Business

Auditor General: $3.5 Billion in CEBA Loans Went to Ineligible Businesses, Recovery Efforts Lacking.

A $3.5 Billion Disaster Exposes Government Negligence, Corporate Greed, and a Total Lack of Accountability

Welcome to the latest edition of “What the Government Doesn’t Want You to Know.” Tonight, we’re talking about Canada’s Canada Emergency Business Account (CEBA) program—a pandemic-era scheme that was supposed to help struggling businesses. Instead, it’s a case study in waste, corruption, and outright negligence.

Here’s what we learned during a bombshell hearing of the Standing Committee on Public Accounts (PACP) Wednesday: $3.5 billion in taxpayer money was handed out to ineligible businesses, 92% of the contracts went to one company, Accenture, without any competitive bidding, and there’s virtually no accountability for any of it.

Let’s break it down.

$3.5 Billion Vanishes, and No One Cares

Here’s what we learned from the Auditor General: The Canada Emergency Business Account program—$49 billion handed out to almost a million small businesses during the pandemic—was a mixed bag. On the one hand, they moved fast. Great. But on the other hand, it was a fiscal train wreck in terms of accountability. And let’s be clear: “accountability” is supposed to be their job.

Now, here’s the kicker. We find out that $3.5 billion—yes, billion with a “B”—went to businesses that didn’t even qualify. That’s our money, taxpayer money, handed over to ineligible recipients. What’s their excuse? Well, they were in a rush, they say. Of course, they were. Crises always become the justification for sloppy governance and waste.

Then there’s Export Development Canada—the folks running this show. They outsourced 92% of their contracts for this program to one company, Accenture. No competitive bidding, no oversight, just one big fat sweetheart deal. And get this: Accenture essentially got to write its own terms. They gave themselves the keys to the vault. They even built systems that made EDC dependent on them until 2028. That’s right—they locked themselves in for years, turning a pandemic emergency into a lucrative, long-term cash cow.

What about the Department of Finance and Global Affairs Canada? Were they stepping in, asking tough questions, setting clear limits? Nope. They were nowhere to be found. Total accountability vacuum. And by the way, administrative costs for this program? Over $850 million. Think about that. You can’t make this stuff up.

And when the Auditor General says, “Hey, maybe you should track down that $3.5 billion and recover it,” EDC just shrugs. They “partially agree.” Partially? Imagine if you told the CRA you “partially agree” with paying your taxes. See how that goes.

Here’s the reality: This is what happens when a government prioritizes speed over basic responsibility. They let the fox guard the henhouse, and now they want us to move on and forget about it. But we shouldn’t. This isn’t just bad management—it’s a betrayal of public trust. It’s our money, and they treated it like Monopoly cash.

So, who’s going to be held accountable? Who’s going to pay the price for this colossal mess? The answer, as usual, is probably no one.

Accenture’s Sweetheart Deal

Here’s the part that should really make your blood boil: $342 million worth of CEBA contracts went to consulting giant Accenture. No competitive bidding. No oversight. Nothing. Just a blank check from EDC with your money.

And it gets worse. Accenture didn’t just get the money—they subcontracted work to themselves. That’s right, they paid themselves with your money. And here’s the kicker: EDC is locked into contracts with Accenture until 2028. So, for the next four years, taxpayers will keep paying this consulting giant, all because EDC couldn’t be bothered to shop around or demand accountability.

Lavery’s excuse? “We needed speed and expertise during the pandemic.” Speed doesn’t justify corruption. It doesn’t justify giving one private company complete control over a multi-billion-dollar program. This isn’t just incompetence; it’s a rigged system designed to enrich consultants at the expense of taxpayers.

$853 Million in Administrative Costs

Let’s talk about efficiency—or the lack thereof. The CEBA program cost $853 million to administer. That’s $300 per loan, according to EDC. Lavery called that “reasonable.” Reasonable? For what? Businesses reported that the call center EDC spent $27 million on barely worked. Think about that: $27 million for a call center where you can’t even get someone to pick up the phone.

Conservative MP Brad Vis summed it up perfectly: “For $27 million, you’d expect a call center that actually answers calls.” But instead, Canadians got more of the same—an expensive, inefficient system that’s great for consultants and terrible for everyone else.

Conservatives Demand Accountability for CEBA Mismanagement: ‘A Blank Check for Consultants’

The Conservatives didn’t hold back in yesterday’s hearing, demanding accountability for what they called a blatant misuse of taxpayer dollars. Conservative MP Brad Vis led the charge, grilling EDC President Mairead Lavery on the $3.5 billion in loans that went to ineligible businesses. He didn’t mince words, calling out the government’s failure to put basic safeguards in place. “How did this happen, and what’s being done to recover this money?” Vis asked repeatedly, only to be met with vague assurances that EDC was “working with Finance Canada” on the issue. Translation: Nothing is actually happening.

MP Kelly McCauley took aim at the $342 million handed to Accenture without a single competitive bid. “How can you justify giving 92% of CEBA contracts to one company without opening it up to competition?” he asked, pointing out that Accenture even subcontracted work to itself, effectively turning the program into a taxpayer-funded cash cow for consultants. McCauley wasn’t buying Lavery’s excuses about pandemic urgency, pointing out that this kind of procurement failure wasn’t just a one-time mistake—it was a systemic problem.

John Nater, another Conservative MP, zeroed in on the long-term fallout. He expressed outrage that EDC is locked into a contract with Accenture until 2028, ensuring that taxpayers will continue funding this flawed system for years to come. Nater demanded to know why no one at EDC or in government thought it necessary to implement oversight mechanisms once the initial rollout phase had passed. “This isn’t just about speed. It’s about accountability. Where was the oversight? Where was the plan to safeguard public money?” Nater asked.

The Conservatives’ message was clear: this wasn’t just a case of pandemic-related haste—it was a failure of leadership, oversight, and governance. They demanded consequences for those responsible and reforms to prevent similar disasters in the future. As McCauley aptly put it, “This wasn’t an emergency response. It was a blank check for consultants, and taxpayers are the ones paying the price.”

Liberals Spin CEBA Disaster as a Success: ‘Sweeping It Under the Rug

The Liberal response to this mess was as predictable as it was infuriating: deny, deflect, and downplay. Instead of addressing the core issues—like the $3.5 billion in loans to ineligible businesses or the sweetheart contracts handed to Accenture—Liberal MPs spent their time patting themselves on the back for the program’s “success” and running interference for Export Development Canada (EDC).

Take Francis Drouin, for example. He spent his time emphasizing how quickly the CEBA program got money into the hands of struggling businesses. Sure, the program distributed $49.1 billion, but at what cost? When confronted with the Auditor General’s findings about fraud, waste, and mismanagement, Drouin brushed past the hard questions and pivoted back to the pandemic. It was a textbook move: ignore the billions lost and focus on how hard the government worked. Typical.

Then there was Valerie Bradford, who followed the same script. Instead of demanding answers about why 92% of contracts went to one consulting firm without competitive bidding, she lobbed softball questions that gave EDC President Mairead Lavery the chance to repeat her excuses about “urgency” and “unprecedented circumstances.” Bradford didn’t challenge the inflated administrative costs, the useless $27 million call center, or the lack of oversight. Instead, she chose to frame the discussion as if this was all just the price of doing business in a crisis.

This wasn’t accountability. This was damage control. The Liberals weren’t there to ask hard questions—they were there to protect their narrative. To them, it doesn’t matter that taxpayers got fleeced. It doesn’t matter that consultants got rich while businesses were left waiting for answers. All that matters is spinning this disaster into a success story, no matter how far from the truth that is.

What’s most galling is the arrogance. The Liberals seem to think Canadians should be grateful for a program that wasted billions, enriched corporations, and locked taxpayers into a disastrous contract until 2028. It’s as if they expect a thank-you card for their incompetence.

Here’s the reality: the Liberal response wasn’t about addressing the scandal. It was about sweeping it under the rug. And unless Canadians demand better, this is the kind of governance they’ll keep getting: one where failure is rebranded as success, and no one ever takes responsibility for the consequences.

Final Thoughts

So, what did we learn from this so-called committee meeting? We learned that billions of taxpayer dollars can be wasted, handed out to ineligible businesses, and funneled into the pockets of consultants without anyone in government blinking an eye. We learned that accountability is a foreign concept in Ottawa, where “working on it” is the go-to excuse for incompetence and outright negligence.

Export Development Canada failed. The Department of Finance failed. The Liberals in charge failed. But here’s the kicker—no one will pay for it. Not the bureaucrats who bungled the program, not the consultants who profited from it, and certainly not the politicians who allowed this circus to happen.

Instead, we got a performance. A parade of excuses, vague promises, and shameless spin. The Conservatives tried to hold the government’s feet to the fire, but the Liberals spent their time running cover for the mess they created. And the Bloc and NDP, while occasionally landing a punch, ultimately let the bureaucrats wiggle off the hook. This wasn’t accountability; it was theater.

The CEBA program wasn’t just a failure—it was a lesson in how the system really works. When there’s no oversight, no consequences, and no urgency to fix anything, corruption and incompetence become the norm. Consultants get rich, bureaucrats get a pass, and taxpayers get the bill.

And the people running this committee? They’re part of the problem. They don’t want to fix the system because the system works perfectly for them. It rewards their friends, protects their power, and keeps them unaccountable. This wasn’t a hearing; it was a farce. And unless Canadians demand real change, this won’t be the last time their government lets them down.

So, ask yourself this: How much more are you willing to let them get away with? Because as long as you stay quiet, they’ll keep doing exactly what they did here—wasting your money, spinning their failures, and walking away without a scratch.

Please consider subscribing to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Business

Canada has given $109 million to Communist China for ‘sustainable development’ since 2015

From LifeSiteNews

A briefing note showed Canadian aid has gone to ‘key foreign policy priorities in China, including human rights, gender equality, sustainable development, and climate change.’

A federal briefing note disclosed that well over $100 million has been provided to the Communist Chinese government in so-called “foreign aid” to promote “sustainable development” that includes woke ideology such as gender equality.

As reported by Blacklock’s Reporter, a recent briefing note titled Assistance to China from May for the Minister of International Development showed $109 million has gone to “key foreign policy priorities in China, including human rights, gender equality, sustainable development, and climate change” since 2015 and $645 million since 2003.

The briefing note asked directly if funding was “going to the Government of China.”

In reply, the briefing note stated, “Canada has not provided direct bilateral assistance to Chinese state authorities since 2013, though it continues to provide small amounts of funding to international partners and non-state partners on the ground.”

Former Prime Minister Justin Trudeau came to power in 2015 and increased relations with the Communist Chinese regime. This trend under the Liberal Party government has continued with Prime Minister Mark Carney.

During a 2025 federal election campaign debate, Conservative Party leader Pierre Poilievre called out Carney for his ties to Communist China.

Conservative MP Andrew Scheer has consistently called out any money at all going to China, saying, “I don’t believe Canadian taxpayers should be sending any money to China.”

“We’re talking about a Communist dictatorial government that abuses human rights, quashes freedoms, violates rights of its citizens, and has a very aggressive foreign policy throughout the region,” he noted.

Scheer added that he has been calling on the Carney Liberals to “stand up for themselves, stand up for Canadians, stop being bullied and pushed around on the world stage, especially by China.”

Most of the money in foreign aid was spent through globalist-backed agencies such as the World Bank and the United Nations Development Program. Some 39 percent of the money was said to have gone straight to Chinese recipients, but no projects were itemized.

Other countries have received millions of dollars in foreign aid, with $2.1 billion going to Ukraine, $195 million to Ethiopia, $172 million to Haiti, and $151 million to the West Bank and Gaza last year.

Foreign aid to all nations totaled $12.3 billion.

LifeSiteNews recently reported that the Canadian Liberal government gave millions in aid to Chinese universities.

China has been accused of direct election meddling in Canada, as reported by LifeSiteNews.

LifeSiteNews also reported that a new exposé by investigative journalist Sam Cooper has claimed there is compelling evidence that Carney and Trudeau are/were strongly influenced by an “elite network” of foreign actors, including those with ties to China and the World Economic Forum.

Business

Canada’s combative trade tactics are backfiring

This article supplied by Troy Media.

Defiant messaging may play well at home, but abroad it fuels mistrust, higher tariffs and a steady erosion of Canada’s agri-food exports

The real threat to Canadian exporters isn’t U.S. President Donald Trump’s tariffs, it’s Ottawa and Queen’s Park’s reckless diplomacy.

The latest tariff hike, whether triggered by Ontario’s anti-tariff ad campaign or not, is only a symptom. The deeper problem is Canada’s escalating loss of credibility at the trade table. Washington’s move to raise duties from 35 per cent to 45 per cent on nonCUSMA imports (goods not covered under the Canada-United States-Mexico Agreement, the successor to NAFTA) reflects a diplomatic climate that is quickly souring, with very real consequences for Canadian exporters.

Some analysts argue that a 10-point tariff increase is inconsequential. It is not. The issue isn’t just what is being tariffed; it is the tone of the relationship. Canada is increasingly seen as erratic and reactive, negotiating from emotion rather than strategy. That kind of reputation is dangerous when dealing with the U.S., which remains Canada’s most important trade partner by a wide margin.

Ontario Premier Doug Ford’s stand up to America messaging, complete with a nostalgic Ronald Reagan cameo, may have been rooted in genuine conviction. Many Canadians share his instinct to defend the country’s interests with bold language. But in diplomacy, tone often outweighs intent. What plays well domestically can sound defiant abroad, and the consequences are already being felt in boardrooms and warehouses across the country.

Ford’s public criticisms of companies such as Crown Royal, accused of abandoning Ontario, and Stellantis, which recently announced it will shift production of its Jeep Compass from Brampton to Illinois as part of a US$13 billion U.S. investment, may appeal to voters who like to see politicians get tough. But those theatrics reinforce the impression that Canada is hostile to

international investors. At a time when global capital can move freely, that perception is damaging. Collaboration, not confrontation, is what’s needed most to secure investment in Canada’s economy.

Such rhetoric fuels uncertainty on both sides of the border. The results are clear: higher tariffs, weaker investor confidence and American partners quietly pivoting away from Canadian suppliers.

Many Canadian food exporters are already losing U.S. accounts, not because of trade rules but because of eroding trust. Executives in the agri-food sector are beginning to wonder whether Canada can still be counted on as a reliable partner, and some have already shifted contracts southward.

Ford’s political campaigns may win applause locally, but Washington’s retaliatory measures do not distinguish between provinces. They hit all exporters, including Canada’s food manufacturers that rely heavily on the U.S. market, which purchases more than half of Canada’s agri-food exports. That means farmers, processors and transportation companies across the country are caught in the crossfire.

Those who believe the new 45 per cent rate will have little effect are mistaken. Some Canadian importers now face steeper duties than competitors in Vietnam, Laos or even Myanmar. And while tariffs matter, perception matters more. Right now, the optics for Canada’s agri-food sector are poor, and once confidence is lost, it is difficult to regain.

While many Canadians dismiss Trump as unpredictable, the deeper question is what happened to Canada’s once-cohesive Team Canada approach to trade. The agri-food industry depends on stability and predictability. Alienating our largest customer, representing 34 per cent of the global consumer market and millions of Canadian jobs tied to trade, is not just short-sighted, it’s economically reckless.

There is no trade war. What we are witnessing is an American recalibration of domestic fiscal policy with global consequences. Canada must adapt with prudence, not posturing.

The lesson is simple: reckless rhetoric is costing Canada far more than tariffs. It’s time to change course, especially at Queen’s Park.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Alberta1 day ago

Alberta1 day agoPremier Smith sending teachers back to school and setting up classroom complexity task force

-

Business2 days ago

Business2 days agoThe painful return of food inflation exposes Canada’s trade failures

-

International21 hours ago

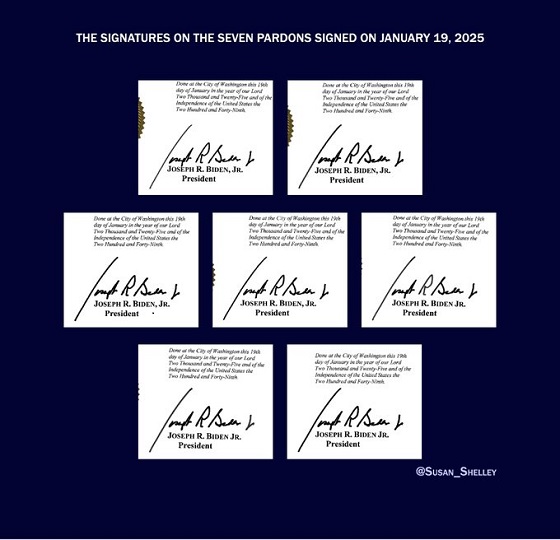

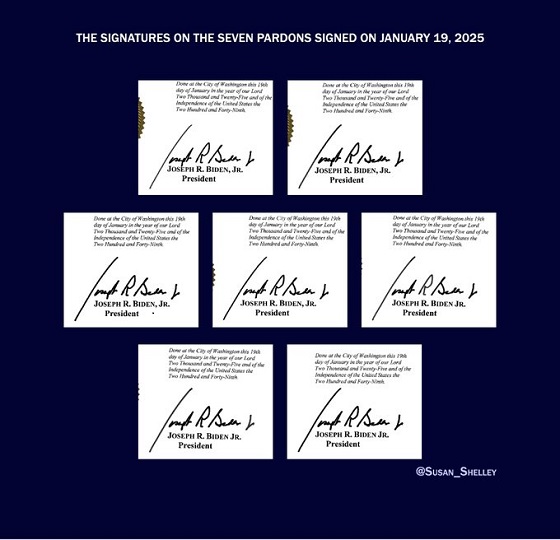

International21 hours agoBiden’s Autopen Orders declared “null and void”

-

Alberta2 days ago

Alberta2 days agoCoutts border officers seize 77 KG of cocaine in commercial truck entering Canada – Street value of $7 Million

-

Business24 hours ago

Business24 hours agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Business2 days ago

Business2 days agoOttawa Bought Jobs That Disappeared: Paying for Trudeau’s EV Gamble

-

National2 days ago

National2 days agoElection Officials Warn MPs: Canada’s Ballot System Is Being Exploited

-

Canada Free Press21 hours ago

Canada Free Press21 hours agoThe real genocide is not taking place in Gaza, but in Nigeria