Business

An era of Indigenous economic leadership in Canada has begun

Energy for a Secure Future (ESF), the Institute of Energy Economics, Japan (IEEJ), and the First Nations LNG Alliance have signed a Memorandum of Understanding (MOU) to increase energy trade between Canada and Japan. The MOU was signed at the Canadian Embassy in Tokyo and recognizes the growing importance of Indigenous-led LNG projects in Canada’s energy security, reducing global emissions, and driving economic growth for First Nations and the country as a whole.

With Canada’s trade relationship with the U.S. uncertain—especially with U.S. President Donald Trump threatening a 25 per cent tariff on Canadian exports, including 10 per cent on energy—the need to diversify markets has never been more pressing. Canada ships 97 per cent of its oil and gas to the U.S., leaving the country exposed to the political whims of Washington. Expanding trade partnerships with key allies like Japan provides an opportunity to mitigate these risks and build a more resilient economy.

At the heart of Canada’s modern energy industry are First Nations-led LNG projects, which are proving to be a model for economic reconciliation and environmental responsibility. The Haisla Nation’s Cedar LNG, the Squamish Nation’s involvement with Woodfibre LNG, and the Nisga’a Nation’s Ksi Lisims LNG project exemplify Indigenous leadership in Canada’s energy future. These projects bring economic prosperity to Indigenous communities and position Canada as a key player in low-emission energy for the world.

Few people embody this leadership more than Chief Crystal Smith of the Haisla Nation, who received the 2025 Testimonial Dinner Award on February 7. Her vision and determination have brought Cedar LNG—the world’s first Indigenous-majority-owned LNG facility—to life. Under her leadership, this $4-billion project will start up in 2028 and will be one of the most sustainable LNG facilities in the world, powered entirely by BC Hydro’s renewable electricity. Her work is not just about resource development—it represents a country-changing shift in Indigenous economic leadership. By owning the majority of the Cedar LNG project, the Haisla Nation has set a precedent for economic self-determination, long-term job creation, revenue generation, and skills training for Indigenous youth.

She is echoed by Karen Ogen, CEO of the First Nations LNG Alliance, who has been a long-time advocate for Indigenous participation in LNG. As she says, “Our involvement in LNG not only represents an opportunity for economic growth for our communities and for Canada but will help the world with energy security and emissions reduction.”

The MOU signed in Tokyo signals Japan’s growing interest in Canadian LNG as part of its energy security strategy. Japan is phasing out coal and needs reliable, low-emission energy sources—Canadian LNG is the answer. Shannon Joseph, Chair of Energy for a Secure Future, said, “Japan wants diverse energy partners, and on this mission, we’ve heard clearly that they want Canada to be one of those partners.”

This partnership also highlights Canada’s missed opportunities over the last decade. As industry leaders like Eric Nuttall of Ninepoint Partners have pointed out, Canada could have avoided its current dependence on U.S. markets had it built more pipelines to the east and west coasts. The cancellation of the Northern Gateway and Energy East pipelines left Canada without the infrastructure to reach Asian and European markets.

Now, with the expansion of Trans Mountain (TMX) and the rise of Indigenous-led LNG projects, Canada has a second chance to shape its energy future.

As B.C. Minister of Economic Development Diana Gibson has said, expanding trade relationships beyond the U.S. is key to Canada’s future.

The First Nations-led LNG sector is demonstrating that Indigenous leadership is driving economic reconciliation and strengthening Canada’s geopolitical influence in global energy markets. For too long, Indigenous communities were merely stakeholders in resource projects—now they are owners and partners. First Nations are proving that responsible development and environmental stewardship can coexist.

With the MOU between Canada and Japan, the growth of LNG projects, and the recognition of Chief Crystal Smith, a new era of Indigenous economic power is emerging. These developments make one thing clear: First Nations are not just leading their communities—they are leading Canada.

In times of trade uncertainty, their vision, resilience, and business acumen are building the foundation for Canada’s energy future, ensuring prosperity is shared between Indigenous peoples and all Canadians.

Business

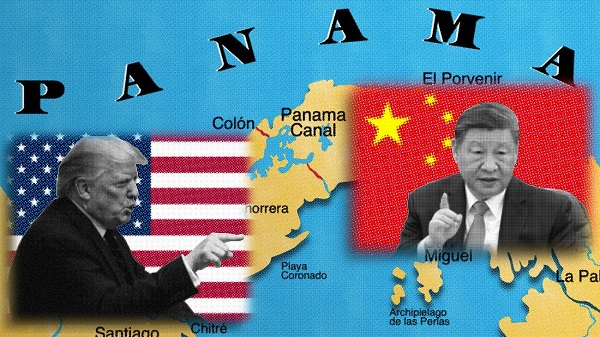

Trump demands free passage for American ships through Panama, Suez

MxM News

MxM News

Quick Hit:

President Donald Trump is pushing for U.S. ships to transit the Panama and Suez canals without paying tolls, arguing the waterways would not exist without America.

Key Details:

-

In a Saturday Truth Social post, Trump said, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

-

Trump directed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the issue, signaling a potential new diplomatic initiative with Panama and Egypt.

-

The Panama Canal generated about $3.3 billion in toll revenue in fiscal 2023, while the Suez Canal posted a record $9.4 billion. U.S. vessels account for roughly 70% of Panama Canal traffic, according to government figures.

Diving Deeper:

President Donald Trump is pressing for American ships to receive free passage through two of the world’s most critical shipping lanes—the Panama and Suez canals—a move he argues would recognize the United States’ historic role in making both waterways possible. In a post shared Saturday on Truth Social, Trump wrote, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

— Rapid Response 47 (@RapidResponse47) April 26, 2025

Trump added that he has instructed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the situation. His comments, first reported by FactSet, come as U.S. companies face rising shipping costs, with tolls for major vessels ranging from $200,000 to over $500,000 per Panama Canal crossing, based on canal authority schedules.

The Suez Canal, operated by Egypt, reportedly saw record revenues of $9.4 billion in 2023, largely driven by American and European shipping amid ongoing Red Sea instability. After a surge in attacks by Houthi militants on commercial ships earlier this year, Trump authorized a sustained military campaign targeting missile and drone sites in northern Yemen. The Pentagon said the strikes were part of an effort to “permanently restore freedom of navigation” for global shipping near the Suez Canal.

Trump has framed the military operations as part of a broader strategy to counter Iranian-backed destabilization efforts across the Middle East.

Meanwhile, in Central America, Trump’s administration is working to counter Chinese influence near the Panama Canal. On April 9th, Defense Secretary Pete Hegseth announced an expanded partnership with Panama to bolster canal security, including a memorandum of understanding allowing U.S. warships and support vessels to move “first and free” through the canal. “The Panama Canal is key terrain that must be secured by Panama, with America, and not China,” Hegseth emphasized during a press conference in Panama City.

American commercial shipping has long depended on the canal, which reduces the shipping route between the U.S. East Coast and Asia by nearly 8,000 miles. About 40% of all U.S. container traffic uses the Panama Canal annually, according to the U.S. Maritime Administration.

The United States originally constructed and controlled the Panama Canal following a monumental effort championed by President Theodore Roosevelt in the early 20th century. After backing Panama’s independence from Colombia in 1903, the U.S. secured the rights to build and operate the canal, which opened in 1914. Although U.S. control ended in 1999 under the Torrijos-Carter Treaties, the canal remains vital to U.S. trade.

2025 Federal Election

Columnist warns Carney Liberals will consider a home equity tax on primary residences

From LifeSiteNews

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Winnipeg Sun Columnist Kevin Klein is sounding the alarm there is substantial evidence the Carney Liberal Party is considering implementing a home equity tax on Canadians’ primary residences as a potential huge source of funds to bring down the massive national debt their spending created.

Klein wrote in his April 23 column and stated in his accompanying video presentation:

The Canada Mortgage and Housing Corporation (CMHC) — a federal Crown corporation — has investigated the possibility of a home equity tax on more than one occasion, using taxpayer dollars to fund that research. This was not backroom speculation. It was real, documented work.

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Kershaw, by the way, believes homeowners are “lottery winners” who didn’t earn their wealth but lucked into it. That’s the ideology being advanced to the highest levels of government.

It didn’t stop there. These proposals were presented directly to federal cabinet ministers. That’s on record, and most of those same ministers are now part of Mark Carney’s team as he positions himself as the Liberals’ next leader.

Watch below Klein’s 7-minute, impassionate warning to Canadians about this looming major new tax should the Liberals win Monday’s election.

Klein further adds:

The total home equity held by Canadians is over $4.7 trillion. It’s the largest pool of private wealth in the country. For millions of Canadians — especially baby boomers — it’s the only retirement fund they have. They don’t have big pensions. They have a paid-off house and a hope that it will carry them through their later years. Yet, that’s what Ottawa has quietly been circling.

The Canadian Taxpayer’s Federation has researched this issue and published a report on the alarming amount of new taxation a homeowner equity tax could cost Canadians who sell their homes that have increased in value over the years they have lived in it. It is a shocker!

A Google search on the question, “what is a home equity tax?” returns the response:

A home equity tax, simply put, it’s a proposed levy on the increased value of your home, specifically, on your principal residence. The idea is for Government to raise money by taxing wealth accumulation from rising property values.

The Canadian Taxpayers Federation has provided a Home Equity Tax Calculator Backgrounder to help Canadians understand what the impact of three different types of Home Equity Tax Calculators would have on home owners. The required tax payment resulting from all three is a shocker.

Keep in mind that World Economic Forum policies intend to eventually eliminate all private home ownership and have the state own and control not only all residences, but also eliminate car ownership, and control when and where you may live and travel.

Carney, Trudeau and several other members of the Liberal government in key positions are heavily connected to the WEF.

-

2025 Federal Election12 hours ago

2025 Federal Election12 hours agoMark Carney: Our Number-One Alberta Separatist

-

2025 Federal Election15 hours ago

2025 Federal Election15 hours agoNine Dead After SUV Plows Into Vancouver Festival Crowd, Raising Election-Eve Concerns Over Public Safety

-

Opinion1 day ago

Opinion1 day agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

International2 days ago

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

C2C Journal1 day ago

C2C Journal1 day ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

International16 hours ago

International16 hours agoJeffrey Epstein accuser Virginia Giuffre reportedly dies by suicide

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s