Business

Bad Research Still Costs Good Money

I have my opinions about which academic research is worth funding with public money and which isn’t. I also understand if you couldn’t care less about what I think. But I expect we’ll all share similar feelings about research that’s actually been retracted by the academic journals where it was published.

Globally, millions of academic papers are published each year. Many – perhaps most – were funded by universities, charitable organizations, or governments. It’s estimated that hundreds of thousands of those papers contain serious errors, irreproducible results, or straight-up plagiarized or false content.

Not only are those papers useless, but they clog up the system and slow down the real business of science. Keeping up with the serious literature coming out in your field is hard enough, but when genuine breakthroughs are buried under thick layers of trash, there’s no hope.

The Audit is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Society doesn’t need those papers and taxpayers shouldn’t have to pay for their creation. The trick, however, is figuring out how to identify likely trash before we approve a grant proposal.

I just discovered a fantastic tool that can help. The good people behind the Retraction Watch site also provide a large dataset currently containing full descriptions and metadata for more than 60,000 retracted papers. The records include publication authors, titles, and subjects; reasons for the retractions; and any institutions with which the papers were associated.

Using that information, I can tell you that 798 of those 60,000 papers have an obvious Canadian connection. Around half of those papers were retracted in the last five years – so the dataset is still timely.

There’s no single Canadian institution that’s responsible for a disproportionate number of clunkers. The data contains papers associated with 168 Canadian university faculties and 400 hospital departments. University of Toronto overall has 26 references, University of British Columbia has 18, and McMaster and University of Ottawa both have nine. Research associated with various departments of Toronto’s Sick Children’s Hospital combined account for 27 retractions.

To be sure, just because your paper shows up on the list doesn’t mean you’ve done anything wrong. For example, while 20 of the retractions were from the Journal of Obstetrics and Gynaecology Canada, those were all pulled because they were out of date. That’s perfectly reasonable.

I focused on Canadian retractions identified by designations like Falsification (38 papers), Plagiarism (41), Results Not Reproducible (21), and Unreliable (130). It’s worth noting that some of those papers could have been flagged for more than one issue.

Of the 798 Canadian retractions, 218 were flagged for issues of serious concern. Here are the subjects that have been the heaviest targets for concerns about quality:

You many have noticed that the total of those counts comes to far more than 218. That’s because many papers touch on multiple topics.

For those of you keeping track at home, there were 1,263 individual authors involved in those 218 questionable papers. None of them had more than five such papers and only a very small handful showed up in four or five cases. Although there would likely be value in looking a bit more closely at their publishing histories.

This is just about as deep as I’m going to dig into this data right now. But the papers I’ve identified are probably just the tip of the iceberg when it comes to lousy (and expensive) research. So we’ve got an interest in identifying potentially problematic disciplines or institutions. And, thanks to Retraction Watch, we now have the tools.

Kyle Briggs over at CanInnovate has been thinking and writing about these issues for years. He suggests that stemming the crippling flow of bad research will require a serious realigning of the incentives that currently power the academic world.

That, according to Briggs, is most likely to happen by forcing funding agencies to enforce open data requirements – and that includes providing access to the programming code used by the original researchers. It’ll also be critical to truly open up access to research to allow meaningful crowd-sourced review.

Those would be excellent first steps.

The Audit is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

Business

Tariff-driven increase of U.S. manufacturing investment would face dearth of workers

From the Fraser Institute

Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

Donald Trump has long been convinced that the United States must revitalize its manufacturing sector, having—unwisely, in his view—allowed other countries to sell all manner of foreign-produced manufactured goods in the giant American market. As president, he’s moved quickly to shift the U.S. away from its previous embrace of liberal trade and open markets as cornerstones of its approach to international economic policy —wielding tariffs as his key policy instrument. Since taking office barely two months ago, President Trump has implemented a series of tariff hikes aimed at China and foreign producers of steel and aluminum—important categories of traded manufactured goods—and threatened to impose steep tariffs on most U.S. imports from Canada, Mexico and the European Union. In addition, he’s pledged to levy separate tariffs on imports of automobiles, semi-conductors, lumber, and pharmaceuticals, among other manufactured goods.

In the third week of March, the White House issued a flurry of news releases touting the administration’s commitment to “position the U.S. as a global superpower in manufacturing” and listing substantial new investments planned by multinational enterprises involved in manufacturing. Some of these appear to contemplate relocating manufacturing production in other jurisdictions to the U.S., while others promise new “greenfield” investments in a variety of manufacturing industries.

