Energy

Anti-LNG activists have decided that they now actually care for LNG investors after years of calling to divest

From Resource Works

Qatar is building or chartering 104 LNG carriers, and plans to double its LNG output by the end of 2030. It would then produce 142 million megatonnes of LNG a year — more than 20 times the 7 million from the LNG Canada plant.

Strange to see activists opposed to LNG development in Canada publicly worrying about whether such projects are economically viable for investors.

One group has been arguing “the reality is that in the coming years the world may no longer need BC.’s LNG” and that could mean “the risk of future stranded assets.” Of course, they aren’t at all concerned about investors; they’re just desperately throwing every brick they can think of in organized and well-funded political campaigns to influence government.

Meanwhile, two of their prime targets proceed with their government-approved plans: LNG Canada moves steadily toward overseas exports in 2025, and Woodfibre LNG is moving toward construction, and shipping pre-sold exports in 2027. BC has also approved Fortis BC’s planned marine LNG terminal on the Fraser, which would provide LNG as fuel for visiting ships, and could also handle export cargoes from an expanded FortisBC plant in Delta.

And First Nations are working on the Haisla Nation’s Cedar LNG project, and the Nisga’a Nation’s proposed Ksi Lisims LNG operation. Odd how the activists refrain from criticizing the First Nations Peoples who want to export LNG to help their communities thrive .

And, somehow, the activists’ messages fail to impress LNG developers in the U.S., Australia, the United Arab Emirates, Russia, and Qatar. For context, Qatar is building or chartering 104 LNG carriers, and plans to double its LNG output by the end of 2030. It would then produce 142 million megatonnes of LNG a year — more than 20 times the 7 million from the LNG Canada plant.

The critics’ climate issues and concerns are indeed legitimate, no argument. World emissions hit a record high in 2023, the International Energy Agency reports. Emissions in advanced economies fell to a 50-year low, but rose in China and India.

China in 2023 accounted for 35 percent of global carbon-dioxide emissions. The U.S. stood at 12.5 percent and India at 7.7 percent. While China has indeed made much progress on renewables, it and India continue to burn more and more coal.

Why Canadian groups think they can solve world issues by focussing on relatively modest LNG proposals in Canada is beyond us.

Our Canadian LNG will be environmentally cleaner than LNG from many rival suppliers. And buyers can use it to generate more of their electricity, replacing coal-powered generation that produces far more emissions. That’s an environmental plus.

LNG Canada will have an emissions intensity of 0.15 percent of carbon dioxide per tonne of LNG produced, less than half the global industry average of 0.35 percent per tonne, and 35 percent lower than the best-performing facility.

Woodfibre LNG will be the world’s first net-zero LNG export facility — 23 years ahead of government net-zero goals. Woodfibre LNG will have an emissions intensity of just 0.04 percent — and that’s less than one sixth of the global industry average.

The Haisla’s Cedar LNG project will have an emissions intensity of just 0.08 percent of CO2 per tonne of LNG. That’s less than a third of the global average. Its plans call for emissions to be near zero by 2030.

And the Nisga’a Ksi Lisims project promises to be operating with net-zero emissions within three years of the project’s first shipment.

Our LNG has another advantage over U.S. LNG: The shipping distance from BC to prime Asian buyers is about 10 days compared to 20 days from U.S. Gulf Coast LNG plants. That means 50-60 percent lower emissions from the ships carrying the LNG.

Canada produces only 1.5 percent of world greenhouse-gas emissions. As Canada’s independent parliamentary budget officer reported in 2022: “Canada’s own emissions are not large enough to materially impact climate change.”

Thus the First Nations LNG Alliance points out: “You could shut the entire country down — no energy, no industry, no jobs, no transportation, no heat, no light — and that reduction of 1.5 percent of emissions could be wiped out by new energy development and new emissions in other countries in a matter of some months or perhaps a few years.”

And so the Alliance says: “So we have government punishing taxpayers, First Nations and industry by putting on blinkers when it comes to LNG. Ottawa views Canada as a geographical silo in which we must meet our emissions targets, regardless of what others do.

“It’s long past time, indeed, to act locally — but think globally.”

