Alberta

Alberta remains largest net contributor to Ottawa’s coffers despite damaging federal policies

From the Fraser Institute

By Tegan Hill and Spencer Gudewill

According to a recent poll by the Angus Reid Institute, nearly half of Albertans believe they get a “raw deal”—that is, they give more than they get—being part of Canada. It’s easy to see why Albertans are frustrated. Despite the province’s crucial role in the federation, the federal government continues to inflict restrictive and damaging policies on the Albertan economy.

The Trudeau government’s list of policies includes Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48, (which bans large oil tankers off British Columbia’s northern coast and limits access to Asian markets), the oil and gas emission cap, the “clean fuel standard,” numerous “net-zero” targets that disproportionately impact Alberta, and so on. Not surprisingly, the same poll found that 65 per cent of Albertans believe federal government policies have hurt their province’s economy.

What’s less clear is why the federal government wants to thwart Alberta’s economic engine, considering how much the province contributes to the federation financially. In our current system of federalism, Ottawa collects various taxes then redistributes money to Canadians in other provinces for federal programs including equalization, the Canada Pension Plan (CPP) and employment insurance.

According to a new study published by the Fraser Institute, from 2007 to 2022 (the latest period of available data), Albertans contributed $244.6 billion more in taxes and other payments to the federal government than they received in federal spending—more than five times as much as British Columbians or Ontarians. The other seven provinces received more federal dollars than they contributed to federal revenues. In other words, Alberta is by far the largest net contributor to Ottawa’s coffers.

Alberta’s large net contribution reflects its comparatively young population (fewer retirees), higher rates of employment, higher average incomes and relatively strong economy. Alberta has a history of punching above its weight economically. For perspective, from 1981 to 2022, the province had the highest annual average economic growth rate in Canada. And despite dips in growth due to the 2014 oil-price collapse and COVID, in 2022 Alberta accounted for 17.9 per cent of Canada’s total economic growth despite being home to just 11.6 per cent of the country’s population.

It’s a similar story for business investment per private-sector worker (in 2022, Alberta’s level more than doubled the non-Alberta average among provinces) and private-sector job growth with Alberta contributing nearly one in every five private-sector jobs created in Canada in 2022.

Alberta’s prosperity, which helps fuel federation, may help explain why in 2022 56,245 more Canadian residents moved to Alberta than left it—a much higher net inflow than in any other province. For decades, Alberta has provided economic opportunities for Canadians from other provinces willing to relocate.

Finally, without Alberta’s large net contribution to the federal government’s bottom line, Ottawa would have significantly larger budget deficits. In 2022, for instance, without Alberta the Trudeau government’s $25.7 billion budget deficit would have ballooned to $39.9 billion. The larger the deficit (all else equal) the greater the debt accumulation, which Canadians must ultimately finance through their taxes.

When Alberta’s economy is strong and prosperous, it benefits all of Canada. And due to Alberta’s economic success, Albertans continue to contribute relatively more to the federation than Canadians in other provinces. That’s something the federal government should encourage, not discourage.

Authors:

Alberta

Red Deer Justice Centre Grand Opening: Building access to justice for Albertans

The new Red Deer Justice Centre will help Albertans resolve their legal matters faster.

Albertans deserve to have access to a fair, accessible and transparent justice system. Modernizing Alberta’s courthouse infrastructure will help make sure Alberta’s justice system runs efficiently and meets the needs of the province’s growing population.

Alberta’s government has invested $191 million to build the new Red Deer Justice Centre, increasing the number of courtrooms from eight to 12, allowing more cases to be heard at one time.

“Modern, accessible courthouses and streamlined services not only strengthen our justice

system – they build safer, stronger communities across the province. Investing in the new Red Deer Justice Centre is vital to helping our justice system operate more efficiently, and will give people in Red Deer and across central Alberta better access to justice.”

Government of Alberta and Judiciary representatives with special guests at the Red Deer Justice Centre plaque unveiling event April 22, 2025.

On March 3, all court services in Red Deer began operating out of the new justice centre. The new justice centre has 12 courtrooms fully built and equipped with video-conference equipment to allow witnesses to attend remotely if they cannot travel, and vulnerable witnesses to testify from outside the courtroom.

The new justice centre also has spaces for people taking alternative approaches to the traditional courtroom trial process, with the three new suites for judicial dispute resolution services, a specific suite for other dispute resolution services, such as family mediation and civil mediation, and a new Indigenous courtroom with dedicated venting for smudging purposes.

“We are very excited about this new courthouse for central Alberta. Investing in the places where people seek justice shows respect for the rights of all Albertans. The Red Deer Justice Centre fills a significant infrastructure need for this rapidly growing part of the province. It is also an important symbol of the rule of law, meaning that none of us are above the law, and there is an independent judiciary to decide disputes. This is essential for a healthy functioning democracy.”

“Public safety and access to justice go hand in hand. With this investment in the new Red Deer Justice Centre, Alberta’s government is ensuring that communities are safer, legal matters are resolved more efficiently and all Albertans get the support they need.”

“This state-of-the-art facility will serve the people of Red Deer and surrounding communities for generations. Our team at Infrastructure is incredibly proud of the work done to plan, design and build this project. I want to thank everyone, at all levels, who helped make this project a reality.”

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The new Red Deer Justice Centre is 312,000 sq ft (29,000 m2). (The old courthouse is 98,780 sq ft (9,177 m2)).

- The approved project funding for the Red Deer Justice Centre is about $191 million.

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

-

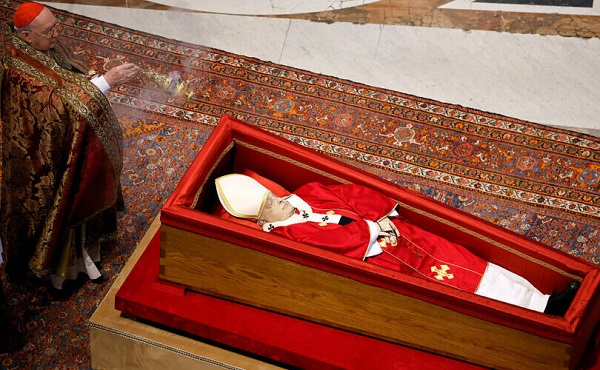

International2 days ago

International2 days agoPope Francis’ body on display at the Vatican until Friday

-

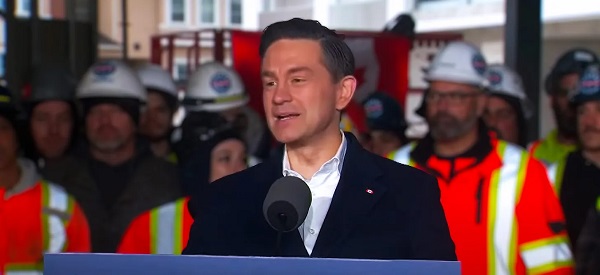

2025 Federal Election1 day ago

2025 Federal Election1 day agoFormer WEF insider accuses Mark Carney of using fear tactics to usher globalism into Canada

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election11 hours ago

2025 Federal Election11 hours agoThe Anhui Convergence: Chinese United Front Network Surfaces in Australian and Canadian Elections

-

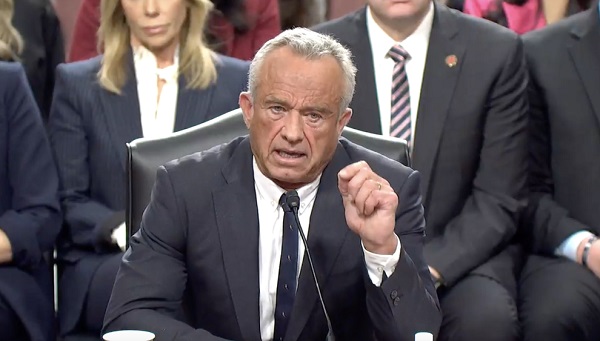

COVID-192 days ago

COVID-192 days agoRFK Jr. Launches Long-Awaited Offensive Against COVID-19 mRNA Shots

-

2025 Federal Election9 hours ago

2025 Federal Election9 hours agoTrump Has Driven Canadians Crazy. This Is How Crazy.

-

Business2 days ago

Business2 days agoTrump considers $5K bonus for moms to increase birthrate

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada’s press tries to turn the gender debate into a non-issue, pretend it’s not happening