National

BC high school scraps gender-neutral bathroom plan after parental outrage

From LifeSiteNews

Pleasant Valley Secondary School in Armstrong, British Columbia, has re-opened single-sex bathrooms after having closed them in favor of ‘gender-neutral’ only facilities.

After outcry from parents and students alike, a Canadian high school has reversed course and reinstated boys’ and girls’ bathrooms after it scrapped them in favor of solely “gender-neutral” options.

Earlier this month, Pleasant Valley Secondary School in Armstrong, British Columbia, had closed the boys’ and girls’ bathrooms, effectively forcing all students to use so-called “gender-neutral” facilities. Shortly after, parents expressed their outrage on social media, relaying concerns passed along by their children who felt uncomfortable with the new arrangement.

Following parental backlash, the school’s principal, Steve Drapala, reversed course and reinstated single-sex facilities.

One father of a teenage girl at the school, Josh Ellis, noted that washrooms are meant to be a “private place” and forcing boys and girls to use the same facilities obviously diminishes that feeling of privacy.

Ellis’s wife Jolene said that their daughter had finally decided to use the gender-neutral bathrooms, only to be harassed by a group of boys who pounded away at her stall.

LifeSiteNews had reported on the initial outrage from parents because of the school’s gender-neutral bathroom policy.

While having separate washrooms for boys and girls is a matter of common sense, gender ideologues have continued to attack the notion of biological reality, with the most noticeable push happening in Western nations like the United States and Canada. This has led to instances of young girls being exposed to men pretending to be women using change-rooms and other private facilities.

In Canada, much of this began after the Senate in 2017 passed a pro-transgender bill that added “gender expression” and “gender identity” to Canada’s Human Rights Code and to the Criminal Code’s hate crime section.

International

Pope Francis Got Canadian History Wrong

From the Frontier Centre for Public Policy

Pope Francis’s careless genocide comment gave activists the fuel they needed, and Parliament rushed to judgment without examining the facts

Many Catholics will grieve the death of Pope Francis. But not all.

That’s because Francis was arguably the most political Pope in recent memory. Depending on your definition, he was either a socialist or a communist. There wasn’t a leftist leader or cause he didn’t embrace, and few conservative ones he supported. He regularly weighed in on progressive issues like climate change and offered political opinions, even when he seemed to lack a full understanding of the topic.

One such issue was Canadian history.

In 2021, the Tk’emlúps te Secwépemc First Nation announced that ground-penetrating radar had detected anomalies near the former Kamloops Indian Residential School, interpreted by some as possible unmarked graves of children. The claim made international headlines and sparked widespread outrage, although no remains have ever been unearthed.

During a late-night flight, the ailing octogenarian Pope, seemingly charmed by a young reporter, described Canada’s residential schools as “genocide,” a departure from his earlier, carefully prepared statement, which made no such accusation and echoed apologies offered by his predecessors. Those statements expressed regret for harm done but also acknowledged the good work of countless priests and nuns who dedicated their lives to educating Indigenous children.

In a moment of startling informality, Pope Francis appeared to accept the now-disputed Kamloops story as fact, effectively accusing thousands of priests, nuns, teachers and support workers—both Indigenous and non-Indigenous—of committing genocide. He appeared to accept at face value the now-disputed Kamloops story of secret burials and sinister deaths. In doing so, he didn’t just slander individuals—he changed Canadian history.

“Yes, it’s a technical word, genocide. I didn’t use it because it didn’t come to mind. But yes, I described it. Yes, it’s a genocide,” Francis said in July.

Indigenous activists wasted no time. They realized those words were exactly what they needed. Their initial genocide motion in Parliament—based on the Kamloops claim of 215 hidden graves—had failed. But with the Pope’s remarks, the political climate shifted.

NDP MP Leah Gazan led the charge. She had introduced a motion after the Kamloops claim first surfaced. She returned the following year with the same proposal, and this time, the Pope’s comments gave it new weight.

The motion declared Canada’s treatment of Indigenous children in residential schools as genocide—a declaration that, while not legally binding, carries moral and political weight. It passed quickly and without debate.

The irony? The very same activists who had earlier promoted deeply anti-Catholic conspiracy theories about atrocities committed by priests and nuns—stories that fuelled church burnings across Canada—were now treating every word from the Pope’s mouth as gospel. Non-believers appeared to be embracing some version of papal infallibility (a Catholic doctrine that, in specific cases, the Pope’s declarations are considered free from error)—if only when it suited them.

Meanwhile, Parliament failed to do its homework. Elected representatives never seriously investigated the many holes in the Kamloops story. Despite the global headlines, no excavations at the Kamloops site have confirmed the presence of remains. Multiple independent experts have raised concerns about the methodology and public interpretation of the findings.

Yet MPs allowed themselves to be swayed. Incredibly, they spent just 47 seconds debating and approving a motion that condemned their own country for genocide.

Much has been written about the lack of evidence behind the Kamloops claim. Suffice it to say, the “remains of 215 children” turned out to be an old sewage trench. Think about that—our nation was convicted of genocide based on a sewage trench.

Earlier popes took a more thoughtful approach. They acknowledged that wrongs were committed, that abuse occurred, and that some individuals within the system failed. But they also recognized that the goal of educating Indigenous children was legitimate, and that many students gained literacy and language skills that served them for life.

Those are the papal perspectives worth remembering.

Pope Francis did much good in his life, and many will reflect fondly on his legacy. But when it comes to Canada, his careless and misinformed comments on genocide did real harm. Let’s hope the next Pope is more careful with his late-night musings.

Brian Giesbrecht is a retired judge and a senior fellow at the Frontier Centre for Public Policy.

2025 Federal Election

Conservatives promise to ban firing of Canadian federal workers based on COVID jab status

From LifeSiteNews

The Conservative platform also vows that the party will oppose mandatory digital ID systems and a central bank digital currency if elected.

Pierre Poilievre’s Conservative Party’s 2025 election platform includes a promise to “ban” the firing of any federal worker based “solely” on whether or not they chose to get the COVID shots.

On page 23 of the “Canada First – For A Change” plan, which was released on Tuesday, the promise to protect un-jabbed federal workers is mentioned under “Protect Personal Autonomy, Privacy, and Data Security.”

It promises that a Conservative government will “Ban the dismissal of federal workers based solely on COVID vaccine status.”

The Conservative Party also promises to “Oppose any move toward mandatory digital ID systems” as well as “Prohibit the Bank of Canada from developing or implementing a central bank digital currency.”

In October 2021, the Liberal government of former Prime Minister Justin Trudeau announced unprecedented COVID-19 jab mandates for all federal workers and those in the transportation sector. The government also announced that the unjabbed would no longer be able to travel by air, boat, or train, both domestically and internationally.

This policy resulted in thousands losing their jobs or being placed on leave for non-compliance. It also trapped “unvaccinated” Canadians in the country.

COVID jab mandates, which also came from provincial governments with the support of the federal government, split Canadian society. The shots have been linked to a multitude of negative and often severe side effects, such as death, including in children.

Many recent rulings have gone in favor of those who chose not to get the shots and were fired as a result, such as an arbitrator ruling that one of the nation’s leading hospitals in Ontario must compensate 82 healthcare workers terminated after refusing to get the jabs.

Beyond health concerns, many Canadians, especially Catholics, opposed the injections on moral grounds because of their link to fetal cell lines derived from the tissue of aborted babies.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

John Stossel2 days ago

John Stossel2 days agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

Media2 days ago

Media2 days agoCBC retracts false claims about residential schools after accusing Rebel News of ‘misinformation’

-

Business2 days ago

Business2 days ago‘Great Reset’ champion Klaus Schwab resigns from WEF

-

Bjorn Lomborg2 days ago

Bjorn Lomborg2 days agoNet zero’s cost-benefit ratio is CRAZY high

-

International2 days ago

International2 days agoPope Francis’ funeral to take place Saturday

-

Business21 hours ago

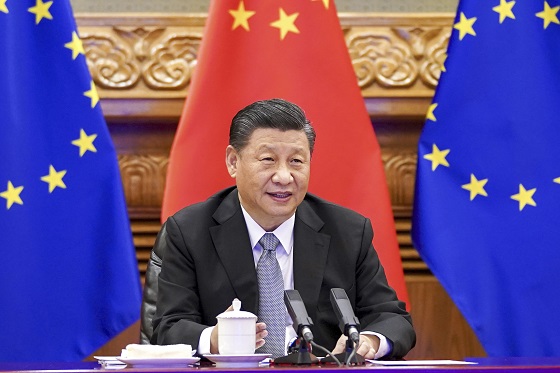

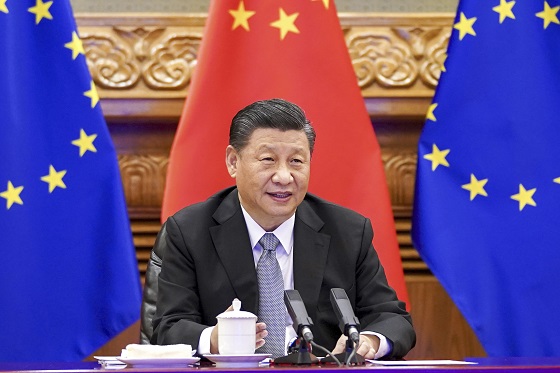

Business21 hours agoTrump: China’s tariffs to “come down substantially” after negotiations with Xi