Alberta

Alberta Preparing a New Regulatory Framework for iGaming

With the success of the iGaming market in Ontario, Alberta is looking to it as a blueprint for its own plans in that arena. Despite this, there will likely be differences in the way the two provinces regulate this industry. These potential differences will likely be based on the strategies laid out by Dale Nally, Alberta’s Minister of Service and Red Tape Reduction.

The manner in which Alberta eventually decides to handle its iGaming regulations will be crucial to maintaining a healthy balance for the industry there. Many other regions have begun seeing the drawbacks of over-regulation in this field. As a result, many new-age casinos operating offshore have been gaining popularity over traditional ones that are often stifled by restrictions.

This is because restrictions place more onerous burdens on operators and cause lengthy delays with everything from sign-up procedures to payout times. However, offshore casinos have become a revelation for players tied down by these restrictions. For example, crypto casinos and the perks found at sites like an instant payout casino have seen the number of players from regions like the US, UK, Asia, Europe, and even Canada soaring in recent years.

Instant payout casinos in particular have grown very popular in recent years as they offer players same-day access to their winnings. This phenomenon has been playing out amid ever-tightening regulations on iGaming sites being deployed in many prominent markets.

While reasonable regulations have their benefits, many players feel that most jurisdictions are over-regulating the industry now and players have begun to respond by flocking to offshore sites. Instant payout casinos offer a perfect refuge since platforms like these feature fewer restrictions, more expansive gaming libraries, more privacy, and more generous bonuses.

While Alberta is drawing heavily from Ontario’s regulatory guidelines, it also wants to retain some aspects that will distinguish it too. Minister Nally has indicated that Alberta will seek a less onerous regulatory regime than Ontario. However, as it is with Ontario, there won’t be a limit imposed on the number of iGaming operators permitted. These would also not require any partnerships with land-based casinos.

This approach is expected to foster a competitive online betting environment. As such, huge operators are expected to set up shop there and operate freely alongside the government-run Play Alberta—which currently holds a monopoly.

Nally’s ministry has already been busy working on these new regulations and is set to keep being so as it will also be directly responsible for overseeing iGaming regulations and their enforcement. This ensures a separate regulatory body need not be created. It also addresses concerns raised by operators that Alberta’s Gaming, Liquor, and Cannabis Commission (AGLC) would have a conflict of interest if it managed the new regime as the AGLC is a market operator since it runs the Play Alberta platform.

All in all, Alberta’s approach currently does look good and at least considers the need for making it as simple as possible for new entrants to gain access to the market. Alberta’s method to “conduct and manage” gambling activities is in direct contrast with Ontario’s, where iGaming Ontario (iGO) is simply a subsidiary of the Alcohol and Gaming Commission of Ontario (AGCO).

The revenue-sharing model will also be looked at. Currently, Ontario operators are taxed 20% with the province making $790 million of them last year—with more expansion on the horizon. On that note, Alberta has hinted that it may seek a higher percentage. With other things like consults with indigenous communities and other stakeholders, and setting up transition periods for “grey” market operators, there is more work to be done. However, for now, the future of the iGaming industry in Alberta looks good indeed.

Alberta

Alberta Next: Alberta Pension Plan

From Premier Danielle Smith and Alberta.ca/Next

Let’s talk about an Alberta Pension Plan for a minute.

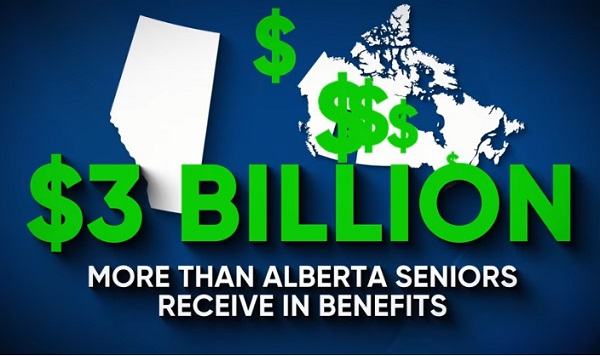

With our young Alberta workforce paying billions more into the CPP each year than our seniors get back in benefits, it’s time to ask whether we stay with the status quo or create our own Alberta Pension Plan that would guarantee as good or better benefits for seniors and lower premiums for workers.

I want to hear your perspective on this idea and please check out the video. Get the facts. Join the conversation.

Visit Alberta.ca/next

Alberta

COVID mandates protester in Canada released on bail after over 2 years in jail

Chris Carbert (right) and Anthony Olienick, two of the Coutts Four were jailed for over two years for mischief and unlawful possession of a firearm for a dangerous purpose.

From LifeSiteNews

The “Coutts Four” were painted as dangerous terrorists and their arrest was used as justification for the invocation of the Emergencies Act by the Trudeau government, which allowed it to use draconian measures to end both the Coutts blockade and the much larger Freedom Convoy

COVID protestor Chris Carbert has been granted bail pending his appeal after spending over two years in prison.

On June 30, Alberta Court of Appeal Justice Jo-Anne Strekaf ordered the release of Chris Carbert pending his appeal of charges of mischief and weapons offenses stemming from the Coutts border blockade, which protested COVID mandates in 2022.

“[Carbert] has demonstrated that there is no substantial likelihood that he will commit a criminal offence or interfere with the administration of justice if released from detention pending the hearing of his appeals,” Strekaf ruled.

“If the applicant and the Crown are able to agree upon a release plan and draft order to propose to the court, that is to be submitted by July 14,” she continued.

Carbert’s appeal is expected to be heard in September. So far, Carbert has spent over two years in prison, when he was charged with conspiracy to commit murder during the protest in Coutts, which ran parallel to but was not officially affiliated with the Freedom Convoy taking place in Ottawa.

Later, he was acquitted of the conspiracy to commit murder charge but still found guilty of the lesser charges of unlawful possession of a firearm for a dangerous purpose and mischief over $5,000.

In September 2024, Chris Carbert was sentenced to six and a half years for his role in the protest. However, he is not expected to serve his full sentence, as he was issued four years of credit for time already served. Carbert is also prohibited from owning firearms for life and required to provide a DNA sample.

Carbert was arrested alongside Anthony Olienick, Christopher Lysak and Jerry Morin, with the latter two pleading guilty to lesser charges to avoid trial. At the time, the “Coutts Four” were painted as dangerous terrorists and their arrest was used as justification for the invocation of the Emergencies Act by the Trudeau government, which allowed it to use draconian measures to end both the Coutts blockade and the much larger Freedom Convoy occurring thousands of kilometers away in Ottawa.

Under the Emergency Act (EA), the Liberal government froze the bank accounts of Canadians who donated to the Freedom Convoy. Trudeau revoked the EA on February 23 after the protesters had been cleared out. At the time, seven of Canada’s 10 provinces opposed Trudeau’s use of the EA.

Since then, Federal Court Justice Richard Mosley ruled that Trudeau was “not justified” in invoking the Emergencies Act, a decision that the federal government is appealing.

-

International2 days ago

International2 days agoWoman wins settlement after YMCA banned her for complaining about man in girls’ locker room

-

Alberta1 day ago

Alberta1 day agoAlberta government records $8.3 billion surplus—but the good times may soon end

