Business

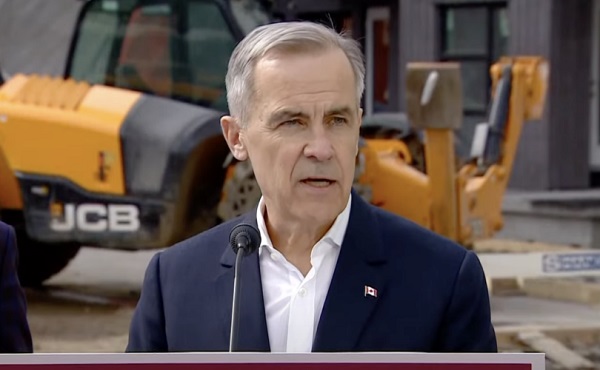

Bank of Canada admits eliminating carbon tax could reduce inflation by 16%

From LifeSiteNews

Bank of Canada Governor Tiff Macklem testified that cutting the tax would create a one-time reduction of inflation by 0.6%, which is 16% of Canada’s total inflation rate

Bank of Canada Governor Tiff Macklem admitted that Trudeau’s carbon tax is responsible for 16% of Canada’s current inflation rate.

On October 30, Macklem told the House of Commons finance committee that eliminating the carbon tax would reduce inflation by 0.6%, which is 16% of Canada’s total inflation rate.

“That would create a one-time drop in inflation of 0.6 percentage points,” Macklem told Conservative MP Philip Lawrence, who had questioned the tax’s effect on the economy.

Currently, Canada’s inflation rate is at 3.8% which means that a decrease of 0.6% by eliminating the tax would result in a 16% decrease in the overall inflation.

Lawrence further questioned if eliminating the tax would ease the economic situation, considering it would mean a “sizable drop in inflation.” However, Macklem explained that cutting the tax would only affect inflation for one year.

“It would be helpful if monetary and fiscal policy was rowing in the same direction,” he added, explaining that government spending has made keeping interest rates steady a difficult task.

“Any standard economic textbook will tell you if you cut government spending that will tend to slow growth, raise the unemployment rate, and reduce inflation,” Macklem explained.

In September, Macklem admitted that food costs are of particular concern as “[m]eat’s up six percent, bread’s up 13 percent, coffee’s up eight percent, baby food’s up nine percent. If you look at food overall it is up nine percent.”

Macklem revealed at the time that food prices are rising significantly faster than the headline inflation rate – the overall inflation rate in the country – as staple food items are increasing at a rate of 10 percent to 18 percent year-over-year.

To combat this inflation, the Bank of Canada has raised interest rates to 5 percent, the highest benchmark rate in 22 years. Another increase is expected in October.

In addition to deficit spending, others have pointed to the Trudeau government’s ongoing carbon taxes and energy regulations as one of the reasons for the sharp increases in the cost of living.

According to a March report, Trudeau’s carbon tax is costing Canadians hundreds of dollars annually as government rebates remain insufficient to compensate for the increased fuel prices.

Last week, Prime Minster Justin Trudeau suspended his carbon tax on home heating oil, amid rising costs of living and his decreasing popularity across multiple polls.

Under the new regulations, home heating oil is exempted from the carbon tax, while rural residents will receive a 10 percent increase in the carbon tax rebate payments. The increase is set to climb to 20 percent beginning next year.

In March, the Parliamentary Budget Officer calculated the total carbon tax costs for fuel in 2023 minus government rebates. The steepest increase is for Albertans, who will pay an average of $710 extra per household. Following Alberta is Ontario with a $478 increase.

Prince Edward Island households will pay an extra $465, Nova Scotia $431, Saskatchewan $410, Manitoba $386, and Newfoundland and Labrador $347.

The increased costs are only expected to rise as a recent report revealed that a carbon tax of more than $350 per tonne is needed to reach Trudeau’s net-zero goals by 2050.

Currently, Canadians living in provinces under the federal carbon pricing scheme pay $65 per tonne, but the Trudeau government has a goal of $170 per tonne by 2030.

Business

Labor Department cancels “America Last” spending spree spanning five continents

MxM News

MxM News

Quick Hit:

The U.S. Department of Labor has scrapped nearly $600 million in foreign aid grants, including $10 million aimed at promoting “gender equity in the Mexican workplace.”

Key Details:

-

Labor Secretary Lori Chavez-DeRemer and Deputy Secretary Keith Sonderling were credited with delivering $237 million in savings through the latest round of canceled programs.

-

Among the defunded initiatives: $12.2 million for “worker empowerment” efforts in South America, $6.25 million to improve labor rights in Central American agriculture, and $5 million to promote women’s workplace participation in West Africa.

-

The Department of Government Efficiency described the cuts as necessary to realign U.S. labor policy with national interests and applauded the elimination of all 69 international grants managed by the Bureau of International Labor Affairs.

Diving Deeper:

The U.S. Department of Labor on Wednesday canceled $577 million in foreign aid grants, including a controversial $10 million program aimed at promoting “gender equity in the Mexican workplace,” according to documents obtained by The Washington Post. The sweeping decision to terminate all 69 active international labor grants comes as part of a larger restructuring effort led by John Clark, a senior DOL official appointed during the Trump administration.

Clark directed the department’s Bureau of International Labor Affairs (ILAB) to shut down its entire grant portfolio, citing a “lack of alignment with agency priorities and national interest.” The memo explaining the cancellations was first reported by The Washington Post and highlights a broader shift in federal labor policy toward domestic-focused initiatives.

Among the eliminated grants were high-dollar projects that had drawn criticism from watchdog groups for years. These included $12.2 million designated for “worker empowerment in South America,” $6.25 million targeting labor conditions in Honduras, Guatemala, and El Salvador, and $5 million to elevate women’s workplace participation in West Africa. Other defunded programs involved $4.3 million to support foreign migrant workers in Malaysia, $3 million to improve social protections for internal migrants in Bangladesh, and $3 million to promote “safe and inclusive work environments” in Lesotho.

The Department of Government Efficiency, also involved in the review, labeled the grants as “America Last” initiatives, and pointed to the lack of measurable outcomes and limited benefits to American workers. The agency commended the leadership of Labor Secretary Lori Chavez-DeRemer and Deputy Secretary Keith Sonderling for securing $237 million in savings during this round alone.

The cuts mark the second major cost-saving move under Chavez-DeRemer’s leadership in as many weeks. Just days earlier, she canceled an additional $33 million in funding, including a $1.5 million grant focused on increasing transparency in Uzbekistan’s cotton sector. Chavez-DeRemer, a former Republican congresswoman from Oregon, was confirmed as Labor Secretary on March 11th by a bipartisan Senate vote of 67-32.

Business

Elon Musk, DOGE officials reveal ‘astonishing’ government waste, fraud in viral interview

From LifeSiteNews

Elon Musk said that ‘the sheer amount of waste and fraud’ in federal agencies, is ‘astonishing’ and that DOGE is cutting ‘$4 billion a day’ in misused taxpayer funds.

In a remarkable Fox News interview, Department of Government Efficiency (DOGE) founder Elon Musk and top officials of the DOGE team offered stunning, often infuriating, insights into how the federal government functions.

The interview, which has garnered well over 10 million online views on X in less than 24 hours, provided one extreme example after another of government mismanagement, excess, waste, and fraud while simultaneously promising a future where the D.C. Leviathan is tamed and restored to its proper, efficient role.

The new Deputy Director of the Office of Management and Budget (OMB), former U.S. House Rep. Dan Bishop, averred that the DOGE A-Team interview was the “most amazing and significant half-hour in TV history.”

Musk was joined by DOGE team members Steve Davis, Joe Gebbia, Aram Moghaddassi, Brad Smith, Anthony Armstrong, Tom Krause, and Tyler Hassen – all successful businessmen and entrepreneurs in their own rights – to describe the widespread systemic weaknesses and failures at the Internal Revenue Service (IRS), the National Institutes of Health (NIH), the Department of Health and Human Services (HHS), the Social Security Administration (SSA), and more.

Fox host Bret Baier described the group as “Silicon Valley colliding with government.”

“This is a revolution. And I think it might be the biggest revolution in government since the original revolution,” said Musk during the discussion.

“But at the end of the day, America’s going to be in much better shape,” he promised.

“America will be solvent. The critical programs that people depend upon will work, and it’s going to be a fantastic future.”

My interview with the @elonmusk and the @DOGE team tonight on #SpecialReport pic.twitter.com/KKpxEPtu1Z

— Bret Baier (@BretBaier) March 27, 2025

“The government is not efficient, and there’s a lot of waste and fraud. So we feel confident that a 15% reduction can be done without affecting any of the critical government services,” began Musk, founder and CEO of both Tesla and SpaceX and owner of X.

Musk said that the most stunning thing he’s discovered during the early phases of DOGE is “the sheer amount of waste and fraud in government. It is astonishing. It’s mind-blowing.”

Musk cited the example of a simple 10-question National Park online survey for which the government was charged nearly $1 billion and which in the end served no purpose.

“I think we will accomplish most of the work required to reduce the deficit by a trillion dollars within [130 days],” he predicted. “Our goal is to reduce the waste and fraud by $4 billion a day, every day, seven days a week. And so far, we are succeeding.”

Billionaire Airbnb co-founder Joe Gebbia, is working to digitize the retirement process for government employees, which is currently stuck using 1950s technology, housed in a Pennsylvania cave.

“It’s an injustice to civil servants who are subjected to these processes that are older than the age of half the people watching the show tonight,” said Gebbia. “We really believe that the government can have an Apple store-like experience, beautifully designed, great user experience, modern systems.”

“The retirement process is all by paper, literally, with people carrying paper and manila envelopes into this gigantic mine,” added Musk, limiting the number of federal employees who can retire to no more than 8,000 per month.

Gebbia expects to have the antiquated system updated and overhauled in a matter of months.

“The two improvements that we’re trying to make to Social Security are helping people that legitimately get benefits protect them from fraud that they experience every day on a routine basis and also make the experience better,” said DOGE software engineer Aram Moghaddassi.

He offered an amazing statistic: “When you want to change your (direct deposit) bank account, you can call Social Security. We learned 40% of the phone calls that they get are from fraudsters” who are attempting to commandeer retired seniors’ benefit payments.

“What we’re doing will help their benefits,” assured Musk. “As a result of the work of DOGE, legitimate recipients of social security will receive more money, not less money.”

“There are over 15 million people that are over the age of 120 that are marked as alive in the Social Security system,” said Steve Davis, who has previously worked alongside Musk at SpaceX, the Boring Company, and X

He explained that despite this being discovered by hardworking personnel at the SSA back in 2008, nothing was done. As a result, 15-20 million social security numbers that were clearly fraudulent were just floating around, susceptible to being used for “bad intentions.”

Health care entrepreneur Brad Smith, who has taken charge of auditing HHS and NIH, also cited stunning, troubling statistics displaying the extreme inefficiencies of the nation’s top federal health organizations.

Smith said that at NIH, “Today they have 27 different centers” created by Congress over the years and there are “700 different IT systems,” each using their own IT software.

“They have 27 different CIOs (Chief Information Officers),” added Smith, “so when you think about making great medical discoveries, you have to connect the data.”

Those discoveries are likely severely hampered by NIH’s communications disconnect.

Anthony Armstrong, a Morgan Stanley banker now working for DOGE at the Office of Personnel Management (OPM) talked about “duplicative functions” and “overstaffing” at government agencies. He said that money is “sloshing out the door.”

As an example, he cited the IRS, which has 1,400 employees whose only job is to provision laptops and cell phones to IRS workers.

“As an ex-CFO of a big public tech company, really what we’re doing is, we’re applying public company standards to the federal government, and it is alarming how the financial operations and financial management is set up today,” said Tom Krause, CEO of Cloud Software Group.

He explained that there is virtually no accountability or verification protections when it comes to the Treasury Department disbursing funds to various government agencies.

A 94-year-old grandmother is no longer “going to be robbed by forces like she’s getting robbed today, and the solvency of the federal government will ensure that she continues to receive those social security checks,” added Musk.

“The reason we’re doing this is because if we don’t do it, America is going to go insolvent and go bankrupt, and nobody’s going to get anything,” said Musk.

Tyler Hassen, a former oil executive working at the Interior Department for DOGE alleged that there was no departmental oversight at the Interior Department “whatsoever” under the Biden administration.

Steve Davis talked about the out-of-control issuance and use of federal credit cards.

“There are in the federal government around 4.6 million credit cards for around 2.3 to 2.4 million employees. This doesn’t make sense. So, one of the things all of the teams have worked on is we’ve worked for the agencies and said, ‘Do you need all of these credit cards? Are they being used? Can you tell us physically where they are?’” recounted Davis.

“Clearly there should not be more credit cards than there are people,” interjected Musk.

Musk later described how the Small Business Administration (SBA) has given out $300 million in loans to people “under the age of 11.” An additional $300 million in loans has been handed out to people “over the age of 120.”

Musk said that these government loans are clearly “fraudulent.”

“Terrible things are being done,” he exclaimed. “We’re stopping it.”

-

Business1 day ago

Business1 day agoFeds Spent Roughly $1 Billion To Conduct Survey That Could’ve Been Done For $10,000, Musk Says

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Alberta17 hours ago

Alberta17 hours agoPhoto radar to be restricted to School, Playground, and Construction Zones as Alberta ends photo radar era

-

Health19 hours ago

Health19 hours agoRFK Jr. Drops Stunning Vaccine Announcement

-

Alberta11 hours ago

Alberta11 hours agoProvince announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

-

Business8 hours ago

Business8 hours agoElon Musk, DOGE officials reveal ‘astonishing’ government waste, fraud in viral interview

-

Energy2 days ago

Energy2 days agoEnergy, climate, and economics — A smarter path for Canada

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFool Me Once: The Cost of Carney–Trudeau Tax Games