Energy

8 ways the Biden / Harris government made gasoline prices higher

From Energy Talking Points

| By Alex Epstein |

Any politician who supports the “net zero” agenda is working to make gasoline prices much higher

This is Part 1 of a 4 part feature where I cover 4 of the top energy issues being discussed this summer

- Every politician will claim this summer that they’re working to make gasoline prices lower, because they know that’s what voters want to hear.

But the many politicians that support “net zero by 2050” are working to make gasoline prices higher.

- For the US to become anywhere near “net zero by 2050,” gasoline use needs to be virtually eliminated.¹

- Since Americans left to their own free will choose to use a lot of gasoline, the only way for “net zero” politicians to eliminate gasoline is to make it unaffordable or illegal.

Low gasoline prices are totally incompatible with “net zero.”

- The Biden-Harris administration knows that all fossil fuels, including gasoline, need to be far more expensive for them to pursue “net zero.” That’s why the EPA set a rising “social cost of carbon” starting at $190/ton—the equivalent of adding $1.50 a gallon to gasoline prices!²

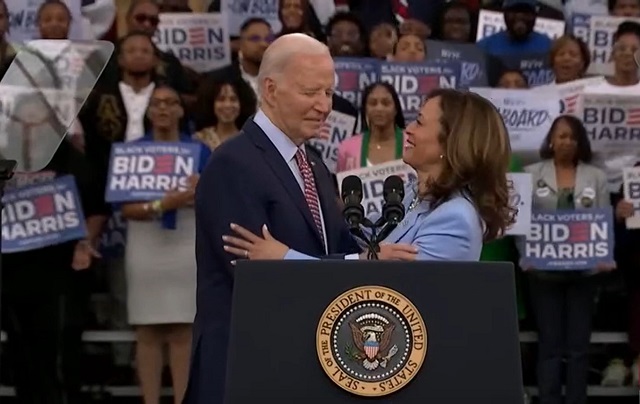

- From Day 1, President Biden has openly supported the destruction of the fossil fuel industry, from his 2019 campaign promise of “I guarantee you, we’re going to end fossil fuel” to his 2021 executive order declaring that America will be “net zero emissions economy-wide” by 2050.³

- Kamala Harris has, unfortunately, been even more supportive of the “net zero” agenda and therefore higher gasoline prices. In 2020 she supported a fracking ban, which would have destroyed 60% of US oil production. And she cosponsored the fossil fuel-destroying Green New Deal.⁴

- Of course, Joe Biden and Kamala Harris, like all politicians, claim to be for lower gasoline prices. But because their real priority is the “net zero” agenda, in practice they are doing everything they can to raise prices.

-

Here are 8 specific actions they’ve taken.

- Biden Gas Gouging Policy #1

Biden has worked to increase gasoline prices by taking a “whole-of-government” approach to reducing greenhouse gas emissions

. This entails reducing oil investment, production, refining, and transport, all of which serves to increase gas prices.⁵

- Biden Gas Gouging Policy #2

Biden has worked to increase gasoline prices by expanding the anti-fossil-fuel ESG divestment movement

. ESG contributed to a 50% decline in oil and gas exploration investments from 2011-2021, resulting in artificially higher prices. Biden is making it worse.The ESG movement is anti-energy, anti-development, and anti-America

·January 6, 2022ESG poses as a moral and financially savvy movement. In reality it is an immoral and financially ruinous movement that is destroying the free world’s ability to produce low-cost, reliable energy. This prevents poor countries from developing and threatens America’s security. Read full story - Biden Gas Gouging Policy #3

Biden has worked to increase gasoline prices via “climate disclosure rules,”

an oil and gas investment-slashing measure that coerces companies into spouting anti-fossil-fuel propaganda and committing to anti-fossil-fuel plans—plans that will raise gas prices.The “climate disclosure” fraud

·Mar 16Congress won’t support Biden’s anti-fossil-fuel agenda. Read full story

- Biden Gas Gouging Policy #4

Biden has worked to increase gasoline prices by issuing a moratorium on oil and gas leases on federal lands, stunting oil and gas production and investment

. When it’s harder to produce and invest in oil, gasoline gets more expensive.⁶

- Biden Gas Gouging Policy #5

Biden has worked to increase gasoline prices by hiking the royalty rate for new oil leases by 50%

. This is money the government gets from the industry on top of taxes. And it discourages oil investments, meaning less production meaning higher gas prices.⁷ - Biden Gas Gouging Policy #6

Biden has worked to increase gasoline prices by restricting oil and gas leasing on nearly 50% of Alaska’s vast petroleum reserve

. This is a crippling blow to Alaska’s oil and gas industry. Less Alaskan oil means higher gas prices.⁸ - Biden Gas Gouging Policy #7

Biden has worked to increase gasoline prices by threatening to stop oil and gas mergers

. Mergers, which increase efficiency, benefit domestic production and lower prices. Blocking mergers raises oil prices long-term, which means higher gas prices.Why government should leave oil and gas mergers alone

·Jun 3Myth: Oil and gas mergers are bad for America because they make oil more expensive. Read full story - Biden Gas Gouging Policy #8

Biden has worked to increase gasoline prices by cancelling the Keystone XL pipeline

. This prevented Canada from using its vast oil deposits to their full potential—meaning lower global supply and higher prices for oil and gasoline.⁹ - Joe Biden should level with the American people and make clear that his agenda is to increase gasoline prices—much like Obama’s infamous admission that “electricity rates would necessarily skyrocket” under his energy plan.

Or he should apologize and embrace energy freedom.¹⁰

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.

2025 Federal Election

Canada Continues to Miss LNG Opportunities: Why the World Needs Our LNG – and We’re Not Ready

From EnergyNow.Ca

By Katarzyna (Kasha) Piquette, Founder and CEO, Canadian Energy Ventures

When Russia invaded Ukraine in 2022, Europe’s energy system was thrown into chaos. Much of the 150 billion cubic meters of Russian gas that once flowed through pipelines had to be replaced—fast. Europe turned to every alternative it could find: restarting coal and nuclear plants, accelerating wind and solar approvals, and most notably, launching a historic buildout of LNG import capacity.

Today, LNG terminals are built around the world. The ‘business case’ is solid. The ships are sailing. The demand is real. But where is Canada?

As of March 28, 2025, natural gas prices tell a story of extreme imbalance. While Europe and Asia are paying around $13 per million BTU, prices at Alberta’s AECO hub remain below $2.20 CAD per gigajoule—a fraction of global market levels. This is more than a pricing mismatch. It’s a signal that Canada, a country rich in natural gas and global goodwill, is failing to connect the dots between energy security abroad and economic opportunity at home.

Since 2022, Europe has added over 80 billion cubic meters of LNG import capacity, with another 80 billion planned by 2030. This infrastructure didn’t appear overnight. It came from urgency, unity, and massive investment. And while Europe was preparing to receive, Canada has yet to build at scale to supply.

We have the resource. We have the relationships. What we lack is the infrastructure.

Estimates suggest that $55 to $75 billion in investment is needed to scale Canadian LNG capacity to match our potential as a global supplier. That includes pipelines, liquefaction terminals, and export facilities on both coasts. These aren’t just economic assets—they’re tools of diplomacy, climate alignment, and Indigenous partnership. A portion of this investment can and should be met through public-private partnerships, leveraging government policy and capital alongside private sector innovation and capacity.

Meanwhile, Germany continues to grapple with the complexities of energy dependence. In January 2025, German authorities seized the Panama-flagged tanker Eventin, suspected of being part of Russia’s “shadow fleet” used to circumvent oil sanctions. The vessel, carrying approximately 100,000 tons of Russian crude oil valued at €40 million, was found adrift off the Baltic Sea island of Rügen and subsequently detained. This incident underscores the ongoing challenges Europe faces in enforcing energy sanctions and highlights the pressing need for reliable, alternative energy sources like Canadian LNG.

What is often left out of the broader energy conversation is the staggering environmental cost of the war itself. According to the Initiative on GHG Accounting of War, the war in Ukraine has produced over 230 million tonnes of CO₂ equivalent (MtCO₂e) since 2022—a volume comparable to the combined annual emissions of Austria, Hungary, the Czech Republic, and Slovakia. These emissions come from military operations, destruction of infrastructure, fires, and the energy used to rebuild and support displaced populations. Yet these emissions are largely absent from official climate accounting, exposing a major blind spot in how we track and mitigate global emissions.

This is not just about dollars and molecules. This is about vision. Canada has an opportunity to offer democratic, transparent, and lower-emission energy to a world in flux. Canadian LNG can displace coal in Asia, reduce reliance on authoritarian suppliers in Europe, and provide real returns to our provinces and Indigenous communities. There is also growing potential for strategic energy cooperation between Canada, Poland, and Ukraine—linking Canadian LNG supply with European infrastructure and Ukrainian resilience, creating a transatlantic corridor for secure and democratic energy flows.

Moreover, LNG presents Canada with a concrete path to diversify its trade relationships, reducing overdependence on the U.S. market by opening new, high-value markets in Europe and Asia. This kind of energy diplomacy would not only strengthen Canada’s strategic position globally but also generate fiscal capacity to invest in national priorities—including increased defense spending to meet our NATO commitments.

Let’s be clear: LNG is not the endgame. Significant resources are being dedicated to building out nuclear capacity—particularly through Small Modular Reactors (SMRs)—alongside the rapid expansion of renewables and energy storage. But in the near term, LNG remains a vital bridge, especially when it’s sourced from a country committed to environmental responsibility, human rights, and the rule of law.

We are standing at the edge of a global shift. If we don’t step up, others will step in. The infrastructure gap is closing—but not in our favor.

Canada holds the key. The world is knocking. It’s time we opened the door.

Sources:

- Natural Gas Prices by Region (March 28, 2025): Reuters

- European LNG Import Capacity Additions: European Commission

- German Seizure of Russian Shadow Fleet Tanker: Reuters

- War Emissions Estimate (230 MtCO₂e): Planetary Security Initiative

Energy

Trump Takes More Action To Get Government Out Of LNG’s Way

From the Daily Caller News Foundation

By David Blackmon

The Trump administration moved this week to eliminate another Biden-era artificial roadblock to energy infrastructure development which is both unneeded and counterproductive to U.S. energy security.

In April 2023, Biden’s Department of Energy, under the hyper-politicized leadership of Secretary Jennifer Granholm, implemented a new policy requiring LNG projects to begin exports within seven years of receiving federal approval. Granholm somewhat hilariously claimed the policy was aimed at ensuring timely development and aligning with climate goals by preventing indefinite delays in energy projects that could impact emissions targets.

This claim was rendered incredibly specious just 8 months later, when Granholm aligned with then-President Joe Biden’s “pause” in permitting for new LNG projects due to absurd fears such exports might actually create higher emissions than coal-fired power plants. The draft study that served as the basis for the pause was thoroughly debunked within a few months, yet Granholm and the White House steadfastly maintained their ruse for a full year until Donald Trump took office on Jan. 20 and reversed Biden’s order.

Certainly, any company involved in the development of a major LNG export project wants to proceed to first cargoes as expeditiously as possible. After all, the sooner a project starts generating revenues, the more rapid the payout becomes, and the higher the returns on investments. That’s the whole goal of entering this high-growth industry. Just as obviously, unforeseen delays in the development process can lead to big cost overruns that are the bane of any major infrastructure project.

On the other hand, these are highly complex, capital-intensive projects that are subject to all sorts of delay factors. As developers experienced in recent years, disruptions in supply chains caused by factors related to the COVID-19 pandemic resulted in major delays and cost overruns in projects in every facet of the economy.

Developers in the LNG industry have argued that this arbitrary timeline was too restrictive, citing these and other factors that can extend beyond seven years. Trump, responding to these concerns and his campaign promises to bolster American energy dominance, moved swiftly to eliminate this requirement. On Tuesday, Reuters reported that the U.S. was set to rescind this policy, freeing LNG projects from the rigid timeline and potentially accelerating their completion.

This policy reversal could signal a broader approach to infrastructure under Trump. The Infrastructure Investment and Jobs Act, enacted in 2021, allocated $1.2 trillion to rebuild roads, bridges, broadband and other critical systems, with funds intended to be awarded over five years, though some projects naturally extend beyond that due to construction timelines. The seven-year LNG deadline was a specific energy-related constraint, but Trump’s administration has shown a willingness to pause or redirect Biden-era infrastructure funding more generally. For instance, Trump’s Jan.20 executive order, “Unleashing American Energy,” directed agencies to halt disbursements under the IIJA and IRA pending a 90-day review, raising questions about whether similar time-bound restrictions across infrastructure sectors might also be loosened or eliminated.

Critics argue that scrapping deadlines risks stalling projects indefinitely, undermining the urgency Biden sought to instill in modernizing U.S. infrastructure. Supporters argue that developers already have every profit-motivated incentive to proceed as rapidly as possible and see the elimination of this restriction as a pragmatic adjustment, allowing flexibility for states and private entities to navigate permitting, labor shortages and supply chain issues—challenges that have persisted into 2025.

For example, the $294 billion in unawarded IIJA funds, including $87.2 billion in competitive grants, now fall under Trump’s purview, and his more energy-focused administration could prioritize projects aligned with his energy and economic goals over Biden’s climate and DEI-focused initiatives.

Ultimately, Trump’s decision to end the seven-year LNG deadline exemplifies his intent to reshape infrastructure policy by prioritizing speed, flexibility and industry needs. Whether this extends formally to all U.S. infrastructure projects remains unclear, but seems likely given the Trump White House’s stated objectives and priorities.

This move also clearly aligns with the overall Trump philosophy of getting the government out of the way, allowing the markets to work and freeing the business community to restore American Energy Dominance in the most expeditious way possible.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoCanada Continues to Miss LNG Opportunities: Why the World Needs Our LNG – and We’re Not Ready

-

COVID-192 days ago

COVID-192 days agoTrump’s new NIH head fires top Fauci allies and COVID shot promoters, including Fauci’s wife

-

Freedom Convoy2 days ago

Freedom Convoy2 days agoFreedom Convoy leaders Tamara Lich, Chris Barber found guilty of mischief

-

Business1 day ago

Business1 day ago‘Time To Make The Patient Better’: JD Vance Says ‘Big Transition’ Coming To American Economic Policy

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoMainstream Media Election Coverage: If the Election Was a NHL Game, the Ice Would be Constantly Tilted Up and to the Left

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre promises to drop ‘radical political ideologies’ in universities

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWill Four More Years Of Liberals Prove The West’s Tipping Point?

-

Business2 days ago

Business2 days agoTrump’s ‘Liberation Day’ – Good News for Canadian Energy and Great News for WCSB Natural Gas