-

Banks2 days ago

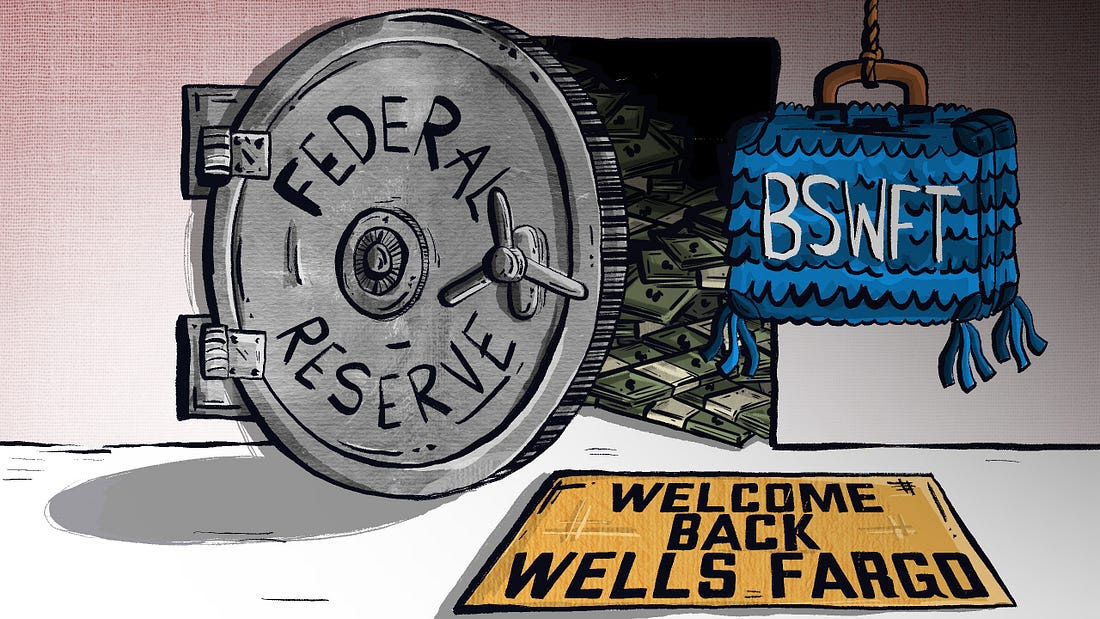

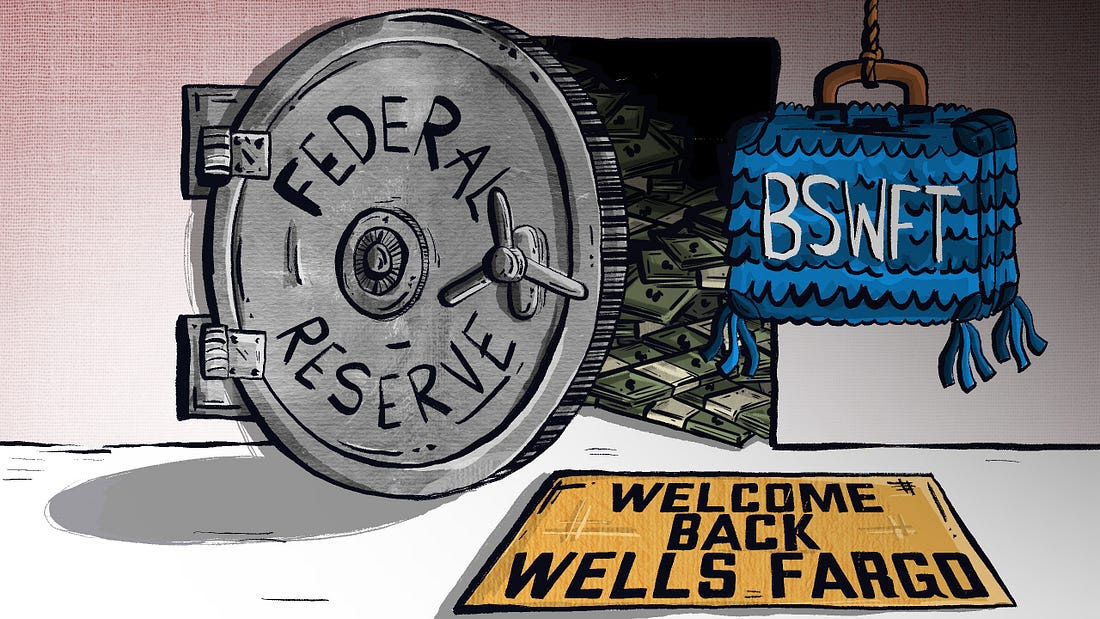

Banks2 days agoWelcome Back, Wells Fargo!

-

MxM News2 days ago

MxM News2 days agoDiddy found not guilty of trafficking, faces prison on lesser charge

-

Also Interesting1 day ago

Also Interesting1 day agoEndorphina Slots: High-Quality Games Now at Zoome Casino Canada

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCanada Day 2025: It’s Time For Boomers To Let The Kids Lead

-

Business1 day ago

Business1 day agoPrairie provinces and Newfoundland and Labrador see largest increases in size of government

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoAlberta oil sands legacy tailings down 40 per cent since 2015