Also Interesting

A year after Euro 2020 was postponed, soccer fans on the edge of their seats as Euro 2021 begins

Another sign the world is getting closer to ‘normal’… Euro 2021 is here! Soccer fans around the world are geared up for the biggest sporting event in the world since the pandemic hit. Teams representing 24 nations are vying for the championship. Here’s what the pro’s see going into the tournament.

The Euro Top Stats And Records

The moment we’ve all been waiting for is finally here. Euro 2021 is set to kick off in June 2021 and participating teams are already training for the big moment. Bettors looking to make a fortune off their favourite teams and players can ready themselves when the games finally begin. Euro 2021 betting sites are already in full fledge so fans can conveniently gamble on any of the 24 qualified teams and also monitor as Europe’s best teams clash for the cup.

But before the event begins in the next couple of weeks, let’s dive into the records set by top teams and players during the tournament. Keep reading this page to learn more!

The Euro Top Stats And Records

Spain and West Germany have dominated UEFA Euro on the national level. Both teams have won the Euro cup three times. Spain won the tournament in 1964, 2008, and in 2012. West Germany also won the tournament in 1972, 1980, and in 1996.

Listed below are some major Euro statistics recorded since the tournament started in 1960.

UEFA Euro Winner & Highest Scoring Teams Recorded Each Tournament.

|

Year |

Host |

Winner |

Highest Scoring Team |

|

1960 |

France |

Soviet Union |

Yugoslavia, 6 goals. |

|

1964 |

Spain |

Spain |

Russia, Spain, Hungary 4 goals. |

|

1968 |

Italy |

Italy |

Italy, 3 goals |

|

1972 |

Belgium |

West Germany |

West Germany, 5 goals. |

|

1976 |

Yugoslavia |

Czechoslovakia |

West Germany, 6 goals. |

|

1980 |

Italy |

West Germany |

West Germany, 6 goals. |

|

1984 |

France |

France |

France, 14 goals. |

|

1988 |

West Germany |

Netherlands |

Netherlands, 8 goals. |

|

1992 |

Sweden |

Denmark |

Germany, 7 goals. |

|

1996 |

England |

Germany |

Germany, 10 goals. |

|

2000 |

Belgium & Netherlands |

France |

Netherlands, France, 13goals.

|

|

2004 |

Portugal |

Greece |

Czech Republic, England, 10 goals. |

|

2008 |

Austria & Switzerland |

Spain |

Spain, 12 goals.

|

|

2012 |

Poland & Ukraine |

Spain |

Spain, 12 goals. |

|

2016 |

France |

Portugal |

France, 13 goals. |

Final Tournament Appearances

Final Tournament Goals

When it comes to individual player performance, Cristiano Ronaldo currently sets the pace forother players in the EURO competition. For years, he has been at the center of the competition leading his country to the finals and then the champion in 2016.

Cristiano Ronaldo also tops the chart as the highest goal scorer in the tournament (including qualifying) At the moment, he has scored 40 goals for his country, Portugal.

While fans were expecting more of Ronaldo and classic performances from other stunning players like David Silva, Sergio Ramos, and Antoine Greizman in the Euro 2020 competition, all their hopes were dashed when the competition was postponed due to the corona pandemic.

Also Interesting

Alberta Plans To Open iGaming Market After Ontario’s Success

With plans to regulate its iGaming market, Alberta aims to deliver safer gaming experiences, greater variety for players, and stronger consumer protections.

Alberta is preparing to launch a regulated iGaming market, following Ontario’s successful model. By opening the industry to private operators, the province aims to increase competition, enhance consumer protections, and generate significant revenue. If implemented, this move could position Alberta as a key player in Canada’s evolving online gaming landscape.

The Alberta government has announced plans to open its iGaming market, following in the footsteps of Ontario’s regulated model. The move is expected to create a competitive online gaming environment by allowing private operators to enter the market, rather than keeping online gambling under the sole control of Alberta Gaming, Liquor and Cannabis (AGLC). This shift aligns with the province’s broader strategy to modernize its gaming industry, offering more choices for players while generating additional revenue for public services.

