Business

BC voters ditching climate crisis for promise to unlock natural resource development

From Energy Now

The LNG Canada facility under construction in Kitimat, British Columbia

Climate Goals Face B.C. Election Backlash in Home of Greenpeace – B.C. Conservatives Have Upended Race With Focus on Unlocking Natural Resource Development

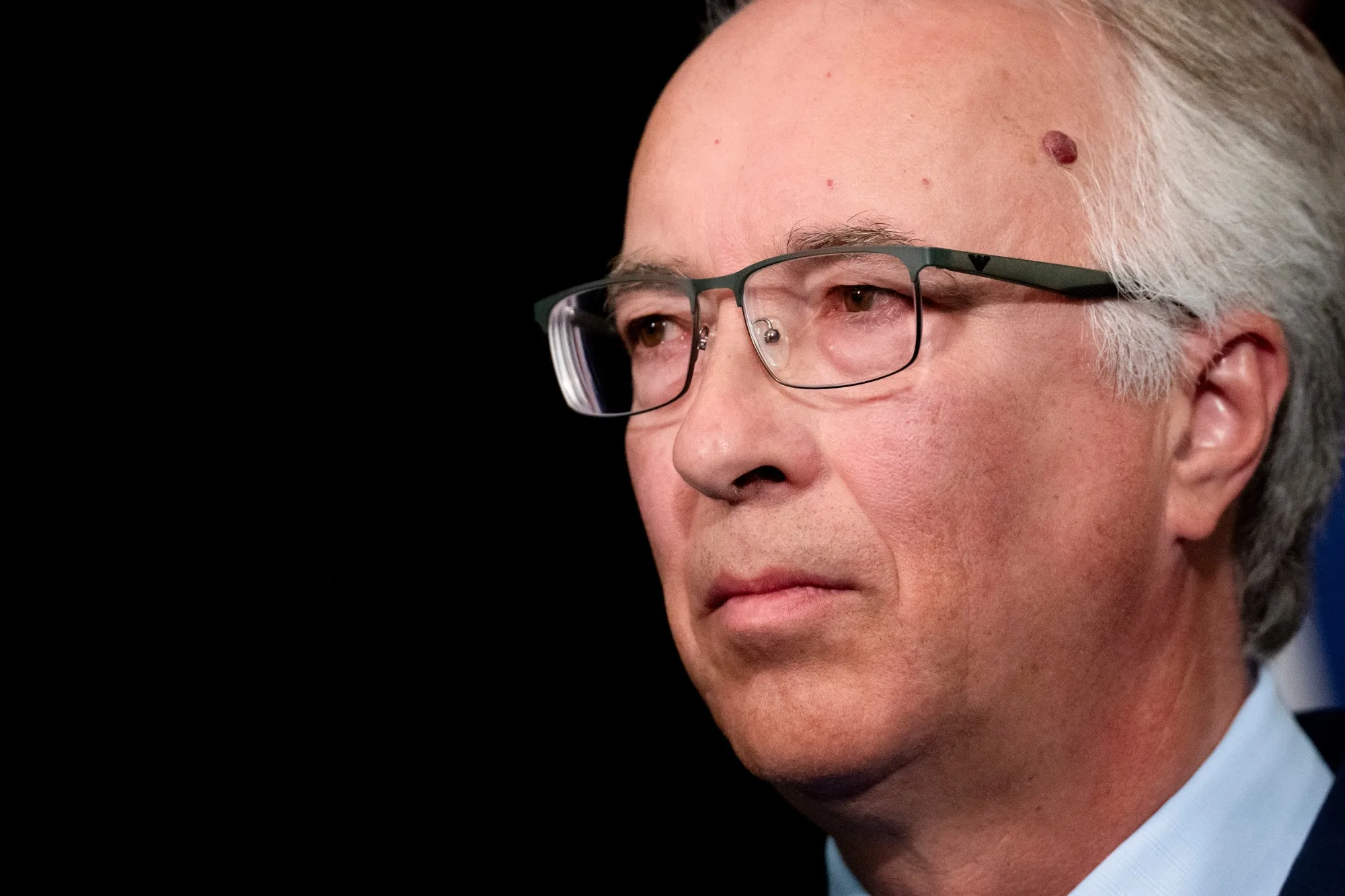

An unlikely political upstart in Canada’s third-largest province, expelled from his previous party for climate science skepticism, is within striking distance of winning power with promises to ditch environmental targets and unleash natural-resources development.

The surge in support for John Rustad’s Conservative Party of British Columbia ahead of the Oct. 19 election may have been helped by the popularity of the unaffiliated federal Conservatives. Victory would add to the roster of right-leaning premiers at odds with Prime Minister Justin Trudeau’s Liberal government in Ottawa.

A Conservative government in BC might mark a bigger shift than anywhere else in the country. The province is famous for environmentalism — Vancouver is the birthplace of Greenpeace and home to Canada’s most famous climate activist, David Suzuki. David Eby, the current premier, unsuccessfully opposed the expansion of the Trans Mountain oil pipeline, and back in 2008 the province brought in one of North America’s first carbon taxes.

Although polls favor Eby’s left-leaning New Democratic Party, it’s close, and a spread between pollsters suggests the result remains unpredictable.

The public has endured inflation and strained local services, slower growth in an economy dragged by higher interest rates and lower exports, and a government that’s gone from surplus to a record C$9 billion ($6.5 billion) deficit. British Columbia, once rated AAA by S&P Global Ratings, has suffered three credit rating downgrades in three years.

Conservatives Have Surged in BC Polls

British Columbia’s Conservatives vault official opposition in election surprise

The ruling NDP — whose origins lie in labor unions — is parrying criticism of its own mixed seven-year record in office. It’s running on blunting the cost of living with subsidies, tying the minimum wage to inflation, taxing home speculation, blocking Airbnb Inc.-style short-term rentals and using hydrocarbon revenues for a “clean economy transition fund.”

Rustad’s rise is also a stunning tale of revenge. The longtime representative of Nechako Lakes — a district 600 miles north of Vancouver in BC’s deep interior — was kicked out of the BC Liberal Party in 2022 on his birthday after sharing a social media post questioning carbon dioxide’s effect on the climate. He took over the BC Conservative Party, then a marginal force in provincial politics. Before long it had leapfrogged his old party in the polls.

Acrimonious talks to merge the two groups failed, and by August the previously formidable Liberals — which had rebranded as BC United — gave up, withdrawing from the election in an effort to unite voters against the NDP.

Unlocking Natural Resources

In an interview with Bloomberg, Rustad said he won’t cut social, health or education spending — a majority of the budget. He’s also promising tax cuts and plans to deepen the deficit to more than C$10 billion in his first year.

His plan to balance BC’s budget over eight years is based on an optimistic 5.4% average GDP growth rate to 2030 — more than double the average rate of the past five years — fueled by axing CleanBC, the NDP plan to cut BC’s emissions 40% by 2030. Rustad said that would save as much as C$2.5 billion in government spending, then bring in billions in extra revenue by unlocking industrial projects.

Foremost among them is LNG Canada, a new liquefied natural gas project in the remote north that the federal government said may be worth C$40 billion — possibly the largest private investment in the country’s history. There’s a plan to double its size, but it’s proving tricky to power with BC’s zero-emission hydroelectricity instead of fossil fuels, because it would need a new transmission line, with one previous cost estimate at C$3 billion.

Not a problem if looser rules let them burn gas.

“In British Columbia, we could stop everything we do, and by next year the increases from China and India will swamp anything that we’ve done,” Rustad told Bloomberg. “So my perspective is we need to make sure we’re looking after people. And so for a changing climate, we need to be able to adapt to it.”

When he appeared on climate-skeptic Canadian influencer Jordan Peterson’s podcast, Rustad said: “How is it that we’ve convinced carbon-based beings that carbon is a problem?”

Rustad also talked up billions in extra revenue from streamlining mine permits — one of BC’s oldest industries and more prominent in the remoter parts of the province he hails from.

Asked about BC’s rural vote, Rustad says: “There’s no question, the NDP completely ignored it.”

Rustad also wants to ditch BC’s carbon tax to cut costs for businesses and consumers. That’s also the top rallying cry for federal Conservatives, who are trying to force a “carbon tax election” to topple Trudeau. Provincial carbon taxes are federally back-stopped, so to banish the tax Rustad would need the Conservative Party of Canada to take power.

“The top-of-mind issues that people are frustrated about are inflation and the cost of living, housing and health care,” Kathryn Harrison, a political science professor at the University of British Columbia, said in an interview. “And what we’ve seen is that the federal Conservative Leader Pierre Poilievre has been able to connect those public concerns with the carbon tax. It’s given them something that they can focus their frustrations on.”

Even the climate-conscious NDP has pivoted away from defending the carbon tax to pledging they would repeal it for consumers — but unlike the Conservatives, they would shift the burden to corporate “polluters.”

In his plan to speed up business, Rustad has also taken issue with BC’s Declaration on the Rights of Indigenous Peoples Act because it causes “friction”. It requires government to seek Indigenous people’s “free, prior and informed consent” to implement measures that may affect BC’s more than 200 Indigenous communities.

Rustad’s Conservatives include Indigenous candidates, and he talks about supporting economic reconciliation — the material, financial side of redressing Canada’s colonial injustices. But some First Nations leaders have called his platform “dangerous” for pitting British Columbians against each other.

Relentless Controversies

Rustad’s biggest weak point may be the controversial things said my members of his team, leading to relentless stories since they’ve been thrust into the spotlight.

Despite his dry, phlegmatic style, the same goes for Rustad himself. He’s said he regretted getting the “so-called” Covid-19 vaccine, and a clip showed him seeming to go along with an activist’s concept of “Nuremberg 2.0” — trials for officials who oversaw pandemic health measures. Rustad apologized and said he “misunderstood” the question.

Rival party staffers gave out BC Conservative-branded tinfoil hats after a candidate’s shared posts described 5G wireless signals as a weapon, according to local media. She was ousted, but another candidate who claimed vaccines can cause a type of AIDS remains part of the caucus.

Another apologized last week for posts including one in 2015 calling Palestinians “inbred walking, talking, breathing time bombs.”

In communities like Metro Vancouver, some of the most diverse in North America, that kind of thing may jeopardize Rustad’s path to power.

But Rustad is also being cheered on by what Harrison described as an “accidental collection of voters who share frustration with the cost of living, the cost of housing, emergency room closures” — which could span from suburban families who judge the economy isn’t working for them to BC’s wealthiest, including billionaire Lululemon Athletica Inc founder Chip Wilson.

If Rustad pulls it off, his unorthodox strategy to turn one of Canada’s progressive strongholds conservative will reverberate with those fighting federal politics in the nation’s capital 3,000 miles away.

2025 Federal Election

As PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work

From Conservative Party Communications

In the first 100 days, a new Conservative government will pass 3 laws:

1. Affordability For a Change Act—cutting spending, income tax, sales tax off homes

2. Safety For a Change Act to lock up criminals

3. Bring Home Jobs Act—that repeals C-69, sets up 6 month permit turnarounds for new projects

No summer holiday til they pass!

Conservative Leader Pierre Poilievre announced today that as Prime Minister he will cancel the summer holiday for Ottawa politicians and introduce three pieces of legislation to make life affordable, stop crime, and unleash our economy to bring back powerful paycheques. Because change can’t wait.

A new Conservative government will kickstart the plan to undo the damage of the Lost Liberal Decade and restore the promise of Canada with a comprehensive legislative agenda to reverse the worst Trudeau laws and cut the cost of living, crack down on crime, and unleash the Canadian economy with ‘100 Days of Change.’ Parliament will not rise until all three bills are law and Canadians get the change they voted for.

“After three Liberal terms, Canadians want change now,” said Poilievre. “My plan for ‘100 Days of Change’ will deliver that change. A new Conservative government will immediately get to work, and we will not stop until we have delivered lower costs, safer streets, and bigger paycheques.”

The ’100 Days of Change’ will include three pieces of legislation:

The Affordability–For a Change Act

Will lower food prices, build more homes, and bring back affordability for Canadians by:

- Cutting income taxes by 15%. The average worker will keep an extra $900 each year, while dual-income families will keep $1,800 more annually.

- Axing the federal sales tax on new homes up to $1.3 million. Combined with a plan to incentivize cities to lower development charges, this will save homebuyers $100,000 on new homes.

- Axing the federal sales tax on new Canadian cars to protect auto workers’ jobs and save Canadians money, and challenge provinces to do the same.

- Axing the carbon tax in full. Repeal the entire carbon tax law, including the federal industrial carbon tax backstop, to restore our industrial base and take back control of our economy from the Americans.

- Scrapping Liberal fuel regulations and electricity taxes to lower the cost of heating, gas, and fuel.

- Letting working seniors earn up to $34,000 tax-free.

- Axing the escalator tax on alcohol and reset the excise duty rates to those in effect before the escalator was passed.

- Scrapping the plastics ban and ending the planned food packaging tax on fresh produce that will drive up grocery costs by up to 30%.

We will also:

- Identify 15% of federal buildings and lands to sell for housing in Canadian cities.

The Safe Streets–For a Change Act

Will end the Liberal violent crime wave by:

- Repealing all the Liberal laws that caused the violent crime wave, including catch-and-release Bill C-75, which lets rampant criminals go free within hours of their arrest.

- Introducing a “three strikes, you’re out” rule. After three serious offences, offenders will face mandatory minimum 10-year prison sentences with no bail, parole, house arrest, or probation.

- Imposing life sentences for fentanyl trafficking, illegal gun trafficking, and human trafficking. For too long, radical Liberals have let crime spiral out of control—Canada will no longer be a haven for criminals.

- Stopping auto theft, extortion, fraud, and arson with new minimum penalties, no house arrest, and a new more serious offence for organized theft.

- Give police the power to end tent cities.

- Bringing in tougher penalties and a new law to crack down on Intimate Partner Violence.

- Restoring consecutive sentences for multiple murderers, so the worst mass murderers are never let back on our streets.

The Bring Home Jobs–For a Change Act

This Act will be rocket fuel for our economy. We will unleash Canada’s vast resource wealth, bring back investment, and create powerful paycheques for workers so we can stand on our own feet and stand up to Trump from a position of strength, by:

- Repealing the Liberal ‘No Development Law’, C-69 and Bill C-48, lifting the cap on Canadian energy to get major projects built, unlock our resources, and start selling Canadian energy to the world again.

- Bringing in the Canada First Reinvestment Tax Cut to reward Canadians who reinvest their earnings back into our country, unlocking billions for home building, manufacturing, and tools, training and technology to boost productivity for Canadian workers.

- Creating a One-Stop-Shop to safely and rapidly approve resource projects, with one simple application and one environmental review within one year.

Poilievre will also:

- Call President Trump to end the damaging and unjustified tariffs and accelerate negotiations to replace CUSMA with a new deal on trade and security. We need certainty—not chaos, but Conservatives will never compromise on our sovereignty and security.

- Get Phase 2 of LNG Canada built to double the project’s natural gas production.

- Accelerate at least nine other projects currently snarled in Liberal red tape to get workers working and Canada building again.

“After the Lost Liberal Decade of rising costs and crime and a falling economy under America’s thumb, we cannot afford a fourth Liberal term,” said Poilievre. “We need real change, and that is what Conservatives will bring in the first 100 days of a new government. A new Conservative government will get to work on Day 1 and we won’t stop until we have delivered the change we promised, the change Canadians deserve, the change Canadians voted for.”

Automotive

Canadians’ Interest in Buying an EV Falls for Third Year in a Row

From Energy Now

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index

Fewer Canadians are considering buying an electric vehicle, marking the third year in a row interest has dropped despite lower EV prices, a survey from AutoTrader shows.

Forty-two per cent of survey respondents say they’re considering an EV as their next vehicle, down from 46 per cent last year. In 2022, 68 per cent said they would consider buying an EV.

Meanwhile, 29 per cent of respondents say they would exclusively consider buying an EV — a significant drop from 40 per cent last year.

The report, which surveyed 1,801 people on the AutoTrader website, shows drivers are concerned about reduced government incentives, a lack of infrastructure and long-term costs despite falling prices.

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index.

The survey, conducted between Feb. 13 and March 12, shows 68 per cent of non-EV owners say government incentives could influence their decision, while a little over half say incentives increase their confidence in buying an EV.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTrump Has Driven Canadians Crazy. This Is How Crazy.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe Anhui Convergence: Chinese United Front Network Surfaces in Australian and Canadian Elections

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

Automotive23 hours ago

Automotive23 hours agoHyundai moves SUV production to U.S.

-

Entertainment1 day ago

Entertainment1 day agoPedro Pascal launches attack on J.K. Rowling over biological sex views

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney Liberals pledge to follow ‘gender-based goals analysis’ in all government policy