Alberta

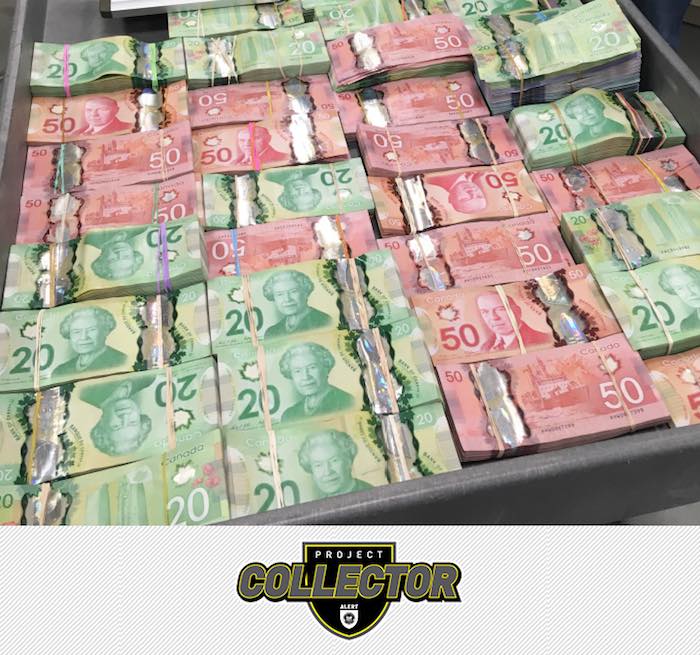

7 arrests. Police seize $16 million in cash, real estate, and vehicles from Alberta, BC money laundering operation

News release from ALERT (Alberta Law Enforcement Response Team)

Project Collector halts Cross-Canada money laundering

Calgary… A professional money laundering organization, working in support of some of Canada’s largest crime groups, has been dismantled following an unprecedented investigation by ALERT and the RCMP.

Project Collector is a three-year financial crime investigation conducted jointly between ALERT Calgary’s financial crime team and RCMP Federal Serious and Organized Crime (FSOC). The investigation began in Calgary and led to the dismantling of a nation-wide criminal organization involved in money laundering.

Seven suspects have been charged, with arrests taking place in Calgary and Vancouver. In addition, more than $16 million in bank accounts, real estate holdings, and vehicles have been placed under criminal restraint.

Proceeds of crime from some of Canada’s largest criminal organizations were allegedly being transported between Ontario, Alberta, and British Columbia. In a one-year period alone investigators identified the transfer of $24 million in cash, while the group’s money laundering activities date back to at least 2013.

Project Collector began in July 2018 after $1 million in cash, that was destined for Vancouver, was intercepted in Calgary. ALERT and RCMP launched an extensive investigation that relied heavily on intelligence from the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Project Collector revealed that the group operated pseudo-bank branches at either side of the country, which while holding large cash reserves, allowed organized crime groups utilizing its service to transfer funds while avoiding the detection of financial banking institutions and authorities. The money laundering was primarily connected back to drug trafficking proceeds.

In total, 71 criminal offences are being pursued against the money laundering organization. Charges include participation in a criminal organization, laundering proceeds of crime, and trafficking property obtained by crime. Charges were also laid under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

The arrests took place in September 2022:

- Lien Ha, 42-year-old from Calgary,

- Donald Hoang, 26-year-old from Vancouver;

- Van Duc Hoang, 64-year-old from Vancouver;

- Van Thi Nguyen, 62-year-old from Vancouver;

- Cynthia Nguyen, 42-year-old from Calgary;

- Yuong Nguyen, 43-year-old from Calgary; and

- Grace Tang, 25-year-old from Vancouver.

During the course of the investigation, search warrants were executed at a total of 10 homes in the Calgary region, Toronto area, and Vancouver.

Project Collector relied on the assistance of a number of police agencies and specialized units, including: Calgary Police Service, Canada Revenue Agency, Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), Forensic Accounting Management Group (FAMG), Vancouver Police, Toronto Police, Edmonton Police, Halton Police, Seized Property Management Directorate, and RCMP units in Ontario and British Columbia.

Members of the public who suspect drug or gang activity in their community can call local police, or contact Crime Stoppers at 1-800-222-TIPS (8477). Crime Stoppers is always anonymous.

ALERT was established and is funded by the Alberta Government and is a compilation of the province’s most sophisticated law enforcement resources committed to tackling serious and organized crime.