Key stakeholders in this expansion include AGLC, which will oversee regulatory compliance and licensing, and private gaming operators looking to secure a presence in the province. While specific details about licensing requirements and revenue-sharing structures are still being finalized, industry experts anticipate a framework similar to Ontario’s, where operators must meet strict guidelines to ensure consumer protection. Although no official launch date has been set, Alberta officials have indicated that the market could open within 2025, pending regulatory approvals and final policy decisions.

Learning from Ontario’s iGaming Model

Ontario’s transition to a regulated iGaming market in 2022 has been widely regarded as a success, providing a model for other provinces like Alberta to follow. By allowing private operators to enter the market under the oversight of iGaming Ontario (iGO), the province created a competitive and transparent industry that offers players a safer and more diverse gaming experience. The shift also helped curb unregulated offshore gambling by giving players legal, well-regulated alternatives.

Since its launch, the market has seen impressive growth. In its first year, the province generated over $1.4 billion in gaming revenue, making it one of the largest regulated online gaming markets in North America. The competitive landscape has attracted dozens of operators, contributing to job creation and economic development while ensuring a steady stream of tax revenue.

Apart from financial success, regulation has strengthened consumer protection through responsible gaming measures, operator accountability, and stringent licensing requirements. This model has boosted government revenue and set a precedent for how other Canadian provinces, including Alberta, can structure their own regulated iGaming markets.

Potential Challenges and Considerations

While Alberta’s plan to open its iGaming market presents significant opportunities, it also comes with challenges that must be carefully managed. One key hurdle is the regulatory framework, as the province must establish clear licensing requirements, tax structures, and operational guidelines to ensure a smooth transition. Policymakers will need to balance industry growth with responsible gaming practices, learning from Ontario’s experience to avoid potential pitfalls.

Responsible gaming will be another major focus, as increased accessibility to online gambling can raise concerns about addiction and player protection. AGLC will need to implement strict measures, including self-exclusion programs, deposit limits, and public awareness campaigns to promote safe gaming habits. Ensuring that operators comply with these measures will be critical to maintaining consumer trust.

Industry and Player Expectations

This move has sparked interest among gaming operators and industry experts. Many see this as a natural progression following Ontario’s success, with expectations that the province will attract major operators eager to expand into a newly regulated space. However, industry leaders will be watching closely to see how Alberta structures its licensing process and tax rates, which will play a key role in determining the market’s competitiveness.

While Alberta is following Ontario’s lead, its approach may differ in key areas. Ontario operates through iGaming Ontario, a regulatory body that oversees private operators, while Alberta may take a more direct role through AGLC. Additionally, given Alberta’s smaller population compared to Ontario, the province may focus on a more controlled rollout rather than opening the market all at once.

For players, the expansion could mean access to a wider range of online casinos, better game variety, including a larger selection of online slots and table games, and more competitive promotions. With private operators entering the scene, expect an increase in sign-up offers, loyalty programs, and exclusive bonuses designed to attract new customers. If executed effectively, Alberta’s iGaming market could create a more dynamic and player-friendly experience while maintaining strong consumer protections.

What Alberta’s iGaming Future Could Look Like

Alberta’s plan to open its iGaming market marks a significant shift toward a more competitive and regulated online gaming industry. By following Ontario’s successful model, the province aims to create a safer and more dynamic gaming environment while driving economic growth. With private operators expected to enter the market under AGLC’s oversight, players will likely benefit from greater choice and enhanced consumer protections.

If Alberta successfully implements this framework, it could set the stage for other provinces to follow, further shaping Canada’s evolving iGaming landscape. A well-regulated market not only boosts provincial revenue but also strengthens responsible gaming initiatives and keeps players within legal platforms. As the industry awaits further details, Alberta’s next steps will be crucial in determining whether it will become Canada’s next major online gaming hub.