President Trump’s intense focus on manufacturing is shared by a large slice of America’s political class, spanning both of the main political parties. Yet American manufacturing has hardly withered away in the last few decades. The value of U.S. manufacturing “output” has continued to climb, reaching almost $3 trillion last year (equal to 10 per cent of total GDP). The U.S. still accounts for 15 per cent of global manufacturing production, measured in value-added terms. In fact, among the 10 largest manufacturing countries, it ranks second in manufacturing value-added on a per-capita basis. True, China has become the world’s biggest manufacturing country, representing about 30 per cent of global output. And the heavy reliance of Western economies on China in some segments of manufacturing does give rise to legitimate national security concerns. But the bulk of international trade in manufactured products does not involve goods or technologies that are particularly critical to national security, even if President Trump claims otherwise. Moreover, in the case of the U.S., a majority of two-way trade in manufacturing still takes place with other advanced Western economies (and Mexico).

In the U.S. political arena, much of the debate over manufacturing centres on jobs. And there’s no doubt that employment in the sector has fallen markedly over time, particularly from the early 1990s to the mid-2010s (see table below). Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

| U.S. Manufacturing Employment, Select Years (000)* | |

|---|---|

| 1990 | 17,395 |

| 2005 | 14,189 |

| 2010 | 14,444 |

| 2015 | 12,333 |

| 2022 | 12,889 |

| 2024 | 12,760 |

| *December for each year shown. Source: U.S. Bureau of Labor Statistics | |

Economists who have studied the trend conclude that the main factors behind the decline of manufacturing employment include continuous automation, significant gains in productivity across much of the sector, and shifts in aggregate demand and consumption away from goods and toward services. Trade policy has also played a part, notably China’s entry into the World Trade Organization (WTO) in 2001 and the subsequent dramatic expansion of its role in global manufacturing supply chains.

Contrary to what President Trump suggests, manufacturing’s shrinking place in the overall economy is not a uniquely American phenomenon. As Harvard economist Robert Lawrence recently observed “the employment share of manufacturing is declining in mature economies regardless of their overall industrial policy approaches. The trend is apparent both in economies that have adopted free-market policies… and in those with interventionist policies… All of the evidence points to deep and powerful forces that drive the long-term decline in manufacturing’s share of jobs and GDP as countries become richer.”

This brings us back to the president’s seeming determination to rapidly ramp up manufacturing investment and production as a core element of his “America First” program. An important issue overlooked by the administration is where to find the workers to staff a resurgent U.S. manufacturing sector. For while manufacturing has become a notably “capital-intensive” part of the U.S. economy, workers are still needed. And today, it’s hard to see where they will be found. This is especially true given the Trump administration’s well-advertised skepticism about the benefits of immigration.

According to the U.S. Bureau of Labor Statistics, the current unemployment rate across America’s manufacturing industries collectively stands at a record low 2.9 per cent, well below the economy-wide rate of 4.5 per cent. In a recent survey by the National Association of Manufacturers, almost 70 per cent of American manufacturers cited the inability to attract and retain qualified employees as the number one barrier to business growth. A cursory look at the leading industry trade journals confirms that skill and talent shortages remain persistent in many parts of U.S. manufacturing—and that shortages are destined to get worse amid the expected significant jump in manufacturing investment being sought by the Trump administration.

As often seems to be the case with Trump’s stated policy objectives, the math surrounding his manufacturing agenda doesn’t add up. Manufacturing in America is in far better shape than the president acknowledges. And a tariff-driven avalanche of manufacturing investment—should one occur—will soon find the sector reeling from an unprecedented human resource crisis.

Jock Finlayson

Senior Fellow, Fraser Institut

Automotive

Trump warns U.S. automakers: Do not raise prices in response to tariffs

MxM News

MxM News

Quick Hit:

Former President Donald Trump warned automakers not to raise car prices in response to newly imposed tariffs, arguing that the move would ultimately benefit the industry by strengthening American manufacturing. However, automakers are signaling that price increases may be unavoidable.

Key Details:

- Trump told auto executives on a recent call that his administration would look unfavorably on price hikes due to tariffs.

- A 25% tariff on imported vehicles and parts is set to take effect on April 2, likely driving up costs for U.S. automakers.

