CBDC Central Bank Digital Currency

Australians Abandon Physical Cash, Financial Freedom

From Heartland Daily News

Australians abandon physical cash for digital payments that are easy to use, monitor, and block.

The end of cash has been heralded for years—mostly by government officials eager to end the expense of minting coins and printing banknotes while pushing transactions to digital forms that can be tracked and taxed. The transformation has met varying degrees of acceptance or resistance from people around the globe. But Australians appear to be eagerly advancing down the road toward a cash-free world.

The Rattler is a weekly newsletter from J.D. Tuccille. If you care about government overreach and tangible threats to everyday liberty, this is for you.

Disappearing Banknotes and Coins

“Cash was once a staple in the economy, but it’s fast becoming a relic of the past,” according to an April report on Australia’s financial evolution from SBSNews. “Just a decade ago, more than half of transactions were cash. Now it’s just one in seven, and it’s happened at an alarming rate.”

Various forms of digital payments now account for the lion’s share of transactions, with a growing number of merchants now refusing coins and banknotes, and ATMs disappearing around the country. That means cash is increasingly difficult to find and use even for those who prefer physical money.

The transformation was turbocharged by COVID-19, as people moved away from any sort of contact. But usage of cash was already plunging, according to the Reserve Bank of Australia, from almost 70 percent of transactions in 2007 to less than 30 percent in 2019. “Cash payments accounted for 13 per cent of the number and 8 per cent of the value of all consumer payments in 2022,” the bank finds.

While Australian consumers and central bank bureaucrats embrace the shift, there are serious downsides to an all-digital economy.

“Digital payments have shortfalls, including their reliance on the internet—which can prove problematic in times of crisis,” cautions SBSNews. The report described the plight of people cut off from processing services by wildfires that severed communications; those with cash could still buy necessities.

Digital transactions also require people to have accounts in their names, which is a challenge for young people and immigrants. And budgeting can be easier with paper and coins than with abstract numbers.

Unmentioned in the piece are any concerns about lost independence when all transactions can be monitored and, potentially, blocked. But that’s a major concern elsewhere.

‘Printed Freedom’

“Printed freedom” is how German economist Lars Feld described physical money in 2015 while responding to a push in his country to abolish physical cash. He defended banknotes and coins on the grounds that people “should be entitled to an escape from all-out state control,” as Hardy Graupner of German broadcaster Deutsche Welle put it.

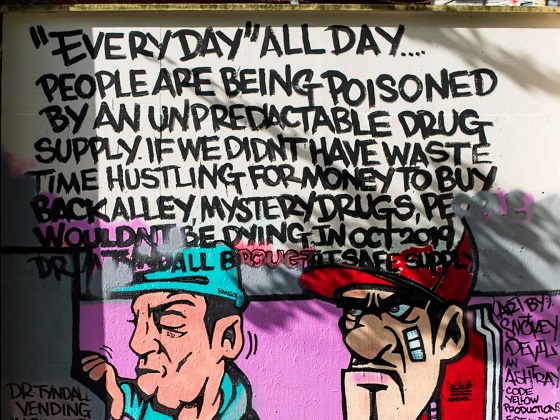

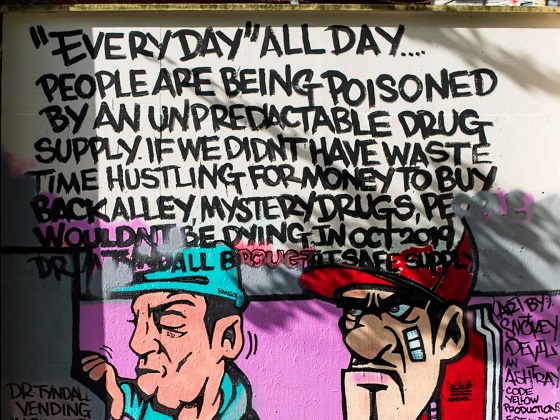

Such concerns came to a head in 2022 when the Canadian government cut off Freedom Convoy protesters’ access to their own bank accounts and blocked digital donations to their cause.

“It’s a Western version of China’s social credit system that does not altogether prohibit political dissent but makes it so costly that it becomes impractical to the ordinary citizen,” commented David Sacks, former COO of PayPal. He had already warned that electronic payment processors were working with governments to deny access to the financial system on ideological grounds.

Canada’s crackdown was dramatic, but it didn’t stand in isolation.

Digital Transactions and Targeted Industries

In 2022, American Banker reported that “a new code identifying credit card sales of guns and ammunition has been approved by the International Standards Organization, creating a potential path for card networks to help law enforcement agencies identify suspicious sales of guns and ammunition.”

Amidst concerns that banks would help government officials track gun owners, and several states banning the gun-specific merchant codes, the financial industry “paused” implementation.

The merchant code controversy was reminiscent of earlier government efforts, under programs including Operation Choke Point, to cut off businesses disliked by politicians from financial services.

“Operation Choke Point was created by the Justice Department to ‘choke out’ companies the Administration considers a ‘high risk’ or otherwise objectionable, despite the fact that they are legal businesses,” summarized a 2014 House Oversight Committee report. “The sheer breadth of industries affected – including firearms and ammunition sales, adult entertainment, check cashing, and payday lending – has generated significant concern with the objectives and scope of Operation Choke Point.”

Notably, physical money offers a workaround for businesses that government officials don’t like. To this day, marijuana is a largely cash industry for businesses legal at the state level but still illegal under federal law—a serious concern for heavily regulated financial institutions. For pot growers and vendors, cash may not always be ideal (it’s a target for thieves), but it offers the freedom to operate.