Alberta

Alberta takes big step towards shorter wait times and higher quality health care

From the Fraser Institute

On Monday, the Smith government announced that beginning next year it will change the way it funds surgeries in Alberta. This is a big step towards unlocking the ability of Alberta’s health-care system to provide more, better and faster services for the same or possibly fewer dollars.

To understand the significance of this change, you must understand the consequences of the current (and outdated) approach.

Currently, the Alberta government pays a lump sum of money to hospitals each year. Consequently, hospitals perceive patients as a drain on their budgets. From the hospital’s perspective, there’s little financial incentive to serve more patients, operate more efficiently and provide superior quality services.

Consider what would happen if your local grocery store received a giant bag of money each year to feed people. The number of items would quickly decline to whatever was most convenient for the store to provide. (Have a favourite cereal? Too bad.) Store hours would become less convenient for customers, alongside a general decline in overall service. This type of grocery store, like an Alberta hospital, is actually financially better off (that is, it saves money) if you go elsewhere.

The Smith government plans to flip this entire system on its head, to the benefit of patients and taxpayers. Instead of handing out bags of money each year to providers, the new system—known as “activity-based funding”—will pay health-care providers for each patient they treat, based on the patient’s particular condition and important factors that may add complexity or cost to their care.

This turns patients from a drain on budgets into a source of additional revenue. The result, as has been demonstrated in other universal health-care systems worldwide, is more services delivered using existing health-care infrastructure, lower wait times, improved quality of care, improved access to medical technologies, and less waste.

In other words, Albertans will receive far better value from their health-care system, which is currently among the most expensive in the world. And relief can’t come soon enough—for example, last year in Alberta the median wait time for orthopedic surgeries including hip and knee replacements was 66.8 weeks.

The naysayers argue this approach will undermine the province’s universal system and hurt patients. But by allowing a spectrum of providers to compete for the delivery of quality care, Alberta will follow the lead of other more successful universal health-care systems in countries such as Australia, Germany, the Netherlands and Switzerland and create greater accountability for hospitals and other health-care providers. Taxpayers will get a much better picture of what they’re paying for and how much they pay.

Again, Alberta is not exploring an untested policy. Almost every other developed country with universal health care uses some form of “activity-based funding” for hospital and surgical care. And remember, we already spend more on health care than our counterparts in nearly all of these countries yet endure longer wait times and poorer access to services generally, in part because of how we pay for surgical care.

While the devil is always in the details, and while it’s still possible for the Alberta government to get this wrong, Monday’s announcement is a big step in the right direction. A funding model that puts patients first will get Albertans more of the high-quality health care they already pay for in a timelier fashion. And provide to other provinces an example of bold health-care reform.

Alberta

Alberta’s embrace of activity-based funding is great news for patients

From the Montreal Economic Institute

From the Montreal Economic Institute

Alberta’s move to fund acute care services through activity-based funding follows best practices internationally, points out an MEI researcher following an announcement made by Premier Danielle Smith earlier today.

“For too long, the way hospitals were funded in Alberta incentivized treating fewer patients, contributing to our long wait times,” explains Krystle Wittevrongel, director of research at the MEI. “International experience has shown that, with the proper funding models in place, health systems become more efficient to the benefit of patients.”

Currently, Alberta’s hospitals are financed under a system called “global budgeting.” This involves allocating a pre-set amount of funding to pay for a specific number of services based on previous years’ budgets.

Under the government’s newly proposed funding system, hospitals receive a fixed payment for each treatment delivered.

An Economic Note published by the MEI last year showed that Quebec’s gradual adoption of activity-based funding led to higher productivity and lower costs in the province’s health system.

Notably, the province observed that the per-procedure cost of MRIs fell by four per cent as the number of procedures performed increased by 22 per cent.

In the radiology and oncology sector, it observed productivity increases of 26 per cent while procedure costs decreased by seven per cent.

“Being able to perform more surgeries, at lower costs, and within shorter timelines is exactly what Alberta’s patients need, and Premier Smith understands that,” continued Mrs. Wittevrongel. “Today’s announcement is a good first step, and we look forward to seeing a successful roll-out once appropriate funding levels per procedure are set.”

The governments expects to roll-out this new funding model for select procedures starting in 2026.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

Business17 hours ago

Business17 hours agoCanadian Police Raid Sophisticated Vancouver Fentanyl Labs, But Insist Millions of Pills Not Destined for U.S.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre Announces Plan To Cut Taxes By $100,000 Per Home

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTwo Canadian police unions endorse Pierre Poilievre for PM

-

Business2 days ago

Business2 days agoScott Bessent Says Trump’s Goal Was Always To Get Trading Partners To Table After Major Pause Announcement

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney needs to cancel gun ban and buyback