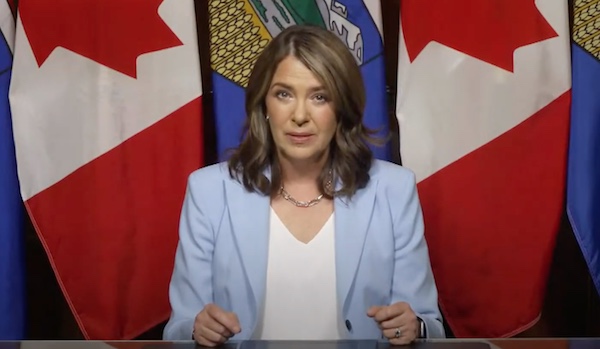

Alberta

Alberta government can deliver tax cut by ending corporate welfare

From the Fraser Institute

By Tegan Hill

In a recent CBC interview, Premier Danielle Smith said she would “love to be able to accelerate our tax cut,” referring to her campaign promise to create a new 8 per cent tax bracket for personal income below $60,000, before adding that her government might not be able to maintain a balanced budget and introduce the cut. Fortunately, there’s a way Smith could achieve both: eliminate corporate welfare.

First, some background on Alberta’s recent tax changes.

In 2015, the provincial NDP government replaced Alberta’s single personal income tax rate of 10 per cent with a five-bracket system including a bottom rate of 10 per cent and a top rate of 15 per cent. Due to this change (and tax changes at the federal level, which increased the top federal income tax rate from 29 per cent to 33 per cent), Albertans faced significantly higher personal income tax rates.

Smith’s proposed tax cut would reduce Alberta’s bottom rate from 10 per cent to 8 per cent and is expected to save Albertans earning $60,000 or more $760 annually. While this change would fail to restore Alberta’s previous tax advantage, it would be a step in the right direction.

But due to fear of incurring a budget deficit, Smith has delayed fully implementing the $1.4 billion tax cut until 2027, contingent on the government being able to maintain a balanced budget.

Which takes us back to corporate welfare.

In 2019, after adjusting for inflation, the Alberta government spent $2.4 billion on subsidies to select businesses and industries. (In 2021, the latest year of available data, it spent $3.3 billion, however the pandemic may have contributed to this number.) And that’s not counting other forms of government handouts such as loan guarantees, direct investment and regulatory privileges for particular firms or industries. Put simply, eliminating corporate welfare would be more than enough to offset Smith’s proposed tax cut, which she promised Albertans in 2023.

Moreover, a significant body of research shows that corporate welfare fails to generate widespread economic benefits. Think of it this way; if businesses that receive subsidies were viable without subsidies, they wouldn’t need government handouts. Moreover, the government must impose higher tax rates on everyone else to pay for these subsidies. Higher taxes discourage productive activity, including business investment, which fuels economic growth. And the higher the rates, the more economic activity they discourage. Put simply, subsidies depress economic activity in some parts of an economy to encourage it in others.

For the same reason, corporate welfare also typically fails to generate new jobs on net. Indeed, while subsidies may create jobs in one specific industry, they pull those jobs away from other sectors that are likely more productive because they don’t need the subsidy.

The Smith government is hesitant to introduce Alberta’s tax cut if it can’t maintain a balanced budget, but if the government eliminates corporate welfare, it can avoid red ink while also fulfilling a promise it made to Alberta workers.

Alberta

Alberta’s oil bankrolls Canada’s public services

This article supplied by Troy Media.

By Perry Kinkaide and Bill Jones

By Perry Kinkaide and Bill Jones

It’s time Canadians admitted Alberta’s oilpatch pays the bills. Other provinces just cash the cheques

When Canadians grumble about Alberta’s energy ambitions—labelling the province greedy for wanting to pump more oil—few stop to ask how much

money from each barrel ends up owing to them?

The irony is staggering. The very provinces rallying for green purity are cashing cheques underwritten not just by Alberta, but indirectly by the United States, which purchases more than 95 per cent of Alberta’s oil and gas, paid in U.S. dollars.

That revenue doesn’t stop at the Rockies. It flows straight to Ottawa, funding equalization programs (which redistribute federal tax revenue to help less wealthy provinces), national infrastructure and federal services that benefit the rest of the country.

This isn’t political rhetoric. It’s economic fact. Before the Leduc oil discovery in 1947, Alberta received about $3 to $5 billion (in today’s dollars) in federal support. Since then, it has paid back more than $500 billion. A $5-billion investment that returned 100 times more is the kind of deal that would send Bay Street into a frenzy.

Alberta’s oilpatch includes a massive industry of energy companies, refineries and pipeline networks that produce and export oil and gas, mostly to the U.S. Each barrel of oil generates roughly $14 in federal revenue through corporate taxes, personal income taxes, GST and additional fiscal capacity that boosts equalization transfers. Multiply that by more than 3.7 million barrels of oil (plus 8.6 billion cubic feet of natural gas) exported daily, and it’s clear Alberta underwrites much of the country’s prosperity.

Yet many Canadians seem unwilling to acknowledge where their prosperity comes from. There’s a growing disconnect between how goods are consumed and how they’re produced. People forget that gasoline comes from oil wells, electricity from power plants and phones from mining. Urban slogans like “Ban Fossil Fuels” rarely engage with the infrastructure and fiscal reality that keeps the country running.

Take Prince Edward Island, for example. From 1957 to 2023, it received $19.8 billion in equalization payments and contributed just $2 billion in taxes—a net gain of $17.8 billion.

Quebec tells a similar story. In 2023 alone, it received more than $14 billion in equalization payments, while continuing to run balanced or surplus budgets. From 1961 to 2023, Quebec received more than $200 billion in equalization payments, much of it funded by revenue from Alberta’s oil industry..

To be clear, not all federal transfers are equalization. Provinces also receive funding through national programs such as the Canada Health Transfer and

Canada Social Transfer. But equalization is the one most directly tied to the relative strength of provincial economies, and Alberta’s wealth has long driven that system.

By contrast to the have-not provinces, Alberta’s contribution has been extraordinary—an estimated 11.6 per cent annualized return on the federal

support it once received. Each Canadian receives about $485 per year from Alberta-generated oil revenues alone. Alberta is not the problem—it’s the

foundation of a prosperous Canada.

Still, when Alberta questions equalization or federal energy policy, critics cry foul. Premier Danielle Smith is not wrong to challenge a system in which the province footing the bill is the one most often criticized.

Yes, the oilpatch has flaws. Climate change is real. And many oil profits flow to shareholders abroad. But dismantling Alberta’s oil industry tomorrow wouldn’t stop climate change—it would only unravel the fiscal framework that sustains Canada.

The future must balance ambition with reality. Cleaner energy is essential, but not at the expense of biting the hand that feeds us.

And here’s the kicker: Donald Trump has long claimed the U.S. doesn’t need Canada’s products and therefore subsidizes Canada. Many Canadians scoffed.

But look at the flow of U.S. dollars into Alberta’s oilpatch—dollars that then bankroll Canada’s federal budget—and maybe, for once, he has a point.

It’s time to stop denying where Canada’s wealth comes from. Alberta isn’t the problem. It’s central to the country’s prosperity and unity.

Dr. Perry Kinkaide is a visionary leader and change agent. Since retiring in 2001, he has served as an advisor and director for various organizations and founded the Alberta Council of Technologies Society in 2005. Previously, he held leadership roles at KPMG Consulting and the Alberta Government. He holds a BA from Colgate University and an MSc and PhD in Brain Research from the University of Alberta.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Alberta

Alberta’s industrial carbon tax freeze is a good first step

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation is applauding Alberta Premier Danielle Smith’s decision to freeze the province’s industrial carbon tax.

“Smith is right to freeze the cost of Alberta’s hidden industrial carbon tax that increases the cost of everything,” said Gage Haubrich, CTF Prairie Director. “This move is a no-brainer to make Alberta more competitive, save taxpayers money and protect jobs.”

Smith announced the Alberta government will be freezing the rate of its industrial carbon tax at $95 per tonne.

The federal government set the rate of the consumer carbon tax to zero on April 1. However, it still imposes a requirement for an industrial carbon tax.

Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax.