Use It or Lose It

That was the sort of concern that pushed Germany’s Lars Feld to describe physical money as “printed freedom.” It also inspired Swiss activists last year to urge their countrymen to vote “yes to a free and independent Swiss currency in the form of coins and banknotes.” Swiss officials rejected the initiative as insufficiently specific, but they also promised to incorporate protections for cash into the constitution.

Many Australians appear to feel otherwise, and they’re not alone. With demand plunging for cash, Denmark stopped printing and minting kroner in 2016 (private companies will be commissioned to produce more as needed).

“One of the reasons why it is no longer profitable to produce coins and banknotes in Denmark is that the Danes increasingly pay with either credit card or mobile phone,” BT reported at the time.

There is no denying that digital transactions are easy—sometimes too easy—requiring only a card or app, and not sufficient paper in your wallet. But despite the still largely unrealized promise of Bitcoin and other cyber currencies, most digital transactions leave records and require processing by third parties. Those intermediaries, under political pressure, can turn our own funds into tools of control. The more accustomed we become to digital payments, the more likely physical money and the freedom it offers will slip away.

“If you don’t use it, you’re going to lose it,” Steve Worthington of Swinburne University’s School of Business, Law, and Entrepreneurship told SBS News. “The less and less we’re able to access and use cash, the more likely it is that we will lose access to it the same way we have with paper cheques.”

It’s something to think about the next time you head for the store to make a purchase.

Business

President Trump Signs Executive Order Banning CBDCs

The executive order marks a decisive pivot in US digital asset policy.

|

|

Business

Bank of Canada admits ‘significant’ number of citizens would resist digital dollar

From LifeSiteNews

A significant number’ of Canadians are suspicious of government overreach and would resist any measures by the government or central bank to create digital forms of official money.

A Bank of Canada study has found that Canadians are very wary of a government-backed digital currency, concluding that “significant number” of citizens would resist the implementation of such a system.

The study, conducted by the Bank of Canada, found that a “significant number” of Canadians are suspicious of government overreach, and would resist any measures by the government or central bank to create digital forms of official money.

According to results from the BOC’s report titled The Consumer Value Proposition For A Hypothetical Digital Canadian Dollar, “cash remains an important method of payment” for Canadians and “[c]ertain groups may strongly resist a digital dollar if they conflate its launch with the end of cash issuance.”

The BOC noted that not only would a “significant number” of Canadians “reject” digital money, but that for some “mindset segments, their lack of interest in a hypothetical digital Canadian dollar was heavily influenced by perceptions of government overreach.”

As reported by LifeSiteNews in September, the BOC has already said that plans to create a digital “dollar,” also known as a central bank digital currency (CBDC), have been shelved.

The shelving came after the BOC had already forged ahead and filed a trademark for a digital currency, as LifeSiteNews previously reported.

Officials from Canada’s central bank said that a digital currency, or electronic “loonie,” will no longer be considered after years of investigating bringing one to market.

However, that does not mean the BOC is still not researching or exploring other options when it comes to digital money. As noted by researchers, despite there being some “interest” in a “hypothetical digital Canadian dollar,” that “interest does not necessarily translate to adoption.”

“Most participants felt well served by current means of payment,” noted the study, adding, “Individuals who support the issuance of a hypothetical digital Canadian dollar did not imagine themselves using it regularly.”

Those most enthusiastic about a government-backed version of Bitcoin were teenagers and young adults. Those older remained especially skeptical.

“They were skeptical of the need for this new form of money and of its reliability,” read the report, which also noted, “They did not trust that concepts were secure or that their personal information would be kept private.”

Given the results from the report, the bank concluded that “[b]road early adoption” of a digital dollar “is unlikely given that available payment methods meet the needs of most users.”

“Financially vulnerable segments often have the most to gain from this payment method but are most resistant to adoption. Important considerations for appeal and adoption potential include universal merchant acceptance, low costs, easy access, simplified online payments, shared payment features, budgeting tools and customizable security and privacy settings,” it noted.

Digital currencies have been touted as the future by some government officials, but, as LifeSiteNews has reported before, many experts warn that such technology would restrict freedom and could be used as a “control tool” against citizens, similar to China’s pervasive social credit system.

Most Canadians do not want a digital dollar, as previously reported by LifeSiteNews. A public survey launched by the BOC to gauge Canadians’ taste for a digital dollar revealed that an overwhelming majority of citizens want to “leave cash alone” and not proceed with a digital iteration of the national currency.

The BOC last August admitted that the creation of a CBDC is not even necessary, as many people rely on cash to pay for things. The bank concluded that the introduction of a digital currency would only be feasible if consumers demanded its release.

In August, LifeSiteNews also reported that the Conservative Party is looking to gather support for a bill that would outright ban the federal government from ever creating a digital currency and make it so that cash is kept as the preferred means of settling debts.

Conservative leader Pierre Poilievre promised that if he is elected prime minister, he would stop any implementation of a “digital currency” or a compulsory “digital ID” system.

Prominent opponents of CBDCs have been strongly advocating that citizens use cash whenever possible and boycott businesses that do not accept cash payments as a means of slowing down the imposition of CBDCs.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTrump Has Driven Canadians Crazy. This Is How Crazy.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe Anhui Convergence: Chinese United Front Network Surfaces in Australian and Canadian Elections

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

Automotive1 day ago

Automotive1 day agoHyundai moves SUV production to U.S.

-

Entertainment1 day ago

Entertainment1 day agoPedro Pascal launches attack on J.K. Rowling over biological sex views

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoAs PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work