Business

BlackRock’s woke capitalist vision is failing: here’s why

Larry Fink, New York Times DealBook 2022. Thos Robinson/Getty Images for The New York Times

From LifeSiteNews

By Frank Wright

Corbett shows how public outrage at the unelected political power of asset managers has led to an investor backlash, with politicians and legislators taking steps against the “forcing of behaviors” which BlackRock CEO Larry Fink once trumpeted as his mission

The always engaging James Corbett has produced some of the most informative guides to the power of BlackRock – who together with second-placed Vanguard Group own a combined 15 trillion U.S. dollars of assets under management.

In this report I relate how Corbett argues for a fightback against BlackRock and the asset management giants like them, who use their power to shape the world regardless of public consent. His views are more than corroborated by the news which followed the release of his video.

Corbett’s September 21 presentation, “How to Defeat BlackRock,” followed up by his excellent, “How BlackRock Conquered the World,” begins with some very encouraging news about the fortunes of the global investment giants – and what can be done to stop them. Happily, this process is already underway.

Corbett shows how public outrage at the unelected political power of asset managers has led to an investor backlash, with politicians and legislators taking steps against the “forcing of behaviors” which BlackRock CEO Larry Fink once trumpeted as his mission.

According to Corbett, and a growing number of other sources, this pressure looks likely to force asset management giants like BlackRock out of the behavior business altogether.

READ: How Vanguard and BlackRock took control of the global economy

A faltering global agenda

The first piece of good news is that the brand of ESG (environmental, social and governance) is so toxic that not even BlackRock’s CEO wants to use it any more.

BlackRock, under the leadership of Larry Fink, has used its immense wealth for years to compel companies to adopt the ESG agenda, becoming the driving force of “woke” capitalism. Yet leveraging financial power to force social and political change in this way has led to a backlash – from the general public, from lawmakers – and from the financial sector itself.

Last December, the North Carolina State Treasurer Dale R. Folwell called for Fink’s resignation, threatening to withdraw over $14 billion in state funds from the investment firm. As The Daily Mail reported, Folwell said:

Fink is in ‘pursuit of a political agenda… A focus on ESG is not a focus on returns and potentially could force us to violate our own fiduciary duty.’

Six months later, in June 2023, Fink said he was “ashamed” of ESG which he said had become “politically weaponized.”

Though his company, BlackRock, has continued to rate businesses on the same criteria, it has removed almost every mention of the term from its communications.

Speaking in Aspen, Colorado, Fink admitted that the decision of Florida Governor Ron DeSantis to withdraw $2 billion in state assets managed by BlackRock had hurt the company. The ESG agenda advanced by BlackRock is so beleaguered, even its former champion will not speak its name.

The power of public opinion

What this shows, as Corbett argues, is a further piece of good news: that public opinion still matters. It is public knowledge of the unelected political meddling of BlackRock and others which has led to outrage – and to action.

As a result of extensive coverage – mainly from independent media – of the nefarious influence of his company, Larry Fink has faced sustained criticism for over a year. This in turn has led to the kind of legal and financial consequences which have made people like Fink think again.

READ: How Larry Fink uses ESG and AI to control the world’s money

This also shows why so much money is invested in propaganda, censorship and “narrative control.” Governments and corporations are afraid of a well-informed public, because such a public is very likely to demand they are held to account.

The case of BlackRock not only shows that what is in your mind can indeed matter, but also that the goliaths of globalism do not always win.

This is one reason for the ongoing information war, and the growing censorship-industrial complex. An informed citizenry has the power to hold the powerful to account. Taken together, public outrage can also move markets – and the money men who watch them.

I investigated some of the claims Corbett made about the financial world’s mounting unease with the involvement of BlackRock, Vanguard and other firms in pushing unelected political and social change. I found more cause for celebration than even Corbett himself would admit at the time.

Passive investments, legal actions

In further good news, mounting legal troubles have accompanied the practice of companies like BlackRock, Vanguard and State Street to leverage their enormous asset piles into social and political compliance engineering.

According to a June 2023 report from RIAbiz, an online journal for registered investment advisers (RIAs), BlackRock and Vanguard’s “fooling around” with ESG targets has left them exposed to prosecution.

The business of managing many assets is supposed to be “passive” – a legal term which means that companies such as BlackRock are prohibited from “exercising control” of the companies whose funds they manage.

Federal exemptions had been granted to these asset management giants, but their habit of forcing behaviors on issues such as carbon “net zero” and “diversity” has placed their capacity to do business in jeopardy.

In May of this year, BlackRock and Vanguard saw a legal challenge emerge, and one which not only deters investors, but may also lead to their being broken up.

As Oisin Breen reported on June 1:

Seventeen AGs moved on May 10 against BlackRock on the grounds that its climate-based activism and its pro-ethical, governance and social (ESG) stance make it an active investor, in breach of a FERC antitrust agreement.

The Federal Energy Regulatory Commission (FERC) is involved due to BlackRock’s – and Vanguard’s – holdings in domestic energy utilities. Breen continues:

Separately, 13 AGs filed a motion to block Vanguard from renewing its FERC exemption. They represent mostly energy-producing states like Texas, as do the 17 now pressing to have BlackRock’s exemption revoked.

Though Breen concluded that both firms had “won a reprieve” from immediate legal censure, the message appears to have been received.

Three months later, Fortune magazine reported:

Finance giants BlackRock and Vanguard – once ESG’s biggest proponents – seem to be reversing course.

Hitting the bottom line

The global business publication noted the legal complications of mixing finance with social, environmental and governance policies, saying:

It appears these strategic shifts are being driven by a combination of public backlash and a focus on their bottom lines.

Then, on October 23, leading U.S. insurance brokerage WTW reported that BlackRock, Vanguard and State Street had all seen significant drops in their total amounts of assets under management (AUM). BlackRock’s alone fell from over 10 trillion dollars to just over 8 trillion.

By October 31, Fortune returned with the verdict that BlackRock, Vanguard and State Street had all “turned against environment and social proposals… in a clear sign of backlash.”

Their report noted a “precipitous” fall in the support of all three asset giants’ commitment to these agendas – with BlackRock’s funding of “ESG” measures falling by over 30 percent from 2021.

Real world consequences

This is the delayed result of a reality which BlackRock themselves acknowledged – and one which drove much of the public disapproval – that the ESG agenda was an economic and social wrecking ball.

Remarkably, BlackRock itself admitted that its promotion of ESG, in the aggressive pursuit of net zero and diversity policies, had actually contributed to a severe economic downturn.

In its “2023 Outlook,” the asset giant said these initiatives had been a major factor in ending the decades-long period of prosperity in the West known as the Great Moderation.

READ: The End of Prosperity? How BlackRock manipulates the West’s economic downturn

Buycotts – not boycotts

In his video Corbett is frank about the limitations of individual consumer power. You cannot “access BlackRock directly,” as it is a management firm. You can, of course, withdraw support from the companies in which it and its fellow behemoths Vanguard and State Street have holdings.

Yet Corbett moves from boycotts of individual corporations to the intriguing concept of “buycotts.” What he means by this is “taking your money from the corporations and using it to build things you want to see.”

How realistic is this solution? Already, businesses are emerging to capitalize on growing public discontent with what is done with their money – without their consent or approval.

Changing our behaviors – for good

The investment platform Reverberate, for example, allows users to “Rate companies highly (over 2.5 stars) if they make your life better, or lower if they make your life worse.”

What is more, user feedback from the public will determine which shares it buys:

Our publicly-traded investment fund buys shares of companies whose average ratings are high and/or rising, and sells shares of those whose average ratings are low and/or falling.

On their website, Reverberate says:

This is our way of trying to align capital allocation with the interests of the general public, as estimated by us in a relatively unbiased, wide-reaching way.

The decline of the asset managers’ ESG agenda is a happy corrective to the damaging belief that nothing can be done about anything.

It shows how well-informed public opinion can lead to genuine change, and with some of Corbett’s insights, how we can move from complaint to constructive action in making a better world.

You can see Corbett’s entertaining case for countering the woke asset management giants here.

Business

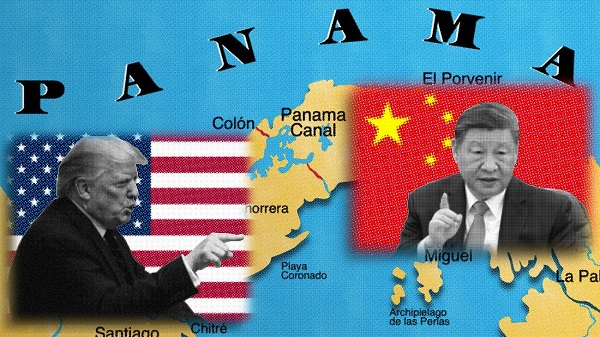

Trump demands free passage for American ships through Panama, Suez

MxM News

MxM News

Quick Hit:

President Donald Trump is pushing for U.S. ships to transit the Panama and Suez canals without paying tolls, arguing the waterways would not exist without America.

Key Details:

-

In a Saturday Truth Social post, Trump said, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

-

Trump directed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the issue, signaling a potential new diplomatic initiative with Panama and Egypt.

-

The Panama Canal generated about $3.3 billion in toll revenue in fiscal 2023, while the Suez Canal posted a record $9.4 billion. U.S. vessels account for roughly 70% of Panama Canal traffic, according to government figures.

