International

Bombshell report shows FBI had ‘informants’ in Washington, DC on January 6

From LifeSiteNews

By Stephen Kokx

The FBI had at least 26 “confidential human sources” on the ground in D.C. that day, with three being sent there directly to report on events. The other 23 were allegedly there on their own accord, of which three entered the Capitol while eleven went into the restricted area, purportedly having not been directed to do so by the government.

A bombshell report by the Department of Justice’s Inspector General is being heralded by conservatives as evidence the U.S. government was involved in the January 6 protest on Capitol Hill in 2021.

GOP Congressman Thomas Massie published an X post this week arguing that the report, which confirms that there was more than two dozen FBI “informants” in Washington, D.C. that day, vindicates his many past statements.

“For years I was called a conspiracy theorist for asking … whether government assets participated in J6,” Massie said. “Yesterday I was vindicated. DOJ IG report confirms there were FBI confidential human sources in the crowd, entering the Capitol, and breaking laws.”

Massie informed his X followers that the report additionally reveals that the FBI paid the travel expenses for one of its informants.

The 88-page report garnered headlines from every corner of the political world earlier this week. Among its most alarming findings is that the FBI had at least 26 “confidential human sources” on the ground in D.C. that day, with three being sent there directly to report on events. The other 23 were allegedly there on their own accord, of which three entered the Capitol while eleven went into the restricted area, purportedly having not been directed to do so by the government.

Conservative influencer Charlie Kirk was outraged over the report. In an X post, he asked: “Was this entrapment? Why did it take us four years to learn this?”

BREAKING: An Inspector General Report confirms the FBI had 26 confidential human sources on the ground at J6 and that some of them went into the Capitol.

Was this entrapment?

Why did it take us four years to learn this?Criminal. pic.twitter.com/D1xSyifGdX

— Charlie Kirk (@charliekirk11) December 12, 2024

Incoming Vice President JD Vance has also drawn attention to the report. “For those keeping score at home, this was labeled a dangerous conspiracy theory months ago,” he said on X.

Left-wing media have been quick to point out that the informants were not “agents” and that the report found that they were not “directed” to orchestrate the protest. They say that this debunks Trump’s and other Republican’s long-standing claims that the government was behind the protest.

But Trump and many others have repeatedly spoken about the Deep State’s complicity in the protest in a general way while also pointing out that the corrupt January 6 House Select Committee that included Liz Cheney and other RINO lawmakers withheld evidence that showed the extent of the government’s involvement.

Sports commentator Stephen A. Smith, who does not normally share his opinions on politics, felt the need to opine on the matter given the blatant misinformation the media had spread about it previously.

“I’m really, really sick and tired of every time I turn around, I’m finding something else that the Democrats have lied about or downplayed or misrepresented along the way,” he said on his podcast this week.

“The Democrats worked really, really diligently to make the case that the right had a monopoly on insidious, evil tendencies … we turn around and find out that at least some of them are guilty of the same s—.”

Since Trump’s election, many January 6 prisoners have held out hope that they would receive pardons for their sentences. Trump himself said he would “be acting very quickly” to help them during an interview with MSNBC recently. Former prisoner Leo Kelly of Cedar Rapids, Iowa told LifeSite he hopes Trump will do that soon after he takes office.

Autism

RFK Jr. Completely Shatters the Media’s Favorite Lie About Autism

The Vigilant Fox

The Vigilant Fox

They say autism is rising because of “better diagnosis”—but RFK Jr. just blew that narrative wide open. He brought the hard data and dropped one undeniable truth the denialists can’t explain.

HHS Secretary Robert Kennedy Jr. appeared on Hannity Thursday evening and unloaded on the predominant autism narrative. It started with a bombshell reveal from Kennedy’s own childhood.

Hannity asked: “What was the number when you were a kid—and what do you think is going on?”

Kennedy replied: “There’s really good data on that.”

He pointed to one of the largest studies ever conducted—900,000 children in Wisconsin, published in a top-tier medical journal.

“It looked at 900,000 kids. It was published in a high-gravitas journal, peer-reviewed study, and they found the rate to be 0.7 out of 10,000.”

That’s less than 1 in 10,000. Today? It’s around 1 in 31.

Let that sink in.

Join 110K+ Substack readers and 1.6 million 𝕏 users who follow the work of Vigilant Fox.

Subscribe for top-tier news aggregation and exclusive stories you won’t find anywhere else.

That’s when Kennedy sounded the alarm on what’s happening now—and why it’s so catastrophic. He said the rise isn’t just in frequency—it’s in severity.

“Two years ago, it was 1 in 36. The CDC data we released this week shows 1 in 31,” Kennedy said.

“The worst state is California,” Kennedy continued, “which actually has the best collection methodologies. So they actually, probably reflect what we’re seeing nationwide.”

“In California, it’s 1 in every 20 kids, and 1 in every 12.5 boys,” he explained.

Even worse, he said the numbers are likely underreported in minority communities. And for many kids, the symptoms are devastating:

“About 25% of the population of those kids with autism, about 25% of them are nonverbal, nontoilet trained,” Kennedy explained.

