Business

Bank of Canada admits ‘significant’ number of citizens would resist digital dollar

From LifeSiteNews

A significant number’ of Canadians are suspicious of government overreach and would resist any measures by the government or central bank to create digital forms of official money.

A Bank of Canada study has found that Canadians are very wary of a government-backed digital currency, concluding that “significant number” of citizens would resist the implementation of such a system.

The study, conducted by the Bank of Canada, found that a “significant number” of Canadians are suspicious of government overreach, and would resist any measures by the government or central bank to create digital forms of official money.

According to results from the BOC’s report titled The Consumer Value Proposition For A Hypothetical Digital Canadian Dollar, “cash remains an important method of payment” for Canadians and “[c]ertain groups may strongly resist a digital dollar if they conflate its launch with the end of cash issuance.”

The BOC noted that not only would a “significant number” of Canadians “reject” digital money, but that for some “mindset segments, their lack of interest in a hypothetical digital Canadian dollar was heavily influenced by perceptions of government overreach.”

As reported by LifeSiteNews in September, the BOC has already said that plans to create a digital “dollar,” also known as a central bank digital currency (CBDC), have been shelved.

The shelving came after the BOC had already forged ahead and filed a trademark for a digital currency, as LifeSiteNews previously reported.

Officials from Canada’s central bank said that a digital currency, or electronic “loonie,” will no longer be considered after years of investigating bringing one to market.

However, that does not mean the BOC is still not researching or exploring other options when it comes to digital money. As noted by researchers, despite there being some “interest” in a “hypothetical digital Canadian dollar,” that “interest does not necessarily translate to adoption.”

“Most participants felt well served by current means of payment,” noted the study, adding, “Individuals who support the issuance of a hypothetical digital Canadian dollar did not imagine themselves using it regularly.”

Those most enthusiastic about a government-backed version of Bitcoin were teenagers and young adults. Those older remained especially skeptical.

“They were skeptical of the need for this new form of money and of its reliability,” read the report, which also noted, “They did not trust that concepts were secure or that their personal information would be kept private.”

Given the results from the report, the bank concluded that “[b]road early adoption” of a digital dollar “is unlikely given that available payment methods meet the needs of most users.”

“Financially vulnerable segments often have the most to gain from this payment method but are most resistant to adoption. Important considerations for appeal and adoption potential include universal merchant acceptance, low costs, easy access, simplified online payments, shared payment features, budgeting tools and customizable security and privacy settings,” it noted.

Digital currencies have been touted as the future by some government officials, but, as LifeSiteNews has reported before, many experts warn that such technology would restrict freedom and could be used as a “control tool” against citizens, similar to China’s pervasive social credit system.

Most Canadians do not want a digital dollar, as previously reported by LifeSiteNews. A public survey launched by the BOC to gauge Canadians’ taste for a digital dollar revealed that an overwhelming majority of citizens want to “leave cash alone” and not proceed with a digital iteration of the national currency.

The BOC last August admitted that the creation of a CBDC is not even necessary, as many people rely on cash to pay for things. The bank concluded that the introduction of a digital currency would only be feasible if consumers demanded its release.

In August, LifeSiteNews also reported that the Conservative Party is looking to gather support for a bill that would outright ban the federal government from ever creating a digital currency and make it so that cash is kept as the preferred means of settling debts.

Conservative leader Pierre Poilievre promised that if he is elected prime minister, he would stop any implementation of a “digital currency” or a compulsory “digital ID” system.

Prominent opponents of CBDCs have been strongly advocating that citizens use cash whenever possible and boycott businesses that do not accept cash payments as a means of slowing down the imposition of CBDCs.

2025 Federal Election

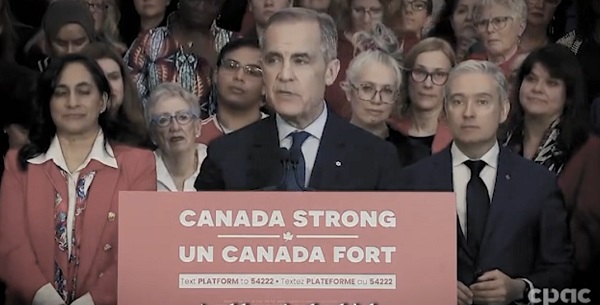

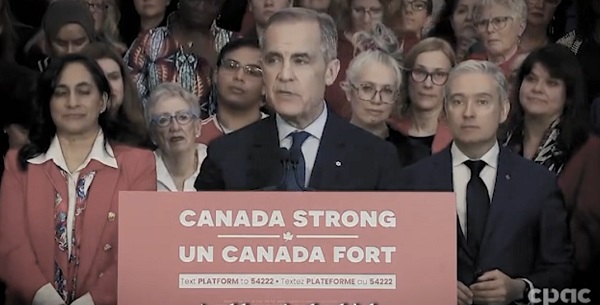

Carney’s budget means more debt than Trudeau’s

The Canadian Taxpayers Federation is criticizing Liberal Party Leader Mark Carney’s budget plan for adding another $225 billion to the debt.

“Carney plans to borrow even more money than the Trudeau government planned to borrow,” said Franco Terrazzano, CTF Federal Director. “Carney claims he’s not like Trudeau and when it comes to the debt, here’s the truth: Carney’s plan is billions of dollars worse than Trudeau’s plan.”

Today, Carney released the Liberal Party’s “fiscal and costing plan.” Carney’s plan projects the debt to increase consistently.

Here is the breakdown of Carney’s annual budget deficits:

- 2025-26: $62 billion

- 2026-27: $60 billion

- 2027-28: $55 billion

- 2028-29: $48 billion

Over the next four years, Carney plans to add an extra $225 billion to the debt. For comparison, the Trudeau government planned on increasing the debt by $131 billion over those years, according to the most recent Fall Economic Statement.

Carney’s additional debt means he will waste an extra $5.6 billion on debt interest charges over the next four years. Debt interest charges already cost taxpayers $54 billion every year – more than $1 billion every week.

“Carney’s debt binge means he will waste $1 billion more every year on debt interest charges,” Terrazzano said. “Carney’s plan isn’t credible and it’s even more irresponsible than the Trudeau plan.

“After years of runaway spending Canadians need a government that will cut spending and stop wasting so much money on debt interest charges.”

Business

Canada Urgently Needs A Watchdog For Government Waste

From the Frontier Centre for Public Policy

By Ian Madsen

From overstaffed departments to subsidy giveaways, Canadians are paying a high price for government excess

Not all the Trump administration’s policies are dubious. One is very good, in theory at least: the Department of Government Efficiency. While that term could be an oxymoron, like ‘political wisdom,’ if DOGE is useful, so may be a Canadian version.

DOGE aims to identify wasteful, duplicative, unnecessary or destructive government programs and replace outdated data systems. It also seeks to lower overall costs and ensure mechanisms are in place to evaluate proposed programs for effectiveness and value for money. This can, and usually does, involve eliminating some departments and, eventually, thousands of jobs. Some new roles within DOGE may need to become permanent.

The goal in the U.S. is to lower annual operating costs and ensure that the growth in government spending is lower than in revenues. Washington’s spending has exploded in recent years. The U.S. federal deficit exceeds six per cent of gross domestic product. According to the U.S. Treasury Department, annual debt service cost is escalating unsustainably.

Canada’s latest budget deficit of $61.9 billion in fiscal 2023–24 is about two per cent of GDP, which seems minor compared to our neighbour. However, it adds to the federal debt of $1.236 trillion, about 41 per cent of our approximate $3 trillion GDP. Ottawa’s public accounts show that expenses are 17.8 per cent of GDP, up from about 14 per cent just eight years ago. Interest on the escalating debt were 10.2 per cent of revenues in the most recent fiscal year, up from just five per cent a mere two years ago.

The Canadian Taxpayers Federation (CTF) continually identifies dubious or frivolous spending and outright waste or extravagance: “$30 billion in subsidies to multinational corporations like Honda, Volkswagen, Stellantis and Northvolt. Federal corporate subsidies totalled $11.2 billion in 2022 alone. Shutting down the federal government’s seven regional development agencies would save taxpayers an estimated $1.5 billion annually.”

The CTF also noted that Ottawa hired 108,000 more staff in the past eight years at an average annual cost of over $125,000. Hiring in line with population growth would have added only 35,500, saving about $9 billion annually. The scale of waste is staggering. Canada Post, the CBC and Via Rail lose, in total, over $5 billion a year. For reference, $1 billion would buy Toyota RAV4s for over 25,600 families.

Ottawa also duplicates provincial government functions, intruding on their constitutional authority. Shifting those programs to the provinces, in health, education, environment and welfare, could save many more billions of dollars per year. Bad infrastructure decisions lead to failures such as the $33.4 billion squandered on what should have been a relatively inexpensive expansion of the Trans Mountain pipeline—a case where hiring better staff could have saved money. Terrible federal IT systems, exemplified by the $4 billion Phoenix payroll horror, are another failure. The Green Slush Fund misallocated nearly $900 million.

Ominously, the fast-growing Old Age Supplement and Guaranteed Income Security programs are unfunded, unlike the Canada Pension Plan. Their costs are already roughly equal to the deficit and could become unsustainable.

Canada is sleepwalking toward financial perdition. A Canadian version of DOGE—Canada Accountability, Efficiency and Transparency Team, or CAETT—is vital. The Auditor General Office admirably identifies waste and bad performance, but is not proactive, nor does it have enforcement powers. There is currently no mechanism to evaluate or end unnecessary programs to ensure Canadians will have a prosperous and secure future. CAETT could fill that role.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy.

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Health2 days ago

Health2 days agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures