Alberta

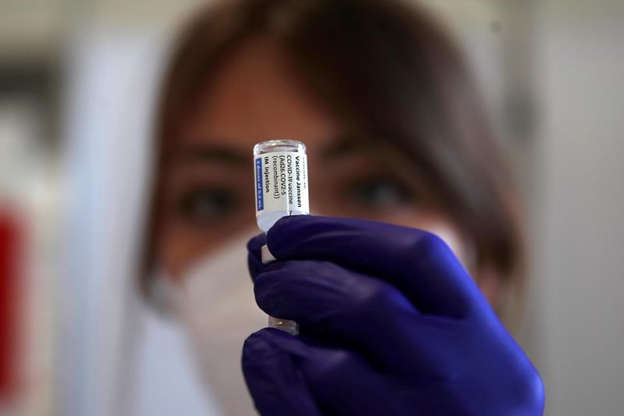

All Albertans 12+ eligible for the COVID-19 vaccine

All Albertans over the age of 12 will soon be eligible for COVID-19 vaccine to protect themselves and stop the spike.

After offering vaccine to Albertans most at risk for severe outcomes, Alberta has now progressed to Phase 3, where everyone over the age of 12 can make an appointment to receive their first dose.

With this expansion, 3.8 million Albertans will become eligible for the COVID-19 vaccine.

To avoid overwhelming booking systems, appointments will be staggered in two age groups.

- Starting on May 6, every Albertan 30 or older (born in 1991 or earlier), can book an appointment through Alberta Health Services or a participating pharmacy.

- On May 10, appointment bookings will expand to include Albertans ages 12 to 29 (born in 2009 to 1992).

More than 1.66 million doses of vaccine have now been administered across the province. All vaccine appointments will continue to rely on the incoming supply to Alberta.

“This is a very exciting day for Alberta and it arrives right when we need it the most. We are battling an extremely aggressive third wave of COVID-19 and we know that vaccines are our best weapon against it. By opening bookings to everybody over 12 years of age, we are taking a huge step towards stopping the spike and hopefully putting this pandemic behind us for good.”

“We vowed to protect those who were most at risk of severe outcomes from COVID-19 first. We’ve done just that, and now, happily, we can move to protect the general population, starting with those age 30 and older. We are ahead of schedule and delivering on our promise to provide at least one dose to every adult Albertan who wants one by June 30. Now that we have gotten to this point, every Albertan can help drive cases down by getting vaccinated.”

“We need every Albertan who is eligible to book their appointment and get immunized. It may take time at first, but please be patient and book your appointment in the coming weeks. This is the most important thing you can do to protect yourselves, your loved ones, and your communities.”

All eligible Albertans will be able to book appointments to receive a mRNA vaccine with AHS online or through 811.

Albertans can also book an appointment for these vaccines through participating pharmacies. To find the closest location to you with an earliest available booking date, check the list on Alberta Blue Cross.

Alberta’s government is responding to the COVID-19 pandemic by protecting lives and livelihoods with precise measures to bend the curve, sustain small businesses and protect Alberta’s health-care system.

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

International12 hours ago

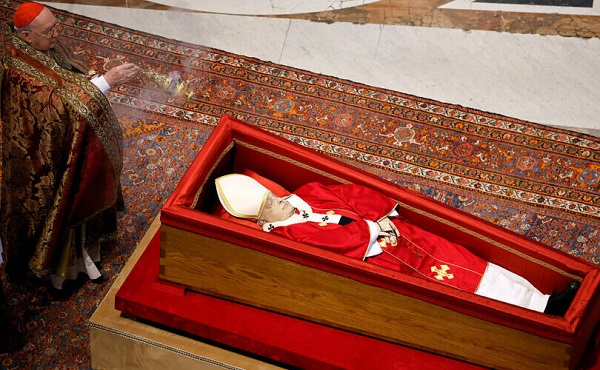

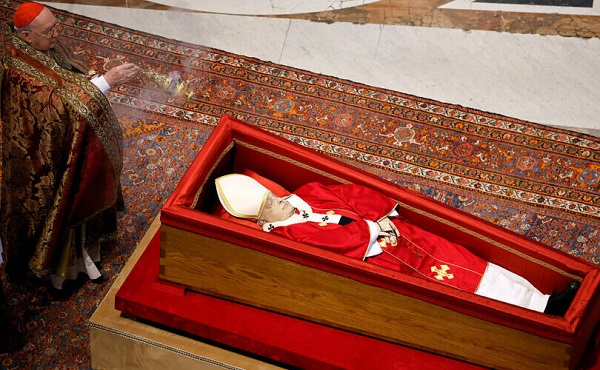

International12 hours agoPope Francis’ body on display at the Vatican until Friday

-

Business22 hours ago

Business22 hours agoHudson’s Bay Bid Raises Red Flags Over Foreign Influence

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoCanada’s pipeline builders ready to get to work