Alberta

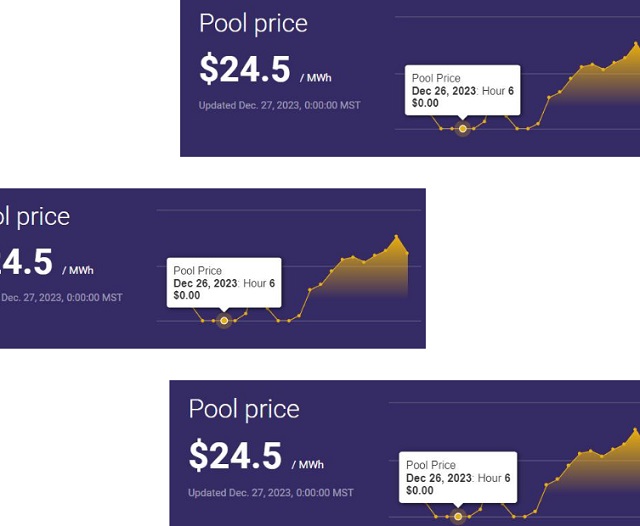

Boxing Day Special! Alberta had free power for several hours, and that’s not a good thing

From the Frontier Centre for Public Policy

Imagine, if you will, a Boxing Day sale where everything was free for everyone across every store at the same time, for several hours.

And imagine if in early morning hours of Dec. 26, Best Buy, Staples, Walmart, and indeed every single store in the entire economy got paid precisely zero dollars for their wares for several hours that morning.

Preposterous, you say!

Indeed, it did happen, in Alberta’s free-wheeling unregulated electrical market. The pool price, as recorded by the Alberta Electric System Operator (AESO) was $0.00 per megawatt at 4-7 a.m., and from 11 a.m. until noon.

And as a pool price, that means unless there’s some other contract going, that’s the price all generators get paid.

I might not have an MBA, but I’m fairly certain no business model in the world can survive getting paid nothing at all for their product for terribly long. If McDonalds, Burger King and Tim Horton’s all gave away their breakfasts on Dec. 26 to all comers, they couldn’t do it for long before someone would realize this is idiocy and shut the doors.

So what was happening during those wee hours in the morning, as the Boxing Day shoppers were in line for their flat screen TVs? It was quite windy in Alberta.

X bot account @ReliableAB, which logs hourly reports of the AESO minute-by-minute reporting of the grid showed that wind generation was just a hummin’. For several weeks, Alberta wind power has been been frequently pumping out high numbers, often in excess of 70 per cent of its nameplate capacity. One would think this would be a great thing, right? It’s finally doing what it’s supposed to do.

At 4:38 a.m., @ReliableAB reported Alberta’s now 45 wind farms were putting out 3,508 megawatts of the installed capacity of 4,481 megawatts while the pool price was zero.

At that point, wind was generating a full 33 per cent of total generation, which again, sounds like great news.

It was during one of the deadest periods of economic activity in the whole year, the night after Christmas. Demand in Alberta was low, with an internal load of 9,632 megawatts. The lack of demand happened to coincide with lots of surplus power being dumped onto the grid.

(As it was still dark, solar wasn’t a factor.)

What to do? How about sell as much as you can?

And that’s what happened. Alberta was pumping out 995 megawatts of power exports to its neighbours, 967 megawatts to BC, 26 to Saskatchewan, and two megawatts to Montana.

This situation is also the converse of what I’ve been reporting on over almost precisely 24 months, the frequent collapse of wind power generation in Alberta. Almost every time that has happened, the pool price shoots up, often hitting $700, $800, $900 or even the theoretical maximum of $999.99 per megawatt hour. If the maximum was $2,000, I’m willing to bet it would have hit those heights, too. And the integral under that graph – what consumers get on their bill – is horrendous.

So here we have renewable, “green” power in surplus, driving prices down for everyone, and so much so that it can benefit the neighbours, too.

But therein is the fundamental problem. No one, not Best Buy, McDonalds or Capital Power can produce product for nothing, and definitely not for extended periods. There is a cost to generating power, be it capital or fuel or operating costs. Nor can they sell their products, be it flat screen TVs, hamburgers or electricity for next to nothing, either. The entire economic model will collapse, and then what? Who will provide the power then?

When I wrote my first story on Alberta wind power on Dec. 28, 2021, the province had 2,269 megawatts on nameplate wind generation capacity. It’s now double that, at 4,481 megawatts, a level where big swings in wind power production have a huge impact. And Alberta’s last coal plant will switch to natural gas in a few months.

And there’s more wind coming. Oct. 24, the Calgary Herald noted, “More than 3,500 megawatts of renewable power generation projects are now under construction in Alberta.

“By the end of August, the AESO received 74 wind and solar project applications after the moratorium was announced, (Premier Danielle) Smith noted.”

What’s going to happen when all that comes online, when Alberta will have around 9,600 megawatts of wind and solar, almost equal to daily demand? Will the grid be flooded with power so cheap that reliable, dispatchable power generators can’t stay in business, only to see prices skyrocket when wind and solar inevitably fail, as they frequently do, and at the worst times?

