Alberta

Albertans continue to contribute disproportionately to Canadian federalism

From the Fraser Institute

By Tegan Hill

Net contribution totaled $244.6 billion between 2007 and 2022

Between 2007 and 2022, Albertans continued to contribute disproportionately to Canadian federalism in terms of the amount of federal taxes paid versus federal spending in the province, finds a new study published today by the Fraser Institute, an independent non-partisan Canadian think-tank.

“It’s clear that Albertans continue to disproportionately contribute to the economic success of the country and to federal finances,” said Tegan Hill, director of Alberta Policy at the Fraser Institute and co-author of Understanding Alberta’s Outsized Contribution to Confederation.

Overall, from 2007 and 2022, Albertans’ contributed $244.6 billion to the federal government in taxes and other payments in excess of the money Ottawa spent or transferred to Alberta – more than five times as much as was contributed (on net) by either British Columbians or Ontarians. The other seven provinces, and most notably Quebec were net recipients of federalism, meaning the amount of revenues collected by the federal government in those provinces was exceeded by the amount of money spent or transferred by Ottawa back to the provinces.

“When Alberta’s economy is strong and prosperous, it benefits the entire nation,” commented Hill.

In 2022, Alberta’s inflation-adjusted GDP growth was the fastest in the country (5 per cent), it also reported the fastest private sector employment growth (7.8 per cent), the highest level of business investment per private sector worker ($36,412) and had the highest net interprovincial migration (56,245 people).

“It is the economic success of Alberta that leads to Albertans contributing more to Canadian federalism than other provinces, which is absolutely something to be encouraged rather than discouraged,” said Hill.

- When Alberta is economically strong, all Canadians benefit, because money is redistributed to other parts of Canada.

- In 2022, despite restrictive federal policies, Alberta continued to contribute disproportionately to the federation.

- Alberta’s 5.0% real GDP growth rate was the fastest in Canada in 2022, accounting for 17.9% of Canada’s real GDP growth, despite being home to 11.6% of the population.

- In 2022, 56,245 Canadian residents relocated to Alberta, representing more than 75% of total net in-migration within Canada.

- Alberta reported the fastest private sector employment growth among the provinces (7.8%) in 2022, accounting for 19.2% of private sector jobs created in Canada.

- Per private sector worker, Alberta attracted $36,412 of business investment, more than double the national average (excluding Alberta).

- From 2007 to 2022, Alberta’s net contribution to the federal finances totalled $244.6 billion—more than five times as much as BC’s ($46.9 billion) or Ontario’s ($41.9 billion). In 2022, Alberta contributed $14.2 billion more to federal revenues than it received back in federal spending.

- If Alberta were an “average contributor” based on the other provinces, rather than a large net contributor, the federal government would have had a fiscal shortfall of $16.9 billion in 2022. For perspective, to cover this net revenue loss, the federal GST rate would need to increase from 5.0% to 7.2%.

- Put simply, without Alberta’s oversized contribution to the federation, Canada would be worse off. To benefit all Canadians, the federal government should focus on supportive policies, not restrictive ones.

Authors:

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoEuthanasia is out of control in Canada, but nobody is talking about it on the campaign trail

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoMEI-Ipsos poll: 56 per cent of Canadians support increasing access to non-governmental healthcare providers

-

2025 Federal Election18 hours ago

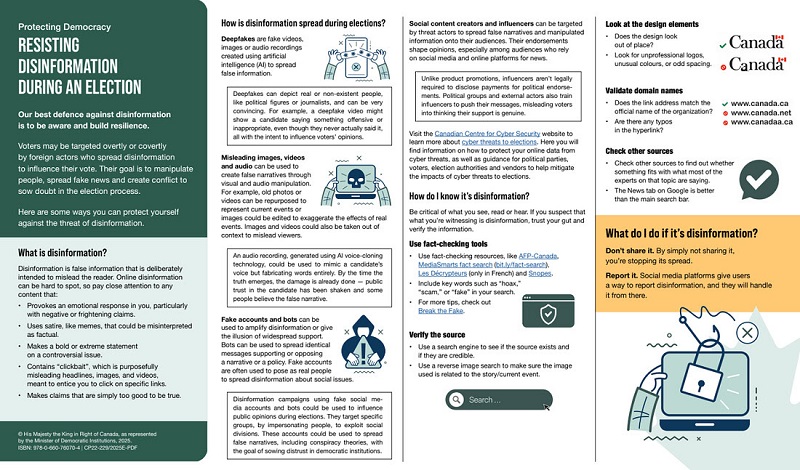

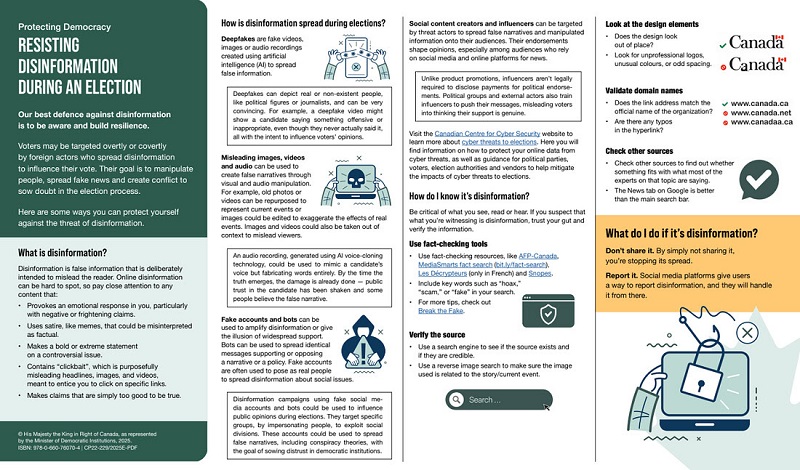

2025 Federal Election18 hours agoAI-Driven Election Interference from China, Russia, and Iran Expected, Canadian Security Officials Warn

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoInside Buttongate: How the Liberal Swamp Tried to Smear the Conservative Movement — and Got Exposed

-

illegal immigration1 day ago

illegal immigration1 day agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.

-

Bjorn Lomborg23 hours ago

Bjorn Lomborg23 hours agoGlobal Warming Policies Hurt the Poor