Alberta

Alberta fighting federal “unconstitutional intrusion” into provincial jurisdiction

Alberta to fight federal plastics ban once more

Alberta’s government will continue defending the province’s constitutional jurisdiction and economy by intervening in Ottawa’s appeal of the Federal Court’s ruling on plastics.

On Nov. 16, the Federal Court of Canada ruled that the federal order-in-council classifying plastics as toxic is not only unreasonable but unconstitutional. The federal government has chosen to appeal this decision, ignoring calls from Alberta and others to accept the court’s decision.

As a result, Alberta’s government will participate in the appeal and will argue that the federal government’s decision to label plastic as a “toxic substance” is an unconstitutional intrusion into provincial jurisdiction.

“It is past time for Ottawa to listen. We have told them they are overreaching their jurisdiction, the private sector has told them so, and so have both the Supreme Court and the Federal Court. Ottawa cannot assume regulatory authority over any substance simply by designating it as toxic. We will continue to push back against Ottawa’s unconstitutional actions, including through this legal action, until they listen.”

The toxic designation and bans have also had a detrimental impact on Alberta’s economy. Alberta’s Industrial Heartland Association estimates the designation will potentially jeopardize more than $30 billion in capital investment in the petrochemical sector by 2030. Those risks would also put Albertan and Canadian workers at risk of losing their jobs.

“The Federal Court clearly ruled that the federal government’s plastics ban policies were unconstitutional. The federal government’s environmental policies and constitutional overreach have been heavily criticized and this ruling further confirms the indisputable nature of provincial jurisdiction in these matters. We are intervening in this appeal and will continue to participate wherever and whenever necessary to protect Alberta’s interests.”

In addition to intervening in the appeal, Alberta will monitor any further legal action taken to remove plastic manufactured items from the current Schedule 1 of the Canadian Environmental Protection Act. Several Calgary-based companies producing compostable plastic bags are now caught in the ban and will be barred from supplying Calgarians with low-emissions alternatives to traditional plastic shopping bags.

“Instead of listening to the courts and to Canadians, the federal government has chosen overreach once again. We will continue standing up for our constitutional jurisdiction while focusing on more effective ways to reduce plastic waste and keep it out of landfills.”

Alberta is committed to reducing plastic waste through initiatives like extended producer responsibility, which encourages businesses to find new ways to recycle materials and reduce waste. The province also advocates for strategies that create economies of scale, promote recycled content and develop local markets for transformed plastic waste.

Quick facts

- On April 23, 2021, the administrator in council issued an order-in-council directing that “plastic manufactured items” be added to Schedule 1 of the Canadian Environmental Protection Act, 1999 (CEPA).

- The category of plastic manufactured items includes every piece of plastic that enters Alberta.

- Once a substance is designated as toxic under CEPA, CEPA allows the federal government to make regulations regulating every aspect of that substance’s life, from manufacture to sale to use and to disposal.

- Canada subsequently enacted the Single-use Plastics Prohibition Regulations (SUPPR) prohibiting the manufacture, import and sale of six single-use plastics. SUPPR is only valid if “plastic manufactured items” is listed as toxic on Schedule 1 of CEPA.

- The Responsible Plastic Use Coalition, Dow, Imperial Oil and Nova applied for a judicial review of the order. They challenged it as unreasonable on administrative law grounds and as unconstitutional on division of powers grounds.

- On Sept. 7, 2022, Alberta intervened in the application to address the constitutional questions. Saskatchewan intervened on Oct. 24, 2022.

- The application was heard March 7-9, 2023, and the court reserved its decision.

- On Nov. 16, the federal Court of Canada issued its decision. Justice Angela Furlanetto concluded that the order adding “plastic manufactured items” to the Schedule 1 was both unreasonable from an administrative law perspective, and unconstitutional.

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

Business11 hours ago

Business11 hours agoHudson’s Bay Bid Raises Red Flags Over Foreign Influence

-

2025 Federal Election8 hours ago

2025 Federal Election8 hours agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust

-

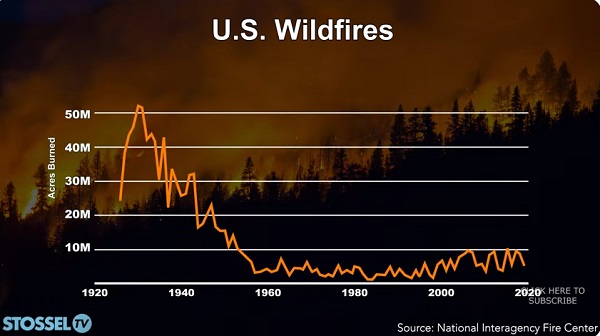

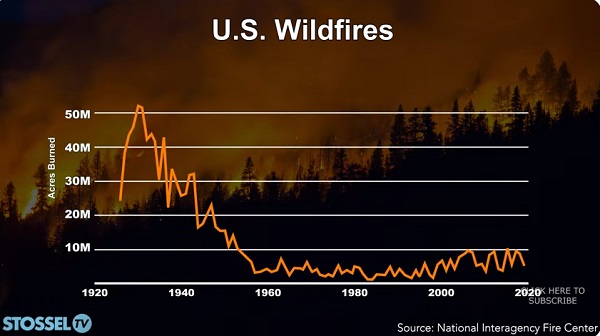

John Stossel1 day ago

John Stossel1 day agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs