Alberta

Albertans don’t have to choose between heating and eating. Here’s how you keep your home warm this winter

Alberta’s Winter Rules for utilities protect vulnerable Albertans by helping keep their lights on and homes warm during the cold winter months.

When temperatures drop, Alberta’s Winter Rules for utilities are designed to keep the power and heat on for Albertans during the cold winter months. Ensuring Albertans have access to reliable and affordable energy is a top priority for Alberta’s government.

From Oct. 15 to April 15, electricity and natural gas services in Alberta cannot be fully disconnected by retailers. This also applies to any time during the year when the forecast for the next 24 hours indicates temperatures below zero degrees.

“During Alberta’s harsh winters, no one should be forced to choose between heating and eating. We’re keeping the lights on for the most vulnerable and taking action to lower power bills for all Albertans. I encourage anyone having difficulties with their utility bill to contact the Utilities Consumer Advocate and learn what options are available.”

Under the Winter Utilities Reconnection program, customers with disconnected utilities are contacted to help get them reconnected before the cold weather hits. This is led by the Utilities Consumer Advocate (UCA), in partnership with the Alberta Utilities Commission (AUC), utility retailers and distributors and other government agencies. Albertans who are having difficulty with paying their utility bills, communicating with their retailer or making manageable payment arrangements should contact the UCA.

“The Winter Utilities Reconnection Program is an important protection for customers struggling with utility bills. UCA Mediation Staff are available to help customers get energy utilities reconnected and stay safe during winter. They can be reached at 310-4822.”

Alberta’s government is working tirelessly to lower utility bills and protect ratepayers, ensuring Albertans keep more of their hard-earned dollars in their bank accounts. With more still to come, Alberta’s government has already taken action by stabilizing local access fees through new legislation, introducing regulations to prevent power price spikes and investing in programs to help municipalities and rural Albertans manage and lower their energy costs. Additionally, the UCA continues to help consumers better understand and navigate the utility market, and their advocacy has led to Albertans saving more than $3.2 billion over the past two decades.

Affordable electricity options are available

Alberta has a unique competitive electricity market, which gives Albertans the power to choose the best energy provider, plan and payment option to fit their needs. Consumers can purchase their power from more than 50 competitive retailers, with the choice of either fixed or variable rate contracts.

Albertans are encouraged to explore their options and find the competitive rate best-suited to their needs. Last year, tens of thousands of households moved off the Rate of Last Resort to competitive contracts for a more affordable option. Albertans who are looking for help with their utility bills or are experiencing a dispute with their provider should contact the Utilities Consumer Advocate at 310-4822, via email, or through their website.

Related information

- Utilities Consumer Advocate

- Financial Assistance Resources (UCA)

- Alberta Utilities Commission

- Farm fuel and rural utility programs

Related news

- Introducing the Rate of Last Resort (Sept. 25, 2024)

- Helping Alberta communities lower energy costs (Sept. 24, 2024)

- Helping Calgarians save millions on their power bills (Sept. 19, 2024)

- Power rates slashed in half by new market rules (Sept. 5, 2024)

- Power watchdog supports Alberta’s electricity market reforms (Aug. 5, 2024)

- Preventing power price spikes (June 26, 2024)

- Making utility bills more affordable (April 22, 2024)

- Making electricity more affordable (April 18, 2024)

Alberta

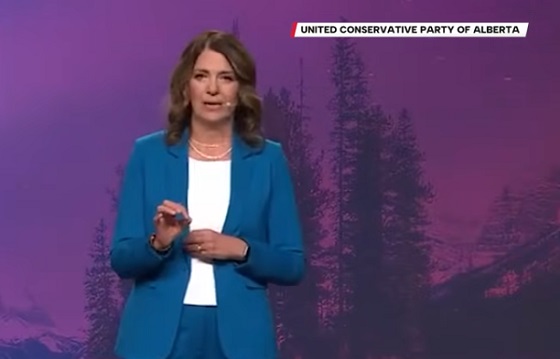

Keynote address of Premier Danielle Smith at 2025 UCP AGM

Alberta

Net Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

From the Fraser Institute

By Jason Clemens and Elmira Aliakbari

The challenge of GHG emissions in 2050 is not in the industrial world but rather in the developing world, where there is still significant basic energy consumption using timber and biomass.

The new Memorandum of Understanding (MOU) between the federal and Alberta governments lays the groundwork for substantial energy projects and infrastructure development over the next two-and-a-half decades. It is by all accounts a step forward, though, there’s debate about how large and meaningful that step actually is. There is, however, a fundamental flaw in the foundation of the agreement: it’s commitment to net zero in Canada by 2050.

The first point of agreement in the MOU on the first page of text states: “Canada and Alberta remain committed to achieving net zero greenhouse gas emissions by 2050.” In practice, it’s incredibly difficult to offset emissions with tree planting or other projects that reduce “net” emissions, so the effect of committing to “net zero” by 2050 means that both governments agree that Canada should produce very close to zero actual greenhouse gas (GHG) emissions. Consider the massive changes in energy production, home heating, transportation and agriculture that would be needed to achieve this goal.

So, what’s wrong with Canada’s net zero 2050 and the larger United Nations’ global goal for the same?

Let’s first understand the global context of GHG reductions based on a recent study by internationally-recognized scholar Vaclav Smil. Two key insights from the study. First, despite trillions being spent plus international agreements and regulatory measures starting back in 1997 with the original Kyoto agreement, global fossil fuel consumption between then and 2023 increased by 55 per cent.

Second, fossil fuels as a share of total global energy declined from 86 per cent in 1997 to 82 per cent in 2022, again, despite trillions of dollars in spending plus regulatory requirements to force a transition away from fossil fuels to zero emission energies. The idea that globally we can achieve zero emissions over the next two-and-a-half decades is pure fantasy. Even if there is an historic technological breakthrough, it will take decades to actually transition to a new energy source(s).

Let’s now understand the Canada-specific context. A recent study examined all the measures introduced over the last decade as part of the national plan to reduce emissions to achieve net zero by 2050. The study concluded that significant economic costs would be imposed on Canadians by these measures: inflation-adjusted GDP would be 7 per cent lower, income per worker would be more than $8,000 lower and approximately 250,000 jobs would be lost. Moreover, these costs would not get Canada to net zero. The study concluded that only 70 per cent of the net zero emissions goal would be achieved despite these significant costs, which means even greater costs would be imposed on Canadians to fully achieve net zero.

It’s important to return to a global picture to fully understand why net zero makes no sense for Canada within a worldwide context. Using projections from the International Energy Agency (IEA) in its latest World Energy Outlook, the current expectation is that in 2050, advanced countries including Canada and the other G7 countries will represent less than 25 per cent of global emissions. The developing world, which includes China, India, the entirety of Africa and much of South America, is estimated to represent at least 70 per cent of global emissions in 2050.

Simply put, the challenge of GHG emissions in 2050 is not in the industrial world but rather in the developing world, where there is still significant basic energy consumption using timber and biomass. A globally-coordinated effort, which is really what the U.N. should be doing rather than fantasizing about net zero, would see industrial countries like Canada that are capable of increasing their energy production exporting more to these developing countries so that high-emitting energy sources are replaced by lower-emitting energy sources. This would actually reduce global GHGs while simultaneously stimulating economic growth.

Consider a recent study that calculated the implications of doubling natural gas production in Canada and exporting it to China to replace coal-fired power. The conclusion was that there would be a massive reduction in global GHGs equivalent to almost 90 per cent of Canada’s total annual emissions. In these types of substitution arrangements, the GHGs would increase in energy-producing countries like Canada but global GHGs would be reduced, which is the ultimate goal of not only the U.N. but also the Carney and Smith governments as per the MOU.

Finally, the agreement ignores a basic law of economics. The first lesson in the very first class of any economics program is that resources are limited. At any given point in time, we only have so much labour, raw materials, time, etc. In other words, when we choose to do one project, the real cost is foregoing the other projects that could have been undertaken. Economics is mostly about trying to understand how to maximize the use of limited resources.

The MOU requires massive, literally hundreds of billions of dollars to be used to create nuclear power, other zero-emitting power sources and transmission systems all in the name of being able to produce low or even zero-emitting oil and gas while also moving to towards net zero.

These resources cannot be used for other purposes and it’s impossible to imagine what alternative companies or industries would have been invested in. What we do know is that workers, entrepreneurs, businessowners and investors are not making these decisions. Rather, politicians and bureaucrats in Ottawa and Edmonton are making these decisions but they won’t pay any price if they’re wrong. Canadians pay the price. Just consider the financial fiasco unfolding now with Ottawa, Ontario and Quebec’s subsidies (i.e. corporate welfare) for electric vehicle batteries.

Understanding the fundamentally flawed commitment to Canadian net zero rather than understanding a larger global context of GHG emissions lays at the heart of the recent MOU and unfortunately for Canadians will continue to guide flawed and expensive policies. Until we get the net zero policies right, we’re going to continue to spend enormous resources on projects with limited returns, costing all Canadians.

-

Opinion2 days ago

Opinion2 days agoLandmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away

-

Focal Points2 days ago

Focal Points2 days agoSTUDY: TikTok, Instagram, and YouTube Shorts Induce Measurable “Brain Rot”

-

Alberta2 days ago

Alberta2 days agoRed Deer’s Jason Stephan calls for citizen-led referendum on late-term abortion ban in Alberta

-

Business1 day ago

Business1 day agoBlacked-Out Democracy: The Stellantis Deal Ottawa Won’t Show Its Own MPs

-

Health2 days ago

Health2 days agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

Agriculture1 day ago

Agriculture1 day agoHealth Canada pauses plan to sell unlabeled cloned meat

-

Artificial Intelligence19 hours ago

Artificial Intelligence19 hours agoGoogle denies scanning users’ email and attachments with its AI software

-

Indigenous2 days ago

Indigenous2 days agoIndigenous activist wins landmark court ruling for financial transparency