Sounds like a recipe for utter chaos. And blackouts.

Brian Zinchuk is editor and owner of Pipeline Online, and occasional contributor to the Frontier Centre for Public Policy. He can be reached at [email protected].

Alberta

Alberta takes big step towards shorter wait times and higher quality health care

From the Fraser Institute

On Monday, the Smith government announced that beginning next year it will change the way it funds surgeries in Alberta. This is a big step towards unlocking the ability of Alberta’s health-care system to provide more, better and faster services for the same or possibly fewer dollars.

To understand the significance of this change, you must understand the consequences of the current (and outdated) approach.

Currently, the Alberta government pays a lump sum of money to hospitals each year. Consequently, hospitals perceive patients as a drain on their budgets. From the hospital’s perspective, there’s little financial incentive to serve more patients, operate more efficiently and provide superior quality services.

Consider what would happen if your local grocery store received a giant bag of money each year to feed people. The number of items would quickly decline to whatever was most convenient for the store to provide. (Have a favourite cereal? Too bad.) Store hours would become less convenient for customers, alongside a general decline in overall service. This type of grocery store, like an Alberta hospital, is actually financially better off (that is, it saves money) if you go elsewhere.

The Smith government plans to flip this entire system on its head, to the benefit of patients and taxpayers. Instead of handing out bags of money each year to providers, the new system—known as “activity-based funding”—will pay health-care providers for each patient they treat, based on the patient’s particular condition and important factors that may add complexity or cost to their care.

This turns patients from a drain on budgets into a source of additional revenue. The result, as has been demonstrated in other universal health-care systems worldwide, is more services delivered using existing health-care infrastructure, lower wait times, improved quality of care, improved access to medical technologies, and less waste.

In other words, Albertans will receive far better value from their health-care system, which is currently among the most expensive in the world. And relief can’t come soon enough—for example, last year in Alberta the median wait time for orthopedic surgeries including hip and knee replacements was 66.8 weeks.

The naysayers argue this approach will undermine the province’s universal system and hurt patients. But by allowing a spectrum of providers to compete for the delivery of quality care, Alberta will follow the lead of other more successful universal health-care systems in countries such as Australia, Germany, the Netherlands and Switzerland and create greater accountability for hospitals and other health-care providers. Taxpayers will get a much better picture of what they’re paying for and how much they pay.

Again, Alberta is not exploring an untested policy. Almost every other developed country with universal health care uses some form of “activity-based funding” for hospital and surgical care. And remember, we already spend more on health care than our counterparts in nearly all of these countries yet endure longer wait times and poorer access to services generally, in part because of how we pay for surgical care.

While the devil is always in the details, and while it’s still possible for the Alberta government to get this wrong, Monday’s announcement is a big step in the right direction. A funding model that puts patients first will get Albertans more of the high-quality health care they already pay for in a timelier fashion. And provide to other provinces an example of bold health-care reform.

Alberta

Alberta’s embrace of activity-based funding is great news for patients

From the Montreal Economic Institute

From the Montreal Economic Institute

Alberta’s move to fund acute care services through activity-based funding follows best practices internationally, points out an MEI researcher following an announcement made by Premier Danielle Smith earlier today.

“For too long, the way hospitals were funded in Alberta incentivized treating fewer patients, contributing to our long wait times,” explains Krystle Wittevrongel, director of research at the MEI. “International experience has shown that, with the proper funding models in place, health systems become more efficient to the benefit of patients.”

Currently, Alberta’s hospitals are financed under a system called “global budgeting.” This involves allocating a pre-set amount of funding to pay for a specific number of services based on previous years’ budgets.

Under the government’s newly proposed funding system, hospitals receive a fixed payment for each treatment delivered.

An Economic Note published by the MEI last year showed that Quebec’s gradual adoption of activity-based funding led to higher productivity and lower costs in the province’s health system.

Notably, the province observed that the per-procedure cost of MRIs fell by four per cent as the number of procedures performed increased by 22 per cent.

In the radiology and oncology sector, it observed productivity increases of 26 per cent while procedure costs decreased by seven per cent.

“Being able to perform more surgeries, at lower costs, and within shorter timelines is exactly what Alberta’s patients need, and Premier Smith understands that,” continued Mrs. Wittevrongel. “Today’s announcement is a good first step, and we look forward to seeing a successful roll-out once appropriate funding levels per procedure are set.”

The governments expects to roll-out this new funding model for select procedures starting in 2026.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

Business2 days ago

Business2 days agoStocks soar after Trump suspends tariffs

-

COVID-192 days ago

COVID-192 days agoBiden Admin concealed report on earliest COVID cases from 2019

-

Business2 days ago

Business2 days agoScott Bessent Says Trump’s Goal Was Always To Get Trading Partners To Table After Major Pause Announcement

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

Business1 day ago

Business1 day agoTimeline: Panama Canal Politics, Policy, and Tensions

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

COVID-191 day ago

COVID-191 day agoFauci, top COVID officials have criminal referral requests filed against them in 7 states

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity