CBDC Central Bank Digital Currency

A Fed-Controlled Digital Dollar Could Mean The End Of Freedom

From the Daily Caller News Foundation

From the Daily Caller News Foundation

Central bank digital currencies (CBDC) are a threat to liberty.

Sixty-eight countries, including communist China, are exploring the possibility of issuing a CBDC. CBDCs are essentially government-sponsored cryptocurrencies pegged to the value of a national currency that allow for real-time payments.

The European Union has a digital euro CBDC pilot program, and all BRICS nations (Brazil, Russia, India, China and South Africa) are working to stand up CBDCs. China’s CBDC pilot, the largest in the world, is being used by 260 million individuals.

While faster payments are a positive for markets and economic growth, CBDCs present major risks. They would allow governments to meticulously monitor transactions made by their citizens, and CBDCs open the door for government planners to limit the types of transactions made.

Power corrupts, and no government should have that level of control. No wonder China and other authoritarian regimes around the globe are eager to implement a CBDC.

Governments that issue CBDCs could prohibit the sale or purchase of certain goods or services and more easily freeze and seize assets. But that would never happen in the U.S, right? Don’t be so certain.

Take a look at recent events in our neighbor to the north. The government of Canada shut down bank accounts and froze assets of Canadian citizens protesting the COVID-19 vaccination in Ottawa during the winter of 2022. With a CBDC, authoritarian actions of this kind would be even easier to execute.

To make matters worse, the issuance of a CBDC by the Federal Reserve, the U.S.’s central bank, has the potential to undermine the existing banking system. The exact ramifications of what a CBDC would mean to the banking sector are unclear, but such a development could position the Fed to offer banking services directly to American businesses and citizens, undercutting the community banks, credit unions, and other financial institutions that currently serve main street effectively.

The Fed needs to stay out of the banking business – it’s having a hard enough time achieving its core mission of getting inflation under control. A CBDC would open the door for the Fed to compete with the private sector, undercutting economic growth, innovation, and financial access in the process.

Fed Chair Jerome Powell has testified before Congress that America’s central bank would not issue a CBDC without express approval from Congress, but the Fed has studied CBDCs extensively.

For consumers who want the ability to make real-time payments internationally, CBDCs are not the answer. Stablecoins offer a commonsense private sector solution to this market demand.

Stablecoins are a type of cryptocurrency pegged to the value of a certain asset, such as the U.S. dollar. If Congress gets its act together and creates a regulatory framework for stablecoins, many banks, cryptocurrency firms, and other innovative private sector entities would issue dollar-pegged stablecoins. These financial instruments would allow for instantaneous cross-border payments for market participants who find that service of value.

Stablecoins are the free market response to CBDCs. They offer the benefits associated with the technology without the privacy risk, and they would likely enhance, not disrupt, the existing banking sector.

Representatives Patrick McHenry (R-N.C.) and French Hill (R-Ark.) have done yeoman’s work advancing quality, commonsense stablecoin legislation in the House of Representatives, and the Senate needs to move forward on this issue.

Inaction by Congress will force innovators overseas and put the U.S. at a competitive disadvantage. It would also help the Fed boost the case for a CBDC that will undermine liberty and open the door to government oppression.

Tommy Tuberville is a Republican from Alabama serving in the United States Senate. He is a member of the Senate Agriculture Committee, which plays a key role in overseeing emerging digital assets markets.

Carbon Tax

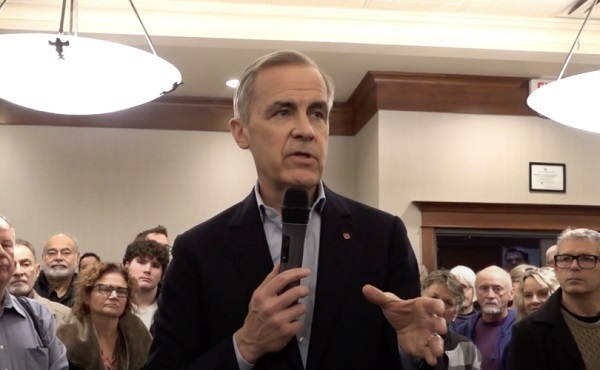

Mark Carney has history of supporting CBDCs, endorsed Freedom Convoy crackdown

From LifeSiteNews

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

World Economic Forum-linked Liberal Party leadership frontrunner Mark Carney has a history of supporting central bank digital currencies, and in 2022 supported “choking off the money” donated to the Freedom Convoy.

In his 2021 book Value(s), Carney said that the “future of money” is a “central bank stablecoin, known as a central bank digital currency or CBDC.”

He noted in his book that such a currency would be similar to current cryptocurrencies such as Bitcoin, but without the private nature afforded to it by its decentralization.

“It is simply untenable in democracies that the core of the monetary system could be based on forms of electronic private money whose creators control large blocks of the currency, like Bitcoin,” he wrote. “Cryptocurrencies are not the future of money.”

Carney noted that a CBDC, if “properly designed,” could serve “all the functions to which private cryptocurrencies and stablecoins aspire while addressing the fundamental legal and governance issues that will, in time, undermine those alternatives.”

Expanding on his worldview in relation to CBDCs, Carney suggested that “fear” can be taken advantage of to shape the future of money.

“With fear on the march, people were willing to surrender to Hobbes’ ‘Leviathan’ such basic rights as the freedom to leave their homes,” he wrote. “And so it is with money. People will support the delegation to independent central banks of the tough decisions that are necessary to maintain the value of money provided the authorities deliver monetary and financial stability.”

Some Canadians are alarmed by the prospect of CBDCs, a fear that only worsened after the Liberals under Prime Minister Justin Trudeau froze hundreds of bank accounts it deemed were importantly linked to the 2022 Freedom Convoy.

During the Freedom Convoy, Carney wrote in an op-ed for the Globe and Mail, “Those who are still helping to extend this occupation must be identified and punished to the full force of the law,” adding that “Drawing the line means choking off the money that financed this occupation.”

Carney is a former head of the Bank of Canada and Bank of England. His ties to globalist groups have led to Conservative Party leader Pierre Poilievre calling him the World Economic Forum’s “golden boy.”

In addition to his comments on CBDCs, Carney has a history of promoting anti-life and anti-family agendas, including abortion and LGBT-related efforts. He has also previously endorsed the carbon tax and even criticized Trudeau when the tax was exempted from home heating oil to reduce costs for some Canadians.

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

The Liberal Party of Canada will choose its next leader, who will automatically become prime minister, on March 9, after Prime Minister Justin Trudeau announced that he plans to step down as Liberal Party leader once a new leader has been chosen.

In contrast to Carney, Poilievre has promised that if he is elected prime minister, he would stop any implementation of a “digital currency” or a compulsory “digital ID” system.

When it comes to a digital Canadian dollar, the Bank of Canada found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Business

Black Rock latest to leave Net Zero Alliance

From The Center Square

By

US House committee investigating 60 companies over ESG policies

Blackrock Inc. is the latest to announce it has left a United Nations-backed Net-Zero Banking Alliance (NZBA), among several within one month and not soon after Donald Trump was elected president. It did so as it and roughly 60 companies are being investigated by Congress for allegedly colluding as a “woke ESG cartel” to “impose radical environmental, social, and governance goals on American companies.”

Last month, Goldman Sachs was the first to withdraw from the alliance, followed by Wells Fargo, The Center Square reported. Citigroup, Bank of America, Morgan Stanley and JPMorgan next announced their departure.

According to the “bank-led and UN-convened” alliance, global banks joined, pledging to align their lending, investment and capital markets activities with a net-zero greenhouse gas emissions target by 2050.

Major U.S. banks began leaving the alliance after President-elect Donald Trump vowed to increase domestic oil and natural gas production and pledged to go after “woke” companies.

They also announced their departure two years after 19 state attorneys general launched an investigation into them for alleged deceptive trade practices connected to ESG.

While the companies haven’t appeared to seem daunted by state investigations, Trump’s reelection appears to be a different matter.

“BlackRock has hung in there as long as it could, but the pressure has become too great, and the reputational and legal risks too high, just before Trump takes office. It won’t be the last financial organization to quit a net zero initiative,” Hortense Bioy, Morningstar Analytics director of sustainable investing research, told Bloomberg News.

Texas Comptroller Glenn Hegar has expressed skepticism about companies claiming to withdraw from ESG commitments, noting there is often doublespeak in announcements, The Center Square reported. This includes statements made by Goldman Sachs, JPMorgan and Blackrock.

Blackrock claims its “participation in NZAMi didn’t impact the way we managed client portfolios. Therefore, our departure doesn’t change the way we develop products and solutions for clients or how we manage their portfolios. … Our commitment to helping our clients achieve their investment goals remains unwavering,” Bloomberg reported.

Last month, the U.S. House Judiciary Committee announced it was investigating more than 60 US-based asset managers’ involvement in the alliance, including BlackRock, Inc., JP Morgan Asset Management, Rockefeller Asset Management, State Street Global Advisors, among others.

The committee also issued a report, “Climate Control: Exposing the Decarbonization Collusion in Environmental, Social, and Governance (ESG) Investing,” saying it found “direct evidence of a ‘climate cartel’ consisting of left-wing activists and major financial institutions that collude to impose radical environmental, social, and governance goals on American companies.”

Under the Trump administration, the committee will continue to investigate if “existing civil and criminal penalties and current antitrust law enforcement efforts are sufficient to deter anticompetitive collusion to promote ESG-related goals in the investment industry.” It also maintains that the companies “must answer for their involvement in prioritizing woke investments over their own fiduciary duties.”

The committee sent letters to dozens of entities in 12 states and the District of Columbia requesting them to provide information by Jan. 10. The majority are located in New York, Massachusetts and California.

-

Automotive2 days ago

Automotive2 days agoHyundai moves SUV production to U.S.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAs PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work

-

armed forces1 day ago

armed forces1 day agoYet another struggling soldier says Veteran Affairs Canada offered him euthanasia

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre Campaigning To Build A Canadian Economic Fortress

-

International16 hours ago

International16 hours agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe Cost of Underselling Canadian Oil and Gas to the USA

-

Opinion8 hours ago

Opinion8 hours agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

Automotive2 days ago

Automotive2 days agoCanadians’ Interest in Buying an EV Falls for Third Year in a Row