“They have all of these stereotypical behaviors, the head banging, biting, toe walking, stimming, and that population is growing higher and higher.”

“It’s becoming a larger percentage, so we’re seeing many more cases that are now linked to severe intellectual disability.”

He says it’s a glaring red warning sign—and it’s past time to start acting on it.

And this was the moment that Kennedy took a flamethrower to the media narrative about autism. He shattered the core excuse we’ve all been fed—that this epidemic isn’t real, that it’s just a change in how we count it.

He’s not buying it.

“The media has bought into this industry canard, this mythology, that we’re just seeing more autism because we’re noticing it more. We’re better at recognizing it or there’s been changing diagnostic criteria.”

But the scientific literature, Kennedy said, says otherwise.

“There is study after study in the scientific literature going back, and they decided that the literature going back says decades that says that’s not true.”

He then cited a major investigation by California’s own lawmakers.

“In fact, the California legislature… asked the Mind Institute at UC Davis to look exactly at that topic. They [asked], is it real or are we just noticing it more? The Mind Institute came back and said, ‘Absolutely this is a real epidemic. This is something we’ve never seen before.’”

And he made it painfully clear:

“Anybody with common sense, Sean, would notice that, because the autism—this epidemic is only happening in our children. It’s not happening in people who are our age. And if it was better recognition, you’d see it in 70-year-old men.”

But we don’t.

And after laying out the data, dismantling the media narrative, and exposing the severity of the crisis, Kennedy concluded with a clarion call to get to the bottom of this epidemic.

That’s why he says it’s time to dig deeper—leave no stone unturned, and we may have answers sooner than you think.

“President Trump asked me to find out what’s causing it,” he told Hannity.

“And I am approaching that agnostically. We are looking at everything, we are going to do, we’re going to be very transparent in how we design the studies.”

To get real answers, he’s farming the research out to top institutions across the country—with full transparency from day one.

“We’re going to farm the studies out to 15 premier research groups from all over the country. And we’re going to be transparent about our protocols, about the data sets, and then every study will have to be replicated.”

The list of possible factors is long—and nothing is being ruled out, Kennedy explained.

“We’re going to look at mold. We’re going to look at the age of parents. We’re going to look at food and food additives. We’re going to look at pesticides and toxic exposures. We’re going to look at medicines. We’re going to look at vaccines. We’re going to look at everything.”

When asked how long it would take, Kennedy didn’t miss a beat.

“I think we’ll have some preliminary answers in six months. It will take us probably a year from then before we can have definitive answers because a lot of the studies will not go out until the end of the summer.”

For the first time in decades, someone is asking the hard questions—and demanding real answers.

This time, nothing is off-limits.

Thanks for reading. If you value the work being published here, upgrading your subscription is the most powerful way to support it. The more this Substack earns, the more I can do to improve quality and create the best reader experience possible.

Thank you for your support.

Energy

‘War On Coal Is Finally Over’: Energy Experts Say Trump Admin’s Deregulation Agenda Could Fuel Coal’s ‘Revival’

From the Daily Caller News Foundation

By Audrey Streb

Within the first months of his second administration, President Donald Trump has prioritized “unleashing” American energy and has already axed several of what he considers to be burdensome regulations on the coal industry, promising it’s “reinvigoration.”

Trump signed an executive order on April 8 to revive the coal industry, and shortly after moved to exempt several coal plants from Biden-era regulations. Though it has become a primary target of many climate activists, coal has been historically regarded as readily available and affordable, and several energy policy experts who spoke with Daily Caller News Foundation believe Trump has the cards necessary to strengthen the industry.

“When utility bills are skyrocketing or blackouts are happening in winter, people are going to want reliable power back,” Amy Cooke, co-founder and president of Always on Energy Research and the director of the Energy and Environmental Policy Center told the DCNF. “The beauty of coal is that it allows for affordable, reliable power, which is absolutely crucial to economic prosperity, and in particular, innovation.”

“I think the number one, most significant threat to humanity is no power,” Cooke said, adding that coal is a vital contributor to the nation’s “baseload power.”

Following his executive order, Trump in early April granted a two-year exemption for nearly 70 coal plants from a Biden-era rule on air pollution that required them to reduce certain air pollutants. The Environmental Protection Agency (EPA) said that the move would “bolster coal-fired electricity generation, ensuring that our nation’s grid is reliable, that electricity is affordable for the American people, and that EPA is helping to promote our nation’s energy security.”

Shortly after, skepticism swirled surrounding whether or not the coal industry would be able to experience a revival, and whether it would be economically savvy to pursue one.

Energy generated from burning coal only powers roughly 16% of the U.S., though 40 states are dependent on coal, according to data from America’s Power. Energy generation through coal reached a record low in 2023, a Rhodium Group study reported. In 2021, however, coal was the primary source of energy for 15 states, according to the U.S. Energy Information Administration.

“We can lead the world in innovation,” Cook told the DCNF, referencing developments in natural gas and nuclear power as beneficial. “But you have to have coal. It has to be part of the mix.”

