Economy

Argentine President Javier Milei blasts WEF audience with passionate warning against socialism

Imagine you’re at a ballgame and the person invited to throw the ceremonial first pitch decided to hurl a beanball. That’s more less what happened Wednesday at the 54th Annual Meeting of the World Economic Forum.

Argentinian President Javier Milei managed to steal the spotlight in Davos with his passionate defense of free enterprise capitalism and his warning against the very type of measures attendees came to Davos to discuss.

The theme of this year’s WEF conference was “Rebuilding Trust”. President Milei did his best to shatter trust in the international forum with a 20 minute blast in which he warned “The state is not the solution, the state is the problem itself”.

This is the video of the entire presentation. Milei begins speaking at the 6:00 mark.

Business

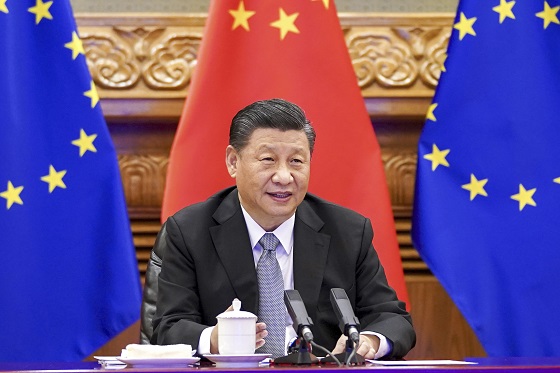

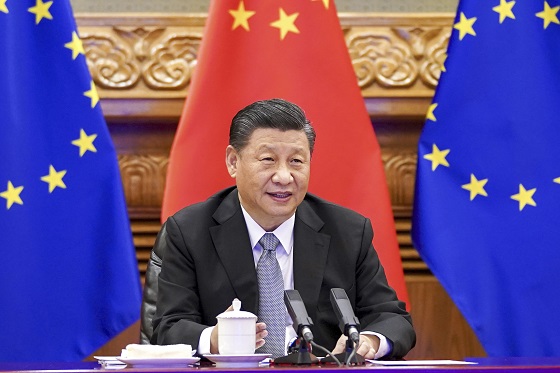

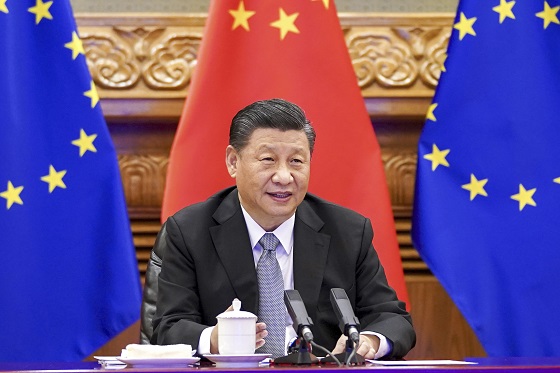

Trump: China’s tariffs to “come down substantially” after negotiations with Xi

MxM News

MxM News

Quick Hit:

President Trump said the 145% tariff rate on Chinese imports will drop significantly once a deal is struck with Chinese President Xi Jinping, expressing confidence that a new agreement is on the horizon.

Key Details:

- Trump said the current 145% tariff rate on China “won’t be anywhere near that high” after negotiations.

- He pointed to his relationship with Xi Jinping as a reason for optimism.

- The White House said it is preparing the groundwork for a deal, and Treasury officials expect a “de-escalation” of the trade war.

Diving Deeper:

President Donald Trump on Tuesday told reporters that the steep tariff rate currently imposed on Chinese imports will come down substantially after his administration finalizes a new trade deal with Chinese President Xi Jinping. While the current level stands at 145%, Trump made clear that number was temporary and would be adjusted following talks with Beijing.

“145 percent is very high. It won’t be that high, it’s not going to be that high … it won’t be anywhere near that high,” Trump said from the Oval Office, signaling a shift once a bilateral agreement is reached. “It will come down substantially, but it won’t be zero.”