Also Interesting

The Economic Impact of Online Poker on Canada’s Gambling Industry

Canada’s online gambling market pulled in $2.64 billion in 2021, with nearly half of that coming from online formats. That figure grew to $3.1 billion by the end of 2023, reflecting the industry’s steady expansion. Meanwhile, offshore sites rake in over $4 billion annually from Canadian players, highlighting the significant outflow of gambling revenue to unregulated platforms.

In Ontario alone, online poker generated $11.7 million in revenue in the first quarter of 2024. Across the country, wagers on online poker exceed $100 million annually, a small slice of Canada’s total gambling market, which surpasses $12.5 billion each year.

Ontario’s regulated system has successfully retained over 85% of its players on locally licensed platforms, setting a precedent for other provinces. As a result, many regions are now considering similar regulatory approaches to keep tax revenues within Canada while ensuring a safer gambling environment for players.

The Role of Tournaments in Driving Revenue

Large-scale poker tournaments have played a pivotal role in shaping Canada’s gambling economy, generating millions in prize pools and boosting tourism. The World Series of Poker (WSOP) Circuit event in Toronto drew over 5,000 entries and awarded more than $5.5 million in 2024, further cementing poker’s economic influence. Similarly, the annual World Poker Tour (WPT) in Montreal attracts both local and international players, significantly benefiting casinos and the hospitality industry.

Online poker in Canada continues to grow steadily amid these live tournaments. Online platforms host major events with guaranteed prize pools that attract thousands of players. This dual presence of live and online tournaments reinforces poker’s financial impact on Canada’s gambling sector.

Employment and Industry Development

The expansion of online gambling has led to the creation of approximately 7,000 new jobs in 2023. From game developers and cybersecurity experts to customer support teams and marketing professionals, the industry has fostered employment growth across various sectors.

Additionally, investment in Canadian gaming studios such as Old Skool Studios, Zartek, and Pear Fiction has surged. These companies play a crucial role in developing innovative gaming content, ensuring a steady influx of new titles that keep players engaged while keeping revenue within Canada’s economy.

Beyond direct employment, gambling revenues support social programs. British Columbia, for instance, allocates $140 million annually from gambling revenues to fund community projects. Other provinces have implemented similar initiatives, demonstrating the broad societal benefits

of the industry beyond casino profits. Other provinces have varied approaches for distributing these funds.

Legal Framework and Consumer Trends

Ontario remains a leader in online poker regulation, with iGaming Ontario overseeing operations and maintaining strict compliance measures. The province saw $14 billion in wagers from 920,000 registered players in early 2023, growing to $17.2 billion by the year’s end, generating $658 million in revenue.

Nationwide, about 30% of adults are registered on at least one online betting site, with a demographic skew toward players aged 30 to 50 years old. Men account for 56% of users, reflecting a gender-based trend in online poker engagement.

With the growing acceptance of online gambling, provincial governments are increasingly considering regulatory frameworks to provide safer, locally governed alternatives to offshore platforms. Esports betting is also gaining traction, with expectations that it will become a significant market segment by 2025.

Mobile and High-Tech Gaming Expansion

The shift towards mobile gaming has redefined player behavior. More gamblers now prefer smartphones over desktops, prompting online casinos and poker sites to optimize their mobile platforms for seamless accessibility.

Artificial intelligence has been incorporated into several aspects of online gambling, such as personalized game recommendations and automated customer support. Additionally, blockchain technology has improved transactional security and payout speeds, ensuring greater transparency for players.

Looking ahead, virtual reality (VR) and augmented reality (AR) are expected to play a more prominent role in online gambling, creating immersive experiences that simulate real-world casino environments. These advancements will likely drive further engagement and attract a younger demographic of tech-savvy players.

The Economic Challenges and Future Prospects

Despite its growth, Canada’s online poker industry faces key challenges, particularly regarding offshore gambling competition and regulatory discrepancies across provinces. Offshore operators continue to attract Canadian players, diverting potential tax revenue away from local

governments. Addressing this issue through a nationwide regulatory approach could help Canada maximize the economic benefits of online poker.

Additionally, the gambling industry’s relationship with responsible gaming initiatives will be crucial in ensuring sustainable growth. With the rise in problem gambling awareness, implementing more robust player protection measures and responsible gaming campaigns will be essential.

The future of online poker in Canada looks promising. As more provinces explore regulatory frameworks, the industry is poised for further expansion, bringing new jobs, increased tax revenues, and enhanced consumer protections. Continued technological innovation and tournament expansion will further solidify Canada’s position as a significant player in the global online poker market.

Conclusion

Online poker plays an integral role in Canada’s gambling industry, contributing millions in revenue, job creation, and technological advancements. With Ontario leading the way in regulation, other provinces are likely to follow suit, fostering a safer and more profitable gaming environment.

However, addressing offshore gambling competition and strengthening responsible gaming measures will be crucial in maintaining industry stability. As mobile gaming, AI, and blockchain continue to evolve, the online poker market will remain a key economic driver in Canada’s gambling sector for years to come.

By fostering regulatory expansion, technological innovation, and responsible gaming practices, Canada can ensure the continued success of its online poker industry, keeping revenue within national borders while offering a secure and engaging experience for players.

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Business2 days ago

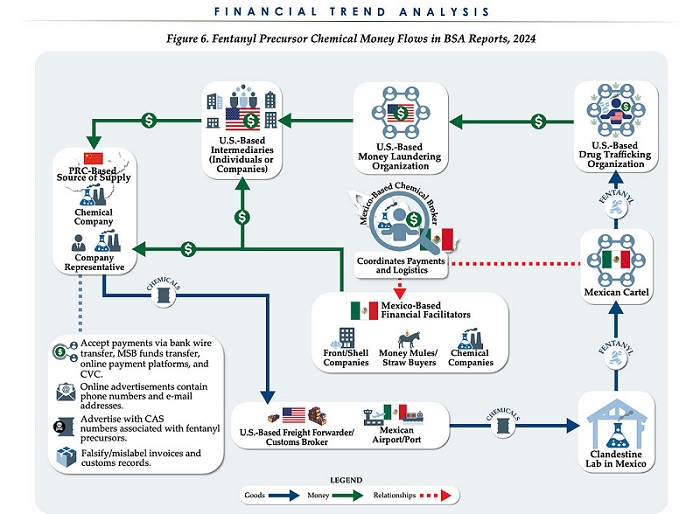

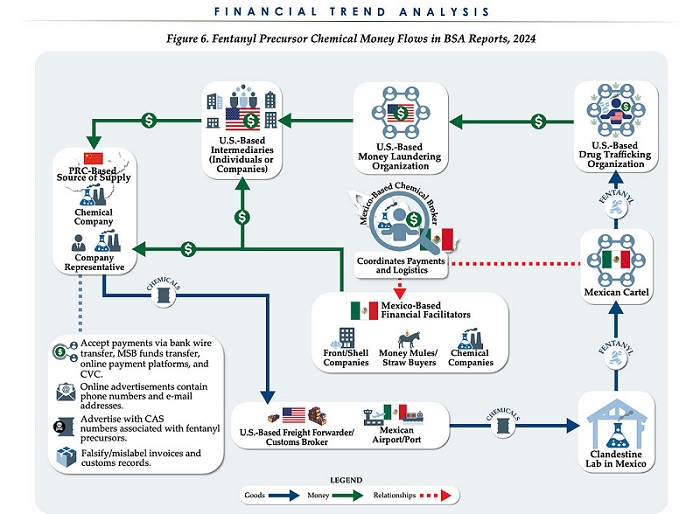

Business2 days agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

COVID-191 day ago

COVID-191 day agoTamara Lich and Chris Barber trial update: The Longest Mischief Trial of All Time continues..