The industrial carbon tax currently costs businesses $95 per tonne of emissions. It is set to increase to $170 per tonne by 2030. Carney has said he would extend the current industrial carbon tax framework until 2035, meaning the costs could reach $245 a tonne. That’s more than double the current tax.

The Saskatchewan government recently scrapped its industrial carbon tax completely.

Seventy per cent of Canadians said businesses pass most or some industrial carbon tax costs on to consumers, according to a recent Leger poll.

“Smith needs to stand up for Albertans and cancel the industrial carbon tax altogether,” Haubrich said. “Smith deserves credit for freezing Alberta’s industrial carbon tax and she needs to finish the job by scrapping the industrial carbon tax completely.”

-

Business2 days ago

Business2 days agoThe ESG Shell Game Behind The U.S. Plastics Pact

-

International2 days ago

International2 days agoBongino announces FBI will release files on COVID cover up, Mar-a-Lago Raid and more

-

Great Reset1 day ago

Great Reset1 day agoThe WHO Pandemic Treaty could strip Canada of its ability to make its own health decisions

-

Fraser Institute1 day ago

Fraser Institute1 day agoCarney government’s housing plan poses major risks to taxpayers

-

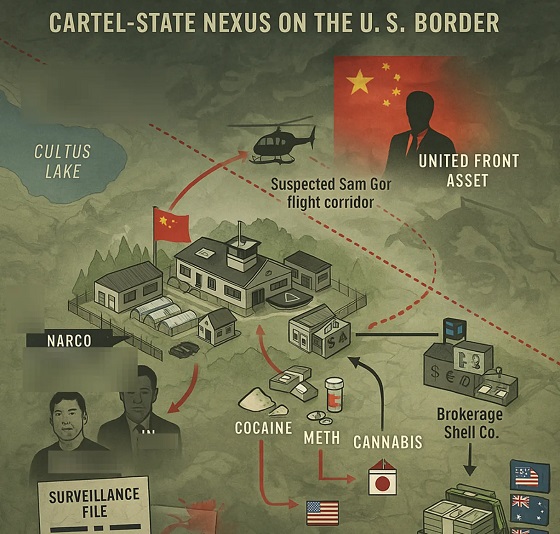

espionage1 day ago

espionage1 day agoPro-Beijing Diaspora Group That Lobbied to Oust O’Toole Now Calls for Poilievre’s Resignation Amid PRC Interference Probes

-

espionage22 hours ago

espionage22 hours agoOttawa Raises Alarm With Beijing Over Hong Kong Detention of CPC Candidate Joe Tay’s Family

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy leader Tamara Lich to face sentencing July 23

-

Health2 days ago

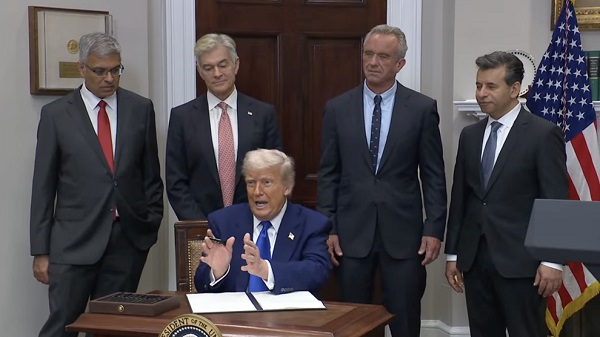

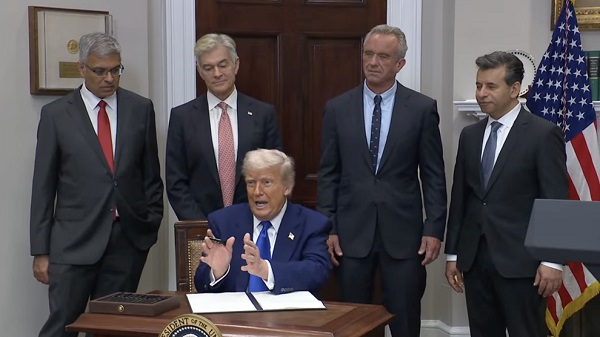

Health2 days agoTrump signs executive order aiming to slash prescription drug costs up to 90%