Energy

Indigenous-led Projects Hold Key To Canada’s Energy Future

From the Frontier Centre for Public Policy

Indigenous leaders call for policy reforms and Indigenous equity ownership to unlock Canada’s energy potential

A surprising twist in Canada’s pipeline debate emerged on Jan. 21, 2025, when Alberta Premier Danielle Smith called for a revival of the Northern Gateway pipeline.

Unexpectedly, Grand Chief Stewart Phillip, president of the Union of B.C. Indian Chiefs, voiced support, warning that if Canada doesn’t act, Donald Trump will. Yet just a day later, Phillip abruptly retracted his statement, raising fresh questions about external influence and the future of Indigenous participation in energy development.

Northern Gateway, a pipeline once proposed to carry Alberta oilsands crude to the B.C. coast for export to Asia, was cancelled in 2016 after years of environmental opposition and legal challenges. Its demise became a symbol of Canada’s broader struggles to balance resource development, environmental concerns and Indigenous rights. Now, amid rising global energy demand and growing Indigenous interest in ownership stakes, calls to revive the project are resurfacing, with political, legal and economic implications.

Adding to the intrigue, Phillip has long been a vocal critic of major resource projects, including Northern Gateway, making his initial endorsement all the more surprising.

Some observers, like Calvin Helin, a member of the Tsimshian Nation and principal at INDsight Advisers, see deeper forces at work. A lawyer specializing in commercial and Indigenous law and a best-selling author, Helin believes the incident highlights how environmental activists are shaping the conversation.

“Environmental groups have infiltrated some Indigenous organizations,” Helin said in an interview. “They managed to support a government that championed their agendas, particularly Alberta-focused objectives like the coastal pipeline ban and changes to the regulatory approval system. In this era of Trump, all they’ve managed to do is weaken Canada’s position.”

Nonetheless, Helin emphasized that the energy industry has learned the importance of genuine engagement with Indigenous interests. He pointed out that Indigenous leaders increasingly support responsible natural resource development. Inclusion and recognition from the outset, Helin argued, are essential for energy projects in 2025 and beyond.

After the cancellation of Northern Gateway, Indigenous leader Dale Swampy, who helped establish the Northern Gateway Aboriginal Equity Partners, formed the National Coalition of Chiefs, a pro-development alliance of First Nation chiefs advocating for oil and gas development in their communities.

Swampy continues to champion the idea of a pipeline dedicated solely to moving bitumen to the coast, arguing that Canada has been “putting all its eggs in one basket” by selling almost exclusively to the United States while competitors, including the U.S. itself, have entered global markets.

According to the Canadian Energy Centre, global demand for oil and gas in emerging and developing economies is expected to remain robust through 2050. With the added pressures of U.S. tariffs, conversations about Canadian pipelines to tidewater have gained urgency. Swampy advocates for a policy reset and the revival of Northern Gateway, this time powered by Indigenous equity investment.

“First, we’ve got to get rid of the oil tanker ban (Bill C-48),” Swampy said. “We need more fluid regulatory processes so we can build projects on a reasonable timeline, without costing us billions more waiting for approvals—like TMX (Trans Mountain Expansion Project). And you’ve got to get the proponents back to the table. Last time, 31 of the 40 communities were already signed on. I believe we can get them on board again.”

Swampy continues to work with industry partners to develop an Indigenous-led bitumen pipeline to the West Coast. “We can get this project built if it’s led by First Nations.”

He also noted that other Indigenous leaders are increasingly recognizing the benefits of collaborating on resource development, whether in mining or B.C. LNG projects, which he says enjoy widespread First Nations support.

Discussions with Helin, Swampy and other Indigenous leaders resulted in the following policy recommendations for 2025 and beyond.

- Repeal Bill C-69, the Impact Assessment Act. It blocks not only pipelines but also mines, refineries, export plants and other energy infrastructure in which First Nations want to invest. The Supreme Court of Canada ruled it unconstitutional on Oct. 13, 2023.

- Cut taxes to offset U.S. tariffs. Reducing taxes on investment and energy projects can neutralize tariff impacts and attract new investment. Eliminate the carbon tax, which Indigenous leaders argue has placed Canada at a strategic disadvantage globally.

- Repeal Bill C-59, the so-called greenwashing bill. According to Stephen Buffalo, president and chief executive officer of the Indian Resource Council of Canada, this legislation has silenced many voices within the Indigenous energy community.

- Approve LNG plants and related infrastructure. Canada currently sells gas exports almost exclusively to the United States, but there’s a strong business case for expanding to Asian and European markets. In a recent Canadian Energy Ventures webcast, it was revealed that LNG sold to Europe fetches up to 16 times the price Canada receives from U.S. sales. First Nations are already successfully involved in Woodfibre LNG, Cedar LNG and Ksi Lisims LNG in B.C.

- Cut regulatory delays. Prolonged approval timelines erode investor confidence. Streamlining processes can help projects proceed in reasonable timeframes.

Finally, clarify reconciliation guidelines. Clearly define what constitutes meaningful consultation. Industry must treat Indigenous peoples as true partners, advancing economic reconciliation through equity partnerships.

A social media stir over Northern Gateway has reignited debate over Indigenous ownership in Canada’s energy future. While some leaders waver, others like Helin and Swampy make a compelling case: Indigenous-led projects are crucial for Canada’s economic and energy security. Their message is clear — repeal restrictive policies, accelerate project approvals and embrace Indigenous equity. If Ottawa removes the roadblocks, Canada can unlock its full energy potential.

Maureen McCall is an energy business analyst and Fellow at the Frontier Center for Public Policy. She writes on energy issues for EnergyNow and the BOE Report. She has 20 years of experience as a business analyst for national and international energy companies in Canada.

Energy

Many Canadians—and many Albertans—live in energy poverty

From the Fraser Institute

By Tegan Hill and Elmira Aliakbari

Amid an ongoing trade war with the United States, which will increase prices for Canadian and American consumers alike, affordable energy is crucial to fuel our daily lives and power the economy. Unfortunately, energy prices have been rising for years, straining household budgets across Canada including in Alberta.

For perspective, from 2002 to 2023 (the latest year of available data) the price of energy (electricity, gasoline, etc.) grew by 105.5 per cent compared to 53.5 per cent for non-energy goods and services. This reflects a significantly higher increase in energy prices compared to other goods.

Why have energy prices increased?

While there are many factors, bad government policy has added fuel to the fire. The list includes the federal carbon tax, which remains in place for large industrial emitters. And Ottawa’s “Clean Electricity Regulations,” which mandate that by 2050, 100 per cent of Canada’s electricity must come from clean energy sources as wind, solar, hydro, etc. To meet this goal, Canada would need to build a massive amount of new infrastructure and technology, potentially driving electricity costs even higher.

Of course, Canadians pay the price for bad policy. Due in part to rising energy prices, in 2021 (the latest year of available data), 11.0 per cent of Canadians lived in “energy poverty”—that is, at least 10 per cent of their household total annual spending paid for energy-related goods such as electricity, natural gas, gasoline and other heating fuels. In Alberta, the number was 10.0 per cent. All told, that’s a lot people in energy poverty.

And energy poverty disproportionally affects lower-income households. For instance, in 2021 across Canada, 22.1 per cent of households earning $31,200 or less, and 20.7 per cent earning between $31,200.01 and $55,000, were in a state of energy poverty compared to only 1.6 per cent of households earning more than $124,000.

When the next federal government—whoever that may be—works with the provinces to develop energy policy, it should understand the significant level of energy poverty in Canada including Alberta, particularly among low-income households. Increasing energy prices further would likely increase the burden on families already experiencing energy poverty and those families at risk of falling into it.

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Health1 day ago

Health1 day agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election1 day ago

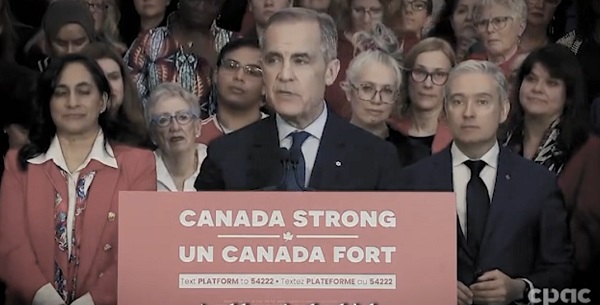

2025 Federal Election1 day agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures