Energy

Archaic Federal Law Keeps Alaskans From Using Abundant Natural Gas Reserves

Welcome to The Rattler, a Reason newsletter from me, J.D. Tuccille. If you care about government overreach and tangible threats to everyday liberty, you’re in the right place. Did someone forward this to you? You may freely choose to subscribe right here.

Alaska is an energy behemoth with massive reserves of oil, natural gas, and petroleum. It also, oddly, faces a looming natural gas shortage—not good for a state where half of electricity production depends on the stuff. The problem is that most natural gas deposits are far from population centers and pipelines to transport the gas don’t yet exist and may never be built. So, to get gas to Alaskans, you need to transport it by ship. But federal law requires that only U.S.-flagged liquid natural gas (LNG) carriers be used, and there aren’t any.

Vast Energy Reserves

Alaska really is a powerhouse. According to the U.S. Energy Information Administration, the state’s “proved crude oil reserves—about 3.2 billion barrels at the beginning of 2022—are the fourth-largest in the nation.” It’s “recoverable coal reserves are estimated at 2.8 billion tons, about 1% of the U.S. total.” And, most impressively, Alaska’s “proved natural gas reserves—about 100 trillion cubic feet—rank third among the states.”

With that much natural gas to draw on, it’s no wonder the state gets about half of its total electricity from generators powered by natural gas, with roughly three-quarters of power to the main Railbelt grid coming from gas. Nevertheless, the lights could soon flicker—and a lot of people’s furnaces and stoves sputter—because of lack of access to the vast natural gas reserves.

“Alaska lawmakers are searching for solutions to a looming shortage of natural gas that threatens power and heating for much of the state’s population,” Alaska Public Media reported in February. “The state’s largest gas utility is warning that shortfalls could come as soon as next year – and imports are years off.”

But Not Where It’s Needed

It turns out that the gas Alaskans use comes not from the vast North Slope reserves, but from wells in the Cook Inlet. Most companies say it’s not worth their time to drill there, and so sold their leases to Hilcorp over 10 years ago. Hilcorp is a Texas-based company that specializes in getting the most out of declining oil and gas wells—and the existing Cook Inlet wells are decades old and long past their peak. The company expects to produce about 55 billion cubic feet of gas this year but predicts production will fall to 32 billion cubic feet in 2029.

If few companies want to drill more wells in the Cook Inlet, it makes sense to draw on the natural gas in another part of Alaska, the North Slope. In 2020, federal and state officials approved a pipeline to transport gas from the North Slope to the Kenai Peninsula for local use as well as export. But building another pipeline across rugged Alaska is a massive undertaking and the project has struggled to find backers. It won’t be ready for years, if ever.

That leaves transportation by sea. The gas could be transported from the North Slope by LNG carrier and offloaded in the populated areas where it’s needed. But there’s a hitch.

No Ships for You

A century ago, Congress passed the Merchant Marine Act of 1920 (better known as the Jones Act) to prop up the country’s shipping industry. The law “among other things, requires shipping between U.S. ports be conducted by US-flag ships,” according to Cornell Law Schools’s Legal Information Institute. The ships must also be built here. So, to move natural gas from one part of Alaska to another, you need American LNG carriers. And here we find another shortage.

“LNG carriers have not been built in the United States since before 1980, and no LNG carriers are currently registered under the U.S. flag,” the U.S. Government Accountability Office found in 2015. And while there’s lots of demand for more LNG carriers for the export market, not just for Alaska, “U.S. carriers would cost about two to three times as much as similar carriers built in Korean shipyards and would be more expensive to operate.”

U.S. Customs and Border Protection did make an exception to let foreign LNG carriers transport U.S. natural gas to Puerto Rico earlier this year, but only because the gas was first piped to Mexico before being loaded onto ships. Isolated Alaska doesn’t have that option.

The feds are diligent about prosecuting Jones Act violations, too. In 2017, the U.S. Department of Justice imposed a $10 million penalty on an energy exploration and production company for transporting a drill rig from the Gulf of Mexico to Alaska’s Cook Inlet in a foreign-flagged vessel. That company’s intention was to bring more natural gas to market in Alaska.

Given the law’s strict terms and the government’s enthusiastic enforcement, “it will be perfectly legal for ships from other countries to pick up liquid natural gas from the new production facility in northern Alaska—as long as they don’t stop at any other American ports to unload,” Reason’s Eric Boehm noted in 2020.

When Boehm wrote, the century-old protectionist law contributed to high prices for Alaskans. Now it may actually precipitate a crisis by making it effectively illegal for energy companies to ship abundant natural gas from one part of the state to eager customers in another.

A Law In Need of Repeal or Relief

In 2018, the Cato Institute’s Colin Grabow, Inu Manak, and Daniel J. Ikenson delved into the damage done by the Jones Act in terms of higher costs and distorted markets, even as it fails to keep the domestic shipping industry from withering. The authors called for the law’s repeal. Failing that, they recommended the federal government “grant a permanent exemption of the Jones Act for Alaska, Hawaii, Puerto Rico, and Guam.” These isolated jurisdictions suffer the most from Jones Act protectionism and would benefit from greater leeway for foreign shipping.

Until that happens, Alaskans may suffer from a natural gas shortage while having plenty of the stuff to sell to the rest of the world.

– J.D.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Daily Caller

Trump Issues Order To End Green Energy Gravy Train, Cites National Security

From the Daily Caller News Foundation

By Audrey Streb

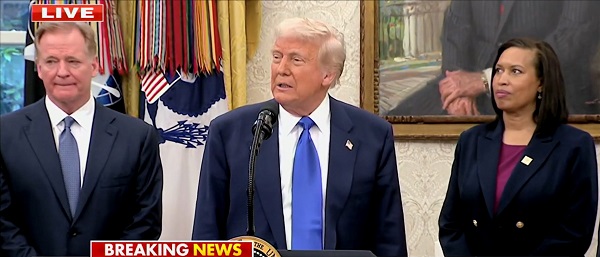

President Donald Trump issued an executive order calling for the end of green energy subsidies by strengthening provisions in the One Big Beautiful Bill Act on Monday night, citing national security concerns and unnecessary costs to taxpayers.

The order argues that a heavy reliance on green energy subsidies compromise the reliability of the power grid and undermines energy independence. Trump called for the U.S. to “rapidly eliminate” federal green energy subsidies and to “build upon and strengthen” the repeal of wind and solar tax credits remaining in the reconciliation law in the order, directing the Treasury Department to enforce the phase-out of tax credits.

“For too long, the Federal Government has forced American taxpayers to subsidize expensive and unreliable energy sources like wind and solar,” the order states. “Reliance on so-called ‘green’ subsidies threatens national security by making the United States dependent on supply chains controlled by foreign adversaries.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Former President Joe Biden established massive green energy subsidies under his signature 2022 Inflation Reduction Act (IRA), which did not receive a single Republican vote.

The reconciliation package did not immediately terminate Biden-era federal subsidies for green energy technology, phasing them out over time instead, though some policy experts argued that drawn-out timelines could lead to an indefinite continuation of subsidies. Trump’s executive order alludes to potential loopholes in the bill, calling for a review by Secretary of the Treasury Scott Bessent to ensure that green energy projects that have a “beginning of construction” tax credit deadline are not “circumvented.”

Additionally, the executive order directs the U.S. to end taxpayer support for green energy supply chains that are controlled by foreign adversaries, alluding to China’s supply chain dominance for solar and wind. Trump also specifically highlighted costs to taxpayers, market distortions and environmental impacts of subsidized green energy development in explaining the policy.

Ahead of the reconciliation bill becoming law, Trump told Republicans that “we’ve got all the cards, and we are going to use them.” Several House Republicans noted that the president said he would use executive authority to enhance the bill and strictly enforce phase-outs, which helped persuade some conservatives to back the bill.

-

International2 days ago

International2 days agoSecret Service suspends six agents nearly a year after Trump assassination attempt

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoThe Covid 19 Disaster: When Do We Get The Apologies?

-

Crime21 hours ago

Crime21 hours agoSweeping Boston Indictment Points to Vast Chinese Narco-Smuggling and Illegal Alien Labor Plot via Mexican Border

-

Alberta1 day ago

Alberta1 day agoAlberta school boards required to meet new standards for school library materials with regard to sexual content

-

Business2 days ago

Business2 days agoWEF-linked Linda Yaccarino to step down as CEO of X

-

Automotive2 days ago

Automotive2 days agoAmerica’s EV Industry Must Now Compete On A Level Playing Field

-

Environment21 hours ago

Environment21 hours agoEPA releases report on chemtrails, climate manipulation

-

Business2 days ago

Business2 days ago‘Experts’ Warned Free Markets Would Ruin Argentina — Looks Like They Were Dead Wrong