Alberta

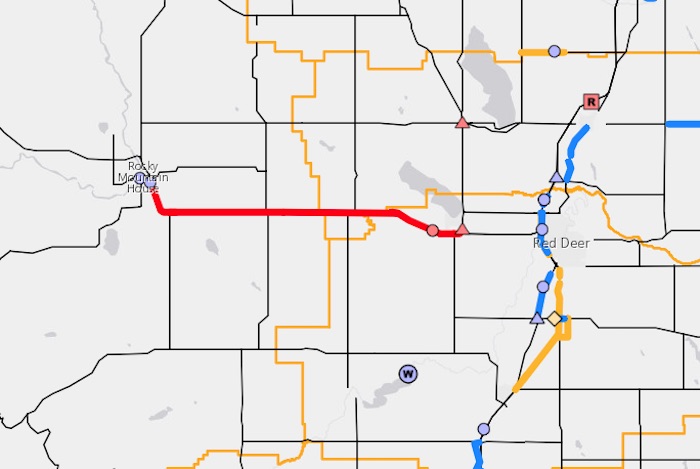

Alberta 2023 budget plows ahead with twinning highway 11 from Sylvan Lake to Rocky Mountain House

Building Alberta’s economic corridor network

Budget 2023 includes strategic investments in Alberta’s highway network to build economic corridors, creating jobs, improving safety and supporting economic development.

Budget 2023 includes $8 billion for the Ministry of Transportation and Economic Corridors’ three-year capital plan, a $718-million increase compared with Budget 2022.

“Budget 2023 is focused on securing Alberta’s future by growing the economy. Our investments will enhance economic corridors that provide vital links to markets in and out of Alberta, helping our industries expand and succeed. These projects will increase the safety and efficiency of our provincial highway network, improving travel for Albertans and commercial carriers in key industries.”

The total capital investment is $2 billion for planning, design and construction of major highway and bridge projects. This work focuses on improving traffic flow and supporting investments in the province’s major trade corridors. Examples of projects across the province that are receiving funding include the Calgary and Edmonton ring roads, Highway 3 twinning, Highway 11 twinning, and replacing the Highway 2 and Highway 556 interchange at Balzac. This capital investment funding also includes $75.5 million over three years for 23 engineering or planning projects to address known future needs.

“Budget 2023 is investing in Alberta drivers through improvements to Highway 60 through Acheson. These improvements will help families save time on their commute while improving the efficient movement of goods across the province. Budget 2023 also responds to safety concerns from the community with a new intersection at Highway 16A and Range Road 20 in Parkland County. The new intersection will not only help area residents get to and from home safely but will also improve traffic flow along this major economic corridor.”

“Highway 63, north of Fort McMurray, is a critical link in northern Alberta for oversize and overweight vehicles transporting goods for the energy sector. Twinning this highway will improve efficiency and safety for both commercial drivers and commuters. It also enables oilsands workers to more easily commute from Fort McMurray, which we know provides a healthier lifestyle for them and their families as opposed to flying from out of province and living in a camp. The workers who decide to make this move will see the benefits of living in such an amazing province like Alberta.”

“Alberta’s Industrial Heartland Association is pleased that the 55-year-old Vinca Bridge replacement is included in the Government of Alberta’s 2023 budget. As a vital component of Alberta’s high-load corridor and a strategic connector in Alberta’s Industrial Heartland, the bridge services a thriving industrial zone with over $45 billion in total capital investment and billions more expected in the coming years. Replacing Vinca Bridge will shorten travel times, reduce greenhouse gas emissions and enhance the competitiveness of both the Industrial Heartland and the manufacturing supply chain that contributes to its success.”

“We have been advocating hard for twinning and rail grade separation for Highway 60, and we are pleased to see this commitment from the Government of Alberta. Acheson is not only the beating, industrial heart of Parkland County, it is one of the largest industrial areas in Western Canada. Completing this work in a timely matter will improve access and movement along Highway 60 and allow for further development in Acheson, which will contribute to economic growth and job creation throughout Parkland County and the Edmonton region.”

“Representing hundreds of businesses in the Acheson area, the Acheson Business Association is thrilled with and would like to thank the Government of Alberta for this latest announcement for the twinning and rail grade separation for Highway 60. Highway 60 is an important connector of arterial highways, allowing products to move all directions through the metro Edmonton area, and the twinning and overpass will create a safer route for employees, travellers and business owners who are passing through this stretch of road every day. This will also enable the region to continue to attract more investors and businesses by reducing delays and eliminating congestion along this major trade corridor.”

Budget 2023 also includes $1.7 billion over three years for capital maintenance and renewal, which extends the life of the province’s existing road and bridge network and helps industry create and maintain jobs. These investments will allow the province to maintain existing roads and bridges to support safe and efficient travel to benefit Albertans and the economy.

Transportation and Economic Corridors will also be providing $3.9 billion for capital grants to municipalities over the next three years. This includes maintaining the funding commitment to Calgary and Edmonton for their LRT projects and continuing to provide funding for the Strategic Transportation Infrastructure Program to help municipalities improve critical local transportation infrastructure. Ongoing investments in water and wastewater infrastructure programs will also ensure all Albertans have reliable access to clean drinking water and effective wastewater services.

Additionally, Budget 2023 will provide nearly $400 million to support building and repairing water management infrastructure that provides irrigation for the agriculture sector and flood mitigation for Alberta communities such as the Springbank Off-stream Reservoir.

