From The Center Square

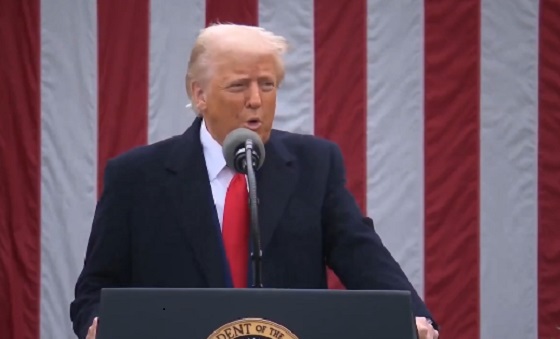

President Donald Trump signed four executive orders Tuesday promoting the deregulation and expansion of the “beautiful, clean coal” industry in the U.S.

The first order White House Staff Secretary Will Scharf said might be “one of the most significant executive orders” the president has issued so far.

“This directs all departments and agencies of the federal government to end all discriminatory policies against the coal industry. This ends the leasing moratorium that prevents new coal projects on federal land, and it’s going to accelerate all permitting and funding for new coal projects,” Scharf said.

The other executive orders attempt to prevent some Biden-era policies from going into effect that would have caused the shuttering of dozens of American coal plants; support policies promoting the continued incorporation of coal and fossil-fuel forms of energy into the grid; and direct the Department of Justice to investigate state policies that may illegally or unconstitutionally “[discriminate] against coal” and “secure sources of energy.”

The White House hosted a large group of coal miners, members of Congress, administration officials and others Tuesday afternoon to commemorate the “Unleashing American Energy” signing event.

“This is a very important day to me because we’re bringing back an industry that was abandoned despite the fact that it was just about the best – certainly the best in terms of power, real power,” Trump said.

Trump said he was “honored” to be signing the orders in defense of the coal industry and that the administration was “ending Joe Biden’s war on beautiful, clean coal once and for all.”

Trump also said his administration was working on something unique that would guarantee the coal industry would not be upended by changes in administrations, based on an idea he had “about 15 minutes” before the event.

“We’re going to give a guarantee that… if somebody comes in, they can’t change it at a whim. They’re gonna have to go through hell to close you up,” he said to the coal miners.

Under the new administration, the department of the interior has approved the expansion of the Spring Creek Mine in Montana, and Trump promised there would be more coal ventures in Alabama, North Dakota, Utah, Wyoming and other states.

“I think we’re gonna look back with great pride at what we’ve done today – not just in putting people to work but at really reawakening our country,” Trump said.