The tariff, which Trump previously described as “reciprocal,” was maintained on China even after he delayed similar penalties on other trading partners. Those were cut to 10% and paused for 90 days to allow room for further negotiation.

“We’re going to be very nice. They’re going to be very nice, and we’ll see what happens. But ultimately, they have to make a deal because otherwise they’re not going to be able to deal in the United States,” Trump said, reinforcing his view that the U.S. holds the leverage.

Trump’s remarks come as markets remain wary of ongoing trade tensions, though the White House signaled progress, saying it is “setting the stage for a deal with China.” The president cited his personal rapport with Xi Jinping as a key factor in his confidence that an agreement can be reached.

“China was taking us for a ride, and it’s not going to happen,” Trump said. “They would make billions a year off us and build up their military with our money. That’s over. But we’ll still be good to China, and I think we’ll work together.”

Treasury Secretary Scott Bessent also said Tuesday that he expects a cooling of trade hostilities between the two nations, according to several reports from a private meeting with investors.

As the 90-day pause on other reciprocal tariffs nears its end, Trump emphasized that his team is prepared to finalize deals quickly. “We’ve been in talks with many, many world leaders,” he said, expressing confidence that talks will “go pretty quickly.”

White House Press Secretary Karoline Leavitt added that the administration has received 18 formal proposals from other countries engaged in trade negotiations, another sign that momentum is building behind Trump’s broader push to restructure global trade in favor of American workers and businesses.

(Li Xueren/Xinhua via AP)

2025 Federal Election

Next federal government should end corporate welfare for forced EV transition

From the Fraser Institute

By Tegan Hill and Jake Fuss

Corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

General Motors recently announced the temporary closure of its electric vehicle (EV) manufacturing plant in Ontario, laying off 500 people because its new EV isn’t selling. The plant will shut down for six months despite hundreds of millions in government subsides financed by taxpayers. This is just one more example of corporate welfare—when governments subsidize favoured industries and companies—and it’s time for the provinces and the next federal government to eliminate it.

Between the federal government and Ontario government, GM received about $500 million to help fund its EV transition. But this is just one example of corporate welfare in the auto sector. Stellantis and Volkswagen will receive about $28 billion in government subsidies while Honda is promised $5 billion.

More broadly, from 2007 to 2019, the last pre-COVID year of data, the federal government spent an estimated $84.6 billion (adjusted for inflation) on corporate welfare while provincial and local governments spent another $302.9 billion. And crucially, these numbers exclude other forms of government support such as loan guarantees, direct investments and regulatory privileges, so the actual cost of corporate welfare during this period was much higher.

Of course, politicians claim that corporate welfare benefits workers. Yet according to a significant body of research, corporate welfare fails to generate widespread economic benefit. Think of it this way—if the businesses that received subsidies were viable to begin with, they wouldn’t need government support. So unprofitable companies are kept in business through governments’ support, which can prevent resources, including investment and workers, from moving to profitable companies, hurting overall economic growth.

Put differently, rather than fuelling economic growth, corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

Governments also must impose higher tax rates on everyone else to pay for corporate welfare. In turn, higher tax rates discourage entrepreneurship and business investment—again, which fuels economic growth. And the higher the tax rates, the more economic activity they discourage.

GM’s EV plant shut down once again proves that when governments try to engineer the economy with corporate welfare, workers will ultimately lose. It’s time for the provinces and the next federal government—whoever it may be—to finally put an end to this costly and ineffective policy approach.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

John Stossel2 days ago

John Stossel2 days agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

Media2 days ago

Media2 days agoCBC retracts false claims about residential schools after accusing Rebel News of ‘misinformation’

-

Business2 days ago

Business2 days ago‘Great Reset’ champion Klaus Schwab resigns from WEF

-

Bjorn Lomborg2 days ago

Bjorn Lomborg2 days agoNet zero’s cost-benefit ratio is CRAZY high

-

International2 days ago

International2 days agoPope Francis’ funeral to take place Saturday

-

Business17 hours ago

Business17 hours agoTrump: China’s tariffs to “come down substantially” after negotiations with Xi