Alberta

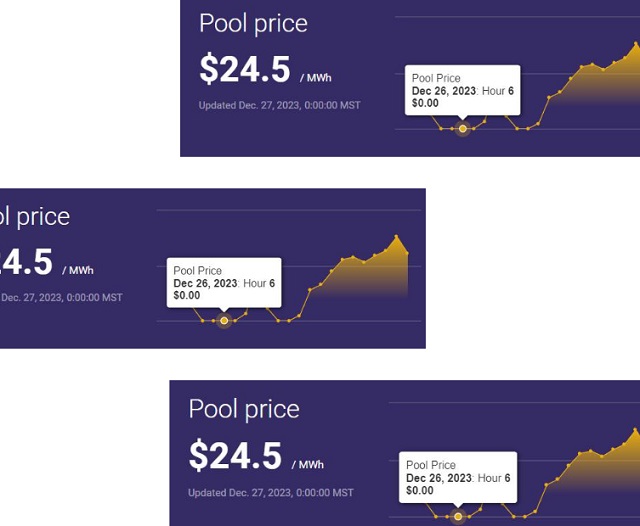

Boxing Day Special! Alberta had free power for several hours, and that’s not a good thing

From the Frontier Centre for Public Policy

Imagine, if you will, a Boxing Day sale where everything was free for everyone across every store at the same time, for several hours.

And imagine if in early morning hours of Dec. 26, Best Buy, Staples, Walmart, and indeed every single store in the entire economy got paid precisely zero dollars for their wares for several hours that morning.

Preposterous, you say!

Indeed, it did happen, in Alberta’s free-wheeling unregulated electrical market. The pool price, as recorded by the Alberta Electric System Operator (AESO) was $0.00 per megawatt at 4-7 a.m., and from 11 a.m. until noon.

And as a pool price, that means unless there’s some other contract going, that’s the price all generators get paid.

I might not have an MBA, but I’m fairly certain no business model in the world can survive getting paid nothing at all for their product for terribly long. If McDonalds, Burger King and Tim Horton’s all gave away their breakfasts on Dec. 26 to all comers, they couldn’t do it for long before someone would realize this is idiocy and shut the doors.

So what was happening during those wee hours in the morning, as the Boxing Day shoppers were in line for their flat screen TVs? It was quite windy in Alberta.

X bot account @ReliableAB, which logs hourly reports of the AESO minute-by-minute reporting of the grid showed that wind generation was just a hummin’. For several weeks, Alberta wind power has been been frequently pumping out high numbers, often in excess of 70 per cent of its nameplate capacity. One would think this would be a great thing, right? It’s finally doing what it’s supposed to do.

At 4:38 a.m., @ReliableAB reported Alberta’s now 45 wind farms were putting out 3,508 megawatts of the installed capacity of 4,481 megawatts while the pool price was zero.

At that point, wind was generating a full 33 per cent of total generation, which again, sounds like great news.

It was during one of the deadest periods of economic activity in the whole year, the night after Christmas. Demand in Alberta was low, with an internal load of 9,632 megawatts. The lack of demand happened to coincide with lots of surplus power being dumped onto the grid.

(As it was still dark, solar wasn’t a factor.)

What to do? How about sell as much as you can?

And that’s what happened. Alberta was pumping out 995 megawatts of power exports to its neighbours, 967 megawatts to BC, 26 to Saskatchewan, and two megawatts to Montana.

This situation is also the converse of what I’ve been reporting on over almost precisely 24 months, the frequent collapse of wind power generation in Alberta. Almost every time that has happened, the pool price shoots up, often hitting $700, $800, $900 or even the theoretical maximum of $999.99 per megawatt hour. If the maximum was $2,000, I’m willing to bet it would have hit those heights, too. And the integral under that graph – what consumers get on their bill – is horrendous.

So here we have renewable, “green” power in surplus, driving prices down for everyone, and so much so that it can benefit the neighbours, too.

But therein is the fundamental problem. No one, not Best Buy, McDonalds or Capital Power can produce product for nothing, and definitely not for extended periods. There is a cost to generating power, be it capital or fuel or operating costs. Nor can they sell their products, be it flat screen TVs, hamburgers or electricity for next to nothing, either. The entire economic model will collapse, and then what? Who will provide the power then?

When I wrote my first story on Alberta wind power on Dec. 28, 2021, the province had 2,269 megawatts on nameplate wind generation capacity. It’s now double that, at 4,481 megawatts, a level where big swings in wind power production have a huge impact. And Alberta’s last coal plant will switch to natural gas in a few months.

And there’s more wind coming. Oct. 24, the Calgary Herald noted, “More than 3,500 megawatts of renewable power generation projects are now under construction in Alberta.

“By the end of August, the AESO received 74 wind and solar project applications after the moratorium was announced, (Premier Danielle) Smith noted.”

What’s going to happen when all that comes online, when Alberta will have around 9,600 megawatts of wind and solar, almost equal to daily demand? Will the grid be flooded with power so cheap that reliable, dispatchable power generators can’t stay in business, only to see prices skyrocket when wind and solar inevitably fail, as they frequently do, and at the worst times?

Sounds like a recipe for utter chaos. And blackouts.

Brian Zinchuk is editor and owner of Pipeline Online, and occasional contributor to the Frontier Centre for Public Policy. He can be reached at [email protected].

Alberta

Housing in Calgary and Edmonton remains expensive but more affordable than other cities

From the Fraser Institute

By Tegan Hill and Austin Thompson

In cities across the country, modest homes have become unaffordable for typical families. Calgary and Edmonton have not been immune to this trend, but they’ve weathered it better than most—largely by making it easier to build homes.

Specifically, faster permit approvals, lower municipal fees and fewer restrictions on homebuilders have helped both cities maintain an affordability edge in an era of runaway prices. To preserve that edge, they must stick with—and strengthen—their pro-growth approach.

First, the bad news. Buying a home remains a formidable challenge for many families in Calgary and Edmonton.

For example, in 2023 (the latest year of available data), a typical family earning the local median after-tax income—$73,420 in Calgary and $70,650 in Edmonton—had to save the equivalent of 17.5 months of income in Calgary ($107,300) or 12.5 months in Edmonton ($73,820) for a 20 per cent down payment on a typical home (single-detached house, semi-detached unit or condominium).

Even after managing such a substantial down payment, the financial strain would continue. Mortgage payments on the remaining 80 per cent of the home’s price would have required a large—and financially risky—share of the family’s after-tax income: 45.1 per cent in Calgary (about $2,757 per month) and 32.2 per cent in Edmonton (about $1,897 per month).

Clearly, unless the typical family already owns property or receives help from family, buying a typical home is extremely challenging. And yet, housing in Calgary and Edmonton remains far more affordable than in most other Canadian cities.

In 2023, out of 36 major Canadian cities, Edmonton and Calgary ranked 8th and 14th, respectively, for housing affordability (relative to the median after-tax family income). That’s a marked improvement from a decade earlier in 2014 when Edmonton ranked 20th and Calgary ranked 30th. And from 2014 to 2023, Edmonton was one of only four Canadian cities where median after-tax family income grew faster than the price of a typical home (in Calgary, home prices rose faster than incomes but by much less than in most Canadian cities). As a result, in 2023 typical homes in Edmonton cost about half as much (again, relative to the local median after-tax family income) as in mid-sized cities such as Windsor and Kelowna—and roughly one-third as much as in Toronto and Vancouver.

To be clear, much of Calgary and Edmonton’s improved rank in affordability is due to other cities becoming less and less affordable. Indeed, mortgage payments (as a share of local after-tax median income) also increased since 2014 in both Calgary and Edmonton.

But the relative success of Alberta’s two largest cities shows what’s possible when you prioritize homebuilding. Their approach—lower municipal fees, faster permit approvals and fewer building restrictions—has made it easier to build homes and helped contain costs for homebuyers. In fact, homebuilding has been accelerating in Calgary and Edmonton, in contrast to a sharp contraction in Vancouver and Toronto. That’s a boon to Albertans who’ve been spared the worst excesses of the national housing crisis. It’s also a demographic and economic boost for the province as residents from across Canada move to Alberta to take advantage of the housing market—in stark contrast to the experience of British Columbia and Ontario, which are hemorrhaging residents.

Alberta’s big cities have shown that when governments let homebuilders build, families benefit. To keep that advantage, policymakers in Calgary and Edmonton must stay the course.

Alberta

Danielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

From LifeSiteNews

The Alberta premier has denounced Skate Canada as ‘disgraceful’ for refusing to host events in the province because of a ban on ‘transgender’ men in women’s sports.

Alberta Premier Danielle Smith has demanded an apology after Skate Canada refused to continue holding events in Alberta.

In a December 16 post on X, Smith denounced Skate Canada’s recent decision to stop holding competitions in Alberta due to a provincial law keeping gender-confused men from competing in women’s sports.

“Women and girls have the right to play competitive sports in a safe and fair environment against other biological females,” Smith declared. “This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.”

Women and girls have the right to play competitive sports in a safe and fair environment against other biological females.

This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.

Skate Canada‘s refusal to hold events in… pic.twitter.com/n4vbkTx6B0

— Danielle Smith (@ABDanielleSmith) December 16, 2025

“Skate Canada‘s refusal to hold events in Alberta because we choose to protect women and girls in sport is disgraceful,” she declared.

“We expect they will apologize and adjust their policies once they realize they are not only compromising the fairness and safety of their athletes, but are also offside with the international community, including the International Olympic Committee, which is moving in the same direction as Alberta,” Smith continued.

Earlier this week, Skate Canada announced their decision in a statement to CBC News, saying, “Following a careful assessment of Alberta’s Fairness and Safety in Sport Act, Skate Canada has determined that we are unable to host events in the province while maintaining our national standards for safe and inclusive sport.”

Under Alberta’s Fairness and Safety in Sport Act, passed last December, biological men who claim to be women are prevented from competing in women’s sports.

Notably, Skate Canada’s statement failed to address safety and fairness concerns for women who are forced to compete against stronger, and sometimes violent, male competitors who claim to be women.

Under their 2023 policy, Skate Canada states “skaters in domestic events sanctioned by Skate Canada who identify as trans are able to participate in the gender category in which they identify.”

While Skate Canada maintains that gender-confused men should compete against women, the International Olympic Committee is reportedly moving to ban gender-confused men from women’s Olympic sports.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely that males have a considerable innate advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Alberta2 days ago

Alberta2 days agoDanielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

-

International1 day ago

International1 day agoTOTAL AND COMPLETE BLOCKADE: Trump cuts off Venezuela’s oil lifeline

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

COVID-191 day ago

COVID-191 day agoSenator Demands Docs After ‘Blockbuster’ FDA Memo Links Child Deaths To COVID Vaccine

-

Business18 hours ago

Business18 hours agoCanada Hits the Brakes on Population

-

COVID-191 day ago

COVID-191 day agoChina Retaliates Against Missouri With $50 Billion Lawsuit In Escalating Covid Battle

-

Energy2 days ago

Energy2 days agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

International2 days ago

International2 days agoBondi Beach Shows Why Self-Defense Is a Vital Right