Budget 2023 secures Alberta’s future by transforming the health-care system to meet people’s needs, supporting Albertans with the high cost of living, keeping our communities safe and driving the economy with more jobs, quality education and continued diversification.

Alberta

Danielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

From LifeSiteNews

The Alberta premier has denounced Skate Canada as ‘disgraceful’ for refusing to host events in the province because of a ban on ‘transgender’ men in women’s sports.

Alberta Premier Danielle Smith has demanded an apology after Skate Canada refused to continue holding events in Alberta.

In a December 16 post on X, Smith denounced Skate Canada’s recent decision to stop holding competitions in Alberta due to a provincial law keeping gender-confused men from competing in women’s sports.

“Women and girls have the right to play competitive sports in a safe and fair environment against other biological females,” Smith declared. “This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.”

Women and girls have the right to play competitive sports in a safe and fair environment against other biological females.

This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.

Skate Canada‘s refusal to hold events in… pic.twitter.com/n4vbkTx6B0

— Danielle Smith (@ABDanielleSmith) December 16, 2025

“Skate Canada‘s refusal to hold events in Alberta because we choose to protect women and girls in sport is disgraceful,” she declared.

“We expect they will apologize and adjust their policies once they realize they are not only compromising the fairness and safety of their athletes, but are also offside with the international community, including the International Olympic Committee, which is moving in the same direction as Alberta,” Smith continued.

Earlier this week, Skate Canada announced their decision in a statement to CBC News, saying, “Following a careful assessment of Alberta’s Fairness and Safety in Sport Act, Skate Canada has determined that we are unable to host events in the province while maintaining our national standards for safe and inclusive sport.”

Under Alberta’s Fairness and Safety in Sport Act, passed last December, biological men who claim to be women are prevented from competing in women’s sports.

Notably, Skate Canada’s statement failed to address safety and fairness concerns for women who are forced to compete against stronger, and sometimes violent, male competitors who claim to be women.

Under their 2023 policy, Skate Canada states “skaters in domestic events sanctioned by Skate Canada who identify as trans are able to participate in the gender category in which they identify.”

While Skate Canada maintains that gender-confused men should compete against women, the International Olympic Committee is reportedly moving to ban gender-confused men from women’s Olympic sports.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely that males have a considerable innate advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

Alberta

Alberta’s huge oil sands reserves dwarf U.S. shale

From the Canadian Energy Centre

By Will Gibson

Oil sands could maintain current production rates for more than 140 years

Investor interest in Canadian oil producers, primarily in the Alberta oil sands, has picked up, and not only because of expanded export capacity from the Trans Mountain pipeline.

Enverus Intelligence Research says the real draw — and a major factor behind oil sands equities outperforming U.S. peers by about 40 per cent since January 2024 — is the resource Trans Mountain helps unlock.

Alberta’s oil sands contain 167 billion barrels of reserves, nearly four times the volume in the United States.

Today’s oil sands operators hold more than twice the available high-quality resources compared to U.S. shale producers, Enverus reports.

“It’s a huge number — 167 billion barrels — when Alberta only produces about three million barrels a day right now,” said Mike Verney, executive vice-president at McDaniel & Associates, which earlier this year updated the province’s oil and gas reserves on behalf of the Alberta Energy Regulator.

Already fourth in the world, the assessment found Alberta’s oil reserves increased by seven billion barrels.

Verney said the rise in reserves despite record production is in part a result of improved processes and technology.

“Oil sands companies can produce for decades at the same economic threshold as they do today. That’s a great place to be,” said Michael Berger, a senior analyst with Enverus.

BMO Capital Markets estimates that Alberta’s oil sands reserves could maintain current production rates for more than 140 years.

The long-term picture looks different south of the border.

The U.S. Energy Information Administration projects that American production will peak before 2030 and enter a long period of decline.

Having a lasting stable source of supply is important as world oil demand is expected to remain strong for decades to come.

This is particularly true in Asia, the target market for oil exports off Canada’s West Coast.

The International Energy Agency (IEA) projects oil demand in the Asia-Pacific region will go from 35 million barrels per day in 2024 to 41 million barrels per day in 2050.

The growing appeal of Alberta oil in Asian markets shows up not only in expanded Trans Mountain shipments, but also in Canadian crude being “re-exported” from U.S. Gulf Coast terminals.

According to RBN Energy, Asian buyers – primarily in China – are now the main non-U.S. buyers from Trans Mountain, while India dominates purchases of re-exports from the U.S. Gulf Coast. .

BMO said the oil sands offers advantages both in steady supply and lower overall environmental impacts.

“Not only is the resulting stability ideally suited to backfill anticipated declines in world oil supply, but the long-term physical footprint may also be meaningfully lower given large-scale concentrated emissions, high water recycling rates and low well declines,” BMO analysts said.

-

Health17 hours ago

Health17 hours agoSaskatchewan woman approved for euthanasia urged to seek medical help in Canada rather than US

-

Indigenous17 hours ago

Indigenous17 hours agoResidential school burials controversy continues to fuel wave of church arsons, new data suggests

-

Health22 hours ago

Health22 hours agoCanadian gov’t considers sharing census data on gender-confused children

-

International17 hours ago

International17 hours agoFBI didn’t think it had cause to raid Trump but DOJ did it anyway

-

Crime2 days ago

Crime2 days agoTrump designates fentanyl a ‘weapon of mass destruction’

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Business1 day ago

Business1 day agoCOP30 finally admits what resource workers already knew: prosperity and lower emissions must go hand in hand

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria