Alberta

Alberta Income Tax cut is great but balanced budgets are needed

By Kris Sims

The Canadian Taxpayers Federation is applauding the Alberta government for giving Albertans a huge income tax cut in Budget 2025, but is strongly warning against its dive into debt by running a deficit.

“Premier Danielle Smith keeping her promise to cut Alberta’s income tax is great news, because it means huge savings for most working families,” said Kris Sims, CTF Alberta Director. “Families are fighting to afford basics right now, and if they can save more than $1,500 per year thanks to this big tax cut, that would cover a month’s rent or more than a month’s worth of groceries.”

Finance Minister Nate Horner announced, effective this fiscal year, Alberta will drop its lowest income tax rate to eight per cent, down from 10 per cent, for the first $60,000 of earnings.

The government estimates this income tax cut will save the average Alberta worker about $750 per year, or more than $1,500 per year for a two-person working family.

Albertans earning less than $60,000 a year will see a 20 per cent reduction to their annual provincial income tax bill.

The budget also contained some bad news.

The province is running a $5.2 billion deficit in 2025-26 and the government is planning to keep running deficits for two more years.

Total spending has gone up from $73.1 billion from last budget to $79.3 billion this year, an increase of 8.4 per cent.

“If the government had frozen spending at last year’s budget level, the province could have a $1 billion surplus and still cut the income tax,” said Sims. “The debt is going up over the next few years, but we caught a lucky break with interest rates dropping this past year, so we aren’t paying as much in interest payments on the debt.”

The province’s debt is now estimated to be $82.8 billion for 2025-26.

Interest payments on the provincial debt are costing taxpayers about $2.9 billion, about a 12 per cent decrease from last year.

Alberta

Energy sector will fuel Alberta economy and Canada’s exports for many years to come

From the Fraser Institute

By any measure, Alberta is an energy powerhouse—within Canada, but also on a global scale. In 2023, it produced 85 per cent of Canada’s oil and three-fifths of the country’s natural gas. Most of Canada’s oil reserves are in Alberta, along with a majority of natural gas reserves. Alberta is the beating heart of the Canadian energy economy. And energy, in turn, accounts for one-quarter of Canada’s international exports.

Consider some key facts about the province’s energy landscape, as noted in the Alberta Energy Regulator’s (AER) 2023 annual report. Oil and natural gas production continued to rise (on a volume basis) in 2023, on the heels of steady increases over the preceding half decade. However, the dollar value of Alberta’s oil and gas production fell in 2023, as the surging prices recorded in 2022 following Russia’s invasion of Ukraine retreated. Capital spending in the province’s energy sector reached $30 billion in 2023, making it the leading driver of private-sector investment. And completion of the Trans Mountain pipeline expansion project has opened new offshore export avenues for Canada’s oil industry and should boost Alberta’s energy production and exports going forward.

In a world striving to address climate change, Alberta’s hydrocarbon-heavy energy sector faces challenges. At some point, the world may start to consume less oil and, later, less natural gas (in absolute terms). But such “peak” consumption hasn’t arrived yet, nor does it appear imminent. While the demand for certain refined petroleum products is trending down in some advanced economies, particularly in Europe, we should take a broader global perspective when assessing energy demand and supply trends.

Looking at the worldwide picture, Goldman Sachs’ 2024 global energy forecast predicts that “oil usage will increase through 2034” thanks to strong demand in emerging markets and growing production of petrochemicals that depend on oil as the principal feedstock. Global demand for natural gas (including LNG) will also continue to increase, particularly since natural gas is the least carbon-intensive fossil fuel and more of it is being traded in the form of liquefied natural gas (LNG).

Against this backdrop, there are reasons to be optimistic about the prospects for Alberta’s energy sector, particularly if the federal government dials back some of the economically destructive energy and climate policies adopted by the last government. According to the AER’s “base case” forecast, overall energy output will expand over the next 10 years. Oilsands output is projected to grow modestly; natural gas production will also rise, in part due to greater demand for Alberta’s upstream gas from LNG operators in British Columbia.

The AER’s forecast also points to a positive trajectory for capital spending across the province’s energy sector. The agency sees annual investment rising from almost $30 billion to $40 billion by 2033. Most of this takes place in the oil and gas industry, but “emerging” energy resources and projects aimed at climate mitigation are expected to represent a bigger slice of energy-related capital spending going forward.

Like many other oil and gas producing jurisdictions, Alberta must navigate the bumpy journey to a lower-carbon future. But the world is set to remain dependent on fossil fuels for decades to come. This suggests the energy sector will continue to underpin not only the Alberta economy but also Canada’s export portfolio for the foreseeable future.

Alberta

Owner sells gas for 80 cents per litre to show Albertans how low prices ‘could’ be

Undoubtedly some of the motorists driving past The Whistle Stop Cafe at Mirror on Tuesday morning thought it was an April Fools prank. It wasn’t.

Chris Scott, owner of the gas station at The Whistle Stop Cafe offered a one day promotion on April 1st. Scott sold 8000 litres of regular gasoline for $0.80/ litre.

The promotion was funded by Scott and the Alberta Prosperity Project. In this video posted to his social media, Chris Scott explains why they did it.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre, Conservatives receive election endorsement from large Canadian trade union

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

2025 Federal Election1 day ago

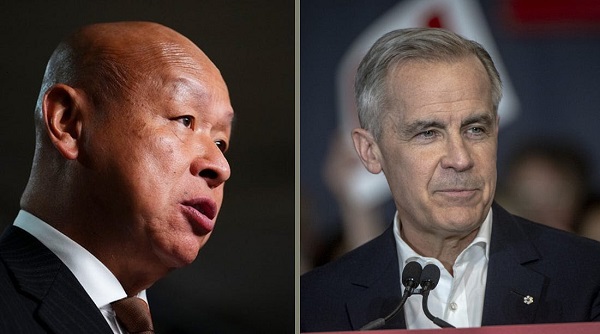

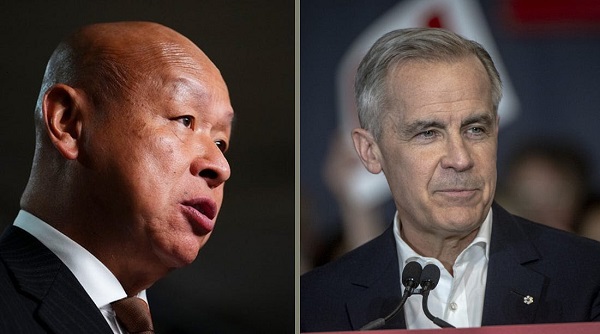

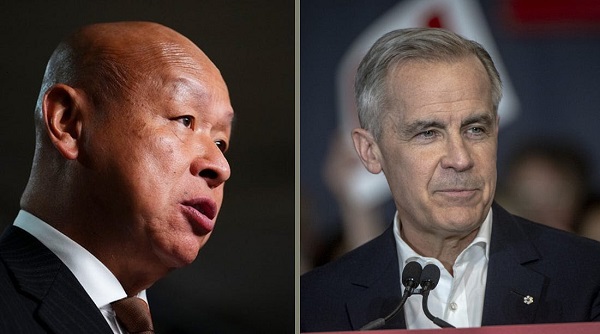

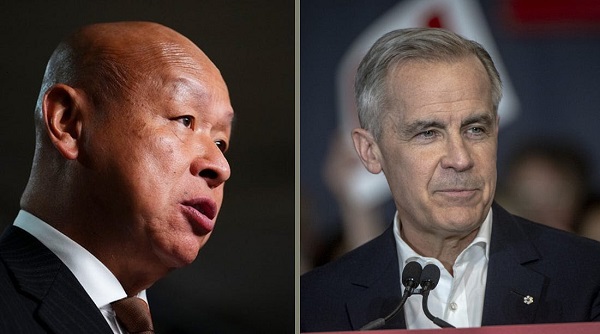

2025 Federal Election1 day agoMark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoFrance condemned for barring populist leader Marine Le Pen from 2027 election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments

-

Business2 days ago

Business2 days agoBiden’s Greenhouse Gas ‘Greendoggle’ Slush Fund Is Unraveling

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLiberal MP Paul Chiang Resigns Without Naming the Real Threat—The CCP

-

Business2 days ago

Business2 days agoTrump says ‘nicer,’ ‘kinder’ tariffs will generate federal revenue