-

Energy2 days ago

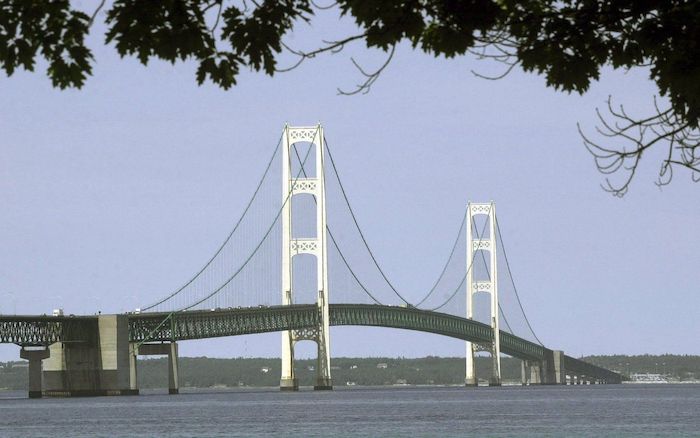

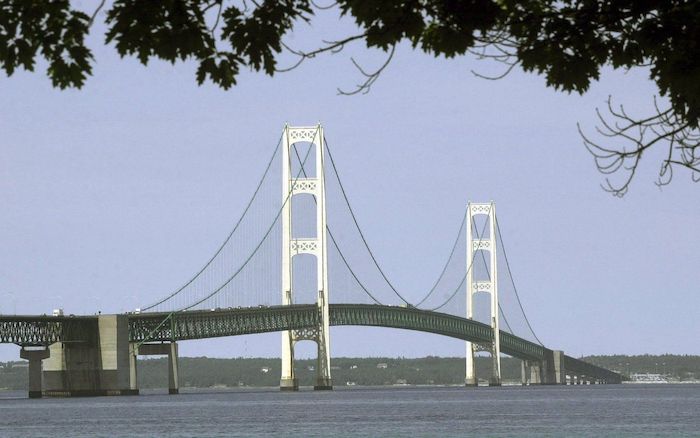

Energy2 days agoStraits of Mackinac Tunnel for Line 5 Pipeline to get “accelerated review”: US Army Corps of Engineers

-

2025 Federal Election16 hours ago

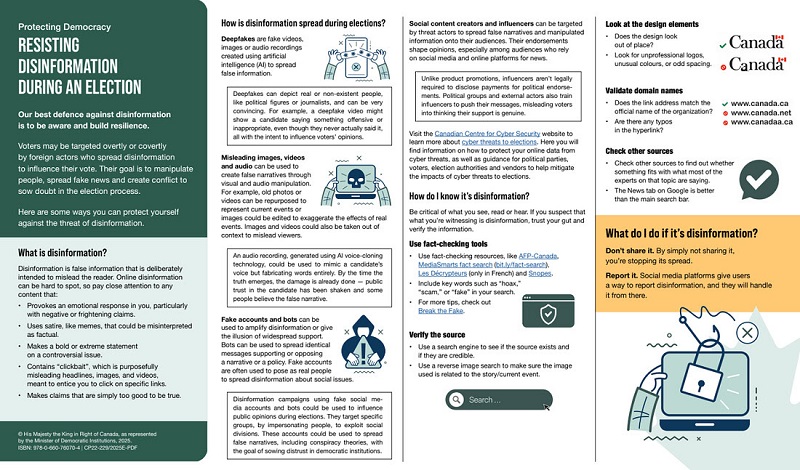

2025 Federal Election16 hours agoPRC-Linked Disinformation Claims Conservatives Threaten Chinese Diaspora Interests, Take Aim at PM Carney’s Debate Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAllegations of ethical misconduct by the Prime Minister and Government of Canada during the current federal election campaign

-

Daily Caller2 days ago

Daily Caller2 days agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties