Business

Bank of Canada missteps helped fuel today’s inflation

From the Fraser Institute

By Herbert Grubel and John Greenwood

The correlation between the quantity of money and inflation shown is not perfect but strong enough to justify the conclusion that Canada would have avoided the inflation starting in early 2021 had the Bank not increased the money supply so dramatically during the first year of the pandemic.

According to Statistics Canada’s latest consumer price index report, in February the annual inflation rate fell to 2.8 per cent, raising the prospect of interest rate cuts by the Bank of Canada sometime this year. “Inflation is caused by too many dollars chasing too few goods” used to be the traditional diagnosis of the cause of inflation, prompting central banks to fight it by slowing the growth of the money supply. This approach is based on what is known as the “monetarist” theory of inflation, which suggests that supply shocks such as those associated with the COVID pandemic do not cause inflation but only a temporary increase in the price level, which is reversed once the cause of the shock ends—unless the money supply has increased.

In recent decades, central banks have fought inflation using interest rates instead of monetary growth. This switch followed the postwar success of Keynesian theory, which blames inflation on excess aggregate demand, which higher interest rates are supposed to curtail.

Targeting interest rates can work if central banks simultaneously pay attention to money growth, but too often they’ve failed to do so. Equally, targeting the money supply can create inflation-fighting interest rates. However, interest rate targeting in practice has a serious shortcoming. Aggregate spending is influenced by real interest rates while central banks can set only nominal rates and real rates are beyond their control because they cannot change inflation by any direct policy.

This important problem arises because, for example, a nominal interest rate of 6 per cent turns into a real rate of minus 2 per cent if the expected inflation is 8 per cent. At that rate, investors can borrow $1 million at 6 per cent, use the money to buy real estate, sell it a year later after it has appreciated at the expected 8 per cent, repay the $1 million and take home a capital gain of $20,000. In other words, the high expected inflation rate incentivizes consumers and businesses to borrow more, which results in faster money growth and risks even higher inflation.

The expected rate of inflation exists only in peoples’ minds and is determined by many factors. The Bank of Canada collects as much information as it can, drawing on the results of public surveys, the information contained in the prices of so-called Real Return Yields, and sophisticated economic models produced by the Bank’s economists. But these efforts do not result in reliable information, as evidenced by the uncertain and speculative nature of economic forecasts found in its economic updates.

The problems associated with not knowing the real rate of interest have persuaded some economists, called “monetarists,” to urge central banks to target the money supply including famed economist Milton Friedman whose monumental study of the history of U.S. money supply and inflation inspired many including David Laidler, emeritus professor at the University of Western Ontario, and Britain’s John Greenwood who maintains a large database he used to create the accompanying graph.

This graph shows Canada’s annual rate of inflation (measured on the left axis) and the annual rate of growth of the money supply (M3) (measured on the right axis) for the years 2014 to 2024 using data published by the Bank of Canada and Statistics Canada, which require little manipulation. The annual percentage change in the money supply is averaged over 12-months, as is done widely to smooth data that fluctuate much over short periods; and the resultant time series is shifted forward 18 months, to achieve the best fit between changes in money growth and changes in inflation in the monetarist tradition, which has found the lag to have been variable historically between 12 and 18 months. (Thus, the peak smoothed money supply growth rate of more than 13 per cent occurred in February/March 2021, but is shown as occurring in August/September 2022, some 18 months later and close to the peak of inflation in June 2022.)

The correlation between the quantity of money and inflation shown is not perfect but strong enough to justify the conclusion that Canada would have avoided the inflation starting in early 2021 had the Bank not increased the money supply so dramatically during the first year of the pandemic.

In 1994, John Crow, then-governor of the Bank of Canada, presented to a parliamentary finance committee a report on the economic outlook. One of the authors of this op-ed (Grubel) was at this meeting. In response to his question, Crow said that the Bank’s econometric forecasting model did not include data on the money supply but that he always looked over his shoulders to ensure it does not get out of line. If his successors had followed his practice, perhaps Canada’s present inflation would have been avoided.

But then it would not be possible to test the usefulness of the model, which draws on money supply growth data over the last 18 months to predict that inflation should fall to 2 per cent near year-end 2024 or early 2025.

If the prediction is realized, however, Canadians should not expect the lower inflation rate to result in lower costs of living. That would happen only if the Bank made the money growth rate negative, something history suggests is unlikely because it usually resulted in recessions. How much better it would have been if the inflation genie had never been allowed out of the lamp.

Authors:

Business

Trump considers $5K bonus for moms to increase birthrate

MxM News

MxM News

Quick Hit:

President Trump voiced support Tuesday for a $5,000 cash bonus for new mothers, as his administration weighs policies to counter the country’s declining birthrate. The idea is part of a broader push to promote family growth and revive the American family structure.

Key Details:

- Trump said a reported “baby bonus” plan “sounds like a good idea to me” during an Oval Office interview.

- Proposals under consideration include a $5,000 birth bonus, prioritizing Fulbright scholarships for parents, and fertility education programs.

- U.S. birthrates hit a 44-year low in 2023, with fewer than 3.6 million babies born.

Diving Deeper:

President Donald Trump signaled his support Tuesday for offering financial incentives to new mothers, including a potential $5,000 cash bonus for each child born, as part of an effort to reverse America’s falling birthrate. “Sounds like a good idea to me,” Trump told The New York Post in response to reports his administration is exploring such measures.

The discussions highlight growing concern among Trump administration officials and allies about the long-term implications of declining fertility and family formation in the United States. According to the report, administration aides have been consulting with pro-family advocates and policy experts to brainstorm solutions aimed at encouraging larger families.

Among the proposals: a $5,000 direct payment to new mothers, allocating 30% of all Fulbright scholarships to married applicants or those with children, and launching federally supported fertility education programs for women. One such program would educate women on their ovulation cycles to help them better understand their reproductive health and increase their chances of conceiving.

The concern stems from sharp demographic shifts. The number of babies born in the U.S. fell to just under 3.6 million in 2023—down 76,000 from 2022 and the lowest figure since 1979. The average American family now has fewer than two children, a dramatic drop from the once-common “2.5 children” norm.

Though the birthrate briefly rose from 2021 to 2022, that bump appears to have been temporary. Additionally, the age of motherhood is trending older, with fewer teens and young women having children, while more women in their 30s and 40s are giving birth.

White House Press Secretary Karoline Leavitt underscored the administration’s commitment to families, saying, “The President wants America to be a country where all children can safely grow up and achieve the American dream.” Leavitt, herself a mother, added, “I am proud to work for a president who is taking significant action to leave a better country for the next generation.”

Business

Trump: China’s tariffs to “come down substantially” after negotiations with Xi

MxM News

MxM News

Quick Hit:

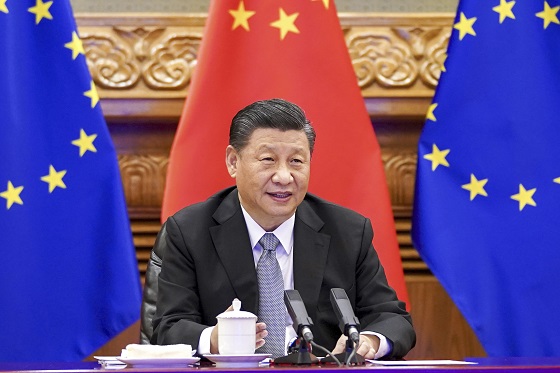

President Trump said the 145% tariff rate on Chinese imports will drop significantly once a deal is struck with Chinese President Xi Jinping, expressing confidence that a new agreement is on the horizon.

Key Details:

- Trump said the current 145% tariff rate on China “won’t be anywhere near that high” after negotiations.

- He pointed to his relationship with Xi Jinping as a reason for optimism.

- The White House said it is preparing the groundwork for a deal, and Treasury officials expect a “de-escalation” of the trade war.

Diving Deeper:

President Donald Trump on Tuesday told reporters that the steep tariff rate currently imposed on Chinese imports will come down substantially after his administration finalizes a new trade deal with Chinese President Xi Jinping. While the current level stands at 145%, Trump made clear that number was temporary and would be adjusted following talks with Beijing.

“145 percent is very high. It won’t be that high, it’s not going to be that high … it won’t be anywhere near that high,” Trump said from the Oval Office, signaling a shift once a bilateral agreement is reached. “It will come down substantially, but it won’t be zero.”

The tariff, which Trump previously described as “reciprocal,” was maintained on China even after he delayed similar penalties on other trading partners. Those were cut to 10% and paused for 90 days to allow room for further negotiation.

“We’re going to be very nice. They’re going to be very nice, and we’ll see what happens. But ultimately, they have to make a deal because otherwise they’re not going to be able to deal in the United States,” Trump said, reinforcing his view that the U.S. holds the leverage.

Trump’s remarks come as markets remain wary of ongoing trade tensions, though the White House signaled progress, saying it is “setting the stage for a deal with China.” The president cited his personal rapport with Xi Jinping as a key factor in his confidence that an agreement can be reached.

“China was taking us for a ride, and it’s not going to happen,” Trump said. “They would make billions a year off us and build up their military with our money. That’s over. But we’ll still be good to China, and I think we’ll work together.”

Treasury Secretary Scott Bessent also said Tuesday that he expects a cooling of trade hostilities between the two nations, according to several reports from a private meeting with investors.

As the 90-day pause on other reciprocal tariffs nears its end, Trump emphasized that his team is prepared to finalize deals quickly. “We’ve been in talks with many, many world leaders,” he said, expressing confidence that talks will “go pretty quickly.”

White House Press Secretary Karoline Leavitt added that the administration has received 18 formal proposals from other countries engaged in trade negotiations, another sign that momentum is building behind Trump’s broader push to restructure global trade in favor of American workers and businesses.

(Li Xueren/Xinhua via AP)

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

International8 hours ago

International8 hours agoPope Francis’ body on display at the Vatican until Friday

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoCanada’s pipeline builders ready to get to work

-

Business19 hours ago

Business19 hours agoHudson’s Bay Bid Raises Red Flags Over Foreign Influence