Alberta

Alberta taking Trudeau government to court to fight unconstitutional Impact Assessment Act

Alberta’s government is again taking the federal government to court over its unconstitutional Impact Assessment Act after they failed to meet the province’s four-week deadline.

Impact Assessment Act lands Ottawa in court again |

In October 2023, the Supreme Court of Canada concluded that the Impact Assessment Act was largely unconstitutional. On June 20, 2024, the federal government amended the Impact Assessment Act as part of a large omnibus budget bill. The amendments fail to correct the constitutional deficiencies the Supreme Court of Canada identified with the original legislation and will continue killing jobs and hurting the economy.

Alberta’s government gave the federal government a four-week deadline to remedy the unconstitutional provisions in the amended Impact Assessment Act or face another legal challenge. The federal government has failed to address Alberta’s concerns, showing a continued disregard and refusal to engage with Alberta on the legislation and its flawed amendments. In response, Alberta has referred the constitutionality of the amended Impact Assessment Act to the Court of Appeal of Alberta.

“We have tried working with Ottawa to change their deeply flawed and unconstitutional Impact Assessment Act but we’ve been met with resistance every step of the way. They have chosen to disregard our input, disregard a Supreme Court of Canada decision, and disregard our deadline, so we’ll see them in court. Again. We will not stand down on this issue.”

The federal government’s Impact Assessment Act enables Ottawa to derail, delay and interfere in projects that have little or nothing to do with matters falling within federal jurisdiction. Alberta’s government has been consistent in its response and continues to wait for the federal government to engage meaningfully and make meaningful amendments to the legislation.

Alberta’s government asked the federal government to:

- Eliminate federal encroachment into provincial jurisdiction.

- Recognize equivalency and the ability to fully substitute our provincial environmental assessment for a federal impact assessment.

- Create certainty for industry and increase investor confidence by imposing concrete timelines and curbing ministerial discretion.

- Emphasize that significant adverse effects within federal jurisdiction is the minimum threshold for federal involvement.

- Streamline the process by scoping projects appropriately and placing some parameters on public involvement.

- Focus the public interest decision-making process on significant adverse effects within federal jurisdiction and countervailing positive effects.

“The federal government needs to respect the decisions of the Supreme Court and stop making meaningless attempts to bypass the rulings of Canada’s highest court. The courts agreed with Alberta in the first legal challenge, and we are prepared to fight as many times as is necessary to defend the rights of Albertans against this blatant overreach.”

Alberta

Alberta takes big step towards shorter wait times and higher quality health care

From the Fraser Institute

On Monday, the Smith government announced that beginning next year it will change the way it funds surgeries in Alberta. This is a big step towards unlocking the ability of Alberta’s health-care system to provide more, better and faster services for the same or possibly fewer dollars.

To understand the significance of this change, you must understand the consequences of the current (and outdated) approach.

Currently, the Alberta government pays a lump sum of money to hospitals each year. Consequently, hospitals perceive patients as a drain on their budgets. From the hospital’s perspective, there’s little financial incentive to serve more patients, operate more efficiently and provide superior quality services.

Consider what would happen if your local grocery store received a giant bag of money each year to feed people. The number of items would quickly decline to whatever was most convenient for the store to provide. (Have a favourite cereal? Too bad.) Store hours would become less convenient for customers, alongside a general decline in overall service. This type of grocery store, like an Alberta hospital, is actually financially better off (that is, it saves money) if you go elsewhere.

The Smith government plans to flip this entire system on its head, to the benefit of patients and taxpayers. Instead of handing out bags of money each year to providers, the new system—known as “activity-based funding”—will pay health-care providers for each patient they treat, based on the patient’s particular condition and important factors that may add complexity or cost to their care.

This turns patients from a drain on budgets into a source of additional revenue. The result, as has been demonstrated in other universal health-care systems worldwide, is more services delivered using existing health-care infrastructure, lower wait times, improved quality of care, improved access to medical technologies, and less waste.

In other words, Albertans will receive far better value from their health-care system, which is currently among the most expensive in the world. And relief can’t come soon enough—for example, last year in Alberta the median wait time for orthopedic surgeries including hip and knee replacements was 66.8 weeks.

The naysayers argue this approach will undermine the province’s universal system and hurt patients. But by allowing a spectrum of providers to compete for the delivery of quality care, Alberta will follow the lead of other more successful universal health-care systems in countries such as Australia, Germany, the Netherlands and Switzerland and create greater accountability for hospitals and other health-care providers. Taxpayers will get a much better picture of what they’re paying for and how much they pay.

Again, Alberta is not exploring an untested policy. Almost every other developed country with universal health care uses some form of “activity-based funding” for hospital and surgical care. And remember, we already spend more on health care than our counterparts in nearly all of these countries yet endure longer wait times and poorer access to services generally, in part because of how we pay for surgical care.

While the devil is always in the details, and while it’s still possible for the Alberta government to get this wrong, Monday’s announcement is a big step in the right direction. A funding model that puts patients first will get Albertans more of the high-quality health care they already pay for in a timelier fashion. And provide to other provinces an example of bold health-care reform.

Alberta

Alberta’s embrace of activity-based funding is great news for patients

From the Montreal Economic Institute

From the Montreal Economic Institute

Alberta’s move to fund acute care services through activity-based funding follows best practices internationally, points out an MEI researcher following an announcement made by Premier Danielle Smith earlier today.

“For too long, the way hospitals were funded in Alberta incentivized treating fewer patients, contributing to our long wait times,” explains Krystle Wittevrongel, director of research at the MEI. “International experience has shown that, with the proper funding models in place, health systems become more efficient to the benefit of patients.”

Currently, Alberta’s hospitals are financed under a system called “global budgeting.” This involves allocating a pre-set amount of funding to pay for a specific number of services based on previous years’ budgets.

Under the government’s newly proposed funding system, hospitals receive a fixed payment for each treatment delivered.

An Economic Note published by the MEI last year showed that Quebec’s gradual adoption of activity-based funding led to higher productivity and lower costs in the province’s health system.

Notably, the province observed that the per-procedure cost of MRIs fell by four per cent as the number of procedures performed increased by 22 per cent.

In the radiology and oncology sector, it observed productivity increases of 26 per cent while procedure costs decreased by seven per cent.

“Being able to perform more surgeries, at lower costs, and within shorter timelines is exactly what Alberta’s patients need, and Premier Smith understands that,” continued Mrs. Wittevrongel. “Today’s announcement is a good first step, and we look forward to seeing a successful roll-out once appropriate funding levels per procedure are set.”

The governments expects to roll-out this new funding model for select procedures starting in 2026.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

Also Interesting2 days ago

Also Interesting2 days agoMortgage Mayhem: How Rising Interest Rates Are Squeezing Alberta Homeowners

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

Also Interesting2 days ago

Also Interesting2 days agoExploring Wildrobin Technological Advancements in Live Dealer Games

-

2025 Federal Election2 days ago

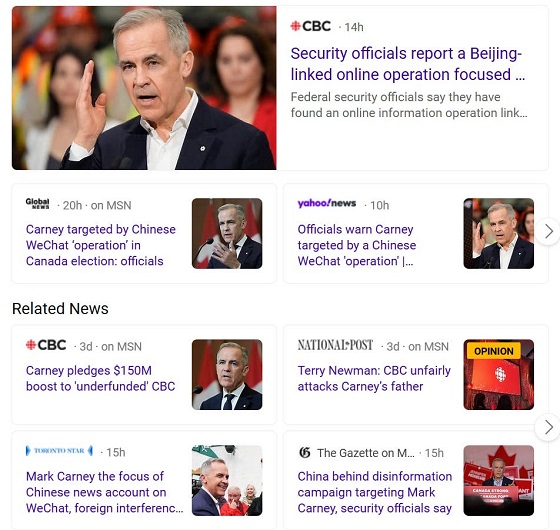

2025 Federal Election2 days agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFifty Shades of Mark Carney

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCorporate Media Isn’t Reporting on Foreign Interference—It’s Covering for It

-

Justice2 days ago

Justice2 days agoCanadian government sued for forcing women to share spaces with ‘transgender’ male prisoners

-

Business1 day ago

Business1 day agoStocks soar after Trump suspends tariffs