Diving Deeper:

President Donald Trump is pressing for American ships to receive free passage through two of the world’s most critical shipping lanes—the Panama and Suez canals—a move he argues would recognize the United States’ historic role in making both waterways possible. In a post shared Saturday on Truth Social, Trump wrote, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

— Rapid Response 47 (@RapidResponse47) April 26, 2025

Trump added that he has instructed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the situation. His comments, first reported by FactSet, come as U.S. companies face rising shipping costs, with tolls for major vessels ranging from $200,000 to over $500,000 per Panama Canal crossing, based on canal authority schedules.

The Suez Canal, operated by Egypt, reportedly saw record revenues of $9.4 billion in 2023, largely driven by American and European shipping amid ongoing Red Sea instability. After a surge in attacks by Houthi militants on commercial ships earlier this year, Trump authorized a sustained military campaign targeting missile and drone sites in northern Yemen. The Pentagon said the strikes were part of an effort to “permanently restore freedom of navigation” for global shipping near the Suez Canal.

Trump has framed the military operations as part of a broader strategy to counter Iranian-backed destabilization efforts across the Middle East.

Meanwhile, in Central America, Trump’s administration is working to counter Chinese influence near the Panama Canal. On April 9th, Defense Secretary Pete Hegseth announced an expanded partnership with Panama to bolster canal security, including a memorandum of understanding allowing U.S. warships and support vessels to move “first and free” through the canal. “The Panama Canal is key terrain that must be secured by Panama, with America, and not China,” Hegseth emphasized during a press conference in Panama City.

American commercial shipping has long depended on the canal, which reduces the shipping route between the U.S. East Coast and Asia by nearly 8,000 miles. About 40% of all U.S. container traffic uses the Panama Canal annually, according to the U.S. Maritime Administration.

The United States originally constructed and controlled the Panama Canal following a monumental effort championed by President Theodore Roosevelt in the early 20th century. After backing Panama’s independence from Colombia in 1903, the U.S. secured the rights to build and operate the canal, which opened in 1914. Although U.S. control ended in 1999 under the Torrijos-Carter Treaties, the canal remains vital to U.S. trade.

2025 Federal Election

Columnist warns Carney Liberals will consider a home equity tax on primary residences

From LifeSiteNews

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Winnipeg Sun Columnist Kevin Klein is sounding the alarm there is substantial evidence the Carney Liberal Party is considering implementing a home equity tax on Canadians’ primary residences as a potential huge source of funds to bring down the massive national debt their spending created.

Klein wrote in his April 23 column and stated in his accompanying video presentation:

The Canada Mortgage and Housing Corporation (CMHC) — a federal Crown corporation — has investigated the possibility of a home equity tax on more than one occasion, using taxpayer dollars to fund that research. This was not backroom speculation. It was real, documented work.

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Kershaw, by the way, believes homeowners are “lottery winners” who didn’t earn their wealth but lucked into it. That’s the ideology being advanced to the highest levels of government.

It didn’t stop there. These proposals were presented directly to federal cabinet ministers. That’s on record, and most of those same ministers are now part of Mark Carney’s team as he positions himself as the Liberals’ next leader.

Watch below Klein’s 7-minute, impassionate warning to Canadians about this looming major new tax should the Liberals win Monday’s election.

Klein further adds:

The total home equity held by Canadians is over $4.7 trillion. It’s the largest pool of private wealth in the country. For millions of Canadians — especially baby boomers — it’s the only retirement fund they have. They don’t have big pensions. They have a paid-off house and a hope that it will carry them through their later years. Yet, that’s what Ottawa has quietly been circling.

The Canadian Taxpayer’s Federation has researched this issue and published a report on the alarming amount of new taxation a homeowner equity tax could cost Canadians who sell their homes that have increased in value over the years they have lived in it. It is a shocker!

A Google search on the question, “what is a home equity tax?” returns the response:

A home equity tax, simply put, it’s a proposed levy on the increased value of your home, specifically, on your principal residence. The idea is for Government to raise money by taxing wealth accumulation from rising property values.

The Canadian Taxpayers Federation has provided a Home Equity Tax Calculator Backgrounder to help Canadians understand what the impact of three different types of Home Equity Tax Calculators would have on home owners. The required tax payment resulting from all three is a shocker.

Keep in mind that World Economic Forum policies intend to eventually eliminate all private home ownership and have the state own and control not only all residences, but also eliminate car ownership, and control when and where you may live and travel.

Carney, Trudeau and several other members of the Liberal government in key positions are heavily connected to the WEF.

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoNine Dead After SUV Plows Into Vancouver Festival Crowd, Raising Election-Eve Concerns Over Public Safety

-

2025 Federal Election15 hours ago

2025 Federal Election15 hours agoMark Carney: Our Number-One Alberta Separatist

-

Opinion1 day ago

Opinion1 day agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

International2 days ago

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

C2C Journal1 day ago

C2C Journal1 day ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

International18 hours ago

International18 hours agoJeffrey Epstein accuser Virginia Giuffre reportedly dies by suicide

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s