Artificial Intelligence

Apple faces proposed class action over its lag in Apple Intelligence

News release from The Deep View

| Apple, already moving slowly out of the gate on generative AI, has been dealing with a number of roadblocks and mounting delays in its effort to bring a truly AI-enabled Siri to market. The problem, or, one of the problems, is that Apple used these same AI features to heavily promote its latest iPhone, which, as it says on its website, was “built for Apple Intelligence.” |

| Now, the tech giant has been accused of false advertising in a proposed class action lawsuit that argues that Apple’s “pervasive” marketing campaign was “built on a lie.” |

| The details: Apple has — if reluctantly — acknowledged delays on a more advanced Siri, pulling one of the ads that demonstrated the product and adding a disclaimer to its iPhone 16 product page that the feature is “in development and will be available with a future software update.” |

|

| Apple did not respond to a request for comment. |

| The lawsuit was first reported by Axios, and can be read here. |

| This all comes amid an executive shuffling that just took place over at Apple HQ, which put Vision Pro creator Mike Rockwell in charge of the Siri overhaul, according to Bloomberg. |

| Still, shares of Apple rallied to close the day up around 2%, though the stock is still down 12% for the year. |

Artificial Intelligence

Apple bets big on Trump economy with historic $500 billion U.S. investment

Diving Deeper:

Apple’s unprecedented $500 billion investment marks what the company calls “an extraordinary new chapter in the history of American innovation.” The tech giant plans to establish an advanced AI server manufacturing facility near Houston and significantly expand research and development across several key states, including Michigan, Texas, California, and Arizona.

Apple CEO Tim Cook highlighted the company’s confidence in the U.S. economy, stating, “We’re proud to build on our long-standing U.S. investments with this $500 billion commitment to our country’s future.” He noted that the expansion of Apple’s Advanced Manufacturing Fund and investments in cutting-edge technology will further solidify the company’s role in American innovation.

President Trump was quick to highlight Apple’s announcement as a testament to his administration’s economic policies. In a Truth Social post Monday morning, he wrote:

“APPLE HAS JUST ANNOUNCED A RECORD 500 BILLION DOLLAR INVESTMENT IN THE UNITED STATES OF AMERICA. THE REASON, FAITH IN WHAT WE ARE DOING, WITHOUT WHICH, THEY WOULDN’T BE INVESTING TEN CENTS. THANK YOU TIM COOK AND APPLE!!!”

Trump previously hinted at the investment during a White House meeting Friday, revealing that Cook had committed to investing “hundreds of billions of dollars” in the U.S. economy. “That’s what he told me. Now he has to do it,” Trump quipped.

Apple’s expansion will include 20,000 new jobs, with a strong focus on artificial intelligence, silicon engineering, and machine learning. The company also aims to support workforce development through training programs and partnerships with educational institutions.

With Apple’s announcement, the U.S. economy stands to benefit from a major influx of investment into high-tech manufacturing and innovation—further underscoring the tech industry’s continued growth under Trump’s economic agenda.

Artificial Intelligence

Everyone is freaking out over DeepSeek. Here’s why

From The Deep View

$600 billion collapse

| Volatility is kind of a given when it comes to Wall Street’s tech sector. It doesn’t take much to send things soaring; it likewise doesn’t take much to set off a downward spiral. | |

| After months of soaring, Monday marked the possible beginning of a spiral, and a Chinese company seems to be at the center of it. | |

| Alright, what’s going on: A week ago, Chinese tech firm DeepSeek launched R1, a so-called reasoning model, that, according to DeepSeek, has reached technical parity with OpenAI’s o1 across a few benchmarks. But, unlike its American competition, DeepSeek open-sourced R1 under an MIT license, making it significantly cheaper and more accessible than any of the closed models coming from U.S. tech giants. | |

|

|

| Since the release of R1, DeepSeek has become the top free app in Apple’s App Store, bumping ChatGPT to the number two slot. In the midst of its spiking popularity, DeepSeek restricted new sign-ups due to large-scale cyberattacks against its servers. And, as Salesforce Chief Marc Benioff noted, “no Nvidia supercomputers or $100M needed,” a point that the market heard loud and clear. | |

| What happened: Led by Nvidia, a series of tech and chip stocks, in addition to the three major stock indices, fell hard in pre-market trading early Monday morning. All told, $1.1 trillion of U.S. market cap was erased within a half hour of the opening bell. | |

|

|

| It’s hard to miss the political tensions underlying all of this. The tail end of former President Joe Biden’s time in office was marked in part by an increasingly tense trade war with China, wherein both countries issued bans on the export of materials needed to build advanced AI chips. And with President Trump hell-bent on maintaining American leadership in AI, and despite the chip restrictions that are in place, Chinese companies seem to be turning hardware challenges into a motivation for innovation that challenges the American lead, something they seem keen to drive home. | |

| R1, for instance, was announced at around the same time as OpenAI’s $500 billion Project Stargate, two impactfully divergent approaches. | |

| What’s happening here is that the market has finally come around to the idea that maybe the cost of AI development (hundreds of billions of dollars annually) is too high, a recognition “that the winners in AI will be the most innovative companies, not just those with the most GPUs,” according to Writer CTA Waseem Alshikh. “Brute-forcing AI with GPUs is no longer a viable strategy.” | |

| Wedbush analyst Dan Ives, however, thinks this is just a good time to buy into Nvidia — Nvidia and the rest are building infrastructure that, he argues, China will not be able to compete with in the long run. “Launching a competitive LLM model for consumer use cases is one thing,” Ives wrote. “Launching broader AI infrastructure is a whole other ballgame.” | |

| “I view cost reduction as a good thing. I’m of the belief that if you’re freeing up compute capacity, it likely gets absorbed — we’re going to need innovations like this,” Bernstein semiconductor analyst Stacy Rasgon told Yahoo Finance. “I understand why all the panic is going on. I don’t think DeepSeek is doomsday for AI infrastructure.” | |

| Somewhat relatedly, Perplexity has already added DeepSeek’s R1 model to its AI search engine. And DeepSeek on Monday launched another model, one capable of competitive image generation. | |

|

|

| Last week, I said that R1 should be enough to make OpenAI a little nervous. This anxiety spread way quicker than I anticipated; DeepSeek spent Monday dominating headlines at every publication I came across, setting off a debate and panic that has spread far beyond the tech and AI community. | |

| Some are concerned about the national security implications of China’s AI capabilities. Some are concerned about the AI trade. Granted, there are more unknowns here than knowns; we do not know the details of DeepSeek’s costs or technical setup (and the costs are likely way higher than they seem). But this does read like a turning point in the AI race. | |

| In January, we talked about reversion to the mean. Right now, it’s too early to tell how long-term the market impacts of DeepSeek will be. But, if Nvidia and the rest fall hard and stay down — or drop lower — through earnings season, one might argue that the bubble has begun to burst. As a part of this, watch model pricing closely; OpenAI may well be forced to bring down the costs of its models to remain competitive. | |

| At the very least, DeepSeek appears to be evidence that scaling is one, not a law, and two, not the only (or best) way to develop more advanced AI models, something that rains heavily on OpenAI and co.’s parade since it runs contrary to everything OpenAI’s been saying for months. Funnily, it actually seems like good news for the science of AI, possibly lighting a path toward systems that are less resource-intensive (which is much needed!) | |

| It’s yet another example of the science and the business of AI not being on the same page. |

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoASK YOURSELF! – Can Canada Endure, or Afford the Economic Stagnation of Carney’s Costly Climate Vision?

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election15 hours ago

2025 Federal Election15 hours agoEuthanasia is out of control in Canada, but nobody is talking about it on the campaign trail

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoInside Buttongate: How the Liberal Swamp Tried to Smear the Conservative Movement — and Got Exposed

-

2025 Federal Election11 hours ago

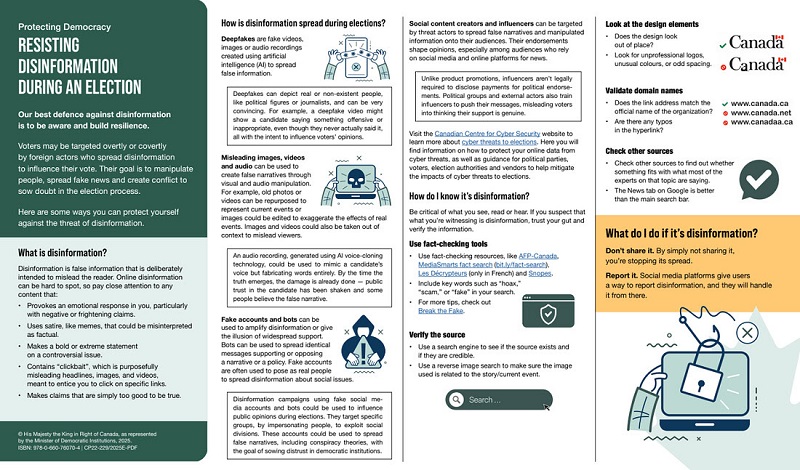

2025 Federal Election11 hours agoAI-Driven Election Interference from China, Russia, and Iran Expected, Canadian Security Officials Warn