Fraser Institute

Australia’s universal health-care system outperforms Canada on key measures including wait times, costs less and includes large role for private hospitals

The Role of Private Hospitals in Australia’s Universal Health Care System

From the Fraser Institute

by Mackenzie Moir and Bacchus Barua

In the wake of the COVID-19 pandemic, provincial governments across Canada relied on private

clinics in order to deliver a limited number of publicly funded surgeries in a bid to clear unprecedented

surgical backlogs. Subsequently, surveys indicated that 78% of Canadians support allowing more

surgeries and tests performed in private clinics while 40% only support this policy to clear the

surgical backlog. While a majority of Canadians are either supportive (or at the very least curious)

about these arrangements, the use of private clinics continues to be controversial and raise questions

around their compatibility with the provision of universal care.

The reality is that private hospitals play a key role in delivering care to patients in other countries with universal health care. Canada is only one of 30 high-income countries with universal care and many of these countries involve the private-sector in their health-care systems to a wide extent while performing better than Canada.

Australia is one of these countries and routinely outperforms Canada on key indicators of health-care performance while spending at a similar or lower level. Like Canada, Australia ranked

in the top ten for health-care spending (as a percentage of GDP and per capita) in 2020. However, after adjusting for the age of the population, it outperforms Canada on 33 (of 36) measures of performance.

Importantly, Australia outperformed Canada on a number of key measures such as the availability of physicians, nurses, hospital beds, CT scanners, and MRI machines. Australia also outperformed

Canada on every indicator of timely access to care, including ease of access to after-hours care, same-day primary care appointments, and, crucially, timely access to elective surgical care and specialist appointments.

Australia’s universal system is also characterized by a deep integration between the public and private sectors in the financing and delivery of care. Universal health-insurance coverage is provided through its public system known as Medicare. However, Australia also has a large private health-care sector that also finances and delivers medical services. Around half of the Australian population (55.2% in 2021/22) benefit from private health-insurance coverage provided by 33 registered not-for-profit and for-profit private insurance companies.

Private hospitals (for profit and not for profit) made up nearly half (48.5%) of all Australian hospitals in 2016 and contain a third of all care beds. These hospitals are a major partner in the delivery of care in Australia. For example, in 2021/22 41% of all recorded episodes of hospital care occurred in private hospitals. While delivering a small minority of emergency care (8.2%), private hospitals delivered the majority of recorded elective care (58.6%) and 70.3% of elective admissions involving surgery.

Private hospitals primarily deliver care to fully funded public patients in two ways. The first is contracted

care, either through ad hoc inter-hospital contracts or formal programs. Fully publicly funded episodes of care occurring in private hospitals made up 6.4% of all care in private hospitals, while representing 2.6% of all recorded care. The second way is privately delivered care paid for through the Department of Veterans’ Affairs. A full 73.5% of care paid for by the Department of Veterans’ Affairs occurred in private hospitals.

It would be easy, however, to underestimate the significance of this public-private partnership by examining only the delivery of care that is fully publicly funded. Privately insured care is also partially subsidized by the government, at a rate of 75% of the public fee. Therefore, in order to understand the full extent of publicly funded or subsidized care in private hospitals, it is helpful to examine private hospital expenditures by the source of funds. In 2019/20, 32.8% of private hospital expenditures came from government sources, 18.2% of which came from private health-insurance rebates. This means that a full

third of private hospital expenditure comes from a range of public sources, including the federal government.

Overall, private hospitals are important partners in the delivery of care within the Australian universal healthcare system. The Australian system outranks Canada’s on a range of performance indicators, while spending less as a percentage of GDP. Further, the integration of private hospitals into the delivery of care, including public care, occurs while maintaining universal access for residents.

Authors:

More from this study

Business

Canada has fewer doctors, hospital beds, MRI machines—and longer wait times—than most other countries with universal health care

From the Fraser Institute

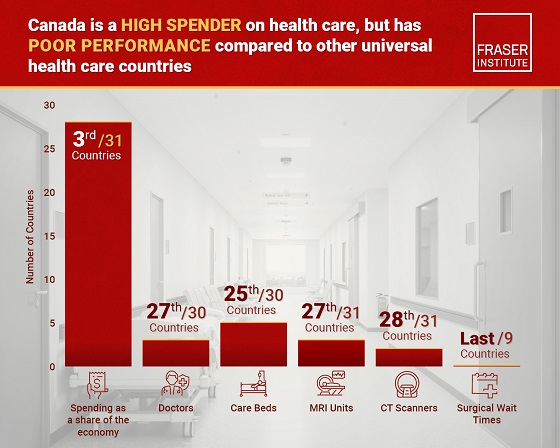

Despite a relatively high level of spending, Canada has significantly fewer doctors, hospital beds, MRI machines and CT scanners compared to other countries with universal health care, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“There’s a clear imbalance between the high cost of Canada’s health-care system and the actual care Canadians receive in return,” said Mackenzie Moir, senior policy

analyst at the Fraser Institute and author of Comparing Performance of Universal Health-Care Countries, 2025.

In 2023, the latest year of available comparable data, Canada spent more on health care (as a percentage of the economy/GDP, after adjusting for population age) than

most other high-income countries with universal health care (ranking 3rd out of 31 countries, which include the United Kingdom, Australia and the Netherlands).

And yet, Canada ranked 27th (of 30 countries) for the availability of doctors and 25th (of 30) for the availability of hospital beds.

In 2022, the latest year of diagnostic technology data, Canada ranked 27th (of 31 countries) for the availability of MRI machines and 28th (of 31) for CT scanners.

And in 2023, among the nine countries with universal health-care systems included in the Commonwealth Fund’s International Health Policy Survey, Canada ranked last for the percentage of patients able to make same- or next-day appointments when sick (22 per cent) and had the highest percentage of patients (58 per cent) who waited two months or more for non-emergency surgery. For comparison, the Netherlands had much higher rates of same- or next-day appointments (47 per cent) and much lower waits of two months or more for non-emergency surgery (20 per cent).

“To improve health care for Canadians, our policymakers should learn from other countries around the world with higher-performing universal health-care systems,”

said Nadeem Esmail, director of health policy at the Fraser Institute.

Comparing Performance of Universal Health Care Countries, 2025

- Of the 31 high-income universal health-care countries, Canada ranks among the highest spenders, but ranks poorly on both the availability of most resources and access to services.

- After adjustments for differences in the age of the population of these 31 countries, Canada ranked third highest for spending as a percentage of GDP in 2023 (the most recent year of comparable data).

- Across 13 indictors measured, the availability of medical resources and timely access to medical services in Canada was generally below that of the average OECD country.

- In 2023, Canada ranked 27th (of 30) for the relative availability of doctors and 25th (of 30) for hospital beds dedicated to physical care. In 2022, Canada ranked 27th (of 31) for the relative availability of Magnetic Resonance Im-aging (MRI) machines, and 28th (of 31) for CT scanners.

- Canada ranked last (or close to last) on three of four indicators of timeliness of care.

- Notably, among the nine countries for which comparable wait times measures are available, Canada ranked last for the percentage of patients reporting they were able to make a same- or next-day appointment when sick (22%).

- Canada also ranked eighth worst for the percentage of patients who waited more than one month to see a specialist (65%), and reported the highest percentage of patients (58%) who waited two months or more for non-emergency surgery.

- Clearly, there is an imbalance between what Canadians get in exchange for the money they spend on their health-care system.

Mackenzie Moir

Senior Policy Analyst, Fraser Institute

Alberta

Petition threatens independent school funding in Alberta

From the Fraser Institute

Recently, amid the backdrop of a teacher strike, an Alberta high school teacher began collecting signatures for a petition to end government funding of independent schools in the province. If she gets enough people to sign—10 per cent of the number of Albertans who voted in the last provincial election—Elections Alberta will consider launching a referendum about the issue.

In other words, the critical funding many Alberta families rely on for their children’s educational needs may be in jeopardy.

In Alberta, the provincial government partially funds independent schools and charter schools. The Alberta Teachers’ Association (ATA), whose members are currently on strike, opposes government funding of independent and charter schools.

But kids are not one-size-fits-all, and schools should reflect that reality, particularly in light of today’s increasing classroom complexity where different kids have different needs. Unlike government-run public schools, independent schools and charter schools have the flexibility to innovate and find creative ways to help students thrive.

And things aren’t going very well for all kids or teachers in government-run pubic school classrooms. According to the ATA, 93 per cent of teachers report encountering some form of aggression or violence at school, most often from students. Additionally, 85 per cent of unionized teachers face an increase in cognitive, social/emotional and behavioural issues in their classrooms. In 2020, one-quarter of students in Edmonton’s government-run public schools were just learning English, and immigration to Canada—and Alberta especially—has exploded since then. It’s not easy to teach a classroom of kids where a significant proportion do not speak English, many have learning disabilities or exceptional needs, and a few have severe behavioural problems.

Not surprisingly, demand for independent schools in Alberta is growing because many of these schools are designed for students with special needs, Autism, severe learning disabilities and ADHD. Some independent schools cater to students just learning English while others offer cultural focuses, expanded outdoor time, gifted learning and much more.

Which takes us back to the new petition—yet the latest attempt to defund independent schools in Alberta.

Wealthy families will always have school choice. But if the Alberta government wants low-income and middle-class kids to have the ability to access schools that fit them, too, it’s crucial to maintain—or better yet, increase—its support for independent and charter schools.

Consider a fictional Alberta family: the Millers. Their daughter, Lucy, is struggling at her local government-run public school. Her reading is below grade level and she’s being bullied. It’s affecting her self-esteem, her sleep and her overall wellbeing. The Millers pay their taxes. They don’t take vacations, they rent, and they haven’t upgraded their cars in many years. They can’t afford to pay full tuition for Lucy to attend an independent school that offers the approach to education she needs to succeed. However, because the Alberta government partially funds independent schools—which essentially means a portion of the Miller family’s tax dollars follow Lucy to the school of their choice—they’re able to afford the tuition.

The familiar refrain from opponents is that taxpayers shouldn’t pay for independent school tuition. But in fact, if you’re concerned about taxpayers, you should encourage school choice. If Lucy attends a government-run public school, taxpayers pay 100 per cent of her education costs. But if she attends an independent or charter school, taxpayers only pay a portion of the costs while her parents pay the rest. That’s why research shows that school choice saves tax dollars.

If you’re a parent with a child in a government-run public school in Alberta, you now must deal with another teacher strike. If you have a child in an independent or charter school, however, it’s business as usual. If Albertans are ever asked to vote on whether or not to end government funding for independent schools, they should remember that students are the most important stakeholder in education. And providing parents more choices in education is the solution, not the problem.

-

MAiD2 days ago

MAiD2 days agoDisabled Canadians increasingly under pressure to opt for euthanasia during routine doctor visits

-

Opinion2 days ago

Opinion2 days agoMAKICHUK: Why we seem to have lost our way in the wilderness

-

Agriculture7 hours ago

Agriculture7 hours agoFrom Underdog to Top Broodmare

-

Digital ID1 day ago

Digital ID1 day agoThousands protest UK government’s plans to introduce mandatory digital IDs

-

Business6 hours ago

Business6 hours ago$15B and No Guarantees? Stellantis Deal explained by former Conservative Shadow Minister of Innovation, Science and Technology

-

Alberta17 hours ago

Alberta17 hours agoAlberta’s licence plate vote is down to four

-

Bruce Dowbiggin17 hours ago

Bruce Dowbiggin17 hours agoIs The Latest Tiger Woods’ Injury Also A Death Knell For PGA Champions Golf?

-

Digital ID2 days ago

Digital ID2 days agoToronto airport requests approval of ‘digital IDs’ for domestic airport travel