“It’s insane that we would shut down any base load power right now, when the demand for power is so high,” Cooke added. She further referenced the North American Electric Reliability Corporation’s 2024 report and research from Always on Energy Research that have projected rolling blackouts to begin across the U.S. by 2028.

As American energy demand continues to climb, the odds of impending blackouts would increase if the supply fails to grow at the same rate. The push toward renewable energy sources, in addition to stringent environmental regulations approved under former President Joe Biden, may have contributed to the slower growth of energy supply currently being experienced in the U.S.

Immediately after returning to the White House, Trump declared a national energy emergency, stating that “the integrity and expansion of our Nation’s energy infrastructure” is “an immediate and pressing priority for the protection of the United States’ national and economic security.”

“We looked at it and predict that there will be periods of blackouts of 24 hours or more,” Cook told the DCNF.

She further noted that “the cheapest power is the power you’ve already paid for,” arguing for the continuation of existing coal plants and the reopening of ones that have been closed.

“The only people who think coal is bad are those who view it through the lens of carbon emissions only, and that is no way to do energy policy,” Cooke said, arguing that it is necessary to adopt a “holistic” approach to energy generation, given the nation’s projected energy crisis.

“The American people need more energy, and the Department of Energy is helping to meet this demand by unleashing supply of affordable, reliable, secure energy sources – including coal,” Department of Energy Secretary Chris Wright said in an April 9 statement. “Coal is essential for generating 24/7 electricity,” he added, “but misguided policies from previous administrations have stifled this critical American industry. With President Trump’s leadership, we are cutting the red tape and bringing back common sense.”

The president has also said that he envisions greater job opportunities for coal miners with the industry’s expansion, stating during an April 8 press conference that the workers are “really well-deserving and great American patriots.”

“For years, people would just bemoan this industry and decimate the industry for absolutely no reason,” Trump added.

“Miners can wake up today for the first time in a decade and their spouses and families will realize they have a job tomorrow,” reporter Bob Aaron said in a video shared on X. They can “hear a president of the country announce that the war on coal is over.”

“I really anticipate a revival in the coal industry in the United States under Trump,” David Blackmon, an energy and policy writer who spent 40 years in the oil and gas business told the DCNF. He pointed to the Trump administration loosening restrictions on coal, adding that the Biden administration made it “near impossible” to build new coal plants due to aggressive climate rules.

Under Biden’s signature climate bill, the Inflation Reduction Act, the U.S. prioritized renewable energy generation and subsidization, resulting in a hefty price tag for taxpayers who had to foot the bill for several environmental initiatives, including hundreds of millions of dollars for solar panel construction in some of the nation’s least-sunny locations.

“The cheapest, the most affordable thing to do is to keep our current infrastructure online,” André Béliveau, Senior Manager of Energy Policy at the Commonwealth Foundation, told the DCNF. “Coal remains one of, if not, the most affordable energy source we have.”

“You’re forcing retirement of full-time energy sources and trying to replace them with part-time energy sources, and that’s not going to work,” Béliveau continued, referencing renewable energy avenues such as wind and solar. “We can’t run a full-time economy on part-time energy.”

-

Business2 days ago

Business2 days agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

espionage2 days ago

espionage2 days agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

Daily Caller2 days ago

Daily Caller2 days agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAllegations of ethical misconduct by the Prime Minister and Government of Canada during the current federal election campaign

-

Energy2 days ago

Energy2 days agoStraits of Mackinac Tunnel for Line 5 Pipeline to get “accelerated review”: US Army Corps of Engineers

-

Opinion2 days ago

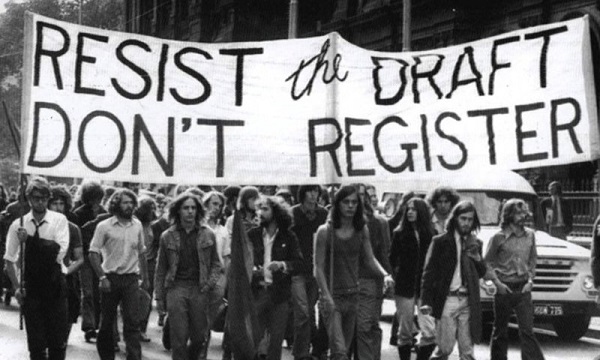

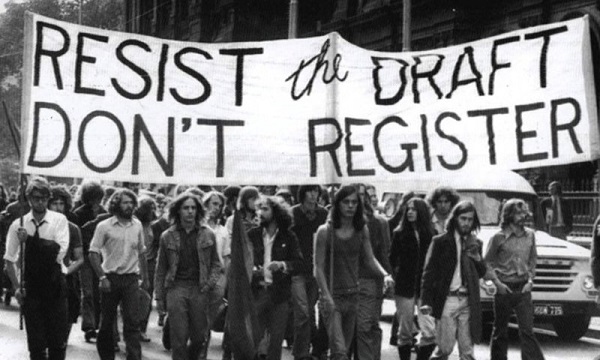

Opinion2 days agoLeft Turn: How Viet Nam War Resisters Changed Canada’s Political Compass