate is that North America will need at least 30 billion cubic feet per day of more gas supply in the next few years, based on everything that’s been announced. That is a very material number, considering the United States’ total natural gas production is a little over 100 billion cubic feet per day.

In terms of oil, since the shale revolution in 2008 there’s been massive growth from North America, and the rest of the world hasn’t grown oil production. We’re now seeing that the tight plays in the U.S. aren’t infinite and are showing signs of plateauing.

Specifically, when we look at the United States’ largest oil play, the Permian, it has essentially been flat at 5.5 million barrels per day since December 2023. Flat production from the Permian is contrary to the previous decade, where we saw tight oil production grow by half a million barrels per day per year.

Oil demand has gone up by about a million barrels a day per year for the past several decades, and at this point we do expect that to continue, at the very least in the near term.

Given the growing demand for oil and the stagnation in supply growth since the shale revolution, it’s expected that Alberta’s oil sands reserves will become increasingly critical. As global oil demand continues to rise, and with limited growth in production from other sources, oil sands reserves will be relied upon more heavily.

-

2025 Federal Election2 days ago

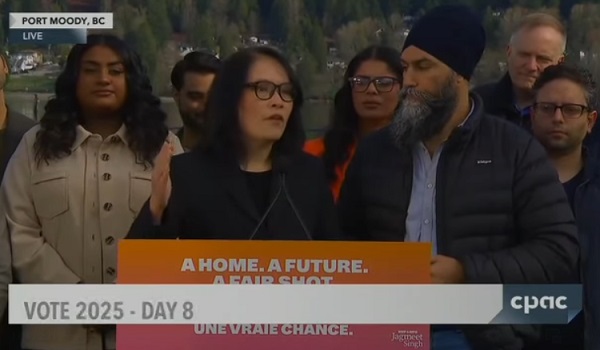

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election1 day ago

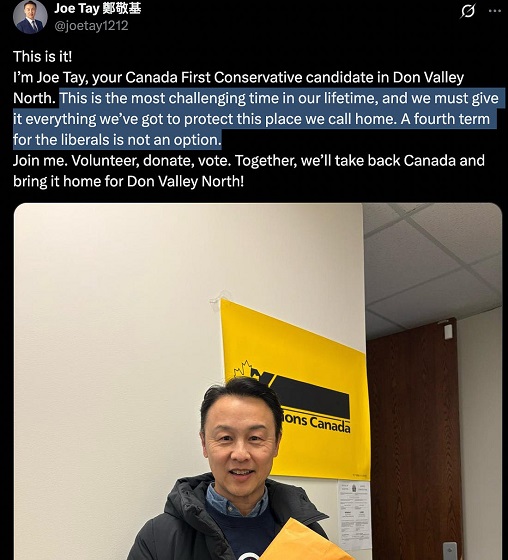

2025 Federal Election1 day agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBeijing’s Echo Chamber in Parliament: Part 2 – Still No Action from Carney