- Industry analysts predict vehicle prices could rise 11% to 12% in response, despite Trump’s insistence that tariffs will benefit American manufacturing.

Diving Deeper:

In a conference call with leading automakers earlier this month, former President Donald Trump issued a stern warning: do not use his new tariffs as an excuse to raise car prices. While Trump presented the tariffs as a boon for American manufacturing, industry leaders remain unconvinced, arguing that the financial burden will inevitably lead to higher costs for consumers.

Trump’s administration is pressing ahead with a 25% tariff on all imported vehicles and parts, set to take effect on April 2. The move is aimed at reshaping trade dynamics in the auto industry, encouraging domestic manufacturing, and reversing what Trump calls the damaging effects of President Joe Biden’s electric vehicle mandates. Despite this, automakers say that rising costs on foreign parts—which many depend on—will leave them little choice but to pass expenses onto consumers.

“You’re going to see prices going down, but going to go down specifically because they’re going to buy what we’re doing, incentivizing companies to—and even countries—companies to come into America,” Trump stated at a recent event, reinforcing his stance that the tariffs will ultimately lower costs in the long run.

However, industry insiders are pushing back, warning that a rapid shift to domestic production is unrealistic. “Tariffs, at any level, cannot be offset or absorbed,” said Ray Scott, CEO of Lear, a major automotive parts supplier. His concern reflects broader anxieties within the industry, as automakers calculate the financial strain of the tariffs. Analysts at Morgan Stanley estimate that vehicle prices could increase between 11% and 12% in the coming months as the new tariffs take effect.

Automakers have been bracing for the fallout. Detroit’s major manufacturers and industry suppliers have voiced their concerns, emphasizing that transitioning supply chains and manufacturing operations back to the U.S. will take years. Meanwhile, auto retailers have stocked up on inventory, temporarily shielding consumers from price hikes. But once that supply runs low—likely by May—the full impact of the tariffs could hit.

Within the Trump administration, inflation remains a pressing concern, though Trump himself rarely discusses it publicly. His economic team is aware of the potential for tariffs to drive up costs, yet the administration’s stance remains firm: automakers must adapt without raising prices. It remains unclear, however, what actions Trump might take should automakers defy his warning.

The auto industry isn’t alone in its concerns. Executives across multiple sectors, from oil and gas to food manufacturing, have been lobbying against major tariffs, arguing that they will inevitably result in higher prices for American consumers. While Trump has largely dismissed these warnings, some analysts suggest that public dissatisfaction with rising costs played a key role in shaping the outcome of the 2024 election.

With the tariffs set to take effect in just weeks, automakers are left grappling with a difficult reality: absorb billions in new costs or risk the ire of a White House determined to remake America’s trade policies.

-

Business2 days ago

Business2 days agoFeds Spent Roughly $1 Billion To Conduct Survey That Could’ve Been Done For $10,000, Musk Says

-

Alberta1 day ago

Alberta1 day agoPhoto radar to be restricted to School, Playground, and Construction Zones as Alberta ends photo radar era

-

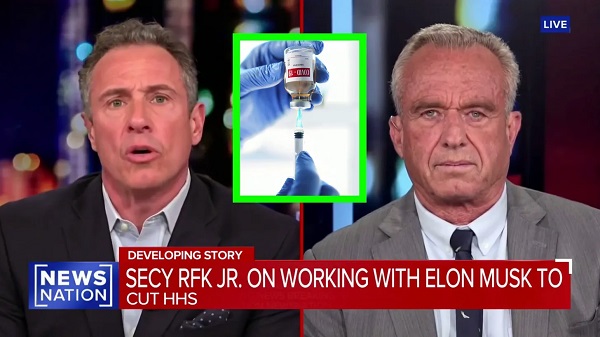

Health1 day ago

Health1 day agoRFK Jr. Drops Stunning Vaccine Announcement

-

Alberta21 hours ago

Alberta21 hours agoProvince announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoDonald Trump suggests Mark Carney will win Canadian election, touts ‘productive call’ with leader

-

Business18 hours ago

Business18 hours agoElon Musk, DOGE officials reveal ‘astonishing’ government waste, fraud in viral interview

-

Energy2 days ago

Energy2 days agoEnergy, climate, and economics — A smarter path for Canada

-

Business2 days ago

Business2 days agoTrump Reportedly Shuts Off Flow Of Taxpayer Dollars Into World Trade Organization

By

By